Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

EDINBURGH AND LEITH

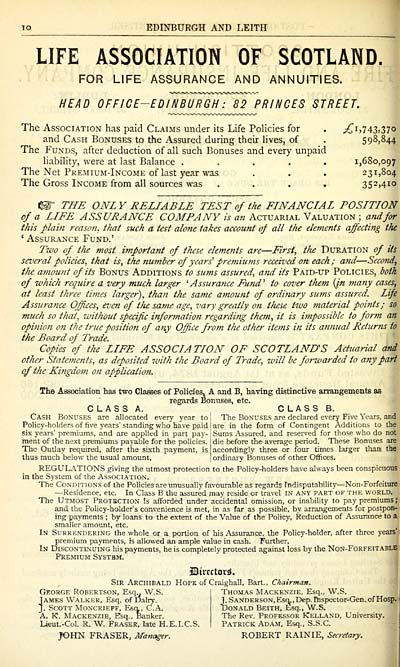

LIFE ASSOCIATION OF SCOTLAND.

FOR LIFE ASSURANCE AND ANNUITIES.

HEAD OFFICE-EDINBURGH : 82 PRINCES STREET.

The Association has paid Claims under its Life Policies for . ;;^i,743,37o

and Cash Bonuses to the Assured during their lives, of . 598,844

The Funds, after deduction of all such Bonuses and every unpaid

liabihty, were at last Balance ..... 1,680,097

The Net Premium-Income of last year was . . . 231,804

The Gross Income from all sources was .... 352,410

^= THE ONL Y RELIABLE TEST of the FINANCIAL POSITION

of a LIFE ASSURANCE COMPANY is an Actuarial Valuation ; and for

this plain reason, that such a test alo?ie takes account of all the elements affecting the

' Assurance Fund.'

Two of the most important of these elements are — First, the Duration of its

several policies, that is, the number of years' premiu?ns received on each; and — Second,

t/i£ amount of its Bonus Additions to sums assured, and its Paid-up Policies, both

of which require a very much larger ^Assurance Fund' to cover them (Jn many cases,

at least three times larger), than the same amount of ordifiary sums assured. Life

Assurance Offices, even of the same age, vary greatly on these two material points; so

much so that, without specific infonnation regarding them, it is impossible to form an

opinio?i on the true position of any Office from the other items in its annual Returns to

the Board of Trade.

Copies of the LIFE ASSOCIATION OF SCOTLAND S Actuarial and

other Statements, as deposited with the Board of Trade, will be forwarded to any part

(if the Kitigdom on application.

The Association has two Claflses of Policies, A and B, having distinctive arrangements as

regards Bonuses, etc.

CLASS A. CLASS B.

Cash Bonuses are allocated every year to I The Bonuses are declared every Five Years, and

Policy-holders of five years' standing who have paid I are in the form of Contingent Additions to the

six years' premiums, and are applied in part pay- I Sums Assured, and reserved for those who do not

ment of the next premiums payable for the policies. I die before the average period. These Bonuses are

The Outlay required, after the sixth payment, is accordingly three or four times larger than the

thus much below the usual amount. | ordinary Bonuses of other Offices.

REGULATIONS giving the utmost protection to the Policy-holders have always been conspicuous

in the System of the Association.

The Conditions of the Policies are unusually favourable as regards Indisputability — Non-Forfeittire

— Residence, etc. In Class B the assured may reside or travel in any part of the w^orld.

The Utmost Protection Is afforded under accidental omission, or inability to pay premiums ;

and the Policy-holder's convenience is met, in as far as possible, by arrangements for postpon-

ing payments ; by loans to the extent of the Value of the Pohcy, Reduction of Assurance to a

smaller amount, etc.

In Surrendering the whole or a portion of his Assurance, the Policy-holder, after three years'

premium payments, is allowed an ample value in cash. Further,

In Discontinuing his payments, he is completely protected against loss by the Non-Forfeitable

Premium Systbm.

JBirfctorjS.

Sir Archibald Hope of Craighall, Bart., Chairman.

Thomas Mackenzie, Esq., W.S.

J. Sanderson, Esq., Dep.Rispector-Gen. of Hosp. \

Donald Beith, Esq., W.S.

The Rev. Professor Kelland, University.

Patrick Adam, Esq., S.S.C.

JOHN FRASER, Manager. ROBERT RAINIE, Secretary.

George Robertson, Esq„ W.S.

James Walker, Esq. of Dairy.

J. Scott Moncrieff, Esix, C.A.

A. K. Mackenzie, Esq., Banker.

Ueut.-Col. R. W. Praser, late H.E.I.C.S.

LIFE ASSOCIATION OF SCOTLAND.

FOR LIFE ASSURANCE AND ANNUITIES.

HEAD OFFICE-EDINBURGH : 82 PRINCES STREET.

The Association has paid Claims under its Life Policies for . ;;^i,743,37o

and Cash Bonuses to the Assured during their lives, of . 598,844

The Funds, after deduction of all such Bonuses and every unpaid

liabihty, were at last Balance ..... 1,680,097

The Net Premium-Income of last year was . . . 231,804

The Gross Income from all sources was .... 352,410

^= THE ONL Y RELIABLE TEST of the FINANCIAL POSITION

of a LIFE ASSURANCE COMPANY is an Actuarial Valuation ; and for

this plain reason, that such a test alo?ie takes account of all the elements affecting the

' Assurance Fund.'

Two of the most important of these elements are — First, the Duration of its

several policies, that is, the number of years' premiu?ns received on each; and — Second,

t/i£ amount of its Bonus Additions to sums assured, and its Paid-up Policies, both

of which require a very much larger ^Assurance Fund' to cover them (Jn many cases,

at least three times larger), than the same amount of ordifiary sums assured. Life

Assurance Offices, even of the same age, vary greatly on these two material points; so

much so that, without specific infonnation regarding them, it is impossible to form an

opinio?i on the true position of any Office from the other items in its annual Returns to

the Board of Trade.

Copies of the LIFE ASSOCIATION OF SCOTLAND S Actuarial and

other Statements, as deposited with the Board of Trade, will be forwarded to any part

(if the Kitigdom on application.

The Association has two Claflses of Policies, A and B, having distinctive arrangements as

regards Bonuses, etc.

CLASS A. CLASS B.

Cash Bonuses are allocated every year to I The Bonuses are declared every Five Years, and

Policy-holders of five years' standing who have paid I are in the form of Contingent Additions to the

six years' premiums, and are applied in part pay- I Sums Assured, and reserved for those who do not

ment of the next premiums payable for the policies. I die before the average period. These Bonuses are

The Outlay required, after the sixth payment, is accordingly three or four times larger than the

thus much below the usual amount. | ordinary Bonuses of other Offices.

REGULATIONS giving the utmost protection to the Policy-holders have always been conspicuous

in the System of the Association.

The Conditions of the Policies are unusually favourable as regards Indisputability — Non-Forfeittire

— Residence, etc. In Class B the assured may reside or travel in any part of the w^orld.

The Utmost Protection Is afforded under accidental omission, or inability to pay premiums ;

and the Policy-holder's convenience is met, in as far as possible, by arrangements for postpon-

ing payments ; by loans to the extent of the Value of the Pohcy, Reduction of Assurance to a

smaller amount, etc.

In Surrendering the whole or a portion of his Assurance, the Policy-holder, after three years'

premium payments, is allowed an ample value in cash. Further,

In Discontinuing his payments, he is completely protected against loss by the Non-Forfeitable

Premium Systbm.

JBirfctorjS.

Sir Archibald Hope of Craighall, Bart., Chairman.

Thomas Mackenzie, Esq., W.S.

J. Sanderson, Esq., Dep.Rispector-Gen. of Hosp. \

Donald Beith, Esq., W.S.

The Rev. Professor Kelland, University.

Patrick Adam, Esq., S.S.C.

JOHN FRASER, Manager. ROBERT RAINIE, Secretary.

George Robertson, Esq„ W.S.

James Walker, Esq. of Dairy.

J. Scott Moncrieff, Esix, C.A.

A. K. Mackenzie, Esq., Banker.

Ueut.-Col. R. W. Praser, late H.E.I.C.S.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1875-1876 > (742) |

|---|

| Permanent URL | https://digital.nls.uk/83201609 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|