Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy

(241) Page 233

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

ANNUITIES.

opular 3. When a certain sum of money is receivable annual-

View. iy, jt js ca]]e(j an Annuity, and its quantum is expressed

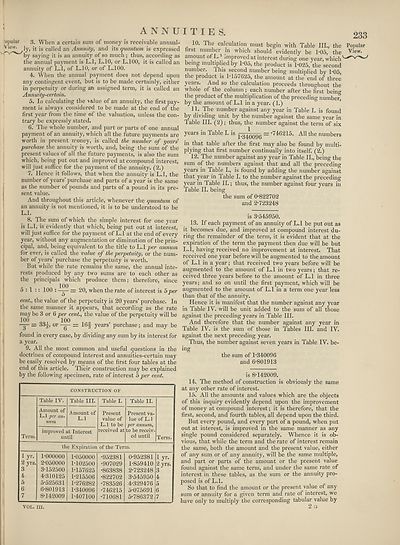

by saying it is an annuity of so much; thus, according as

the annual payment is L.l, L.10, or L.100, it is called an

annuity of L.l, of L.10, or of L.100.

4. When the annual payment does not depend upon

any contingent event, but is to be made certainly, either

in perpetuity or during an assigned term, it is called an

Annuity-certain.

5. In calculating the value of an annuity, the first pay¬

ment is always considered to be made at the end of the

first year from the time of the valuation, unless the con¬

trary be expressly stated.

6. The whole number, and part or parts of one annual

payment of an annuity, which all the future payments are

worth in present money, is called the number of years

purchase the annuity is worth, and, being the sum of the

present values of all the future payments, is also the sum

which, being put out and improved at compound interest,

will just suffice for the payment of the annuity. (2.)

7. Hence it follows, that when the annuity is L.l, the

number of years’ purchase and parts of a year is the same

as the number of pounds and parts of a pound in its pre¬

sent value.

And throughout this article, whenever the quantum of

an annuity is not mentioned, it is to be understood to be

233

10. The calculation must begin with Table III., the Popular

first number in which should evidently be 1*05, the View-

amount of L.1 improved at interest during one 3'ear, which

being multiplied by L05, the product is L025, the second

number. Ihis second number being multiplied by L05,

the product is 1T57625, the amount at the end of three

years. And so the calculation proceeds throughout the

whole of the column; each number after the first being

the product of the multiplication of the preceding number,

by the amount of L.l in a year. (1.)

11. The number against any year in Table I. is found

by dividing unit by the number against the same year in

Table III. (2); thus, the number against the term of six

years in Table I. is ^340096 = *746215. All the numbers

in that table after the first may also be found by multi¬

plying that first number continually into itself. (2.)

12. The number against any year in Table II., being the

sum of the numbers against that and all the preceding

years in Table L, is found by adding the number against

that year in Table I. to the number against the preceding

year in Table II.; thus, the number against four years in

Table II. being

the sum of 0-822702

and 2-723248

L.L

8. The sum of which the simple interest for one year

is L.l, is evidently that which, being put out at interest,

will just suffice for the payment of L.l at the end of every

year, without any augmentation or diminution of the prin¬

cipal, and, being equivalent to the title to L.l per annum

for ever, is called the value of the perpetuity, or the num¬

ber of years’ purchase the perpetuity is worth.

But while the rate remains the same, the annual inte¬

rests produced by any two sums are to each other as

the principals which produce them; therefore, since

5:1 :: 100 : — 20, when the rate of interest is bper

cent., the value of the perpetuity is 20 years’ purchase. In

the same manner it appears, that according as the rate

may be 3 or 6 per cent., the value of the perpetuity will be

-3— = 33A, or 16| years’ purchase; and may be

found in every case, by dividing any sum by its interest for

a year.

9. All the most common and useful questions in the

doctrines of compound interest and annuities-certain may

be easily resolved by means of the first four tables at the

end of this article. Their construction may be explained

by the following specimen, rate of interest 5 per cent.

CONSTRUCTION OF

Term.

Table IV. Table III,

Amount of

L.l per an¬

num

Amount of

L.l

improved at Interest

until

Table I.

Present

value of

L.l to be

received at

Table II.

Present va¬

lue of L. 1

per annum,

to be receiv¬

ed until

Term,

the Expiration of the Term.

1 yr.

2 yrs.

3

4

5

6

7

1-000000

2- 050000

3- 152500

4- 310125

5- 525631

6- 801913

8-142009

1-050000

1-102500

M57625

1-215506

1-276282

1-340096

1-407100

•952381

•907029

•863838

•822702

•783526

•746215

•710681

0-952381

1- 859410

2- 723248

3- 545950

4- 329476

5- 075691

5-786372

1 yr.

2 yrs.

3

4

5

6

7

is 3-545950.

13. If each payment of an annuity of L.l be put out as

it becomes due, and improved at compound interest du¬

ring the remainder of the term, it is evident that at the

expiration of the term the payment then due will be but

L.l, having received no improvement at interest. That

received one year before will be augmented to the amount

of L.l in a year; that received two years before will be

augmented to the amount of L.l in two years; that re¬

ceived three years before to the amount of L.l in three

years; and so on until the first payment, which will be

augmented to the amount of L.l in a term one year less

than that of the annuity.

Hence it is manifest that the number against any year

in Table IV. will be unit added to the sum of all those

against the preceding years in Table III.

And therefore that the number against any year in

Table IV. is the sum of those in Tables III. and IV.

against the next preceding year.

Thus, the number against seven years in Table IV. be¬

ing

the sum of 1-340096

and 6-801913

is 8-142009.

14. The method of construction is obviously the same

at any other rate of interest.

15. All the amounts and values which are the objects

of this inquiry evidently depend upon the improvement

of money at compound interest; it is therefore, that the

first, second, and fourth tables, all depend upon the third.

But every pound, and every part of a pound, when put

out at interest, is improved in the same manner as any

single pound considered separately. Whence it is ob¬

vious, that while the term and the rate of interest remain

the same, both the amount and the present value, either

of any sum or of any annuity, will be the same multiple,

and part or parts of the amount or the present value

found against the same term, and under the same rate of

interest in these tables, as the sum or the annuity pro¬

posed is of L.L

So that to find the amount or the present value of any

sum or annuity for a given term and rate of interest, we

have only to multiply the corresponding tabular value by

VOL. in.

opular 3. When a certain sum of money is receivable annual-

View. iy, jt js ca]]e(j an Annuity, and its quantum is expressed

by saying it is an annuity of so much; thus, according as

the annual payment is L.l, L.10, or L.100, it is called an

annuity of L.l, of L.10, or of L.100.

4. When the annual payment does not depend upon

any contingent event, but is to be made certainly, either

in perpetuity or during an assigned term, it is called an

Annuity-certain.

5. In calculating the value of an annuity, the first pay¬

ment is always considered to be made at the end of the

first year from the time of the valuation, unless the con¬

trary be expressly stated.

6. The whole number, and part or parts of one annual

payment of an annuity, which all the future payments are

worth in present money, is called the number of years

purchase the annuity is worth, and, being the sum of the

present values of all the future payments, is also the sum

which, being put out and improved at compound interest,

will just suffice for the payment of the annuity. (2.)

7. Hence it follows, that when the annuity is L.l, the

number of years’ purchase and parts of a year is the same

as the number of pounds and parts of a pound in its pre¬

sent value.

And throughout this article, whenever the quantum of

an annuity is not mentioned, it is to be understood to be

233

10. The calculation must begin with Table III., the Popular

first number in which should evidently be 1*05, the View-

amount of L.1 improved at interest during one 3'ear, which

being multiplied by L05, the product is L025, the second

number. Ihis second number being multiplied by L05,

the product is 1T57625, the amount at the end of three

years. And so the calculation proceeds throughout the

whole of the column; each number after the first being

the product of the multiplication of the preceding number,

by the amount of L.l in a year. (1.)

11. The number against any year in Table I. is found

by dividing unit by the number against the same year in

Table III. (2); thus, the number against the term of six

years in Table I. is ^340096 = *746215. All the numbers

in that table after the first may also be found by multi¬

plying that first number continually into itself. (2.)

12. The number against any year in Table II., being the

sum of the numbers against that and all the preceding

years in Table L, is found by adding the number against

that year in Table I. to the number against the preceding

year in Table II.; thus, the number against four years in

Table II. being

the sum of 0-822702

and 2-723248

L.L

8. The sum of which the simple interest for one year

is L.l, is evidently that which, being put out at interest,

will just suffice for the payment of L.l at the end of every

year, without any augmentation or diminution of the prin¬

cipal, and, being equivalent to the title to L.l per annum

for ever, is called the value of the perpetuity, or the num¬

ber of years’ purchase the perpetuity is worth.

But while the rate remains the same, the annual inte¬

rests produced by any two sums are to each other as

the principals which produce them; therefore, since

5:1 :: 100 : — 20, when the rate of interest is bper

cent., the value of the perpetuity is 20 years’ purchase. In

the same manner it appears, that according as the rate

may be 3 or 6 per cent., the value of the perpetuity will be

-3— = 33A, or 16| years’ purchase; and may be

found in every case, by dividing any sum by its interest for

a year.

9. All the most common and useful questions in the

doctrines of compound interest and annuities-certain may

be easily resolved by means of the first four tables at the

end of this article. Their construction may be explained

by the following specimen, rate of interest 5 per cent.

CONSTRUCTION OF

Term.

Table IV. Table III,

Amount of

L.l per an¬

num

Amount of

L.l

improved at Interest

until

Table I.

Present

value of

L.l to be

received at

Table II.

Present va¬

lue of L. 1

per annum,

to be receiv¬

ed until

Term,

the Expiration of the Term.

1 yr.

2 yrs.

3

4

5

6

7

1-000000

2- 050000

3- 152500

4- 310125

5- 525631

6- 801913

8-142009

1-050000

1-102500

M57625

1-215506

1-276282

1-340096

1-407100

•952381

•907029

•863838

•822702

•783526

•746215

•710681

0-952381

1- 859410

2- 723248

3- 545950

4- 329476

5- 075691

5-786372

1 yr.

2 yrs.

3

4

5

6

7

is 3-545950.

13. If each payment of an annuity of L.l be put out as

it becomes due, and improved at compound interest du¬

ring the remainder of the term, it is evident that at the

expiration of the term the payment then due will be but

L.l, having received no improvement at interest. That

received one year before will be augmented to the amount

of L.l in a year; that received two years before will be

augmented to the amount of L.l in two years; that re¬

ceived three years before to the amount of L.l in three

years; and so on until the first payment, which will be

augmented to the amount of L.l in a term one year less

than that of the annuity.

Hence it is manifest that the number against any year

in Table IV. will be unit added to the sum of all those

against the preceding years in Table III.

And therefore that the number against any year in

Table IV. is the sum of those in Tables III. and IV.

against the next preceding year.

Thus, the number against seven years in Table IV. be¬

ing

the sum of 1-340096

and 6-801913

is 8-142009.

14. The method of construction is obviously the same

at any other rate of interest.

15. All the amounts and values which are the objects

of this inquiry evidently depend upon the improvement

of money at compound interest; it is therefore, that the

first, second, and fourth tables, all depend upon the third.

But every pound, and every part of a pound, when put

out at interest, is improved in the same manner as any

single pound considered separately. Whence it is ob¬

vious, that while the term and the rate of interest remain

the same, both the amount and the present value, either

of any sum or of any annuity, will be the same multiple,

and part or parts of the amount or the present value

found against the same term, and under the same rate of

interest in these tables, as the sum or the annuity pro¬

posed is of L.L

So that to find the amount or the present value of any

sum or annuity for a given term and rate of interest, we

have only to multiply the corresponding tabular value by

VOL. in.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Anatomy-Astronomy > (241) Page 233 |

|---|

| Permanent URL | https://digital.nls.uk/193760481 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.16 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|