Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

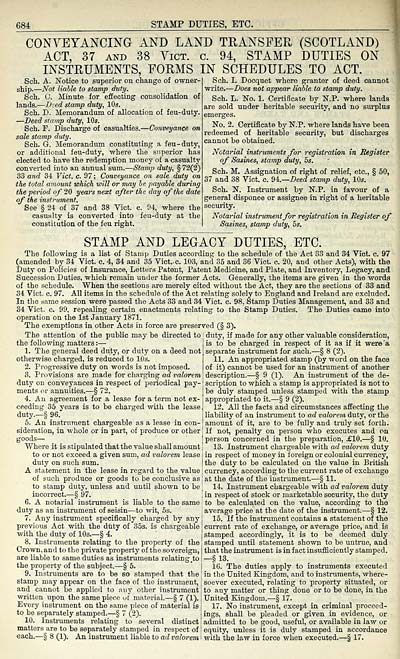

684

STAMP DUTIES, ETC.

CONVEYANCING AND LAND TRANSFER (SCOTLAND)

ACT, 37 and 38 Vict. c. 94, STAMP DUTIES ON

INSTRUMENTS, FORMS IN SCHEDULES TO ACT.

Scli. A. Notice to superior on change of owner-

ship. — Not liable to stamp duty.

Sch. C. Minute for effecting consolidation of

lands. — peed stamp duty, 10s.

Sch. D. Memorandum of allocation of feu-duty.

— Deed stamp duty, 10s.

Sch. F. Discharge of casualties. — Conveyance on

sale stamp duty.

Sch. G. Memorandum constituting a feu- duty,

or additional feu-duty, where the superior has

elected to have the redemption money of a casualty

converted into an annual sum. — Stamp duty, § 72(2)

33 and 34 Vict. c. 97; Conveyance on sale duty on

the total amount which will or may be payable during

the period of 20 years next after the day of the date

of the instrument.

See § 24 of 37 and 38 Vict. c. 94, where the

casualty is converted into feu-duty at the

constitution of the feu right.

Sch. I. Docquet where granter of deed cannot

write. — Does not appear liable to stamp duty.

Sch. L. No. 1. Certificate by N.P. where lands

are sold under heritable security, and no surplus

emerges.

No. 2. Certificate by N.P. where lands have been

redeemed of heritable security, but discharges

cannot be obtained.

Notarial instruments for registration in Register

of Sasines, stamp duty, 5s.

Sch. M. Assignation of right of relief, etc., § 50,

37 and 38 Vict. c. 94. — Deed stamp duty, 10s.

Sch. N. Instrument by N.P. in favour of a

general disponee or assignee in right of a heritable

security.

Notarial instrument for registration in Register of

Sasines, stamp duty, 5s.

STAMP AND LEGACY DUTIES, ETC.

The following is a list of Stamp Duties according to the schedule of the Act 33 and 34 Vict. c. 97

(amended by 34 Vict. c. 4, 34 and 35 Vict.-c. 103, and 35 and 36 Vict. c. 20, and other Acts), with the

Duty on Policies of Insurance, Letters Patent, Patent Medicine, and Plate, and Inventory, Legacy, and

Succession Duties, which remain under the former Acts. Generally, the items are given in the words

of the schedule. When the sections are merely cited without the Act, they are the sections of 33 and

34 Vict. c. 97. All items in the schedule of the Act relating solely to England and Ireland are excluded.

In the same session were passed the Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and

34 Vict. c. 99, repealing certain enactments relating to the Stamp Duties. The Duties came into

operation on the 1st January 1871.

The exemptions in other Acts in force are preserved (§ 3).

The attention of the public may be directed to duty, if made for any other valuable consideration,

the following matters :

1. The general deed duty, or duty on a deed not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of periodical pay-

ments or annuities. — § 72.

4. An agreement for a lease for a term not ex-

ceeding 35 years is to be charged with the lease

duty.— § 96.

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

goods —

Where it is stipulated that the value shall amount

is to be charged in respect of it as if it were 'a

separate instrument for such. — § 8 (2).

11. An appropriated stamp (byword on the face

of it) cannot be used for an instrument of another

description. — § 9 (1). An instrument of the de-

scription to which a stamp is appropriated is not to

be duly stamped unless stamped with the stamp

appropriated to it. — § 9 (2).

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth.

If not, penalty on person who executes and on

person concerned in the preparation, £10. — § 10.

13. Instrument chargeable with ad valorem duty

to or not exceed a given sum, ad valorem lease I in respect of money in foreign or colonial currency,

duty on such sum. the duty to be calculated on the value in British

A statement in the lease in regard to the value | currency, according to the current rate of exchange

of such produce or goods to be conclusive as ] at the date of the instrument- — § 11.

to stamp duty, unless and until shown to be : 14. Instrument chargeable with ad valorem duty

incorrect. — § 97. ; in respect of stock or marketable security, the duty

6. A notarial instrument is liable to the same to be calculated on the value, according to the

duty as an instrument of seisin — to wit, 5s,

7. Any instrument specifically charged by any

previous Act with the duty of 35s. is chargeable

with the duty of 10s. — § 4.

8. Instruments relating to the property of the

Crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject. — § 5

average price at the date of the instrument. — § 12.

15. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly

stamped until statement shown to be untrue, and

that the instrument is in fact insufficiently stamped.

—§13.

1G. The duties apply to instruments executed

9. Instruments are to be so stamped that the ! in the United Kingdom, and to instruments, where

stamp may appear on the face of the instrument, j soever executed, relating to property situated, or

and cannot be applied to any other instrument | to any matter or thing done or to be done, in the

written upon the same piece of material. — § 7 (1).

Every instrument on the same piece of material is

to be separately stamped. — § 7 (2).

10. Instruments relating to several distinct

matters are to be separately stamped in respect of

United Kingdom. — § 17.

17. No instrument, except in criminal proceed-

ings, shall be pleaded or given in evidence, or

admitted to be good, useful, or available in law or

equity, unless it is duly stamped in accordance

each.— § 8 (1). An instrument liable to ad valorem I with the law in force wlien executed.— § 17

STAMP DUTIES, ETC.

CONVEYANCING AND LAND TRANSFER (SCOTLAND)

ACT, 37 and 38 Vict. c. 94, STAMP DUTIES ON

INSTRUMENTS, FORMS IN SCHEDULES TO ACT.

Scli. A. Notice to superior on change of owner-

ship. — Not liable to stamp duty.

Sch. C. Minute for effecting consolidation of

lands. — peed stamp duty, 10s.

Sch. D. Memorandum of allocation of feu-duty.

— Deed stamp duty, 10s.

Sch. F. Discharge of casualties. — Conveyance on

sale stamp duty.

Sch. G. Memorandum constituting a feu- duty,

or additional feu-duty, where the superior has

elected to have the redemption money of a casualty

converted into an annual sum. — Stamp duty, § 72(2)

33 and 34 Vict. c. 97; Conveyance on sale duty on

the total amount which will or may be payable during

the period of 20 years next after the day of the date

of the instrument.

See § 24 of 37 and 38 Vict. c. 94, where the

casualty is converted into feu-duty at the

constitution of the feu right.

Sch. I. Docquet where granter of deed cannot

write. — Does not appear liable to stamp duty.

Sch. L. No. 1. Certificate by N.P. where lands

are sold under heritable security, and no surplus

emerges.

No. 2. Certificate by N.P. where lands have been

redeemed of heritable security, but discharges

cannot be obtained.

Notarial instruments for registration in Register

of Sasines, stamp duty, 5s.

Sch. M. Assignation of right of relief, etc., § 50,

37 and 38 Vict. c. 94. — Deed stamp duty, 10s.

Sch. N. Instrument by N.P. in favour of a

general disponee or assignee in right of a heritable

security.

Notarial instrument for registration in Register of

Sasines, stamp duty, 5s.

STAMP AND LEGACY DUTIES, ETC.

The following is a list of Stamp Duties according to the schedule of the Act 33 and 34 Vict. c. 97

(amended by 34 Vict. c. 4, 34 and 35 Vict.-c. 103, and 35 and 36 Vict. c. 20, and other Acts), with the

Duty on Policies of Insurance, Letters Patent, Patent Medicine, and Plate, and Inventory, Legacy, and

Succession Duties, which remain under the former Acts. Generally, the items are given in the words

of the schedule. When the sections are merely cited without the Act, they are the sections of 33 and

34 Vict. c. 97. All items in the schedule of the Act relating solely to England and Ireland are excluded.

In the same session were passed the Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and

34 Vict. c. 99, repealing certain enactments relating to the Stamp Duties. The Duties came into

operation on the 1st January 1871.

The exemptions in other Acts in force are preserved (§ 3).

The attention of the public may be directed to duty, if made for any other valuable consideration,

the following matters :

1. The general deed duty, or duty on a deed not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of periodical pay-

ments or annuities. — § 72.

4. An agreement for a lease for a term not ex-

ceeding 35 years is to be charged with the lease

duty.— § 96.

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

goods —

Where it is stipulated that the value shall amount

is to be charged in respect of it as if it were 'a

separate instrument for such. — § 8 (2).

11. An appropriated stamp (byword on the face

of it) cannot be used for an instrument of another

description. — § 9 (1). An instrument of the de-

scription to which a stamp is appropriated is not to

be duly stamped unless stamped with the stamp

appropriated to it. — § 9 (2).

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth.

If not, penalty on person who executes and on

person concerned in the preparation, £10. — § 10.

13. Instrument chargeable with ad valorem duty

to or not exceed a given sum, ad valorem lease I in respect of money in foreign or colonial currency,

duty on such sum. the duty to be calculated on the value in British

A statement in the lease in regard to the value | currency, according to the current rate of exchange

of such produce or goods to be conclusive as ] at the date of the instrument- — § 11.

to stamp duty, unless and until shown to be : 14. Instrument chargeable with ad valorem duty

incorrect. — § 97. ; in respect of stock or marketable security, the duty

6. A notarial instrument is liable to the same to be calculated on the value, according to the

duty as an instrument of seisin — to wit, 5s,

7. Any instrument specifically charged by any

previous Act with the duty of 35s. is chargeable

with the duty of 10s. — § 4.

8. Instruments relating to the property of the

Crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject. — § 5

average price at the date of the instrument. — § 12.

15. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly

stamped until statement shown to be untrue, and

that the instrument is in fact insufficiently stamped.

—§13.

1G. The duties apply to instruments executed

9. Instruments are to be so stamped that the ! in the United Kingdom, and to instruments, where

stamp may appear on the face of the instrument, j soever executed, relating to property situated, or

and cannot be applied to any other instrument | to any matter or thing done or to be done, in the

written upon the same piece of material. — § 7 (1).

Every instrument on the same piece of material is

to be separately stamped. — § 7 (2).

10. Instruments relating to several distinct

matters are to be separately stamped in respect of

United Kingdom. — § 17.

17. No instrument, except in criminal proceed-

ings, shall be pleaded or given in evidence, or

admitted to be good, useful, or available in law or

equity, unless it is duly stamped in accordance

each.— § 8 (1). An instrument liable to ad valorem I with the law in force wlien executed.— § 17

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1882-1883 > (718) |

|---|

| Permanent URL | https://digital.nls.uk/83478807 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|