Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

IlfSIJRANCE DIRECTORY.

XXIX

MUTUAL ASSURANCE COMBINED WITH MODERATE PREMIUMS.

SCOTTISH PROVIDENT INSTITUTION,

FOR ASSURANCES AND ANNUITIES ON LIVES.

3Encorp0rat£l( fig ^ct $f parliament.

No. 14 ST ANDREW SQUARE, EDINBURGH.

DIRECTORS.

Robert Hunter, Esq., Advocate, Sheriff of

Buteshire.

Francis Richardson, Esq., Merchapt.

James Cathcart, Esq., Merchant.

John Auld, Esq., W.S.

David Hector, Esq., Advocate.

C. W. Anderson, Esq., Merchant, Leith.

Charles Morton, Esq., W.S.

Donald Smith Peddie, Esq., Accountant.

Hugh Redpath, Esq., Merchant.

John Sinclair, Esq., City Clerk.

James Stirling, Esq., Civil Engineer.

William Nelson, Esq., PubUsher.

John Hunter, Esq., Auditor of the Court of

Session.

John Parker, Esq., Inland Revenue Office.

Charles Lawson, Jun., Esq., Seedsman.

Auditors.

James Crawford, Jun., Esq., W.S. | Alexander Biyson, Esq., Watchmaker.

William Brand, Esq., W.S., Secretary to the Union Bank.

Bankers — ^The National Bank of Scotland.

Medical Officers.

Professor Sir George Ballingall. — James Duncan, M.D., 12 Heriot Row.

THE SCOTTISH PROVIDENT INSTITUTION is the only Office in which the advantages of

Mutual Assm-ance can be obtained at Moderate Premiums. The Assured are at the same time

specially exempt from personal liability.

In many Offices, Assurers are offered the choice of a moderate Scale of Premiums, without any

claim to share in the Profits, or of a right to participate in these, at an excessive rate of Premium.

Assurers with the Scottish Provident Institution are the sole recipients of the Profits, and at

rates of Premium equally moderate with those of the Non-Participating Scale of other Offices.

The principle on which the Profits are divided is at once safe, equitable, and favourable to good

lives — ^the Surplus being reserved for those Members who alone can have made surplus payments ; in

other words, for those whose Premiums, with accumulated interest, amount to the sums in their

Policies.

This principle, while it on the one hand avoids the anomaly of giving additions to those Policies

which become claims in their earlier years, secures on the other hand that there is no Member who

has not been in a pecuniary sense a gainer by the transaction, who does not receive a share of the

Profits.

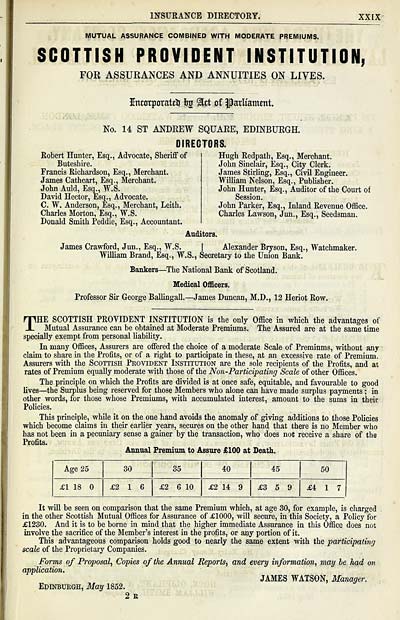

Annual Premium to Assure £100 at Death.

It will be seen on comparison that the same Premium which, at age 30, for example, is cliarged

in the otha- Scottish Mutual Offices for Assurance of £1000, will secure, in this Society, a Policy for

£1230. And it is to be borne in muid that the higher immediate Assurance in this Office does not

involve the sacrifice of the Member's interest in the profits, or any portion of it.

This advantageous comparison holds good to nearly the same extent with the participating

scale of the Proprietary Companies.

Forms of Proposal, Copies of the Annual Reports, and every information, may he had on

application.

JAMES WATSON, Manager.

Edinburgh, May 1852.

2e

XXIX

MUTUAL ASSURANCE COMBINED WITH MODERATE PREMIUMS.

SCOTTISH PROVIDENT INSTITUTION,

FOR ASSURANCES AND ANNUITIES ON LIVES.

3Encorp0rat£l( fig ^ct $f parliament.

No. 14 ST ANDREW SQUARE, EDINBURGH.

DIRECTORS.

Robert Hunter, Esq., Advocate, Sheriff of

Buteshire.

Francis Richardson, Esq., Merchapt.

James Cathcart, Esq., Merchant.

John Auld, Esq., W.S.

David Hector, Esq., Advocate.

C. W. Anderson, Esq., Merchant, Leith.

Charles Morton, Esq., W.S.

Donald Smith Peddie, Esq., Accountant.

Hugh Redpath, Esq., Merchant.

John Sinclair, Esq., City Clerk.

James Stirling, Esq., Civil Engineer.

William Nelson, Esq., PubUsher.

John Hunter, Esq., Auditor of the Court of

Session.

John Parker, Esq., Inland Revenue Office.

Charles Lawson, Jun., Esq., Seedsman.

Auditors.

James Crawford, Jun., Esq., W.S. | Alexander Biyson, Esq., Watchmaker.

William Brand, Esq., W.S., Secretary to the Union Bank.

Bankers — ^The National Bank of Scotland.

Medical Officers.

Professor Sir George Ballingall. — James Duncan, M.D., 12 Heriot Row.

THE SCOTTISH PROVIDENT INSTITUTION is the only Office in which the advantages of

Mutual Assm-ance can be obtained at Moderate Premiums. The Assured are at the same time

specially exempt from personal liability.

In many Offices, Assurers are offered the choice of a moderate Scale of Premiums, without any

claim to share in the Profits, or of a right to participate in these, at an excessive rate of Premium.

Assurers with the Scottish Provident Institution are the sole recipients of the Profits, and at

rates of Premium equally moderate with those of the Non-Participating Scale of other Offices.

The principle on which the Profits are divided is at once safe, equitable, and favourable to good

lives — ^the Surplus being reserved for those Members who alone can have made surplus payments ; in

other words, for those whose Premiums, with accumulated interest, amount to the sums in their

Policies.

This principle, while it on the one hand avoids the anomaly of giving additions to those Policies

which become claims in their earlier years, secures on the other hand that there is no Member who

has not been in a pecuniary sense a gainer by the transaction, who does not receive a share of the

Profits.

Annual Premium to Assure £100 at Death.

It will be seen on comparison that the same Premium which, at age 30, for example, is cliarged

in the otha- Scottish Mutual Offices for Assurance of £1000, will secure, in this Society, a Policy for

£1230. And it is to be borne in muid that the higher immediate Assurance in this Office does not

involve the sacrifice of the Member's interest in the profits, or any portion of it.

This advantageous comparison holds good to nearly the same extent with the participating

scale of the Proprietary Companies.

Forms of Proposal, Copies of the Annual Reports, and every information, may he had on

application.

JAMES WATSON, Manager.

Edinburgh, May 1852.

2e

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1852-1853 > (473) |

|---|

| Permanent URL | https://digital.nls.uk/83422614 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|