Economic and financial section > Report of the Commissioner of the League of Nations in Bulgaria > 22nd report

(2)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

— 2

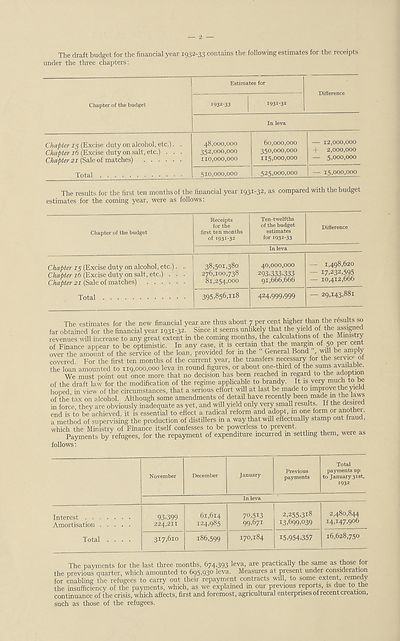

The draft budget for the financial year 1932-33 contains the following estimates for the receipts

under the three chapters:

Chapter of the budget

Chapter 15 (Excise duty on alcohol, etc.'

Chapter 16 (Excise duty on salt, etc.) .

Chapter 21 (Sale of matches) ....

Total

Estimates for

i932-33

48,000,000

352,000,000

110,000,000

510,000,000

i931‘32

In leva

60,000,000

350,000,000

115,000,000

525,000,000

Difference

— 12,000,000

+ 2,000,000

— 5,000,000

15,000,000

The results for the first ten months of the financial year 1931-32, as compared with the budget

estimates for the coming year, were as follows:

Chapter of the budget

Chapter 15 (Excise duty on alcohol, etc.)

Chapter 16 (Excise duty on salt, etc.) .

Chapter 21 (Sale of matches) ....

Total

Receipts

for the

first ten months

of i931-32

Ten-twelfths

of the budget

estimates

for 1932-33

Difference

In leva

38,501,380

276,100,738

81,254,000

395,856,118

40,000,000

293.333,333

91,666,666

424,999,999

1,498,620

17,232,595

10,412,666

29,143,881

The estimates for the new financial year are thus about 7 per cent higher than the results so

far obtained for the financial year 1931-32. Since it seems unlikely that the yield of the assignee

revenues will increase to any great extent in the coming months, the ca culations of the Ministry

of Finance appear to be optimistic. In any case, it is certain that the margin o 5° Per

over the amount of the service of the loan, provided for m the General Bond , will be amply

covered. For the first ten months of the current year, the transfers necessary for the servic^ol

the loan amounted to 119,000,000 leva in round figures, or about one-third of the sums aval a e.

We must point out once more that no decision has been reached m regard to the adoptio

of the draft law for the modification of the regime applicable to brandy. It is very much to be

hoped in view of the circumstances, that a serious effort will at last be made to improve the yield

of the’tax on alcohol. Although some amendments of detail have recently been made m the law

in force, they are obviously inadequate as yet, and will yield only very small results. If the desired

end is to be achieved, it is essential to effect a radical reform and adopt, m one form or another,

a method of supervising the production of distillers in a way that will effectually stamp out fraud,

which the Ministry of Finance itself confesses to be powerless to prevent.

Payments by refugees, for the repayment of expenditure incurred m settling them, were as

follows:

November

December

January

Previous

payments

Total

payments up

to January 31st,

1932

In leva

Interest . .

Amortisation

Total

93.399

224,211

317,610

61,614

124,985

186,599

7°,5i3

99,671

170,184

2,255,318

13,699,039

15,954,357

2,480,844

14,147,906

16,628,750

The payments for the last three months, 674,393 leva, are practically the same as those for

the previous quarter, which amounted to 695,930 leva. Measures at present under consideration

for enabling the refugees to carry out their repayment contracts will, to some extent, remedy

the insufficiency of the payments, which, as we explained in our previous reports, is due to the

continuance of the crisis, which affects, first and foremost, agricultural enterprises of recent creation,

such as those of the refugees.

The draft budget for the financial year 1932-33 contains the following estimates for the receipts

under the three chapters:

Chapter of the budget

Chapter 15 (Excise duty on alcohol, etc.'

Chapter 16 (Excise duty on salt, etc.) .

Chapter 21 (Sale of matches) ....

Total

Estimates for

i932-33

48,000,000

352,000,000

110,000,000

510,000,000

i931‘32

In leva

60,000,000

350,000,000

115,000,000

525,000,000

Difference

— 12,000,000

+ 2,000,000

— 5,000,000

15,000,000

The results for the first ten months of the financial year 1931-32, as compared with the budget

estimates for the coming year, were as follows:

Chapter of the budget

Chapter 15 (Excise duty on alcohol, etc.)

Chapter 16 (Excise duty on salt, etc.) .

Chapter 21 (Sale of matches) ....

Total

Receipts

for the

first ten months

of i931-32

Ten-twelfths

of the budget

estimates

for 1932-33

Difference

In leva

38,501,380

276,100,738

81,254,000

395,856,118

40,000,000

293.333,333

91,666,666

424,999,999

1,498,620

17,232,595

10,412,666

29,143,881

The estimates for the new financial year are thus about 7 per cent higher than the results so

far obtained for the financial year 1931-32. Since it seems unlikely that the yield of the assignee

revenues will increase to any great extent in the coming months, the ca culations of the Ministry

of Finance appear to be optimistic. In any case, it is certain that the margin o 5° Per

over the amount of the service of the loan, provided for m the General Bond , will be amply

covered. For the first ten months of the current year, the transfers necessary for the servic^ol

the loan amounted to 119,000,000 leva in round figures, or about one-third of the sums aval a e.

We must point out once more that no decision has been reached m regard to the adoptio

of the draft law for the modification of the regime applicable to brandy. It is very much to be

hoped in view of the circumstances, that a serious effort will at last be made to improve the yield

of the’tax on alcohol. Although some amendments of detail have recently been made m the law

in force, they are obviously inadequate as yet, and will yield only very small results. If the desired

end is to be achieved, it is essential to effect a radical reform and adopt, m one form or another,

a method of supervising the production of distillers in a way that will effectually stamp out fraud,

which the Ministry of Finance itself confesses to be powerless to prevent.

Payments by refugees, for the repayment of expenditure incurred m settling them, were as

follows:

November

December

January

Previous

payments

Total

payments up

to January 31st,

1932

In leva

Interest . .

Amortisation

Total

93.399

224,211

317,610

61,614

124,985

186,599

7°,5i3

99,671

170,184

2,255,318

13,699,039

15,954,357

2,480,844

14,147,906

16,628,750

The payments for the last three months, 674,393 leva, are practically the same as those for

the previous quarter, which amounted to 695,930 leva. Measures at present under consideration

for enabling the refugees to carry out their repayment contracts will, to some extent, remedy

the insufficiency of the payments, which, as we explained in our previous reports, is due to the

continuance of the crisis, which affects, first and foremost, agricultural enterprises of recent creation,

such as those of the refugees.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| League of Nations > Economic and financial section > Report of the Commissioner of the League of Nations in Bulgaria > 22nd report > (2) |

|---|

| Permanent URL | https://digital.nls.uk/190885932 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | LN.II.13 |

|---|---|

| Shelfmark | LN.II |

|---|

| Description | Over 1,200 documents from the non-political organs of the League of Nations that dealt with health, disarmament, economic and financial matters for the duration of the League (1919-1945). Also online are statistical bulletins, essential facts, and an overview of the League by the first Secretary General, Sir Eric Drummond. These items are part of the Official Publications collection at the National Library of Scotland. |

|---|---|

| Additional NLS resources: |

|