Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

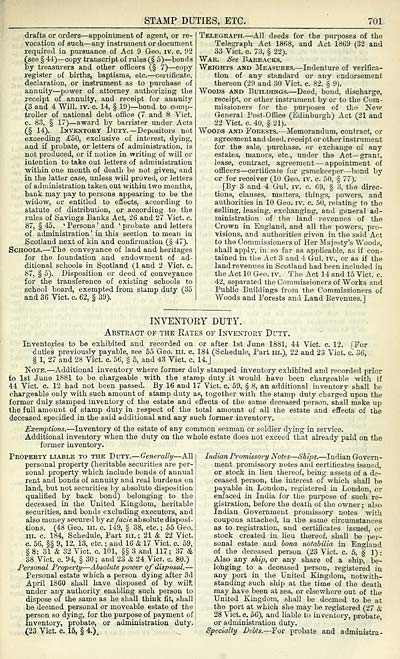

STAMP DUTIES, ETC.

701

drafts or orders — appointment of agent, or re-

vocation of such — any instrument or document

required in pursuance of Act 9 Geo. iv. c. 92

(see § 44) — copy transcript of rules (§ 5) — bonds

by treasurers and other officers (§ 7) — copy

register of births, baptisms, etc. — certificate,

declaration, or instrument as to purchase of

annuity — power of attorney authorizing the

receipt of annuity, and receipt for annuity

(3 and 4 Will. iv. c. 14, § 19) — bond to comp-

troller of national debt office (7 and 8 Vict.

c. 83, § 17)— award by barrister under Acts

(§ 14). Inventory Duty.— Depositors not

exceeding ,£50, exclusive of interest, dying,

and if probate, or letters of administration, is

not produced, or if notice in writing of will or

intention to take out letters of administration

within one month of death be not given, and

in the latter case, unless will proved, or letters

of administration taken out within two months,

bank may pay to persons appearing to be the

widow, or entitled to effects, according to

statute of distribution, or according to the

rules of Savings Banks Act, 26 and 27 Vict. c.

87, § 45. ' Persons ' and ' probate and letters

of administration ' in this section to mean in

Scotland next of kin and confirmation (§ 47).

Schools. — The conveyance of land aud heritages

for the foundation and endowment of ad-

ditional schools in Scotland (1 and 2 Vict. c.

87, § 5). Disposition or deed of conveyance

for the transference of existing schools to

school board, exempted from stamp duty (35

and 36 Vict. c. 62, § 39).

Telegraph. — All deeds for the purposes of the

Telegraph Act 1868, and Act 1869 (32 and

33 Vict. c. 73, § 22).

War. See Barracks.

Weights and Measures. — Indenture of verifica-

tion of any standard or any endorsement

thereon (29 and 30 Vict. c. 82, § 9).

Woods and Buildings. — Deed, bond, discharge,

receipt,, or other instrument by or to the Com-

missioners for the purposes of the New-

General Post-Office (Edinburgh) Act (21 and

22 Vict. c. 40, § 21).

Woods and Forests. — Memorandum, contract, or

agreement and deed, receipt or other instrument

for the sale, purchase, or exchange of any

estates, manors, etc., under the Act— grant,

lease, contract, agreement — appointment of

officers — certificate for gamekeeper — bond by

or for receiver (10 Geo. iv. c. 50, § 77).

[By 3 and 4 Gul. iv. c. 69, § 3, the direc-

tions, clauses, matters, things, powers, and

authorities in 10 Geo. iv. c. 50, relating to tho

selling, leasing, exchanging, and general ad-

ministration of the land revenues of the

Crown in England, and all the powers, pro-

visions, and authorities given in the said Act

to the Commissioners of Her Majesty's Woods,

shall apply, in so far as applicable, as if con-

tained in the Act 3 and 4 Gul. iv, or as if the

land revenues in Scotland had been included in

the Act 10 Geo. iv. The Act 14 and 15 Vict. c.

42, separated the Commissioners of Works and

Public Buildings from the Commissioners of

Woods and Forests and Land Pievenues.]

INVENTORY DUTY.

Abstract of the Eates of Inventory Duty.

Inventories to be exhibited and recorded on or after 1st June 1881, 44 Vict. c. 12. [For

duties previously payable, see 55 Geo. in. c. 184 (Schedule, Part in.), 22 and 23 Vict. c. 36,

§ 1, 27 and 28 Vict. c. 56, § 5, and 43 Vict. c. 14.J

Note. — Additional inventory where former duly stamped inventory exhibited and recorded prior

to 1st June 1881 to be chargeable with the stamp duty it would have been chargeable with if

44 Vict. c. 12 had not been passed. By 16 and 17 Vict. c. 59, § 8, an additional inventory shall be

chargeable only with such amount of stamp duty as, together with the stamp duty charged upon the

former duly stamped inventory of the estate and effects of the same deceased person, shall make up

the full amount of stamp duty in respect of the total amount of all the estate and effects of the

deceased specified in the said additional and any such former inventory.

Exemptions. — Inventory of the estate of any common seaman or soldier dying in service.

Additional inventory when the duty on the whole estate does not exceed that already paid on the

former inventory.

Property liable to the Duty. — Generally — All

personal property (heritable securities are per-

sonal property which include bonds of annual

rent and bonds of annuity and real burdens on

land, but not securities by absolute disposition

qualified by back bond) belonging to the

deceased in the United Kingdom, heritable

securities, and bonds excluding executors, and

also money secured by ex facie absolute disposi-

tions. (48 Geo. hi. c. 149, § 38, etc. ; 55 Geo.

in. c. 184, Schedule, Part in. ; 21 & 22 Vict.

c. 56, §§ 9, 12, 13, etc. ; and 16 & 17 Vict. c. 59,

§ 8; 31 & 32 Vict. c. 101, §§ 3 and 117; 37 &

38 Vict. c. 94, § 30 ; and 23 & 24 Vict. c. 80.)

Personal Property — Absolute power of disposal. —

Personal estate which a person dying after 3d

April 1860 shall have disposed of by wilK

under any authority enabling such person to

dispose of the same as he shall think fit, shall

be deemed personal or moveable estate of the

person so dying, for the purpose of payment of

inventory, probate, or administration duty.

(23 Vict. c. 15, § 4.X

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued,

or stock in lieu thereof, being assets of a de-

ceased person, the interest of which shall be

payable in London, registered iu London, or

enlaced in India for the purpose of such re-

gistration, before the death of the owner ; also

Indian Government promissory notes with

coupons attached, in the same circumstances

as to registration, and certificates issued, or

stock created in lieu thereof, shall be per-

sonal estate and bona notabilia in England

of the deceased person (23 Vict. c. 5, § 1) :

Also any ship, or any share of a ship, be-

longing to a deceased person, registered in

any port in the United Kingdom, notwith-

standing such ship at the time of the death

may have been at sea, or elsewhere out of the

United Kingdom, shall be deemed to be at

the port at which she may be registered (27 &

28 Vict. c. 56), and liable to inventory, probate,

or administration duty.

Specialty Debts.— For probate and admiuistra-

701

drafts or orders — appointment of agent, or re-

vocation of such — any instrument or document

required in pursuance of Act 9 Geo. iv. c. 92

(see § 44) — copy transcript of rules (§ 5) — bonds

by treasurers and other officers (§ 7) — copy

register of births, baptisms, etc. — certificate,

declaration, or instrument as to purchase of

annuity — power of attorney authorizing the

receipt of annuity, and receipt for annuity

(3 and 4 Will. iv. c. 14, § 19) — bond to comp-

troller of national debt office (7 and 8 Vict.

c. 83, § 17)— award by barrister under Acts

(§ 14). Inventory Duty.— Depositors not

exceeding ,£50, exclusive of interest, dying,

and if probate, or letters of administration, is

not produced, or if notice in writing of will or

intention to take out letters of administration

within one month of death be not given, and

in the latter case, unless will proved, or letters

of administration taken out within two months,

bank may pay to persons appearing to be the

widow, or entitled to effects, according to

statute of distribution, or according to the

rules of Savings Banks Act, 26 and 27 Vict. c.

87, § 45. ' Persons ' and ' probate and letters

of administration ' in this section to mean in

Scotland next of kin and confirmation (§ 47).

Schools. — The conveyance of land aud heritages

for the foundation and endowment of ad-

ditional schools in Scotland (1 and 2 Vict. c.

87, § 5). Disposition or deed of conveyance

for the transference of existing schools to

school board, exempted from stamp duty (35

and 36 Vict. c. 62, § 39).

Telegraph. — All deeds for the purposes of the

Telegraph Act 1868, and Act 1869 (32 and

33 Vict. c. 73, § 22).

War. See Barracks.

Weights and Measures. — Indenture of verifica-

tion of any standard or any endorsement

thereon (29 and 30 Vict. c. 82, § 9).

Woods and Buildings. — Deed, bond, discharge,

receipt,, or other instrument by or to the Com-

missioners for the purposes of the New-

General Post-Office (Edinburgh) Act (21 and

22 Vict. c. 40, § 21).

Woods and Forests. — Memorandum, contract, or

agreement and deed, receipt or other instrument

for the sale, purchase, or exchange of any

estates, manors, etc., under the Act— grant,

lease, contract, agreement — appointment of

officers — certificate for gamekeeper — bond by

or for receiver (10 Geo. iv. c. 50, § 77).

[By 3 and 4 Gul. iv. c. 69, § 3, the direc-

tions, clauses, matters, things, powers, and

authorities in 10 Geo. iv. c. 50, relating to tho

selling, leasing, exchanging, and general ad-

ministration of the land revenues of the

Crown in England, and all the powers, pro-

visions, and authorities given in the said Act

to the Commissioners of Her Majesty's Woods,

shall apply, in so far as applicable, as if con-

tained in the Act 3 and 4 Gul. iv, or as if the

land revenues in Scotland had been included in

the Act 10 Geo. iv. The Act 14 and 15 Vict. c.

42, separated the Commissioners of Works and

Public Buildings from the Commissioners of

Woods and Forests and Land Pievenues.]

INVENTORY DUTY.

Abstract of the Eates of Inventory Duty.

Inventories to be exhibited and recorded on or after 1st June 1881, 44 Vict. c. 12. [For

duties previously payable, see 55 Geo. in. c. 184 (Schedule, Part in.), 22 and 23 Vict. c. 36,

§ 1, 27 and 28 Vict. c. 56, § 5, and 43 Vict. c. 14.J

Note. — Additional inventory where former duly stamped inventory exhibited and recorded prior

to 1st June 1881 to be chargeable with the stamp duty it would have been chargeable with if

44 Vict. c. 12 had not been passed. By 16 and 17 Vict. c. 59, § 8, an additional inventory shall be

chargeable only with such amount of stamp duty as, together with the stamp duty charged upon the

former duly stamped inventory of the estate and effects of the same deceased person, shall make up

the full amount of stamp duty in respect of the total amount of all the estate and effects of the

deceased specified in the said additional and any such former inventory.

Exemptions. — Inventory of the estate of any common seaman or soldier dying in service.

Additional inventory when the duty on the whole estate does not exceed that already paid on the

former inventory.

Property liable to the Duty. — Generally — All

personal property (heritable securities are per-

sonal property which include bonds of annual

rent and bonds of annuity and real burdens on

land, but not securities by absolute disposition

qualified by back bond) belonging to the

deceased in the United Kingdom, heritable

securities, and bonds excluding executors, and

also money secured by ex facie absolute disposi-

tions. (48 Geo. hi. c. 149, § 38, etc. ; 55 Geo.

in. c. 184, Schedule, Part in. ; 21 & 22 Vict.

c. 56, §§ 9, 12, 13, etc. ; and 16 & 17 Vict. c. 59,

§ 8; 31 & 32 Vict. c. 101, §§ 3 and 117; 37 &

38 Vict. c. 94, § 30 ; and 23 & 24 Vict. c. 80.)

Personal Property — Absolute power of disposal. —

Personal estate which a person dying after 3d

April 1860 shall have disposed of by wilK

under any authority enabling such person to

dispose of the same as he shall think fit, shall

be deemed personal or moveable estate of the

person so dying, for the purpose of payment of

inventory, probate, or administration duty.

(23 Vict. c. 15, § 4.X

Indian Promissory Notes — Ships. — Indian Govern-

ment promissory notes and certificates issued,

or stock in lieu thereof, being assets of a de-

ceased person, the interest of which shall be

payable in London, registered iu London, or

enlaced in India for the purpose of such re-

gistration, before the death of the owner ; also

Indian Government promissory notes with

coupons attached, in the same circumstances

as to registration, and certificates issued, or

stock created in lieu thereof, shall be per-

sonal estate and bona notabilia in England

of the deceased person (23 Vict. c. 5, § 1) :

Also any ship, or any share of a ship, be-

longing to a deceased person, registered in

any port in the United Kingdom, notwith-

standing such ship at the time of the death

may have been at sea, or elsewhere out of the

United Kingdom, shall be deemed to be at

the port at which she may be registered (27 &

28 Vict. c. 56), and liable to inventory, probate,

or administration duty.

Specialty Debts.— For probate and admiuistra-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1882-1883 > (735) |

|---|

| Permanent URL | https://digital.nls.uk/83479011 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|