Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

796

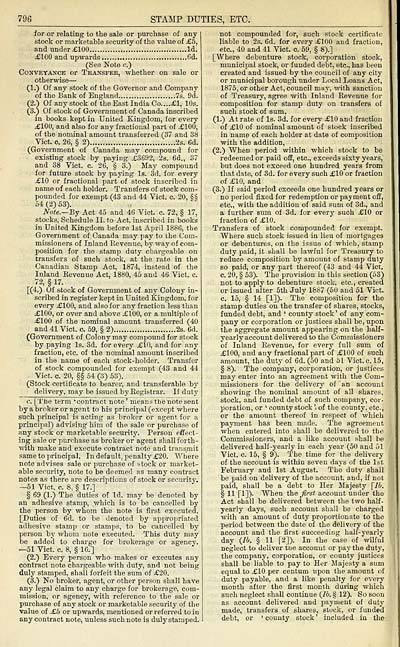

STAMP DUTIES, ETC.

for or relating to the sale or purchase of any

stock or marketable security of the value of £5,

and under £100 Id.

£100 and upwards 6d.

(See Note c.)

Conveyance or Transfer, whether on sale or

otherwise —

(1.) Of any stock of the Governor and Company

of the Bank of England 7s. 9d.

(2.) Of any stock of the East India Co....£l, 10s.

(3.) Of stock of Government of Canada inscribed

in books kept in United Kingdom, for every

£100, and also for any fractional part of £100,

of the nominal amount transferred (37 and 38

Vict. c. 26, § 2) 2s. 6d.

(Government of Canada may compound for

existing stock by paying £3692, 2s. 6d., 37

and 38 Vict. c. 26, § 3.) May compound

for future stock by paying Is. 3d. for every

£10 or fractional part of stock inscribed in

name of each holder. Transfers of stock com-

pounded for exempt (43 and 44 Vict. c. 20, §§

54 (2) 53).

Note.—'Ej Act 45 and 46 Vict. c. 72, § 17,

stocks, Schedule II. to Act, inscribed in books

in United Kingdom before 1st April 1886, the

Government of Canada may pay to the Com-

missioners of Inland Kevenue, by way of com-

position for the stamp duty chargeable on

transfers of such stock, at the rate in the

Canadian Stamp Act, 1874, instead of the

Inland Eevenue Act 1880, 45 and 46 Vict. c.

72, § 17.

[(4.) Of stock of Government of any Colony in-

scribed in register kept in United Kingdom, for

every £100, and also for any fraction less than

£100, or over and above £100, or a multiple of

£100 of the nominal amount transferred (40

and 41 Vict. c. 59, § 2) 2s. 6d.

(Government of Colony may comijound for stock

by paying Is. Sd. for every £10, and for any

fraction, etc. of the nominal amount inscribed

in the name of each stock-holder. Transfer

of stock compounded for exempt (43 and 44

Vict. c. 20, §§ 64 (3) 53).

(Stock certificate to bearer, and transferable by

delivery, may be issued by Registrar. If duty

c. [Tiie term 'contract note ' means tbe note sent

by a broker or agent to his principal (excejDt where

such principal is acting as broker or agent for a

principal) advising him of the sale or purchase of

any stock or marketable security. Person effect-

ing sale or purchase as broker or agent shall forth-

■with make and execute contract note and transmit

same to principal. In default, penalty £20. Where

note advises sale or purchase of stock or market-

able security, note to be deemed as many contract

notes as there are descriptions of stock or security.

—51 Vict. c. 8, § 17.]

§ 69 (1.) The duties of Id. may be denoted by

an adhesive stamp, which is to be cancelled by

the person by whom the note is first executed.

[Duties of 6d. to be denoted by apjoropriated

adhesive stamp or stamps, to be cancelled by

person by whom note executed. This duty may

be added to charge for brokerage or agency.

—51 Vict. c. 8, § 16.]

(2.) Every person who makes or executes any

contract note chargeable with duty, and not being

duly stamped, shall forfeit the sum of £20.

(3.) No broker, agent, or other person shall have

any legal claim to any charge for brokerage, com-

mission, or agency, with reference to the sale or

purchase of any stock or mai-ketable security of the

value of £5 or upwards, mentioned or referred to in

any contract note, unless such note is duly stamped.

not compounded for, such stock certificate

liable to 2s. 6d. for every £100 and fraction,

etc., 40 and 41 Vict. c. 59, § 8).]

[Where debenture stock, corporation stock,

municipal stock, or funded debt, etc., has been

created and issued by the council of any city

or municipal borough under Local Loans Act,

1875, or other Act, council may, with sanction

of Treasury, agree with Inland Eevenue for

composition for stamp duty on transfers of

such stock of sum,

(1.) At rate of Is. 3d. for every £10 and fraction

of £10 of nominal amount of stock inscribed

in name of each holder at date of composition

with the addition,

(2.) When period within which stock to be

redeemed or paid off, etc., exceeds sixty years,

but does not exceed one hundred years from

that date, of 3d. for every such £10 or fraction

of £10, and

(3.) If said period exceeds one hundred years or

no period fixed for redemption or payment off,

etc., with the addition of said sum of od., and

a further sum of 3d. for every such £10 or

fraction of £10.

Transfers of stock compounded for exempt.

Where such stock issued in lieu of mortgages

or debentures, on the issue of which, stamp

duty paid, it shall be lawful for Treasury to

reduce composition by amount of stamp duty

so paid, or any part thereof (43 and 44 Vict.

c. 20, § 53). The provision in this section (63)

not to apply to debenture stock, etc., created

or issued after 5th July 1887 (60 and 51 Vict.

c. 15, § 14 [1]). The composition for the

stamp duties on the transfer of shares, stocks,

funded debt, and ' county stock ' of any com-

pany or corporation or justices shall be, upon

the aggregate amount appearing on the half-

yearly account delivered to the Commissioners

of Inland Eevenue, for every full sum of

£100, and any fractional part of £100 of such

amount, the duty of 6d. (50 and 61 Vict. c. 15,

§ 8). The company, corporation, or justices

may enter into an agreement with the Com-

missioners for the delivery of an account

showing the nominal amount of all shares,

stock, and funded debt of such company, cor-

poration, or ' county stock' of the county, etc.,

or the amount thereof in respect of which

payment has been made. The agreement

when entered into shall be delivered to the

Commissioners, and a like account shall be

delivered half-yearly in each year (50 and 51

Vict. c. 15, § 9). The time for the delivery

of the account is within seven days of the 1st

February and 1st August. The duty shall

be paid on delivery of the account, and, if not

paid, shall be a debt to Her Majesty \lh.

§ 11 [1]). When the first account under the

Act shall be delivered between the two half-

yearly days, such account shall be charged

with an amount of duty proportionate to the

period between the date of the delivery of the

account and the first succeediog half-yearly

day (Jb. § 11 [2]). In the case of wilful

neglect to deliver tbe account or pay the duty,

the company, corporation, or county justices

shall be liable to pay to Her Majesty a sum

equal to £10 per centum upon the amount of

duty payable, and a like penalty for every

mouth after the first month during which

such neglect shall continue {lb. § 12). So soon

as account delivered and payment of duty

made, transfers of shares, stock, or funded

debt, or ' county stock ' included in the

STAMP DUTIES, ETC.

for or relating to the sale or purchase of any

stock or marketable security of the value of £5,

and under £100 Id.

£100 and upwards 6d.

(See Note c.)

Conveyance or Transfer, whether on sale or

otherwise —

(1.) Of any stock of the Governor and Company

of the Bank of England 7s. 9d.

(2.) Of any stock of the East India Co....£l, 10s.

(3.) Of stock of Government of Canada inscribed

in books kept in United Kingdom, for every

£100, and also for any fractional part of £100,

of the nominal amount transferred (37 and 38

Vict. c. 26, § 2) 2s. 6d.

(Government of Canada may compound for

existing stock by paying £3692, 2s. 6d., 37

and 38 Vict. c. 26, § 3.) May compound

for future stock by paying Is. 3d. for every

£10 or fractional part of stock inscribed in

name of each holder. Transfers of stock com-

pounded for exempt (43 and 44 Vict. c. 20, §§

54 (2) 53).

Note.—'Ej Act 45 and 46 Vict. c. 72, § 17,

stocks, Schedule II. to Act, inscribed in books

in United Kingdom before 1st April 1886, the

Government of Canada may pay to the Com-

missioners of Inland Kevenue, by way of com-

position for the stamp duty chargeable on

transfers of such stock, at the rate in the

Canadian Stamp Act, 1874, instead of the

Inland Eevenue Act 1880, 45 and 46 Vict. c.

72, § 17.

[(4.) Of stock of Government of any Colony in-

scribed in register kept in United Kingdom, for

every £100, and also for any fraction less than

£100, or over and above £100, or a multiple of

£100 of the nominal amount transferred (40

and 41 Vict. c. 59, § 2) 2s. 6d.

(Government of Colony may comijound for stock

by paying Is. Sd. for every £10, and for any

fraction, etc. of the nominal amount inscribed

in the name of each stock-holder. Transfer

of stock compounded for exempt (43 and 44

Vict. c. 20, §§ 64 (3) 53).

(Stock certificate to bearer, and transferable by

delivery, may be issued by Registrar. If duty

c. [Tiie term 'contract note ' means tbe note sent

by a broker or agent to his principal (excejDt where

such principal is acting as broker or agent for a

principal) advising him of the sale or purchase of

any stock or marketable security. Person effect-

ing sale or purchase as broker or agent shall forth-

■with make and execute contract note and transmit

same to principal. In default, penalty £20. Where

note advises sale or purchase of stock or market-

able security, note to be deemed as many contract

notes as there are descriptions of stock or security.

—51 Vict. c. 8, § 17.]

§ 69 (1.) The duties of Id. may be denoted by

an adhesive stamp, which is to be cancelled by

the person by whom the note is first executed.

[Duties of 6d. to be denoted by apjoropriated

adhesive stamp or stamps, to be cancelled by

person by whom note executed. This duty may

be added to charge for brokerage or agency.

—51 Vict. c. 8, § 16.]

(2.) Every person who makes or executes any

contract note chargeable with duty, and not being

duly stamped, shall forfeit the sum of £20.

(3.) No broker, agent, or other person shall have

any legal claim to any charge for brokerage, com-

mission, or agency, with reference to the sale or

purchase of any stock or mai-ketable security of the

value of £5 or upwards, mentioned or referred to in

any contract note, unless such note is duly stamped.

not compounded for, such stock certificate

liable to 2s. 6d. for every £100 and fraction,

etc., 40 and 41 Vict. c. 59, § 8).]

[Where debenture stock, corporation stock,

municipal stock, or funded debt, etc., has been

created and issued by the council of any city

or municipal borough under Local Loans Act,

1875, or other Act, council may, with sanction

of Treasury, agree with Inland Eevenue for

composition for stamp duty on transfers of

such stock of sum,

(1.) At rate of Is. 3d. for every £10 and fraction

of £10 of nominal amount of stock inscribed

in name of each holder at date of composition

with the addition,

(2.) When period within which stock to be

redeemed or paid off, etc., exceeds sixty years,

but does not exceed one hundred years from

that date, of 3d. for every such £10 or fraction

of £10, and

(3.) If said period exceeds one hundred years or

no period fixed for redemption or payment off,

etc., with the addition of said sum of od., and

a further sum of 3d. for every such £10 or

fraction of £10.

Transfers of stock compounded for exempt.

Where such stock issued in lieu of mortgages

or debentures, on the issue of which, stamp

duty paid, it shall be lawful for Treasury to

reduce composition by amount of stamp duty

so paid, or any part thereof (43 and 44 Vict.

c. 20, § 53). The provision in this section (63)

not to apply to debenture stock, etc., created

or issued after 5th July 1887 (60 and 51 Vict.

c. 15, § 14 [1]). The composition for the

stamp duties on the transfer of shares, stocks,

funded debt, and ' county stock ' of any com-

pany or corporation or justices shall be, upon

the aggregate amount appearing on the half-

yearly account delivered to the Commissioners

of Inland Eevenue, for every full sum of

£100, and any fractional part of £100 of such

amount, the duty of 6d. (50 and 61 Vict. c. 15,

§ 8). The company, corporation, or justices

may enter into an agreement with the Com-

missioners for the delivery of an account

showing the nominal amount of all shares,

stock, and funded debt of such company, cor-

poration, or ' county stock' of the county, etc.,

or the amount thereof in respect of which

payment has been made. The agreement

when entered into shall be delivered to the

Commissioners, and a like account shall be

delivered half-yearly in each year (50 and 51

Vict. c. 15, § 9). The time for the delivery

of the account is within seven days of the 1st

February and 1st August. The duty shall

be paid on delivery of the account, and, if not

paid, shall be a debt to Her Majesty \lh.

§ 11 [1]). When the first account under the

Act shall be delivered between the two half-

yearly days, such account shall be charged

with an amount of duty proportionate to the

period between the date of the delivery of the

account and the first succeediog half-yearly

day (Jb. § 11 [2]). In the case of wilful

neglect to deliver tbe account or pay the duty,

the company, corporation, or county justices

shall be liable to pay to Her Majesty a sum

equal to £10 per centum upon the amount of

duty payable, and a like penalty for every

mouth after the first month during which

such neglect shall continue {lb. § 12). So soon

as account delivered and payment of duty

made, transfers of shares, stock, or funded

debt, or ' county stock ' included in the

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1888-1889 > (850) |

|---|

| Permanent URL | https://digital.nls.uk/83505361 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|