Economic and financial section > Brussels Financial Conference 1920 : the recommendations and their application : a review after two years. Vol. 2, Italy

(31)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

29

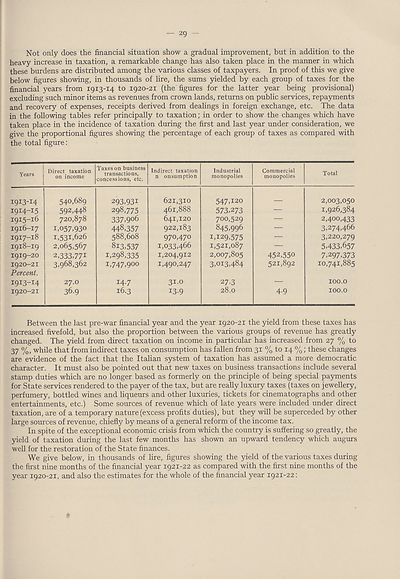

Not only does the financial situation show a gradual improvement, but in addition to the

heavy increase in taxation, a remarkable change has also taken place in the manner in which

these burdens are distributed among the various classes of taxpayers. In proof of this we give

below figures showing, in thousands of lire, the sums yielded by each group of taxes for the

financial years from 1913-14 to 1920-21 (the figures for the latter year being provisional)

excluding such minor items as revenues from crown lands, returns on public services, repayments

and recovery of expenses, receipts derived from dealings in foreign exchange, etc. The data

in the following tables refer principally to taxation; in order to show the changes which have

taken place in the incidence of taxation during the first and last year under consideration, we

give the proportional figures showing the percentage of each group of taxes as compared with

the total figure:

Years

Direct taxation

on income

Taxes on business

transactions,

concessions, etc.

Indirect taxation

n onsumption

Industrial

monopolies

Commercial

monopolies

Total

1913- I4

1914- I5

igrS-rb

1916- 17

1917- 18

1918- 19

1919- 20

1920- 21

Percent.

I913-i4

1920-21

540,689

592,448

720,878

i,o57,93o

1,531,626

2,065,567

2,333,77I

3,968,362

27.0

36.9

293,931

29%>775

337,906

448,357

588,608

8i3,537

1,298,335

r,747,900

14.7

16.3

621,310

461,888

641,120

922,183

970,470

1,033,466

1,204,912

1,490,247

31.0

13-9

547T20

573,273

700,529

845,996

1,129,575

1,521,087

2,007,805

3,013,484

27-3

28.0

452,550

521,892

4-9

2,003,050

1,926,384

2,400,433

3,274,466

3,220,279

5,433,657

7,297,373

10,741,885

100.0

100.0

Between the last pre-war financial year and the year 1920-21 the yield from these taxes has

increased fivefold, but also the proportion between the various groups of revenue has greatly

changed. The yield from direct taxation on income in particular has increased from 27 % to

37 %, while that from indirect taxes on consumption has fallen from 31 % to 14 %; these changes

are evidence of the fact that the Italian system of taxation has assumed a more democratic

character. It must also be pointed out that new taxes on business transactions include several

stamp duties which are no longer based as formerly on the principle of being special payments

for State services rendered to the payer of the tax, but are really luxury taxes (taxes on jewellery,

perfumery, bottled wines and liqueurs and other luxuries, tickets for cinematographs and other

entertainments, etc.) Some sources of revenue which of late years were included under direct

taxation, are of a temporary nature (excess profits duties), but they will be superceded by other

large sources of revenue, chiefly by means of a general reform of the income tax.

In spite of the exceptional economic crisis from which the country is suffering so greatly, the

yield of taxation during the last few months has shown an upward tendency which augurs

well for the restoration of the State finances.

We give below, in thousands of lire, figures showing the yield of the various taxes during

the first nine months of the financial year 1921-22 as compared with the first nine months of the

year 1920-21, and also the estimates for the whole of the financial year 1921-22:

Not only does the financial situation show a gradual improvement, but in addition to the

heavy increase in taxation, a remarkable change has also taken place in the manner in which

these burdens are distributed among the various classes of taxpayers. In proof of this we give

below figures showing, in thousands of lire, the sums yielded by each group of taxes for the

financial years from 1913-14 to 1920-21 (the figures for the latter year being provisional)

excluding such minor items as revenues from crown lands, returns on public services, repayments

and recovery of expenses, receipts derived from dealings in foreign exchange, etc. The data

in the following tables refer principally to taxation; in order to show the changes which have

taken place in the incidence of taxation during the first and last year under consideration, we

give the proportional figures showing the percentage of each group of taxes as compared with

the total figure:

Years

Direct taxation

on income

Taxes on business

transactions,

concessions, etc.

Indirect taxation

n onsumption

Industrial

monopolies

Commercial

monopolies

Total

1913- I4

1914- I5

igrS-rb

1916- 17

1917- 18

1918- 19

1919- 20

1920- 21

Percent.

I913-i4

1920-21

540,689

592,448

720,878

i,o57,93o

1,531,626

2,065,567

2,333,77I

3,968,362

27.0

36.9

293,931

29%>775

337,906

448,357

588,608

8i3,537

1,298,335

r,747,900

14.7

16.3

621,310

461,888

641,120

922,183

970,470

1,033,466

1,204,912

1,490,247

31.0

13-9

547T20

573,273

700,529

845,996

1,129,575

1,521,087

2,007,805

3,013,484

27-3

28.0

452,550

521,892

4-9

2,003,050

1,926,384

2,400,433

3,274,466

3,220,279

5,433,657

7,297,373

10,741,885

100.0

100.0

Between the last pre-war financial year and the year 1920-21 the yield from these taxes has

increased fivefold, but also the proportion between the various groups of revenue has greatly

changed. The yield from direct taxation on income in particular has increased from 27 % to

37 %, while that from indirect taxes on consumption has fallen from 31 % to 14 %; these changes

are evidence of the fact that the Italian system of taxation has assumed a more democratic

character. It must also be pointed out that new taxes on business transactions include several

stamp duties which are no longer based as formerly on the principle of being special payments

for State services rendered to the payer of the tax, but are really luxury taxes (taxes on jewellery,

perfumery, bottled wines and liqueurs and other luxuries, tickets for cinematographs and other

entertainments, etc.) Some sources of revenue which of late years were included under direct

taxation, are of a temporary nature (excess profits duties), but they will be superceded by other

large sources of revenue, chiefly by means of a general reform of the income tax.

In spite of the exceptional economic crisis from which the country is suffering so greatly, the

yield of taxation during the last few months has shown an upward tendency which augurs

well for the restoration of the State finances.

We give below, in thousands of lire, figures showing the yield of the various taxes during

the first nine months of the financial year 1921-22 as compared with the first nine months of the

year 1920-21, and also the estimates for the whole of the financial year 1921-22:

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Brussels Financial Conference 1920 : the recommendations and their application : a review after two years. Vol. 2, Italy > (31) |

|---|

| Permanent URL | https://digital.nls.uk/191783325 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|