Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

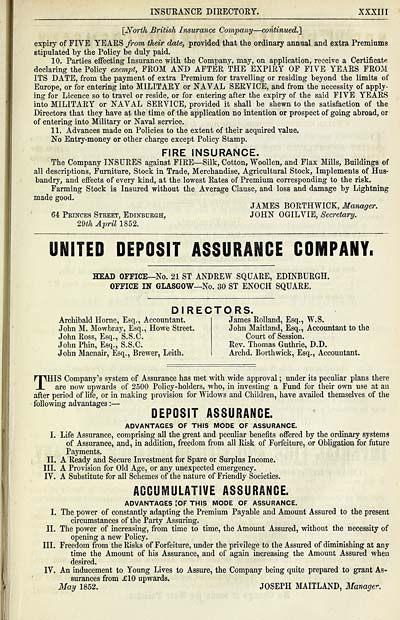

INSUEANCE DIRECTORY. XXXIII

[N^orih British Insurance Company — continued.]

expiry of FIVE YEARS from their date, provided that the ordinary annual and extra Premiums

stipulated by the Policy be duly paid.

10, Parties effecting Insurance with the Company, may, on application, receive a Certificate

declaring the Policy exempt, FROM AND AFTER THE EXPIRY OF FIVE YEARS FROM

ITS DATE, from the payment of extra Premium for travelling or residing beyond the limits of

Europe, or for entering into MILITARY or If AVAL SERVICE, and from the necessity of apply-

ing for Licence so to travel or reside, or for entering after the expiry of the said FIVE YEARS

into MILITARY or KAVAL SERVICE, provided it shall be shewn to the satisfaction of the

Directors that they have at the time of the application no intention or prospect of going abroad, or

of entering into Military or Naval service.

11. Advances made on Policies to the extent of their acquired value.

No Entry-money or other charge except Policy Stamp.

FIRE INSURANCE.

The Company INSURES against FIRE— Silk, Cotton, Woollen, and Flax Mills, Buildings of

all descriptions, Furniture, Stock in Trade, Merchandise, Agricultural Stock, Implements of Hus-

bandry, and effects of every kind, at the lowest Rates of Premium corresponding to the risk.

Farming Stock is Insured without the Average Clause, and loss and damage by Lightning

made good.

JAMES BORTHWICK, Manager.

Gi Princes Street, Edinburgh, JOHN 06ILVIE, Secretary.

29th April 1852.

UNITED DEPOSIT ASSURANCE COMPANY.

HEAD OFFICE— No. 21 ST ANDREW SQUARE, EDINBURGH.

OFFICE IN GLASGOW— No. 30 ST ENOCH SQUARE.

DIRECTORS.

Archibald Home, Esq., Accountant.

John M. Mowbray, Esq., Howe Street.

John Ross, Esq., S.S.C.

John Phin, Esq., S.S.C.

John Macnau', Esq., Brewer, Leith.

James Rolland, Esq., W.S.

John Maitland, Esq., Accountant to the

Court of Session.

Rev. Tliomas Guthrie, D.D.

Archd. Borthwick, Esq., Accountant.

THIS Company's system of Assurance has met with wide approval ; under its peculiar plans there

are now upwards of 2500 Policy-holders, who, in investing a Fund for their own use at an

after period of life, or in making provision for Widows and Children, have availed themselves of the

following advantages : —

DEPOSIT ASSURANCE.

ADVANTAGES OF THIS MODE OF ASSURANCE.

I. Life Assurance, comprising all the great and peculiar benefits offered by the ordinaiy systems

of Assurance, and, in addition, freedom from all Risk of Forfeiture, or Obligation for future

Payments.

II. A Ready and Secure Investment for Spare or Surplus Income.

III. A Provision for Old Age, or any unexpected emergency.

IV. A Substitute for all Schemes of the nature of Friendly Societies.

ACCUMULATIVE ASSURANCE.

ADVANTAGES [OF THIS MODE OF ASSURANCE.

I. The power of constantly adapting the Premium Payable and Amount Assured to the present

circumstances of the Party Assuring.

II. The power of increasing, from time to time, the Amount Assured, without the necessity of

opening a new Policy.

III. Freedom from the Risks of Forfeiture, under the privilege to the Assured of diminishing at any

time the Amount of his Assurance, and of again increasing the Amount Assured when

desired.

IV. An inducement to Young Lives to Assure, the Company being quite prepared to grant As-

surances from £10 upwards.

May 1852. JOSEPH MAITLAND, Manager.

[N^orih British Insurance Company — continued.]

expiry of FIVE YEARS from their date, provided that the ordinary annual and extra Premiums

stipulated by the Policy be duly paid.

10, Parties effecting Insurance with the Company, may, on application, receive a Certificate

declaring the Policy exempt, FROM AND AFTER THE EXPIRY OF FIVE YEARS FROM

ITS DATE, from the payment of extra Premium for travelling or residing beyond the limits of

Europe, or for entering into MILITARY or If AVAL SERVICE, and from the necessity of apply-

ing for Licence so to travel or reside, or for entering after the expiry of the said FIVE YEARS

into MILITARY or KAVAL SERVICE, provided it shall be shewn to the satisfaction of the

Directors that they have at the time of the application no intention or prospect of going abroad, or

of entering into Military or Naval service.

11. Advances made on Policies to the extent of their acquired value.

No Entry-money or other charge except Policy Stamp.

FIRE INSURANCE.

The Company INSURES against FIRE— Silk, Cotton, Woollen, and Flax Mills, Buildings of

all descriptions, Furniture, Stock in Trade, Merchandise, Agricultural Stock, Implements of Hus-

bandry, and effects of every kind, at the lowest Rates of Premium corresponding to the risk.

Farming Stock is Insured without the Average Clause, and loss and damage by Lightning

made good.

JAMES BORTHWICK, Manager.

Gi Princes Street, Edinburgh, JOHN 06ILVIE, Secretary.

29th April 1852.

UNITED DEPOSIT ASSURANCE COMPANY.

HEAD OFFICE— No. 21 ST ANDREW SQUARE, EDINBURGH.

OFFICE IN GLASGOW— No. 30 ST ENOCH SQUARE.

DIRECTORS.

Archibald Home, Esq., Accountant.

John M. Mowbray, Esq., Howe Street.

John Ross, Esq., S.S.C.

John Phin, Esq., S.S.C.

John Macnau', Esq., Brewer, Leith.

James Rolland, Esq., W.S.

John Maitland, Esq., Accountant to the

Court of Session.

Rev. Tliomas Guthrie, D.D.

Archd. Borthwick, Esq., Accountant.

THIS Company's system of Assurance has met with wide approval ; under its peculiar plans there

are now upwards of 2500 Policy-holders, who, in investing a Fund for their own use at an

after period of life, or in making provision for Widows and Children, have availed themselves of the

following advantages : —

DEPOSIT ASSURANCE.

ADVANTAGES OF THIS MODE OF ASSURANCE.

I. Life Assurance, comprising all the great and peculiar benefits offered by the ordinaiy systems

of Assurance, and, in addition, freedom from all Risk of Forfeiture, or Obligation for future

Payments.

II. A Ready and Secure Investment for Spare or Surplus Income.

III. A Provision for Old Age, or any unexpected emergency.

IV. A Substitute for all Schemes of the nature of Friendly Societies.

ACCUMULATIVE ASSURANCE.

ADVANTAGES [OF THIS MODE OF ASSURANCE.

I. The power of constantly adapting the Premium Payable and Amount Assured to the present

circumstances of the Party Assuring.

II. The power of increasing, from time to time, the Amount Assured, without the necessity of

opening a new Policy.

III. Freedom from the Risks of Forfeiture, under the privilege to the Assured of diminishing at any

time the Amount of his Assurance, and of again increasing the Amount Assured when

desired.

IV. An inducement to Young Lives to Assure, the Company being quite prepared to grant As-

surances from £10 upwards.

May 1852. JOSEPH MAITLAND, Manager.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1852-1853 > (477) |

|---|

| Permanent URL | https://digital.nls.uk/83422662 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|