Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

THE

SCOTTISH PROVIDENT INSTITUTION,

6 St. Andrew Square, Edinburgh.

JOHN CAT, Esq.

JAMES CATHCART. Esq.

WILLIAM WATSON, Esq.

THOMAS STEVENSON, Esq.

JOHN MACFIE, Esq.

DIRECTORS.

STAIR AGNEW, Esq.

GEORGE HOPE, Esq.

G. M. TYTLER, Esq,

NORMAN MACPHERSON, Esq.

GRAHAM BINNY, Esq.

Sir WM. JOHNSTON.

WILLIAM SKISNEK, Esq.

JOHN AULD. Esq.

P. G. TAIT, Esq.

ANDW. RUTHERFORD, Esq.

THE DtllECTORS' REPORT to the Thirty- Sixth Annual Meeting was one of more

than usual interest, embracing not merely the usual narrative of the year's transac-

tions, but also a statement of the result of the Fourth Septennial Investigation.

The NEW BUSINESS was— 1745 1*0110168 issued for £980,560; of which £3000 were re-insured.

The Yearly Premiums oa these were £28,615, with £4603 of Single Payments. 204 Proposals for

£111,010 were declined. The Deaths in the Year were 216, and the Claims, including Bonus

Additions, £135,516. The subsisting A ssurances were 18,069, for £8,903,358. The Total Eeceipts in

the Year, including luterest, -nrere £353,613.

The REALIZED FUND, as at 31st December 1873, was £2,253,175, Ofl. 5d. ; the increase in the

year being £203,364.

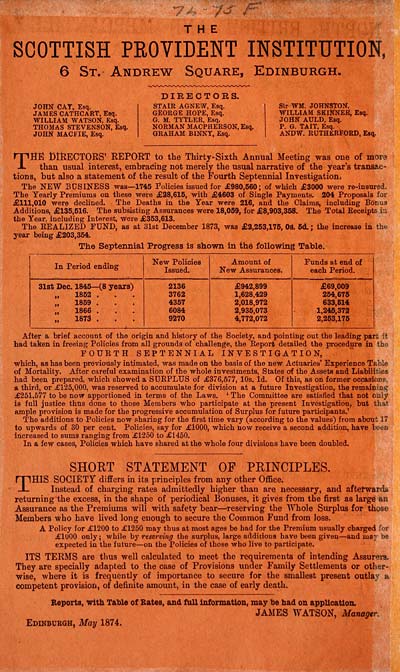

The Septennial Progress is shown in the following Table.

After a brief account of the origin and history of the Society, and pointing out the leading part it

had taken in freeing Policies from all grounds of challenge, the Report detailed the procedure in the

FOURTH SEPTENNIAL INVESTIGATION,

which, as has been previously intimated, was made on the basis of the new Actuaries' Experience Thble

of Mortality. After careful examination of the whole investments, States of the Assets and Liabilities

had been prepared, which showed a SURPLUS of £376,677, 10s. Id. Of this, as on former occasionf ,

a third, or £125,000, was reserved to accumulate for division at a future Investigation, the remaining

£251,677 to be now apportioned ill terms of the Laws. ' The Committee are satisfied that not only

is full justice thus done to those Members who participate at the present Investigation, but that

ample provision is made for the progressive accumulation of Surplus for future participants.'

The additions to Policies now sharing for the first time vary (according to the values) from about 17

to upwards of 30 per cent. Policies, say for £1000, which now receive a second addition, have been

increased to sums ranging from £1250 to £1450.

In a few cases, Policies which have shared at the whole four divisions have beSn doubled.

SHORT STATEMENT OF PRINCIPLES.

THIS SOCIETY differs in its principles from any other Office.

Instead of charging rates admittedly higher than are necessary, and aftetT^ards

returningthe excess, in the shape of periodical Bonuses, it gives from the first as large an

Assurance as the Premiums will with safety bear — reserving the AVhole Surplus for those

Members who have lived long enough to secure the Common Fund from loss.

A Policy for £1200 to £1250 may thus at most ages be had for the Premium usually charged for

£1000 only; while by reserving the surplus, large additions have been given — and may be

expected in the future — on the JPoiicies of those who live to participate,

ITS TERMS are tlius well calculated to meet the requirements of intending Assurers.

They are specially adapted to the case of Provisions under Family Settlements or other-

wise, where it is frequently of importance to secure for the smallest present outlay a

competent provision, of definite amount, in the case of early death.

BeportB, with Table of Bates, and fall information, may be had on application.

JAMES WATSON, Managtr.

Edinburgh, May 1874.

SCOTTISH PROVIDENT INSTITUTION,

6 St. Andrew Square, Edinburgh.

JOHN CAT, Esq.

JAMES CATHCART. Esq.

WILLIAM WATSON, Esq.

THOMAS STEVENSON, Esq.

JOHN MACFIE, Esq.

DIRECTORS.

STAIR AGNEW, Esq.

GEORGE HOPE, Esq.

G. M. TYTLER, Esq,

NORMAN MACPHERSON, Esq.

GRAHAM BINNY, Esq.

Sir WM. JOHNSTON.

WILLIAM SKISNEK, Esq.

JOHN AULD. Esq.

P. G. TAIT, Esq.

ANDW. RUTHERFORD, Esq.

THE DtllECTORS' REPORT to the Thirty- Sixth Annual Meeting was one of more

than usual interest, embracing not merely the usual narrative of the year's transac-

tions, but also a statement of the result of the Fourth Septennial Investigation.

The NEW BUSINESS was— 1745 1*0110168 issued for £980,560; of which £3000 were re-insured.

The Yearly Premiums oa these were £28,615, with £4603 of Single Payments. 204 Proposals for

£111,010 were declined. The Deaths in the Year were 216, and the Claims, including Bonus

Additions, £135,516. The subsisting A ssurances were 18,069, for £8,903,358. The Total Eeceipts in

the Year, including luterest, -nrere £353,613.

The REALIZED FUND, as at 31st December 1873, was £2,253,175, Ofl. 5d. ; the increase in the

year being £203,364.

The Septennial Progress is shown in the following Table.

After a brief account of the origin and history of the Society, and pointing out the leading part it

had taken in freeing Policies from all grounds of challenge, the Report detailed the procedure in the

FOURTH SEPTENNIAL INVESTIGATION,

which, as has been previously intimated, was made on the basis of the new Actuaries' Experience Thble

of Mortality. After careful examination of the whole investments, States of the Assets and Liabilities

had been prepared, which showed a SURPLUS of £376,677, 10s. Id. Of this, as on former occasionf ,

a third, or £125,000, was reserved to accumulate for division at a future Investigation, the remaining

£251,677 to be now apportioned ill terms of the Laws. ' The Committee are satisfied that not only

is full justice thus done to those Members who participate at the present Investigation, but that

ample provision is made for the progressive accumulation of Surplus for future participants.'

The additions to Policies now sharing for the first time vary (according to the values) from about 17

to upwards of 30 per cent. Policies, say for £1000, which now receive a second addition, have been

increased to sums ranging from £1250 to £1450.

In a few cases, Policies which have shared at the whole four divisions have beSn doubled.

SHORT STATEMENT OF PRINCIPLES.

THIS SOCIETY differs in its principles from any other Office.

Instead of charging rates admittedly higher than are necessary, and aftetT^ards

returningthe excess, in the shape of periodical Bonuses, it gives from the first as large an

Assurance as the Premiums will with safety bear — reserving the AVhole Surplus for those

Members who have lived long enough to secure the Common Fund from loss.

A Policy for £1200 to £1250 may thus at most ages be had for the Premium usually charged for

£1000 only; while by reserving the surplus, large additions have been given — and may be

expected in the future — on the JPoiicies of those who live to participate,

ITS TERMS are tlius well calculated to meet the requirements of intending Assurers.

They are specially adapted to the case of Provisions under Family Settlements or other-

wise, where it is frequently of importance to secure for the smallest present outlay a

competent provision, of definite amount, in the case of early death.

BeportB, with Table of Bates, and fall information, may be had on application.

JAMES WATSON, Managtr.

Edinburgh, May 1874.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1874-1875 > (6) |

|---|

| Permanent URL | https://digital.nls.uk/83459722 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|