Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

- 37 -

Methods I, III and V exclusively on the calculation of tax: before the other methods (VI and

VII) can be applied, the income must first be allocated and the method of calculating the tax

settled.

Method I. — Total Deduction.

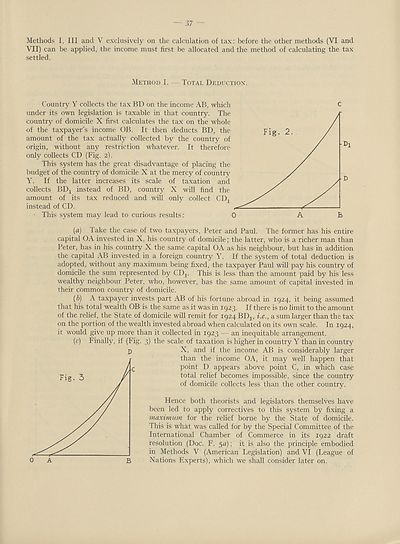

Country Y collects the tax BD on the income AB, which

under its own legislation is taxable in that country. The

country of domicile X first calculates the tax on the whole

of the taxpayer’s income OB. It then deducts BD, the

amount of the tax actually collected by the country of

origin, without any restriction whatever. It therefore

only collects CD (Fig. 2).

This system has the great disadvantage of placing the

budget of the country of domicile X at the mercy of country

Y. If the latter increases its scale of taxation and

collects BDjl instead of BD, country X will find the

amount of its tax reduced and will only collect CD1

instead of CD.

This system may lead to curious results:

C

(a) lake the case of two taxpayers, Peter and Paul. The former has his entire

capital OA invested in X, his country of domicile; the latter, who is a richer man than

Peter, has in his country X the same capital OA as his neighbour, but has in addition

the capital AB invested in a foreign country Y. If the system of total deduction is

adopted, without any maximum being fixed, the taxpayer Paul will pay his country of

domicile the sum represented by CDj. This is less than the amount paid by his less

wealthy neighbour Peter, who, however, has the same amount of capital invested in

their common country of domicile.

(b) A taxpayer invests part AB of his fortune abroad in 1924, it being assumed

that his total wealth OB is the same as it was in 1923. If there is no limit to the amount

of the relief, the State of domicile will remit for 1924 BDj, i.e., a sum larger than the tax

on the portion of the wealth invested abroad when calculated on its own scale. In 1924,

it would give up more than it collected in 1923 — an inequitable arrangement.

(c) Finally, if (Fig. 3) the scale of taxation is higher in country Y than in country

£ X, and if the income AB is considerably larger

than the income OA, it may well happen that

point D appears above point C, in which case

total relief becomes impossible, since the country

of domicile collects less than the other country.

Hence both theorists and legislators themselves have

been led to apply correctives to this system by fixing a

maximum for the relief borne by the State of domicile.

This is what was called for by the Special Committee of the

International Chamber of Commerce in its 1922 draft

resolution (Doc. F. $a); it is also the principle embodied

in Methods V (American Legislation) and VI (League of

Nations Experts), which we shall consider later on.

Methods I, III and V exclusively on the calculation of tax: before the other methods (VI and

VII) can be applied, the income must first be allocated and the method of calculating the tax

settled.

Method I. — Total Deduction.

Country Y collects the tax BD on the income AB, which

under its own legislation is taxable in that country. The

country of domicile X first calculates the tax on the whole

of the taxpayer’s income OB. It then deducts BD, the

amount of the tax actually collected by the country of

origin, without any restriction whatever. It therefore

only collects CD (Fig. 2).

This system has the great disadvantage of placing the

budget of the country of domicile X at the mercy of country

Y. If the latter increases its scale of taxation and

collects BDjl instead of BD, country X will find the

amount of its tax reduced and will only collect CD1

instead of CD.

This system may lead to curious results:

C

(a) lake the case of two taxpayers, Peter and Paul. The former has his entire

capital OA invested in X, his country of domicile; the latter, who is a richer man than

Peter, has in his country X the same capital OA as his neighbour, but has in addition

the capital AB invested in a foreign country Y. If the system of total deduction is

adopted, without any maximum being fixed, the taxpayer Paul will pay his country of

domicile the sum represented by CDj. This is less than the amount paid by his less

wealthy neighbour Peter, who, however, has the same amount of capital invested in

their common country of domicile.

(b) A taxpayer invests part AB of his fortune abroad in 1924, it being assumed

that his total wealth OB is the same as it was in 1923. If there is no limit to the amount

of the relief, the State of domicile will remit for 1924 BDj, i.e., a sum larger than the tax

on the portion of the wealth invested abroad when calculated on its own scale. In 1924,

it would give up more than it collected in 1923 — an inequitable arrangement.

(c) Finally, if (Fig. 3) the scale of taxation is higher in country Y than in country

£ X, and if the income AB is considerably larger

than the income OA, it may well happen that

point D appears above point C, in which case

total relief becomes impossible, since the country

of domicile collects less than the other country.

Hence both theorists and legislators themselves have

been led to apply correctives to this system by fixing a

maximum for the relief borne by the State of domicile.

This is what was called for by the Special Committee of the

International Chamber of Commerce in its 1922 draft

resolution (Doc. F. $a); it is also the principle embodied

in Methods V (American Legislation) and VI (League of

Nations Experts), which we shall consider later on.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (43) |

|---|

| Permanent URL | https://digital.nls.uk/190911867 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|