Economic and financial section > Draft convention for the purpose of facilitating commercial propaganda

(5)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 5 —

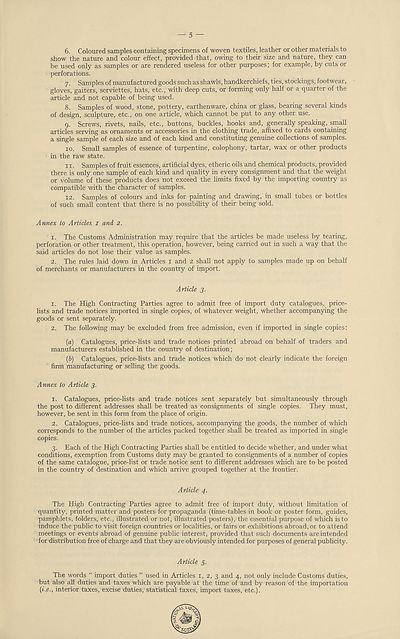

6. Coloured samples containing specimens of woven textiles, leather or other materials to

show the nature and colour effect, provided that, owing to their size and nature, they can

be used only as samples or are rendered useless for other purposes; for example, by cuts or

perforations.

7. Samples of manufactured goods such as shawls, handkerchiefs, ties, stockings, footwear,

gloves, gaiters, serviettes, hats, etc., with deep cuts, or forming only half or a quarter of the

article and not capable of being used.

8. Samples of wood, stone, pottery, earthenware, china or glass, bearing several kinds

of design, sculpture, etc., on one article, which cannot be put to any other use.

9. Screws, rivets, nails, etc., buttons, buckles, hooks and, generally speaking, small

articles serving as ornaments or accessories in the clothing trade, affixed to cards containing

a single sample of each size and of each kind and constituting genuine collections of samples.

10. Small samples of essence of turpentine, colophony, tartar, wax or other products

in the raw state.

11. Samples of fruit essences, artificial dyes, etheric oils and chemical products, provided

there is only one sample of each kind and quality in every consignment and that the weight

or volume of these products does not exceed the limits fixed by the importing country as

compatible with the character of samples.

12. Samples of colours and inks for painting and drawing, in small tubes or bottles

of such small content that there is no possibility of their being sold.

Annex to Articles 1 and 2.

1. The Customs Administration may require that the articles be made useless by tearing,

perforation or other treatment, this operation, however, being carried out in such a way that the

said articles do not lose their value as samples.

2. The rules laid down in Articles 1 and 2 shall not apply to samples made up on behalf

of merchants or manufacturers in the country of import.

Article 3.

1. The High Contracting Parties agree to admit free of import duty catalogues, price¬

lists and trade notices imported in single copies, of whatever weight, whether accompanying the

goods or sent separately.

2. The following may be excluded from free admission, even if imported in single copies:

(a) Catalogues, price-lists and trade notices printed abroad on behalf of traders and

manufacturers established in the country of destination;

(b) Catalogues, price-lists and trade notices which do not clearly indicate the foreign

firm manufacturing or selling the goods.

Annex to Article 3.

1. Catalogues, price-lists and trade notices sent separately but simultaneously through

the post to different addresses shall be treated as consignments of single copies. They must,

however, be sent in this form from the place of origin.

2. Catalogues, price-lists and trade notices, accompanying the goods, the number of which

corresponds to the number of the articles packed together shall be treated as imported in single

copies.

3. Each of the High Contracting Parties shall be entitled to decide whether, and under what

conditions, exemption from Customs duty may be granted to consignments of a number of copies

of the same catalogue, price-list or trade notice sent to different addresses which are to be posted

in the country of destination and which arrive grouped together at the frontier.

Article 4.

The High Contracting Parties agree to admit free of import duty, without limitation of

quantity, printed matter and posters for propaganda (time-tables in book or poster form, guides,

pamphlets, folders, etc., illustrated or not, illustrated posters), the essential purpose of which is to

induce the public to visit foreign countries or localities, or fairs or exhibitions abroad, or to attend

meetings or events abroad of genuine public interest, provided that such documents are intended

for distribution free of charge and that they are obviously intended for purposes of general publicity.

Article 5.

The words “ import duties ” used in Articles 1, 2, 3 and 4, not only include Customs duties,

but also all duties and taxes which are payable at the time of and by reason of the importation

(i.e., interior taxes, excise duties, statistical taxes, import taxes, etc.).

6. Coloured samples containing specimens of woven textiles, leather or other materials to

show the nature and colour effect, provided that, owing to their size and nature, they can

be used only as samples or are rendered useless for other purposes; for example, by cuts or

perforations.

7. Samples of manufactured goods such as shawls, handkerchiefs, ties, stockings, footwear,

gloves, gaiters, serviettes, hats, etc., with deep cuts, or forming only half or a quarter of the

article and not capable of being used.

8. Samples of wood, stone, pottery, earthenware, china or glass, bearing several kinds

of design, sculpture, etc., on one article, which cannot be put to any other use.

9. Screws, rivets, nails, etc., buttons, buckles, hooks and, generally speaking, small

articles serving as ornaments or accessories in the clothing trade, affixed to cards containing

a single sample of each size and of each kind and constituting genuine collections of samples.

10. Small samples of essence of turpentine, colophony, tartar, wax or other products

in the raw state.

11. Samples of fruit essences, artificial dyes, etheric oils and chemical products, provided

there is only one sample of each kind and quality in every consignment and that the weight

or volume of these products does not exceed the limits fixed by the importing country as

compatible with the character of samples.

12. Samples of colours and inks for painting and drawing, in small tubes or bottles

of such small content that there is no possibility of their being sold.

Annex to Articles 1 and 2.

1. The Customs Administration may require that the articles be made useless by tearing,

perforation or other treatment, this operation, however, being carried out in such a way that the

said articles do not lose their value as samples.

2. The rules laid down in Articles 1 and 2 shall not apply to samples made up on behalf

of merchants or manufacturers in the country of import.

Article 3.

1. The High Contracting Parties agree to admit free of import duty catalogues, price¬

lists and trade notices imported in single copies, of whatever weight, whether accompanying the

goods or sent separately.

2. The following may be excluded from free admission, even if imported in single copies:

(a) Catalogues, price-lists and trade notices printed abroad on behalf of traders and

manufacturers established in the country of destination;

(b) Catalogues, price-lists and trade notices which do not clearly indicate the foreign

firm manufacturing or selling the goods.

Annex to Article 3.

1. Catalogues, price-lists and trade notices sent separately but simultaneously through

the post to different addresses shall be treated as consignments of single copies. They must,

however, be sent in this form from the place of origin.

2. Catalogues, price-lists and trade notices, accompanying the goods, the number of which

corresponds to the number of the articles packed together shall be treated as imported in single

copies.

3. Each of the High Contracting Parties shall be entitled to decide whether, and under what

conditions, exemption from Customs duty may be granted to consignments of a number of copies

of the same catalogue, price-list or trade notice sent to different addresses which are to be posted

in the country of destination and which arrive grouped together at the frontier.

Article 4.

The High Contracting Parties agree to admit free of import duty, without limitation of

quantity, printed matter and posters for propaganda (time-tables in book or poster form, guides,

pamphlets, folders, etc., illustrated or not, illustrated posters), the essential purpose of which is to

induce the public to visit foreign countries or localities, or fairs or exhibitions abroad, or to attend

meetings or events abroad of genuine public interest, provided that such documents are intended

for distribution free of charge and that they are obviously intended for purposes of general publicity.

Article 5.

The words “ import duties ” used in Articles 1, 2, 3 and 4, not only include Customs duties,

but also all duties and taxes which are payable at the time of and by reason of the importation

(i.e., interior taxes, excise duties, statistical taxes, import taxes, etc.).

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Draft convention for the purpose of facilitating commercial propaganda > (5) |

|---|

| Permanent URL | https://digital.nls.uk/190894239 |

|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|