Armament > Annuaire statistique du commerce des armes, munitions et matériels de guerre > Fourteenth Year

(95)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

93 —

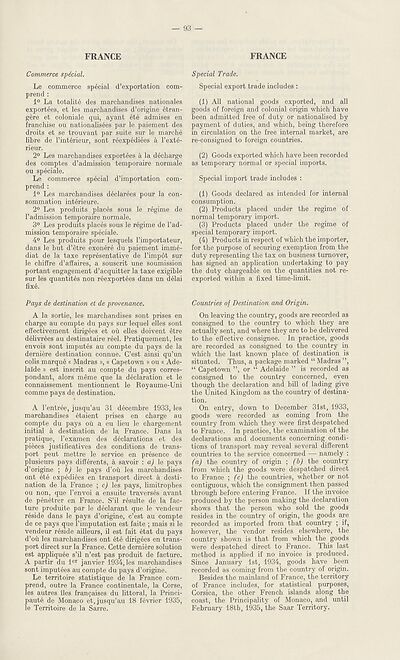

FRANCE

FRANCE

Commerce special.

Le commerce special reexportation com-

prend :

1° La totalite des marchandises Rationales

exportees, et les marchandises d’origine etran-

gere et coloniale qui, ayant ete admises en

franchise on nationalisees par le paiement des

droits et se trouvant par suite sur le marche

libre de Pinterieur, sont reexpediees a 1’exte-

rieur.

2° Les marchandises exportees a la decharge

des comptes d’admission temporaire normale

ou speciale.

Le commerce special d’importation com-

prend :

1° Les marchandises declarees pour la con-

sommation interieure.

2° Les produits places sous le regime de

I’admission temporaire normale.

3° Les produits places sous le regime de Tad-

mission temporaire speciale.

4° Les produits pour lesquels Timportateur,

dans le but d’etre exonere du paiement imme-

diat de la taxe representative de Timpot sur

le chiffre d’affaires, a souscrit une soumission

portant engagement d’acquitter la taxe exigible

sur les quantites non reexportees dans un delai

fixe.

Pays de destination et de provenance.

A la sortie, les marchandises sont prises en

charge au compte du pays sur lequel elles sont

effectivement dirigees et ou elles doivent etre

delivrees au destinataire reel. Pratiquement, les

envois sont imputes au compte du pays de la

derniere destination connue. C’est ainsi qu’un

colis marque « Madras », « Capetown » ou « Ade¬

laide » est inscrit au compte du pays corres-

pondant, alors meme que la declaration et le

connaissement mentionnent le Royaume-Uni

comme pays de destination.

A Tentree, jusqu’au 31 decembre 1933, les

marchandises etaient prises en charge au

compte du pays ou a eu lieu le chargement

initial a destination de la France. Dans la

pratique, Texamen des declarations et des

pieces justificatives des conditions de trans¬

port peut mettre le service en presence de

plusieurs pays differents, a savoir : le pays

d’origine ; b) le pays d’ou les marchandises

ont ete expediees en transport direct a desti¬

nation de la France ; c) les pays, limitrophes

ou non, que Tenvoi a ensuite traverses avant

de penetrer en France. S’il resulte de la fac-

ture produite par le declarant que le vendeur

reside dans le pays d’origine, c’est au compte

de ce pays que Timputation est faite ; mais si le

vendeur reside ailleurs, il est fait etat du pays

d’ou les marchandises ont ete dirigees en trans¬

port direct sur la France. Cette derniere solution

est appliquee s’il n’est pas produit de facture.

A partir du ler janvier 1934, les marchandises

sont imputees au compte du pays d’origine.

Le territoire statistique de la France com-

prend, outre la France continentale, la Corse,

les autres lies fran^aises du littoral, la Princi-

paute de Monaco et, jusqu’au 18 fevrier 1935,

le Territoire de la Sarre.

Special Trade.

Special export trade includes :

(1) All national goods exported, and all

goods of foreign and colonial origin which have

been admitted free of duty or nationalised by

payment of duties, and which, being therefore

in circulation on the free internal market, are

re-consigned to foreign countries.

(2) Goods exported which have been recorded

as temporary normal or special imports.

Special import trade includes :

(1) Goods declared as intended for internal

consumption.

(2) Products placed under the regime of

normal temporary import.

(3) Products placed under the regime of

special temporary import.

(4) Products in respect of which the importer,

for the purpose of securing exemption from the

duty representing the tax on business turnover,

has signed an application undertaking to pay

the duty chargeable on the quantities not re¬

exported within a fixed time-limit.

Countries of Destination and Origin.

On leaving the country, goods are recorded as

consigned to the country to which they are

actually sent, and where they are to be delivered

to the effective consignee. In practice, goods

are recorded as consigned to the country in

which the last known place of destination is

situated. Thus, a package marked “ Madras ”,

“ Capetown ”, or “ Adelaide ” is recorded as

consigned to the country concerned, even

though the declaration and bill of lading give

the United Kingdom as the country of destina¬

tion.

On entry, down to December 31st, 1933,

goods were recorded as coming from the

country from which they were first despatched

to France. In practice, the examination of the

declarations and documents concerning condi¬

tions of transport may reveal several different

countries to the service, concerned — namely :

(a) the country of origin ; (b) the country

from which the goods were despatched direct

to France ; (c) the countries, whether or not

contiguous, which the consignment then passed

through before entering France. If the invoice

produced by the person making the declaration

shows that the person who sold the goods

resides in the country of origin, the goods are

recorded as imported from that country ; if,

however, the vendor resides elsewhere, the

country shown is that from which the goods

were despatched direct to France. This last

method is applied if no invoice is produced.

Since January 1st, 1934, goods have been

recorded as coming from the country of origin.

Besides the mainland of France, the territory

of France includes, for statistical purposes,

Corsica, the other French islands along the

coast, the Principality of Monaco, and until

February 18th, 1935, the Saar Territory.

FRANCE

FRANCE

Commerce special.

Le commerce special reexportation com-

prend :

1° La totalite des marchandises Rationales

exportees, et les marchandises d’origine etran-

gere et coloniale qui, ayant ete admises en

franchise on nationalisees par le paiement des

droits et se trouvant par suite sur le marche

libre de Pinterieur, sont reexpediees a 1’exte-

rieur.

2° Les marchandises exportees a la decharge

des comptes d’admission temporaire normale

ou speciale.

Le commerce special d’importation com-

prend :

1° Les marchandises declarees pour la con-

sommation interieure.

2° Les produits places sous le regime de

I’admission temporaire normale.

3° Les produits places sous le regime de Tad-

mission temporaire speciale.

4° Les produits pour lesquels Timportateur,

dans le but d’etre exonere du paiement imme-

diat de la taxe representative de Timpot sur

le chiffre d’affaires, a souscrit une soumission

portant engagement d’acquitter la taxe exigible

sur les quantites non reexportees dans un delai

fixe.

Pays de destination et de provenance.

A la sortie, les marchandises sont prises en

charge au compte du pays sur lequel elles sont

effectivement dirigees et ou elles doivent etre

delivrees au destinataire reel. Pratiquement, les

envois sont imputes au compte du pays de la

derniere destination connue. C’est ainsi qu’un

colis marque « Madras », « Capetown » ou « Ade¬

laide » est inscrit au compte du pays corres-

pondant, alors meme que la declaration et le

connaissement mentionnent le Royaume-Uni

comme pays de destination.

A Tentree, jusqu’au 31 decembre 1933, les

marchandises etaient prises en charge au

compte du pays ou a eu lieu le chargement

initial a destination de la France. Dans la

pratique, Texamen des declarations et des

pieces justificatives des conditions de trans¬

port peut mettre le service en presence de

plusieurs pays differents, a savoir : le pays

d’origine ; b) le pays d’ou les marchandises

ont ete expediees en transport direct a desti¬

nation de la France ; c) les pays, limitrophes

ou non, que Tenvoi a ensuite traverses avant

de penetrer en France. S’il resulte de la fac-

ture produite par le declarant que le vendeur

reside dans le pays d’origine, c’est au compte

de ce pays que Timputation est faite ; mais si le

vendeur reside ailleurs, il est fait etat du pays

d’ou les marchandises ont ete dirigees en trans¬

port direct sur la France. Cette derniere solution

est appliquee s’il n’est pas produit de facture.

A partir du ler janvier 1934, les marchandises

sont imputees au compte du pays d’origine.

Le territoire statistique de la France com-

prend, outre la France continentale, la Corse,

les autres lies fran^aises du littoral, la Princi-

paute de Monaco et, jusqu’au 18 fevrier 1935,

le Territoire de la Sarre.

Special Trade.

Special export trade includes :

(1) All national goods exported, and all

goods of foreign and colonial origin which have

been admitted free of duty or nationalised by

payment of duties, and which, being therefore

in circulation on the free internal market, are

re-consigned to foreign countries.

(2) Goods exported which have been recorded

as temporary normal or special imports.

Special import trade includes :

(1) Goods declared as intended for internal

consumption.

(2) Products placed under the regime of

normal temporary import.

(3) Products placed under the regime of

special temporary import.

(4) Products in respect of which the importer,

for the purpose of securing exemption from the

duty representing the tax on business turnover,

has signed an application undertaking to pay

the duty chargeable on the quantities not re¬

exported within a fixed time-limit.

Countries of Destination and Origin.

On leaving the country, goods are recorded as

consigned to the country to which they are

actually sent, and where they are to be delivered

to the effective consignee. In practice, goods

are recorded as consigned to the country in

which the last known place of destination is

situated. Thus, a package marked “ Madras ”,

“ Capetown ”, or “ Adelaide ” is recorded as

consigned to the country concerned, even

though the declaration and bill of lading give

the United Kingdom as the country of destina¬

tion.

On entry, down to December 31st, 1933,

goods were recorded as coming from the

country from which they were first despatched

to France. In practice, the examination of the

declarations and documents concerning condi¬

tions of transport may reveal several different

countries to the service, concerned — namely :

(a) the country of origin ; (b) the country

from which the goods were despatched direct

to France ; (c) the countries, whether or not

contiguous, which the consignment then passed

through before entering France. If the invoice

produced by the person making the declaration

shows that the person who sold the goods

resides in the country of origin, the goods are

recorded as imported from that country ; if,

however, the vendor resides elsewhere, the

country shown is that from which the goods

were despatched direct to France. This last

method is applied if no invoice is produced.

Since January 1st, 1934, goods have been

recorded as coming from the country of origin.

Besides the mainland of France, the territory

of France includes, for statistical purposes,

Corsica, the other French islands along the

coast, the Principality of Monaco, and until

February 18th, 1935, the Saar Territory.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Armament > Annuaire statistique du commerce des armes, munitions et matériels de guerre > Fourteenth Year > (95) |

|---|

| Permanent URL | https://digital.nls.uk/195168694 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | LN.IX |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|