Encyclopaedia Britannica > Volume 3, Athens-BOI

(342) Page 330

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

330

BANKING

four, five, or even ten times the value of a quantity of

merchandise, have grown out of its successive sales, before

the first bill of the series has become due. And not only

this, but bills are themselves very frequently rediscounted ;

and*in this case the credit of the last indorser is generally

the only thing looked to ; and there is not, perhaps, one

case in ten in which any inquiries are made in regard to

the origin and history of the bills, though they are often

of the most questionable description.

On the whole, therefore, it would seem that the real or

presumed solvency of the parties signing a bill, and respon¬

sible for its payment, is the only safe criterion by which to

judge whether it should or should not be discounted. But

the fact of a merchant or other trader offering accommoda¬

tion bills for discount ought unquestionably to excite a

suspicion that he is trading beyond his capital. Inquiries

of the most searching description should forthwith be

instituted; and unless satisfactory explanations are given,

his paper should be rejected. On the same principle, the

offering of bills for rediscount ought to awaken suspicions

of the bankers and others who resort to so questionable a

mode of carrying on business. But, except in so far as a

feeling of distrust may be thus very properly excited,

there does not appear to be anything in an accommodation

bill per se to hinder it from coming within the pale of

negotiability. It is a mode of obtaining a loan from a

bank ; and when the character of the bill is known to the

banker, or is openly declared, it does not appear to be an

objectionable mode.

Besides bills avowedly intended for accommodation pur¬

poses, another and a different variety of such bills is drawn

by parties at a distance from each other, often men of straw,

and made to appear as if they were bottomed on real trans¬

actions. Bills of this sort are, it is greatly to be regretted,

always current, and often to a large extent. Of course

no person of respectability can be knowingly connected with

such bills, which are almost always put in motion either to

bolster up some bankrupt concern, or to cheat and defraud

the public. But despite the mischief of which they are

productive, it appears to be pretty generally supposed that

the currency of these bills is an evil which cannot be pre¬

vented. There can, however, be no real doubt that it may,

at all events, be very greatly diminished ; and this desir¬

able result would be effected were it enacted that all bills

shall henceforth bear upon their face what they really are ;

that those that are intended for accommodation purposes

shall have at their head the words “ Accommodation bill; ”

and that those only shall bear to be for “ value received ”

that have grown out of bona fide transfers of property. An

enactment of this sort could not be felt as a grievance by

any one unless he had a fraudulent purpose in view. And

were the impressing of a false character on a bill made a

criminal offence, punishable by several years’ imprison¬

ment, there is every probability that a formidable check

would be given to the issue of spurious bills, and to the

manifold abuses to which the practice gives rise.

Bill-discounters who have got fictitious paper on their

hands and attempt to get rid of it by concealing its char¬

acter or representing it in a favourable light make them¬

selves parties to the fraud. Such conduct is so very

flagitious, that when it can be fairly brought home to the

parties it should subject them to the severest penalties.

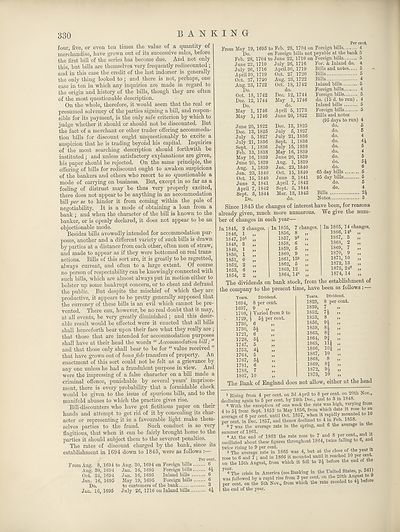

The rates of discount charged by the bank, since its

establishment in 1694 down to 1845, were as follows :

Per cent.

From Aug. 8, 1694 to Aug. 30, 1694 on Foreign bills 6

Aug. 30, 1694 Jan. 16, 1695 Foreign bills 4|

Oct. 24, 1694 Jan. 16, 1695 Inland bills 6

Jan. 16, 1695 May 19, 1695 Foreign bills 6

Do. to customers of the bank 3

Jan. 16, 1695 July 26, 1716 on Inland bills 4|

From May 19,

Do.

Feb. 28,

June 22,

July 26,

April 30,

Oct. 27,

Aug. 23,

Do.

Oct. 18,

Dec. 12,

Do.

May 1,

May 1,

June 20,

Dec. 13,

July 5,

July 21,

Sept. 1,

Feb. 13,

May 16,

June 20,

Aug. 1,

Jan. 23,

Oct. 15,

June 3,

April 7,

Sept. 5,

Do.

1695 to

on

1704 to

1710

1716

1719

1720

1722

1742

1744

1746

1746

1822

1825

1827

1836

1836

1838

1839

1839

1839

1840

1840

1841

1842

1844

Feb. 28, 1704 on

Foreign bills not

June 22, 1710 on

July 26, 1716

April 30, 1719

Oct. 27 1720

Aug. 23, 1722

Oct. 18, 1742

do.

Dec. 12, 1744

May 1, 1746

do.

April 5, 1773

June 20, 1822

Dec. 13, 1825

July 5, 1827

July 21, 1836

Sept. 1, 1836

July 15, 1838

May 16, 1839

June 20, 1839

Aug. 1, 1839

Jan. 23, 1840

Oct. 15, 1840

June 3, 1841

April 7, 1842

Sept. 5, 1844

Mar. 13, 1845

do.

Per cert

Foreign bills 4

payable at the bank 5

Foreign bills 5

For. & Inland do. 4

Bills and notes 5

Bills 5

Bills 4

Inland bills.. 5

Foreign bills 4

Foreign bills 5

do. (15 d. to run) . 4

Inland bills 5

Foreign bills 5

Bills and notes

(95 days to run)

do.

do.

do.

do.

do.

do.

do.

do.

do.

4

5

5

4

4^

5

4

5

54

6

65 day bills 5

95 day bills 5

do. 5

do. 4

Bills 24

Notes 3

Since 1845 the changes of interest have been, for reasons

already given, much more numerous. We give the num¬

ber of changes in each year—

In 1845, 2 changes.

1846, 1

1847, 101

1848, 3

1

1

0

2

6

2

1849,

1850,

1851,

1852,

1853,

1854,

7 changes.

8

In 1855,

1856,

1857, 92

1858, 6

1859, 5

1860, 9

1861, 133

1862, 5

1863, 12

1864, 144

The dividends on bank stock, from the establishment of

he company to the present time, have been as follows :

In 1865, 14 changes.

1866, 14s

1867, 3

1868, 2

1869, 7

1870, 9

1871, 10

1872, 13

1873, 24®

1874, 14

Years. Dividend.

1694, 8 per cent.

1697, 9

1708, ) Yaried from 9 to

1729, ) 5| per cent.

1730, 6

1730, 54

1721, 6

1728, 54

1747, 5

1753, 44

1764, 5

1767, 54

1781, 6

1788, 7

1807, 10

Years. Dividend.

1823, 8 per cent.

1839, 7

1852, 74

1853, 8

1856, 94

1859, 84

1863, 8|

1864, 9f

1865, 111

1866, 104

1867, 10

1868, 8

1869, 8|

1872, 94

1873, 10

The Bank of England does not allow, either at the head

1 Rising from 4 per cent, on 3d April to 8 per cent, on 20th Nov.,

iclining again to 5 per cent, by 24th Dec., and to 3 in 1848.

2 With the exception of one week the rate was high, varying from

to 54 from Sept. 1853 to May 1856, from which date it rose to an

rerage of 6 per cent, until Oct. 1857, when it rapidly mounted to 10

3r cent, in Dec. 1857, and thence declined to 4 in Feb. 1858. _

3 7 was the average rate in the spring, and 6 the average m tlie

immer of 1861. „ , n ,

4 At the end of 1863 the rate rose to 7 and 8 per cent., and it

scillated about these figures throughout 1864, twice falling to 6, and

vice rising to 9 per cent. ,. -+

5 The average rate in 1865 was 4, but at the close °f tjie } 1

ise to 6 and 7 ; and in 1866 it mounted until it reached 10 Fir cent.

11 the 15th August, from which it fell to 34 before the end of th

e®rThe crisis in America (see Banking in the United States, P-341)

-as followed by a rapid rise from 3 per cent, on the 20th f

er cent, on the 5th Nov., from which the rate receded to 42 befoie

fie end of the year.

BANKING

four, five, or even ten times the value of a quantity of

merchandise, have grown out of its successive sales, before

the first bill of the series has become due. And not only

this, but bills are themselves very frequently rediscounted ;

and*in this case the credit of the last indorser is generally

the only thing looked to ; and there is not, perhaps, one

case in ten in which any inquiries are made in regard to

the origin and history of the bills, though they are often

of the most questionable description.

On the whole, therefore, it would seem that the real or

presumed solvency of the parties signing a bill, and respon¬

sible for its payment, is the only safe criterion by which to

judge whether it should or should not be discounted. But

the fact of a merchant or other trader offering accommoda¬

tion bills for discount ought unquestionably to excite a

suspicion that he is trading beyond his capital. Inquiries

of the most searching description should forthwith be

instituted; and unless satisfactory explanations are given,

his paper should be rejected. On the same principle, the

offering of bills for rediscount ought to awaken suspicions

of the bankers and others who resort to so questionable a

mode of carrying on business. But, except in so far as a

feeling of distrust may be thus very properly excited,

there does not appear to be anything in an accommodation

bill per se to hinder it from coming within the pale of

negotiability. It is a mode of obtaining a loan from a

bank ; and when the character of the bill is known to the

banker, or is openly declared, it does not appear to be an

objectionable mode.

Besides bills avowedly intended for accommodation pur¬

poses, another and a different variety of such bills is drawn

by parties at a distance from each other, often men of straw,

and made to appear as if they were bottomed on real trans¬

actions. Bills of this sort are, it is greatly to be regretted,

always current, and often to a large extent. Of course

no person of respectability can be knowingly connected with

such bills, which are almost always put in motion either to

bolster up some bankrupt concern, or to cheat and defraud

the public. But despite the mischief of which they are

productive, it appears to be pretty generally supposed that

the currency of these bills is an evil which cannot be pre¬

vented. There can, however, be no real doubt that it may,

at all events, be very greatly diminished ; and this desir¬

able result would be effected were it enacted that all bills

shall henceforth bear upon their face what they really are ;

that those that are intended for accommodation purposes

shall have at their head the words “ Accommodation bill; ”

and that those only shall bear to be for “ value received ”

that have grown out of bona fide transfers of property. An

enactment of this sort could not be felt as a grievance by

any one unless he had a fraudulent purpose in view. And

were the impressing of a false character on a bill made a

criminal offence, punishable by several years’ imprison¬

ment, there is every probability that a formidable check

would be given to the issue of spurious bills, and to the

manifold abuses to which the practice gives rise.

Bill-discounters who have got fictitious paper on their

hands and attempt to get rid of it by concealing its char¬

acter or representing it in a favourable light make them¬

selves parties to the fraud. Such conduct is so very

flagitious, that when it can be fairly brought home to the

parties it should subject them to the severest penalties.

The rates of discount charged by the bank, since its

establishment in 1694 down to 1845, were as follows :

Per cent.

From Aug. 8, 1694 to Aug. 30, 1694 on Foreign bills 6

Aug. 30, 1694 Jan. 16, 1695 Foreign bills 4|

Oct. 24, 1694 Jan. 16, 1695 Inland bills 6

Jan. 16, 1695 May 19, 1695 Foreign bills 6

Do. to customers of the bank 3

Jan. 16, 1695 July 26, 1716 on Inland bills 4|

From May 19,

Do.

Feb. 28,

June 22,

July 26,

April 30,

Oct. 27,

Aug. 23,

Do.

Oct. 18,

Dec. 12,

Do.

May 1,

May 1,

June 20,

Dec. 13,

July 5,

July 21,

Sept. 1,

Feb. 13,

May 16,

June 20,

Aug. 1,

Jan. 23,

Oct. 15,

June 3,

April 7,

Sept. 5,

Do.

1695 to

on

1704 to

1710

1716

1719

1720

1722

1742

1744

1746

1746

1822

1825

1827

1836

1836

1838

1839

1839

1839

1840

1840

1841

1842

1844

Feb. 28, 1704 on

Foreign bills not

June 22, 1710 on

July 26, 1716

April 30, 1719

Oct. 27 1720

Aug. 23, 1722

Oct. 18, 1742

do.

Dec. 12, 1744

May 1, 1746

do.

April 5, 1773

June 20, 1822

Dec. 13, 1825

July 5, 1827

July 21, 1836

Sept. 1, 1836

July 15, 1838

May 16, 1839

June 20, 1839

Aug. 1, 1839

Jan. 23, 1840

Oct. 15, 1840

June 3, 1841

April 7, 1842

Sept. 5, 1844

Mar. 13, 1845

do.

Per cert

Foreign bills 4

payable at the bank 5

Foreign bills 5

For. & Inland do. 4

Bills and notes 5

Bills 5

Bills 4

Inland bills.. 5

Foreign bills 4

Foreign bills 5

do. (15 d. to run) . 4

Inland bills 5

Foreign bills 5

Bills and notes

(95 days to run)

do.

do.

do.

do.

do.

do.

do.

do.

do.

4

5

5

4

4^

5

4

5

54

6

65 day bills 5

95 day bills 5

do. 5

do. 4

Bills 24

Notes 3

Since 1845 the changes of interest have been, for reasons

already given, much more numerous. We give the num¬

ber of changes in each year—

In 1845, 2 changes.

1846, 1

1847, 101

1848, 3

1

1

0

2

6

2

1849,

1850,

1851,

1852,

1853,

1854,

7 changes.

8

In 1855,

1856,

1857, 92

1858, 6

1859, 5

1860, 9

1861, 133

1862, 5

1863, 12

1864, 144

The dividends on bank stock, from the establishment of

he company to the present time, have been as follows :

In 1865, 14 changes.

1866, 14s

1867, 3

1868, 2

1869, 7

1870, 9

1871, 10

1872, 13

1873, 24®

1874, 14

Years. Dividend.

1694, 8 per cent.

1697, 9

1708, ) Yaried from 9 to

1729, ) 5| per cent.

1730, 6

1730, 54

1721, 6

1728, 54

1747, 5

1753, 44

1764, 5

1767, 54

1781, 6

1788, 7

1807, 10

Years. Dividend.

1823, 8 per cent.

1839, 7

1852, 74

1853, 8

1856, 94

1859, 84

1863, 8|

1864, 9f

1865, 111

1866, 104

1867, 10

1868, 8

1869, 8|

1872, 94

1873, 10

The Bank of England does not allow, either at the head

1 Rising from 4 per cent, on 3d April to 8 per cent, on 20th Nov.,

iclining again to 5 per cent, by 24th Dec., and to 3 in 1848.

2 With the exception of one week the rate was high, varying from

to 54 from Sept. 1853 to May 1856, from which date it rose to an

rerage of 6 per cent, until Oct. 1857, when it rapidly mounted to 10

3r cent, in Dec. 1857, and thence declined to 4 in Feb. 1858. _

3 7 was the average rate in the spring, and 6 the average m tlie

immer of 1861. „ , n ,

4 At the end of 1863 the rate rose to 7 and 8 per cent., and it

scillated about these figures throughout 1864, twice falling to 6, and

vice rising to 9 per cent. ,. -+

5 The average rate in 1865 was 4, but at the close °f tjie } 1

ise to 6 and 7 ; and in 1866 it mounted until it reached 10 Fir cent.

11 the 15th August, from which it fell to 34 before the end of th

e®rThe crisis in America (see Banking in the United States, P-341)

-as followed by a rapid rise from 3 per cent, on the 20th f

er cent, on the 5th Nov., from which the rate receded to 42 befoie

fie end of the year.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Athens-BOI > (342) Page 330 |

|---|

| Permanent URL | https://digital.nls.uk/193654747 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.17 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|