Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy

(243) Page 235

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

ANNUITIES.

'opular

View.

the term is extended; and when the annuity is a perpe-

tuity, there is no such excess. (8.)

29. The reason why the value of an annuity is increas¬

ed by that and the interest being both payable more than

once in the year, is, that the granter loses and the pur¬

chaser gains the interest produced by that part of each

payment which is in excess above the interest then due

upon the purchase-money, from the time of such payment

being made until the expiration of the year.

Hence it is obvious, that the less this excess is, that is,

the longer the term of the annuity is (28), the less must

the increase of value be.

And when the annuity is a perpetuity, its value will be

the same, whether it and the interest of money be both

payable several times in the year, or once only.

30. When the annuity is not payable at the same inter¬

vals at which the interest is convertible into principal, its

value will depend upon the frequencies both of payment

and conversion; but its investigation without algebra

would be too long, and of too little use, to be worth pro¬

secuting here.

235

v-flnp ^ Pa*^ ^or ^ whole, the present Popular

value of L.6047 to be received at the expiration of eleven View.

6 the1^th Profit, that is, the^v^>

™>th Part of ^e present value of L. 1, to be received then.

value of °f lntfrestuis 5 ^ cent, the present

hf I 0ARTrVQ £ at ,the exPiratio" of 11 years,

is L.O 584679; therefore, at that rate of interest, there

should be paid for each life i^H^i1:584679 T O.=47o

6460 —

And the present value of L.100, to be received upon a

hte now 10 years of age attaining to 21, will be L.54-73

or L.54. 14s. 7d. ’

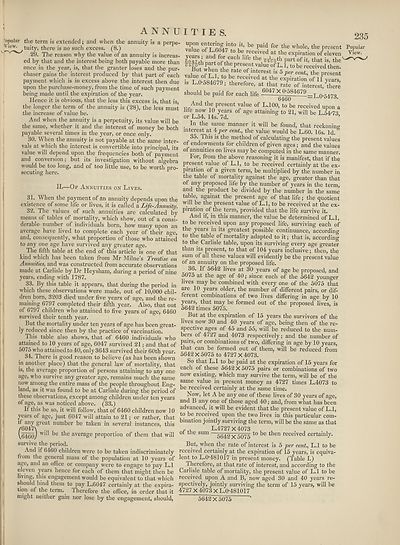

II.—Of Annuities on Lives.

31. When the payment of an annuity depends upon the

existence of some life or lives, it is called a Life-Annuity.

32. The values of such annuities are calculated by

means of tables of mortality, which show, out of a consi¬

derable number of individuals born, how many upon an

average have lived to complete each year of their a^e,

and, consequently, what proportion of those who attained

to any one age have survived any greater age.

The fifth table at the end of this article is one of that

kind which has been taken from Mr Milne’s Treatise on

Annuities, and was constructed from accurate observations

made at Carlisle by Dr Heysham, during a period of nine

years, ending with 1787.

33. By this table it appears, that during the period in

which these observations were made, out of 10,000 chil¬

dren born, 3203 died under five years of age, and the re¬

maining 6797 completed their fifth year. Also, that out

of 6797 children who attained to five years of age, 6460

survived their tenth year.

But the mortality under ten years of age has been great¬

ly reduced since then by the practice of vaccination.

This table also shows, that of 6460 individuals who

attained to 10 years of age, 6047 survived 21; and that of

5075 who attained to 40, only 3643 survived their 60th year.

34. There is good reason to believe (as has been shown

in another place) that the general law of mortality, that

is, the average proportion of persons attaining to any one

age, who survive any greater age, remains much the same

now among the entire mass of the people throughout Eng¬

land, as it was found to be at Carlisle during the period of

these observations, except among children under ten years

of age, as was noticed above. (33.)

If this be so, it will follow, that of 6460 children now 10

years of age, just 6047 will attain to 21; or rather, that

if any great number be taken in several instances, this

/6047\

\6460/ W1 ke the average proportion of them that will

In the same manner it will be found, that reckoning

interest at ^per cent, the value would be L.60. 16s. Id.

35. This is the method of calculating the present values

of endowments for children of given ages; and the values

of annuities on lives may be computed in the same manner.

For, from the above reasoning it is manifest, that if the

present value of L.l, to be received certainly at the ex¬

piration of a given term, be multiplied by the number in

the table of mortality against the age, greater than that

of any proposed life by the number of years in the term,

and the product be divided by the number in the same

table, against the present age of that life; the quotient

will be the present value of L.l, to be received at the ex¬

piration of the term, provided that the life survive it.

And if, in this manner, the value be determined of L.l,

to be received upon any proposed life, surviving each of

the years in its greatest possible continuance, according

to the table of mortality adapted to it; that is, according

to the Carlisle table, upon its surviving every age greater

than its present, to that of 104 years inclusive; then, the

sum of all these values will evidently be the present value

of an annuity on the proposed life.

36. If 5642 lives at 30 years of age be proposed, and

5075 at the age of 40; since each of the 5642 younger

lives may be combined with every one of the 5075 that

are 10 years older, the number of different pairs, or dif¬

ferent combinations of two lives differing in age by 10

years, that may be formed out of the proposed lives, is

5642 times 5075.

But at the expiration of 15 years the survivors of the

lives now 30 and 40 years of age, being then of the re¬

spective ages of 45 and 55, will be reduced to the num¬

bers of 4/27 and 4073 respectively; and the number of

pairs, or combinations of two, differing in age by 10 years,

that can be formed out of them, will be reduced from

5642 X 5075 to 4727 X 4073.

So that L.l to be paid at the expiration of 15 years for

each of these 5642 X 5075 pairs or combinations of two

now existing, which may survive the term, will be of the

same value in present money as 4727 times L.4073 to

be received certainly at the same time.

Now, let A be any one of these lives of 30 years of age,

and B any one of those aged 40; and, from what has been

advanced, it will be evident that the present value of L.l,

to be received upon the two lives in this particular com¬

bination jointly surviving the term, will be the same as that

L.4727X 4073

of the sum —5540 x 5075 ^ien rece^vei^ certainly.

survive the period.

And if 6460 children were to be taken indiscriminately

fiom the general mass of the population at 10 years of

age, and an office or company were to engage to pay L.l

eleven years hence for each of them that might then be

living, this engagement would be equivalent to that which

should bind them to pay L.6047 certainly at the expira¬

tion of the term. Iherefore the office, in order that it

might neither gain nor lose by the engagement, should,

But, when the rate of interest is 5 per cent., L.l to be

received certainly at the expiration of 15 years, is equiva¬

lent to L.0'481017 in present money. (Table I.)

Therefore, at that rate of interest, and according to the

Carlisle table of mortality, the present value of L.l to be

received upon A and B, now aged 30 and 40 years re¬

spectively, jointly surviving the term of 15 years, will be

4727 X 4073 X L.0'481017

5642”X 5075 *

'opular

View.

the term is extended; and when the annuity is a perpe-

tuity, there is no such excess. (8.)

29. The reason why the value of an annuity is increas¬

ed by that and the interest being both payable more than

once in the year, is, that the granter loses and the pur¬

chaser gains the interest produced by that part of each

payment which is in excess above the interest then due

upon the purchase-money, from the time of such payment

being made until the expiration of the year.

Hence it is obvious, that the less this excess is, that is,

the longer the term of the annuity is (28), the less must

the increase of value be.

And when the annuity is a perpetuity, its value will be

the same, whether it and the interest of money be both

payable several times in the year, or once only.

30. When the annuity is not payable at the same inter¬

vals at which the interest is convertible into principal, its

value will depend upon the frequencies both of payment

and conversion; but its investigation without algebra

would be too long, and of too little use, to be worth pro¬

secuting here.

235

v-flnp ^ Pa*^ ^or ^ whole, the present Popular

value of L.6047 to be received at the expiration of eleven View.

6 the1^th Profit, that is, the^v^>

™>th Part of ^e present value of L. 1, to be received then.

value of °f lntfrestuis 5 ^ cent, the present

hf I 0ARTrVQ £ at ,the exPiratio" of 11 years,

is L.O 584679; therefore, at that rate of interest, there

should be paid for each life i^H^i1:584679 T O.=47o

6460 —

And the present value of L.100, to be received upon a

hte now 10 years of age attaining to 21, will be L.54-73

or L.54. 14s. 7d. ’

II.—Of Annuities on Lives.

31. When the payment of an annuity depends upon the

existence of some life or lives, it is called a Life-Annuity.

32. The values of such annuities are calculated by

means of tables of mortality, which show, out of a consi¬

derable number of individuals born, how many upon an

average have lived to complete each year of their a^e,

and, consequently, what proportion of those who attained

to any one age have survived any greater age.

The fifth table at the end of this article is one of that

kind which has been taken from Mr Milne’s Treatise on

Annuities, and was constructed from accurate observations

made at Carlisle by Dr Heysham, during a period of nine

years, ending with 1787.

33. By this table it appears, that during the period in

which these observations were made, out of 10,000 chil¬

dren born, 3203 died under five years of age, and the re¬

maining 6797 completed their fifth year. Also, that out

of 6797 children who attained to five years of age, 6460

survived their tenth year.

But the mortality under ten years of age has been great¬

ly reduced since then by the practice of vaccination.

This table also shows, that of 6460 individuals who

attained to 10 years of age, 6047 survived 21; and that of

5075 who attained to 40, only 3643 survived their 60th year.

34. There is good reason to believe (as has been shown

in another place) that the general law of mortality, that

is, the average proportion of persons attaining to any one

age, who survive any greater age, remains much the same

now among the entire mass of the people throughout Eng¬

land, as it was found to be at Carlisle during the period of

these observations, except among children under ten years

of age, as was noticed above. (33.)

If this be so, it will follow, that of 6460 children now 10

years of age, just 6047 will attain to 21; or rather, that

if any great number be taken in several instances, this

/6047\

\6460/ W1 ke the average proportion of them that will

In the same manner it will be found, that reckoning

interest at ^per cent, the value would be L.60. 16s. Id.

35. This is the method of calculating the present values

of endowments for children of given ages; and the values

of annuities on lives may be computed in the same manner.

For, from the above reasoning it is manifest, that if the

present value of L.l, to be received certainly at the ex¬

piration of a given term, be multiplied by the number in

the table of mortality against the age, greater than that

of any proposed life by the number of years in the term,

and the product be divided by the number in the same

table, against the present age of that life; the quotient

will be the present value of L.l, to be received at the ex¬

piration of the term, provided that the life survive it.

And if, in this manner, the value be determined of L.l,

to be received upon any proposed life, surviving each of

the years in its greatest possible continuance, according

to the table of mortality adapted to it; that is, according

to the Carlisle table, upon its surviving every age greater

than its present, to that of 104 years inclusive; then, the

sum of all these values will evidently be the present value

of an annuity on the proposed life.

36. If 5642 lives at 30 years of age be proposed, and

5075 at the age of 40; since each of the 5642 younger

lives may be combined with every one of the 5075 that

are 10 years older, the number of different pairs, or dif¬

ferent combinations of two lives differing in age by 10

years, that may be formed out of the proposed lives, is

5642 times 5075.

But at the expiration of 15 years the survivors of the

lives now 30 and 40 years of age, being then of the re¬

spective ages of 45 and 55, will be reduced to the num¬

bers of 4/27 and 4073 respectively; and the number of

pairs, or combinations of two, differing in age by 10 years,

that can be formed out of them, will be reduced from

5642 X 5075 to 4727 X 4073.

So that L.l to be paid at the expiration of 15 years for

each of these 5642 X 5075 pairs or combinations of two

now existing, which may survive the term, will be of the

same value in present money as 4727 times L.4073 to

be received certainly at the same time.

Now, let A be any one of these lives of 30 years of age,

and B any one of those aged 40; and, from what has been

advanced, it will be evident that the present value of L.l,

to be received upon the two lives in this particular com¬

bination jointly surviving the term, will be the same as that

L.4727X 4073

of the sum —5540 x 5075 ^ien rece^vei^ certainly.

survive the period.

And if 6460 children were to be taken indiscriminately

fiom the general mass of the population at 10 years of

age, and an office or company were to engage to pay L.l

eleven years hence for each of them that might then be

living, this engagement would be equivalent to that which

should bind them to pay L.6047 certainly at the expira¬

tion of the term. Iherefore the office, in order that it

might neither gain nor lose by the engagement, should,

But, when the rate of interest is 5 per cent., L.l to be

received certainly at the expiration of 15 years, is equiva¬

lent to L.0'481017 in present money. (Table I.)

Therefore, at that rate of interest, and according to the

Carlisle table of mortality, the present value of L.l to be

received upon A and B, now aged 30 and 40 years re¬

spectively, jointly surviving the term of 15 years, will be

4727 X 4073 X L.0'481017

5642”X 5075 *

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy > (243) Page 235 |

|---|

| Permanent URL | https://digital.nls.uk/193760507 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.16 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|