Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

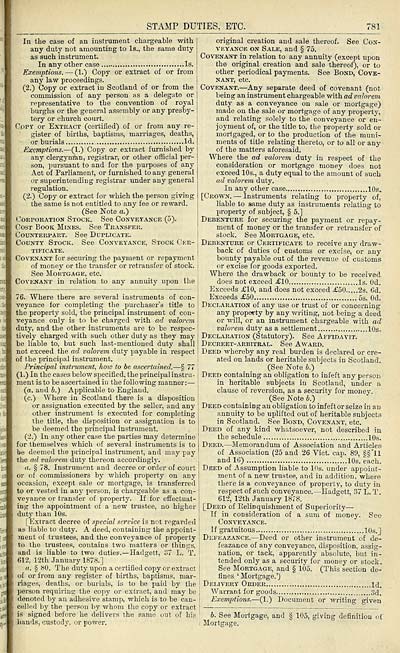

STAMP DUTIES, ETC.

781

'llfW

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract iu Scotland of or from the

commission of any person as a delegate or

representative to the convention of royal

burghs or the general assembly or any presby-

tery or church court.

Copy or Extract (certified) of or from any re-

gister of births, baptisms, marriages, deaths,

or burials Id.

Exemptions. — (1.) Copy or extract furnished by

any clergyman, registrar, or other official per-

son, pursuant to and for the purposes of any

Act of Parliament, or furnished to any general

or superintending registrar under any general

regulation.

(2.) Copy or extract for which the person giving

the same is not entitled to any fee or reward.

(See Note a.)

Corporation Stock. See Convetance (5).

Cost Book Mines. See Transfer.

Counterpart. See Duplicate.

County Stock. See Conveyance, Stock Ckr-

TIFICATE.

Covenant for securing the payment or repayment

of money or the transfer or retransfer of stock.

See Mortgage, etc.

Covenant in relation to any annuity upon the

76. Where there are several instruments of con-

veyance for completing the purchaser's title to

the property sold, the principal instrument of con-

veyance only is to be charged with ad valorem

duty, and the other instruments are to be respec-

tively charged with such other duty as they may

be liable to, but such last-mentioned duty shall

not exceed the ad valorem duty payable in respect

of the principal instrument.

Principal instrument, how to he ascertained. — § 77

(1.) In the cases below specified, the principal instru-

ment is to be ascertained in the following manner: —

(a. aud h.) Applicable to England.

(c.) Where in Scotland there is a disposition

or assignation executed by the seller, and any

other instrument is executed for completing

the title, the disposition or assignation is to

be deemed the principal instrument.

(2.) In any other case the parties may determine

for themselves which of several instruments is to

be deemed the principal instrument, and may pay

the ad valorem duty thereon accordinglj'.

a. § 78. Instrument and decree or order of court

or of commissioners by which property on any

occasion, except sale or mortgage, is transferred

to or vested in any person, is chargeable as a con-

veyance or transfer of property. If for effectuat-

ing the appointment of a new trustee, no higher

dutj' than 10s.

[Extract decree of special service is not regarded

as liable to duty. A deed, containing the appoint-

ment of trustees, and the conveyance of property

to the trustees, contains two matters or things.

and is liable to two duties. — Hadgett, 37 L. T.

612, 12th January 1878.]

«. § 80. The duty upon a certified copy or extract

of or from any register of births, baptisms, mar-

riages, deaths, or burials, is to be jjaid by the

person requiring the copy or extract, and may be

denoted by an adhesive stamp, which is to be can-

celled by the person by whom the copy or extract

is signed before he delivers the same out of his

hands, custody, or power.

original creation and sale thereof. See Con-

veyance on Sale, and § 75.

Covenant in relation to any annuity (except upon

the original creation and sale thereof), or to

other periodical payments. See Bond, Cove-

NiVNT, etc.

Covenant. — Any separate deed of covenant (not

being an instrument chargeable with ad valorem

duty as a conveyance on sale or mortgage)

made on the sale or mortgage of any property',

and relating solely to the conveyance or en-

joyment of, or the title to, the property sold or

mortgaged, or to the production of the muni-

ments of title relating thereto, or to all or any

of the matters aforesaid.

Where the ad valorem duty in respect of the

consideration or mortgage money does not

exceed 10s., a duty equal to the amount of such

ad valorem duty.

In any other case IQs.

[Crown. — Instruments relating to property of,

liable to same duty as instruments relating to

property of subject, § 5.]

Debenture for securing the payment or repay-

ment of money or the transfer or retransfer of

stock. See Mortgage, etc.

Debenture or Certificate to receive any draw-

back of duties of customs or excise, or any

bounty payable out of the revenue of customs

or excise for goods exported.

Where the drawback or bounty to be received

does not exceed £10 Is. Od.

Exceeds £10, and does not exceed £50 2s. 6d.

Exceeds £50 6s. Od.

Declaration of any use or trust of or concerning

any property by any writing, not being a deed

or will, or an instrument chargeable with ad

valorem duty as a settlement 10s.

Declaration (Statutory). See Affidavit.

Decreet-arbitral. See Award.

Deed whereby any real burden is declared or cre-

ated on lands or heritable subjects in Scotland.

(See Note b.)

Deed containing an obligation to infeft any person

in heritable subjects in Scotland, under a

clause of reversion, as a security for money.

(See Note 5.)

Deed containing an obligation to infeftor seize in an

annuity to be uplifted out of heritable subjects

in Scotland. See Bond, Covenant, etc.

Deed of any kind whatsoever, not described in

the schedule 10s.

Deed. — Memorandum of Association and Articles

of Association (25 and 26 Vict. cap. 89, §§"ll

and 10) 10s. each.

Deed of Assumption liable to Ids. under appoint-

ment of a new trustee, and in addition, where

there is a conveyance of property, to duty in

respect of such conveyance. — Hadgett, 37 L. T.

612, 12th January 1878.

[Deed of Eelinquishment of Superiority —

If in consideration of a sum of money. See

CONVEY'ANCE.

If gratuitous 10s. j

Defeazance. — Deed or other instrument of de-

feazance of any conveyance, disposition, assig-

nation, or tack, apparently absolute, but in-

tended only as a security for money or stock.

See Mortgage, and § 105. (This section de-

lines 'Mortgage.')

Delivery Order i(j_

Warrant for goods 3(J,

Exemptions. — (1.) Document or writing given

b. See Mortgage, and § 105, giving definition of .

Mortgage.

781

'llfW

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract iu Scotland of or from the

commission of any person as a delegate or

representative to the convention of royal

burghs or the general assembly or any presby-

tery or church court.

Copy or Extract (certified) of or from any re-

gister of births, baptisms, marriages, deaths,

or burials Id.

Exemptions. — (1.) Copy or extract furnished by

any clergyman, registrar, or other official per-

son, pursuant to and for the purposes of any

Act of Parliament, or furnished to any general

or superintending registrar under any general

regulation.

(2.) Copy or extract for which the person giving

the same is not entitled to any fee or reward.

(See Note a.)

Corporation Stock. See Convetance (5).

Cost Book Mines. See Transfer.

Counterpart. See Duplicate.

County Stock. See Conveyance, Stock Ckr-

TIFICATE.

Covenant for securing the payment or repayment

of money or the transfer or retransfer of stock.

See Mortgage, etc.

Covenant in relation to any annuity upon the

76. Where there are several instruments of con-

veyance for completing the purchaser's title to

the property sold, the principal instrument of con-

veyance only is to be charged with ad valorem

duty, and the other instruments are to be respec-

tively charged with such other duty as they may

be liable to, but such last-mentioned duty shall

not exceed the ad valorem duty payable in respect

of the principal instrument.

Principal instrument, how to he ascertained. — § 77

(1.) In the cases below specified, the principal instru-

ment is to be ascertained in the following manner: —

(a. aud h.) Applicable to England.

(c.) Where in Scotland there is a disposition

or assignation executed by the seller, and any

other instrument is executed for completing

the title, the disposition or assignation is to

be deemed the principal instrument.

(2.) In any other case the parties may determine

for themselves which of several instruments is to

be deemed the principal instrument, and may pay

the ad valorem duty thereon accordinglj'.

a. § 78. Instrument and decree or order of court

or of commissioners by which property on any

occasion, except sale or mortgage, is transferred

to or vested in any person, is chargeable as a con-

veyance or transfer of property. If for effectuat-

ing the appointment of a new trustee, no higher

dutj' than 10s.

[Extract decree of special service is not regarded

as liable to duty. A deed, containing the appoint-

ment of trustees, and the conveyance of property

to the trustees, contains two matters or things.

and is liable to two duties. — Hadgett, 37 L. T.

612, 12th January 1878.]

«. § 80. The duty upon a certified copy or extract

of or from any register of births, baptisms, mar-

riages, deaths, or burials, is to be jjaid by the

person requiring the copy or extract, and may be

denoted by an adhesive stamp, which is to be can-

celled by the person by whom the copy or extract

is signed before he delivers the same out of his

hands, custody, or power.

original creation and sale thereof. See Con-

veyance on Sale, and § 75.

Covenant in relation to any annuity (except upon

the original creation and sale thereof), or to

other periodical payments. See Bond, Cove-

NiVNT, etc.

Covenant. — Any separate deed of covenant (not

being an instrument chargeable with ad valorem

duty as a conveyance on sale or mortgage)

made on the sale or mortgage of any property',

and relating solely to the conveyance or en-

joyment of, or the title to, the property sold or

mortgaged, or to the production of the muni-

ments of title relating thereto, or to all or any

of the matters aforesaid.

Where the ad valorem duty in respect of the

consideration or mortgage money does not

exceed 10s., a duty equal to the amount of such

ad valorem duty.

In any other case IQs.

[Crown. — Instruments relating to property of,

liable to same duty as instruments relating to

property of subject, § 5.]

Debenture for securing the payment or repay-

ment of money or the transfer or retransfer of

stock. See Mortgage, etc.

Debenture or Certificate to receive any draw-

back of duties of customs or excise, or any

bounty payable out of the revenue of customs

or excise for goods exported.

Where the drawback or bounty to be received

does not exceed £10 Is. Od.

Exceeds £10, and does not exceed £50 2s. 6d.

Exceeds £50 6s. Od.

Declaration of any use or trust of or concerning

any property by any writing, not being a deed

or will, or an instrument chargeable with ad

valorem duty as a settlement 10s.

Declaration (Statutory). See Affidavit.

Decreet-arbitral. See Award.

Deed whereby any real burden is declared or cre-

ated on lands or heritable subjects in Scotland.

(See Note b.)

Deed containing an obligation to infeft any person

in heritable subjects in Scotland, under a

clause of reversion, as a security for money.

(See Note 5.)

Deed containing an obligation to infeftor seize in an

annuity to be uplifted out of heritable subjects

in Scotland. See Bond, Covenant, etc.

Deed of any kind whatsoever, not described in

the schedule 10s.

Deed. — Memorandum of Association and Articles

of Association (25 and 26 Vict. cap. 89, §§"ll

and 10) 10s. each.

Deed of Assumption liable to Ids. under appoint-

ment of a new trustee, and in addition, where

there is a conveyance of property, to duty in

respect of such conveyance. — Hadgett, 37 L. T.

612, 12th January 1878.

[Deed of Eelinquishment of Superiority —

If in consideration of a sum of money. See

CONVEY'ANCE.

If gratuitous 10s. j

Defeazance. — Deed or other instrument of de-

feazance of any conveyance, disposition, assig-

nation, or tack, apparently absolute, but in-

tended only as a security for money or stock.

See Mortgage, and § 105. (This section de-

lines 'Mortgage.')

Delivery Order i(j_

Warrant for goods 3(J,

Exemptions. — (1.) Document or writing given

b. See Mortgage, and § 105, giving definition of .

Mortgage.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1887-1888 > (815) |

|---|

| Permanent URL | https://digital.nls.uk/83492120 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|