Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

II

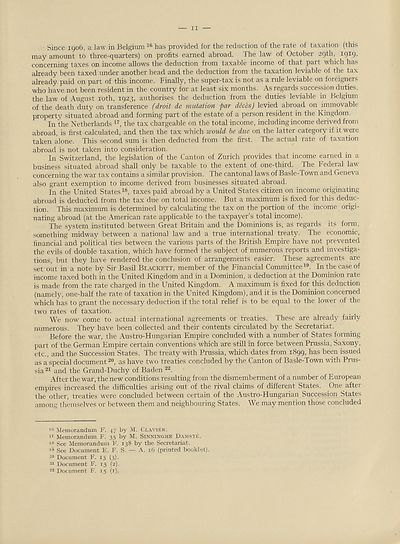

Since 1906, a law in Belgium 16 has provided for the reduction of the rate of taxation (this

may amount to three-quarters) on profits earned abroad. The law of October 29th, iqic),

concerning taxes on income allows the deduction from taxable income of that part which ha;-

already been taxed under another head and the deduction from the taxation leviable of the tax

already paid on part of this income. Finally, the super-tax is not as a rule leviable on foreigners

who have not been resident in the country for at least six months. As regards succession duties,

the law of August 10th, 1923, authorises the deduction from the duties leviable in Belgium

of the death duty on transference (droit de imitation par dices) levied abroad on immovable

property situated abroad and fonning part of the estate of a person resident in the Kingdom.

In the Netherlands l7, the tax chargeable on the total income, including income derived from

abroad, is first calculated, and then the tax which would be due on the latter category if it were

taken alone. This second sum is then deducted from the first. The actual rate of taxation

abroad is not taken into consideration.

In Switzerland, the legislation of the Canton of Zurich provides that income earned in a

business situated abroad shall only be taxable to the extent of one-third. The bederal law

concerning the w^ar tax contains a similar provision. The cantonal laws of Basle- Town and Geneva

also grant exemption to income derived from businesses situated abroad.

In the United States18, taxes paid abroad by a United States citizen on income originating

abroad is deducted from the tax due on total income. But a maximum is fixed for this deduc¬

tion. This maximum is determined by calculating the tax on the portion of the income origi¬

nating abroad (at the American rate applicable to the taxpayer’s total income).

The system instituted between Great Britain and the Dominions is, as regards its form,

something midway between a national lawr and a true international treaty. The economic,

financial and political ties between the various parts of the British Empire have not prevented

the evils of double taxation, which have formed the subject of numerous reports and investiga¬

tions, but they have rendered the conclusion of arrangements easier. These agreements are

set out in a note by Sir Basil Blackett, member of the Financial Committee19. In the case of

income taxed both in the United Kingdom and in a Dominion, a deduction at the Dominion rate

is made from the rate charged in the United Kingdom. A maximum is fixed for this deduction

(namely, one-half the rate of taxation in the United Kingdom), and it is the Dominion concerned

which has to grant the necessary deduction if the total relief is to be equal to the lower of the

twro rates of taxation.

We now come to actual international agreements or treaties. These are already fairly

numerous. They have been collected and their contents circulated by the Secretariat.

Before the war, the Austro-Hungarian Empire concluded vdth a number of States forming

part of the German Empire certain conventions which are still in force between Prussia, Saxony,

etc., and the Succession States. The treaty with Prussia, which dates from 1899, has been issued

as a special document20, as have two treaties concluded by the Canton of Basle-Town with Prus¬

sia 21 and the Grand-Duchy of Baden 22

After the war, the new conditions resulting from the dismemberment of a number of European

empires increased the difficulties arising out of the rival claims of different States. One aftei

the other, treaties w^ere concluded between certain of the Austro-Hungarian Succession States

among themselves or between them and neighbouring States. We may mention those concluded

10 Memorandum F. .47 by M. Clavier.

17 Memorandum F. 35 by M. Sinninghe Damste.

18 See Memorandum F. 138 by the Secretariat.

19 .See Document F.. F. S. — A. 16 (printed booklet).

20 Document F. 15 (3).

21 Document F. 15 (2).

22 Document F. 15 (1),

Since 1906, a law in Belgium 16 has provided for the reduction of the rate of taxation (this

may amount to three-quarters) on profits earned abroad. The law of October 29th, iqic),

concerning taxes on income allows the deduction from taxable income of that part which ha;-

already been taxed under another head and the deduction from the taxation leviable of the tax

already paid on part of this income. Finally, the super-tax is not as a rule leviable on foreigners

who have not been resident in the country for at least six months. As regards succession duties,

the law of August 10th, 1923, authorises the deduction from the duties leviable in Belgium

of the death duty on transference (droit de imitation par dices) levied abroad on immovable

property situated abroad and fonning part of the estate of a person resident in the Kingdom.

In the Netherlands l7, the tax chargeable on the total income, including income derived from

abroad, is first calculated, and then the tax which would be due on the latter category if it were

taken alone. This second sum is then deducted from the first. The actual rate of taxation

abroad is not taken into consideration.

In Switzerland, the legislation of the Canton of Zurich provides that income earned in a

business situated abroad shall only be taxable to the extent of one-third. The bederal law

concerning the w^ar tax contains a similar provision. The cantonal laws of Basle- Town and Geneva

also grant exemption to income derived from businesses situated abroad.

In the United States18, taxes paid abroad by a United States citizen on income originating

abroad is deducted from the tax due on total income. But a maximum is fixed for this deduc¬

tion. This maximum is determined by calculating the tax on the portion of the income origi¬

nating abroad (at the American rate applicable to the taxpayer’s total income).

The system instituted between Great Britain and the Dominions is, as regards its form,

something midway between a national lawr and a true international treaty. The economic,

financial and political ties between the various parts of the British Empire have not prevented

the evils of double taxation, which have formed the subject of numerous reports and investiga¬

tions, but they have rendered the conclusion of arrangements easier. These agreements are

set out in a note by Sir Basil Blackett, member of the Financial Committee19. In the case of

income taxed both in the United Kingdom and in a Dominion, a deduction at the Dominion rate

is made from the rate charged in the United Kingdom. A maximum is fixed for this deduction

(namely, one-half the rate of taxation in the United Kingdom), and it is the Dominion concerned

which has to grant the necessary deduction if the total relief is to be equal to the lower of the

twro rates of taxation.

We now come to actual international agreements or treaties. These are already fairly

numerous. They have been collected and their contents circulated by the Secretariat.

Before the war, the Austro-Hungarian Empire concluded vdth a number of States forming

part of the German Empire certain conventions which are still in force between Prussia, Saxony,

etc., and the Succession States. The treaty with Prussia, which dates from 1899, has been issued

as a special document20, as have two treaties concluded by the Canton of Basle-Town with Prus¬

sia 21 and the Grand-Duchy of Baden 22

After the war, the new conditions resulting from the dismemberment of a number of European

empires increased the difficulties arising out of the rival claims of different States. One aftei

the other, treaties w^ere concluded between certain of the Austro-Hungarian Succession States

among themselves or between them and neighbouring States. We may mention those concluded

10 Memorandum F. .47 by M. Clavier.

17 Memorandum F. 35 by M. Sinninghe Damste.

18 See Memorandum F. 138 by the Secretariat.

19 .See Document F.. F. S. — A. 16 (printed booklet).

20 Document F. 15 (3).

21 Document F. 15 (2).

22 Document F. 15 (1),

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Double taxation and tax evasion > (17) |

|---|

| Permanent URL | https://digital.nls.uk/190911529 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|