Economic and financial section > Report of the Commissioner of the League of Nations in Bulgaria > 24th report

(16)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— i6 —

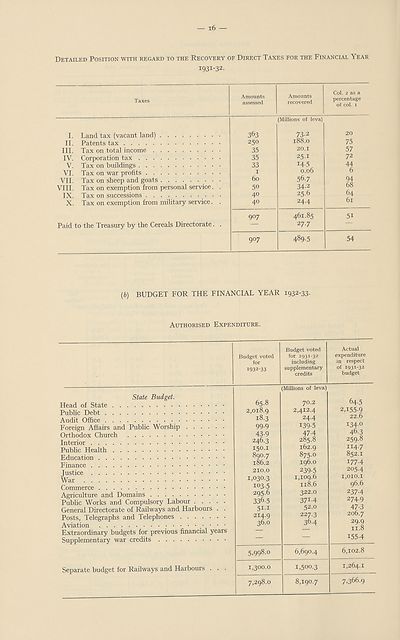

Detailed Position with regard to the Recovery of Direct Taxes for the Financial Year

1931-32.

Taxes

I.

II.

III.

IV.

V.

VI.

VII.

VIII.

IX.

X.

Land tax (vacant land)

Patents tax

Tax on total income

Corporation tax

Tax on buildings

Tax on war profits

Tax on sheep and goats

Tax on exemption from personal service

Tax on successions

Tax on exemption from military service.

Paid to the Treasury by the Cereals Directorate.

Amounts

assessed

363

250

35

35

33

1

60

50

40

40

9°7

9°7

Amounts

recovered

(Millions of leva)

73-2

188.0

20.1

25.1

14-5

0.06

56.7

34-2

25.6

24.4

461.85

27.7

489-5

Col. 2 as a

percentage

of col. 1

20

75

57

72

44

6

94

68

64

61

5i

54

(b) BUDGET FOR THE FINANCIAL YEAR 1932-33-

Authorised Expenditure.

State Budget.

Head of State

Public Debt

Audit Office

Foreign Affairs and Public Worship

Orthodox Church

Interior

Public Health

Education

Finance

Justice

War

Commerce

Agriculture and Domains

Public Works and Compulsory Labour

General Directorate of Railways and Harbours . .

Posts, Telegraphs and Telephones

Aviation •••••/•••

Extraordinary budgets for previous financial years

Supplementary war credits

Separate budget for Railways and Harbours . . .

Budget voted

for

1932-33

65.8

2,018.9

18.3

99.9

43-9

246.3

I50-1

890.7

186.2

210.0

1,030.3

103.5

295.6

336.5

511

214.9

36.0

5,998.0

1,300.0

7,298.0

Budget voted

for iQS1^2

including

supplementary-

credits

(Millions of leva)

70.2

2,412.4

24.4

139-5

47-4

285.8

162.9

875.0

196.0

239-5

1,109.6

118.6

322.0

371-4

52.0

227.3

36.4

6,690.4

1,500.3

8,190.7

Actual

expenditure

in respect

of 1931-32

budget

64-5

2,155-9

22.6

134.0

46- 3

259.8

II4-7

852.1

177.4

205.4

1,010.1

96.6

237-4

274.9

47- 3

206.7

29.9

11.8

155-4

6,102.8

1,264.1

7,366.9

Detailed Position with regard to the Recovery of Direct Taxes for the Financial Year

1931-32.

Taxes

I.

II.

III.

IV.

V.

VI.

VII.

VIII.

IX.

X.

Land tax (vacant land)

Patents tax

Tax on total income

Corporation tax

Tax on buildings

Tax on war profits

Tax on sheep and goats

Tax on exemption from personal service

Tax on successions

Tax on exemption from military service.

Paid to the Treasury by the Cereals Directorate.

Amounts

assessed

363

250

35

35

33

1

60

50

40

40

9°7

9°7

Amounts

recovered

(Millions of leva)

73-2

188.0

20.1

25.1

14-5

0.06

56.7

34-2

25.6

24.4

461.85

27.7

489-5

Col. 2 as a

percentage

of col. 1

20

75

57

72

44

6

94

68

64

61

5i

54

(b) BUDGET FOR THE FINANCIAL YEAR 1932-33-

Authorised Expenditure.

State Budget.

Head of State

Public Debt

Audit Office

Foreign Affairs and Public Worship

Orthodox Church

Interior

Public Health

Education

Finance

Justice

War

Commerce

Agriculture and Domains

Public Works and Compulsory Labour

General Directorate of Railways and Harbours . .

Posts, Telegraphs and Telephones

Aviation •••••/•••

Extraordinary budgets for previous financial years

Supplementary war credits

Separate budget for Railways and Harbours . . .

Budget voted

for

1932-33

65.8

2,018.9

18.3

99.9

43-9

246.3

I50-1

890.7

186.2

210.0

1,030.3

103.5

295.6

336.5

511

214.9

36.0

5,998.0

1,300.0

7,298.0

Budget voted

for iQS1^2

including

supplementary-

credits

(Millions of leva)

70.2

2,412.4

24.4

139-5

47-4

285.8

162.9

875.0

196.0

239-5

1,109.6

118.6

322.0

371-4

52.0

227.3

36.4

6,690.4

1,500.3

8,190.7

Actual

expenditure

in respect

of 1931-32

budget

64-5

2,155-9

22.6

134.0

46- 3

259.8

II4-7

852.1

177.4

205.4

1,010.1

96.6

237-4

274.9

47- 3

206.7

29.9

11.8

155-4

6,102.8

1,264.1

7,366.9

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Report of the Commissioner of the League of Nations in Bulgaria > 24th report > (16) |

|---|

| Permanent URL | https://digital.nls.uk/190886686 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | LN.II.13 |

|---|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|