Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

XXIV

STAMP DUTIES, ETC.

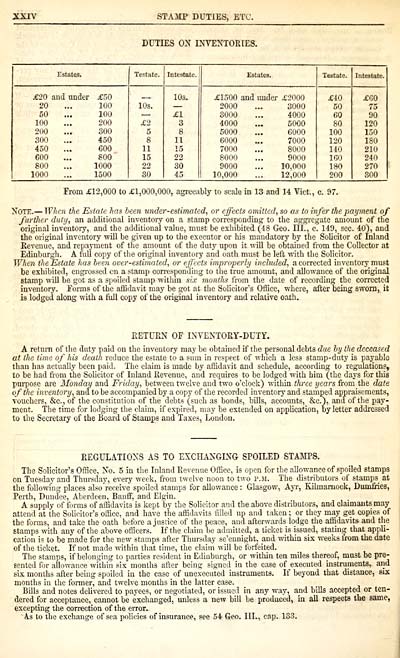

DUTIES ON INVENTORIES.

From £12,000 to £1,000,000, agreeably to scale in 13 and 14 Vict., c. 97.

NOTE. — When the Estate has been under-estimated, or effects omitted, so as to infer the payment of

further duty, an additional inventory on a stamp corresponding to the aggregate amount of the

original inventory, and the additional value, must be exhibited (48 Geo. III., c. 149, sec. 40), and

the original inventory will be given up to the executor or his mandatory by the Solicitor of Inland

Revenue, and repayment of the amount of the duty upon it will be obtained from the Collector at

Edinburgh. A full copy of the original inventory and oath must be left with the Solicitor.

When the Estate has been over-estimated, or effects improperly included, a corrected inventory must

be exhibited, engrossed on a stamp corresponding to the true amount, and allowance of the original

stamp will be got as a spoiled stamp witliin six months from the date of recording the corrected

inventory. Forms of the affidavit may be got at the Solicitor's Office, where, after being sworn, it

is lodged along with a full copy of the original inventory and relative oath.

RETURN OF INVENTORY-DUTY.

A return of the duty paid on the inventory may be obtained if the personal debts due by the deceased

at the time of his death reduce the estate to a sum in respect of which a less stamp-duty is payable

than has actually been paid. The claim is made by affidavit and schedule, according to regulations,

to be had from the Solicitor of Inland Revenue, and requires to be lodged with him (the days for this

purpose are Monday and Friday, between twelve and two o'clock) within three years from the date

of the inventory, and to be accompanied by a copy of the recorded inventory and stamped appraisements,

vouchers, &c, of the constitution of the debts (such as bonds, bills, accounts, &c.), and of the pay-

ment. The time for lodging the claim, if expired, may be extended on application, by letter addressed

to the Secretary of the Board of Stamps and Taxes, London.

REGULATIONS AS TO EXCHANGING SPOILED STAMPS.

The Solicitor's Office, No. 5 in the Inland Revenue Office, is open for the allowance of spoiled stamps

on Tuesday and Thursday, every week, from twelve noon to two p.m. The distributors of stamps at

the following places also receive spoiled stamps for allowance : Glasgow, Ayr, Kilmarnock, Dumfries,

Perth, Dundee, Aberdeen, Banff, and Elgin.

A supply of forms of affidavits is kept by the Solicitor and the above distributors, and claimants may

attend at the Solicitor's office, and have the affidavits filled up and taken ; or they may get copies of

the forms, and take the oath before a justice of the peace, and afterwards lodge the affidavits and the

stamps with any of the above officers. If the claim be admitted, a ticket is issued, stating that appli-

cation is to be made for the new stamps after Thursday se'ennight, and within six weeks from the date

of the ticket. If not made within that time, the claim will be forfeited.

The stamps, if belonging to parties resident in Edinburgh, or within ten miles thereof, must be pre-

sented for allowance within six months after being signed in the case of executed instruments, and

six months after being spoiled in the case of unexecuted instruments. If beyond that distance, six

months in the former, and twelve months in the latter case.

Bills and notes delivered to payees, or negotiated, or issued in any way, and bills accepted or ten-

dered for acceptance, cannot be exchanged, unless a new bill be produced, in all respects the same,

excepting the correction of the error.

As to the exchange of sea policies of insurance, see 54 Geo. III., cap. 133.

STAMP DUTIES, ETC.

DUTIES ON INVENTORIES.

From £12,000 to £1,000,000, agreeably to scale in 13 and 14 Vict., c. 97.

NOTE. — When the Estate has been under-estimated, or effects omitted, so as to infer the payment of

further duty, an additional inventory on a stamp corresponding to the aggregate amount of the

original inventory, and the additional value, must be exhibited (48 Geo. III., c. 149, sec. 40), and

the original inventory will be given up to the executor or his mandatory by the Solicitor of Inland

Revenue, and repayment of the amount of the duty upon it will be obtained from the Collector at

Edinburgh. A full copy of the original inventory and oath must be left with the Solicitor.

When the Estate has been over-estimated, or effects improperly included, a corrected inventory must

be exhibited, engrossed on a stamp corresponding to the true amount, and allowance of the original

stamp will be got as a spoiled stamp witliin six months from the date of recording the corrected

inventory. Forms of the affidavit may be got at the Solicitor's Office, where, after being sworn, it

is lodged along with a full copy of the original inventory and relative oath.

RETURN OF INVENTORY-DUTY.

A return of the duty paid on the inventory may be obtained if the personal debts due by the deceased

at the time of his death reduce the estate to a sum in respect of which a less stamp-duty is payable

than has actually been paid. The claim is made by affidavit and schedule, according to regulations,

to be had from the Solicitor of Inland Revenue, and requires to be lodged with him (the days for this

purpose are Monday and Friday, between twelve and two o'clock) within three years from the date

of the inventory, and to be accompanied by a copy of the recorded inventory and stamped appraisements,

vouchers, &c, of the constitution of the debts (such as bonds, bills, accounts, &c.), and of the pay-

ment. The time for lodging the claim, if expired, may be extended on application, by letter addressed

to the Secretary of the Board of Stamps and Taxes, London.

REGULATIONS AS TO EXCHANGING SPOILED STAMPS.

The Solicitor's Office, No. 5 in the Inland Revenue Office, is open for the allowance of spoiled stamps

on Tuesday and Thursday, every week, from twelve noon to two p.m. The distributors of stamps at

the following places also receive spoiled stamps for allowance : Glasgow, Ayr, Kilmarnock, Dumfries,

Perth, Dundee, Aberdeen, Banff, and Elgin.

A supply of forms of affidavits is kept by the Solicitor and the above distributors, and claimants may

attend at the Solicitor's office, and have the affidavits filled up and taken ; or they may get copies of

the forms, and take the oath before a justice of the peace, and afterwards lodge the affidavits and the

stamps with any of the above officers. If the claim be admitted, a ticket is issued, stating that appli-

cation is to be made for the new stamps after Thursday se'ennight, and within six weeks from the date

of the ticket. If not made within that time, the claim will be forfeited.

The stamps, if belonging to parties resident in Edinburgh, or within ten miles thereof, must be pre-

sented for allowance within six months after being signed in the case of executed instruments, and

six months after being spoiled in the case of unexecuted instruments. If beyond that distance, six

months in the former, and twelve months in the latter case.

Bills and notes delivered to payees, or negotiated, or issued in any way, and bills accepted or ten-

dered for acceptance, cannot be exchanged, unless a new bill be produced, in all respects the same,

excepting the correction of the error.

As to the exchange of sea policies of insurance, see 54 Geo. III., cap. 133.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1853-1854 > (30) |

|---|

| Permanent URL | https://digital.nls.uk/83099670 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|