Encyclopaedia Britannica > Volume 3, Athens-BOI

(329) Page 317

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

317

BANKING

tors, who shall be elected between the 25th of March and

the 25th day of April each year, from among the members

of the company duly qualified.

“ That no dividend shall at any time be made by the

said governor and company, save only out of the interest,

profit, or produce arising by or out of the said capital,

stock, or fund, or by such dealing as is allowed by Act of

Parliament.

“They must be natural-born subjects of England, or

naturalized subjects ; they shall have in their own name,

and for their own use, severally, viz., the governor at least

£4000, the deputy-governor £3000, and each director

£2000, of the capital stock of the said corporation.

“ That thirteen or more of the said governors and direc¬

tors (of which the governor or deputy-governor must be

always one) shall constitute a court of directors, for the

management of the affairs of the company, and for the

appointment of all agents and servants which may be

necessary, paying them such salaries as they may consider

reasonable.

“ Every elector must have, in his own name and for his

own use, £500 or more capital stock, and can only give

one vote. He must, if required by any member present,

take the oath of stock, or the declaration of stock in case

he may be one of the people called Quakers.

“ Four general courts shall be held in every year, in the

months of September, December, April, and July. A

general court may be summoned at any time, upon the

requisition of nine proprietors duly qualified as electors.

The majority of electors in general courts have the power

to make and constitute bye-laws and ordinances for the

government of the corporation, provided that such bye-laws

and ordinances be not repugnant to the laws of the king¬

dom, and be confirmed and approved according to the

statutes in such case made and provided.”

The corporation is prohibited from engaging in any sort

of commercial undertaking other than dealing in bills of

exchange, and in gold and silver. It is authorised to

advance money upon the security of goods or merchandise

pledged to it, and to sell by public auction such goods as

are not redeemed within a specified time.

It was also enacted, in the same year in which the bank

was established, by statute 6 William and Mary, c. 20, that

the bank “ shall not deal in any goods, wares, or merchan¬

dise (except bullion), or purchase any lands or revenues

belonging to the Crown, or advance or lend to their

majesties, their heirs or successors, any sum or sums of

money, by way of loan or anticipation on any part or parts,

branch or branches, fund or funds of the revenue, now

granted or belonging, or hereafter to be granted, to their

majesties, their heirs and successors, other than such fund

or funds, part or parts, branch or branches of the said

revenue only on which a credit of loan is or shall be granted

by Parliament.” And in 1697 it was enacted, that the

“ common capital or principal stock, and also the real fund,

of the governor and company, or any profit or produce to

be made thereof, or arising thereby, shall be exempted from

any rates, taxes, assessments, or impositions whatsoever

during the continuance of the bank ; that all the profit,

benefit, and advantage from time to time arising out of the

management of the said corporation, shall be applied to the

uses of all the members of the said association of the

governor and company of the Bank of England, rateably

and in proportion to each member’s part, share, and interest

in the common capital and principal stock of the said

governor and company hereby established.”

In 1696, during the great recoinage, the bank was

involved in great difficulties, and was even compelled to

suspend payment of its notes, which were at a heavy

discount. Owing, however, to the judicious conduct of the

directors, and the assistance of the Government, the bank

got over the crisis. But it was at the same time judged

expedient, in order to place it in a situation the better to

withstand any adverse circumstances that might afterwards

occur, to increase the capitalfrom£l,200,OOOto £2,201,171.

In 1708 the directors undertook to pay off and cancel one

mdlion and a half of exchequer bills they had circulating

two years befoi'e, at 4J per cent., with the interest upon

them, amounting in all to £1,775,028, which increased the

permanent debt due by the public to the bank, including

£400,000 then advanced in consideration of the renewal

of the charter, to £3,375,028, for which they were allowed

6 per cent. The bank capital was then also doubled, or

increased to £4,402,342. But the year 1708 is chiefly

memorable in the history of the bank, for the Act pre¬

viously alluded to, which declared, that during the con¬

tinuance of the corporation of the Bank of England, “ it

should not be lawful for any body politic, erected or to be

erected, other than the said governor and company of the

Bank of England, or of any other persons whatsoever,

united or to be united in covenants or partnership, exceed¬

ing the number of six persons, in that part of Great Britain

called England, to borrow, owe, or take up any sum or

sums of money on their bills or notes payable on demand,

or in any less time than six months from the borrowing

thereof.” This proviso is said to have been elicited by the

Mine Adventurers Company having commenced banking

business and begun to issue notes. It will be seen on

examination that the proviso did not prohibit the forma¬

tion of associations for general banking business; it simply

forbade the issue of notes by associations of more than six

partners; but the issue of notes was regarded as so essen¬

tial to the business of banking, that it came to be believed

that joint-stock banking associations were absolutely pro¬

hibited in England, and no such association was founded

until after the legislation of 1826 (see p. 322) expressly

permitting them to be established. The charter of the

Bank of England, when first granted, was to continue for

eleven years certain, or till a year’s notice after the 1st of

August 1705. The charter was further prolonged in 1697.

In 1708, the bank, having advanced £400,000 for the

public service, without interest, the exclusive privileges of

the corporation were prolonged till 1733. And in con¬

sequence of various advances made at different times, the

exclusive privileges of the bank were continued by suc¬

cessive renewals till the 1st of August 1855, with the

proviso that they might be cancelled on a year’s notice

to that effect being given after the said 1st of August

1855.

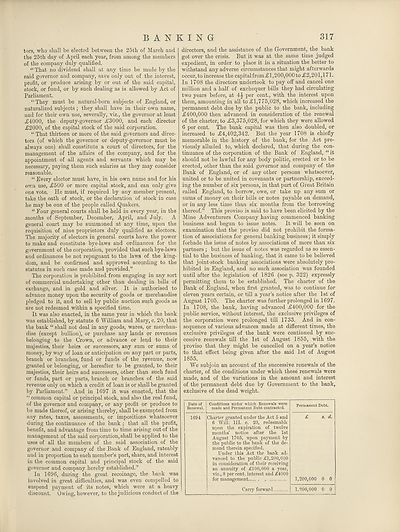

We subjoin an account of the successive renewals of the

charter, of the conditions under which these renewals were

made, and of the variations in the amount and interest

of the permanent debt due by Government to the bank,

exclusive of the dead weight.

Date of

Renewal,

1694

Conditions under which Renewals were

made and Permanent Debt contracted.

Charter granted under the Act 5 and

6 Will. III. c. 20, redeemable

upon the expiration of twelve

months’ notice after the 1st

August 1705, upon payment by

the public to the hank of the de¬

mand therein specified.

Under this Act the hank ad¬

vanced to the public £1,200,000

in consideration of their receiving

an annuity of £100,000 a year,

viz., 8 per cent. interest and £4000

for management

Permanent Debt.

S. d.

1,200,000 0 0

Carry forward | 1.200,000 0 0

BANKING

tors, who shall be elected between the 25th of March and

the 25th day of April each year, from among the members

of the company duly qualified.

“ That no dividend shall at any time be made by the

said governor and company, save only out of the interest,

profit, or produce arising by or out of the said capital,

stock, or fund, or by such dealing as is allowed by Act of

Parliament.

“They must be natural-born subjects of England, or

naturalized subjects ; they shall have in their own name,

and for their own use, severally, viz., the governor at least

£4000, the deputy-governor £3000, and each director

£2000, of the capital stock of the said corporation.

“ That thirteen or more of the said governors and direc¬

tors (of which the governor or deputy-governor must be

always one) shall constitute a court of directors, for the

management of the affairs of the company, and for the

appointment of all agents and servants which may be

necessary, paying them such salaries as they may consider

reasonable.

“ Every elector must have, in his own name and for his

own use, £500 or more capital stock, and can only give

one vote. He must, if required by any member present,

take the oath of stock, or the declaration of stock in case

he may be one of the people called Quakers.

“ Four general courts shall be held in every year, in the

months of September, December, April, and July. A

general court may be summoned at any time, upon the

requisition of nine proprietors duly qualified as electors.

The majority of electors in general courts have the power

to make and constitute bye-laws and ordinances for the

government of the corporation, provided that such bye-laws

and ordinances be not repugnant to the laws of the king¬

dom, and be confirmed and approved according to the

statutes in such case made and provided.”

The corporation is prohibited from engaging in any sort

of commercial undertaking other than dealing in bills of

exchange, and in gold and silver. It is authorised to

advance money upon the security of goods or merchandise

pledged to it, and to sell by public auction such goods as

are not redeemed within a specified time.

It was also enacted, in the same year in which the bank

was established, by statute 6 William and Mary, c. 20, that

the bank “ shall not deal in any goods, wares, or merchan¬

dise (except bullion), or purchase any lands or revenues

belonging to the Crown, or advance or lend to their

majesties, their heirs or successors, any sum or sums of

money, by way of loan or anticipation on any part or parts,

branch or branches, fund or funds of the revenue, now

granted or belonging, or hereafter to be granted, to their

majesties, their heirs and successors, other than such fund

or funds, part or parts, branch or branches of the said

revenue only on which a credit of loan is or shall be granted

by Parliament.” And in 1697 it was enacted, that the

“ common capital or principal stock, and also the real fund,

of the governor and company, or any profit or produce to

be made thereof, or arising thereby, shall be exempted from

any rates, taxes, assessments, or impositions whatsoever

during the continuance of the bank ; that all the profit,

benefit, and advantage from time to time arising out of the

management of the said corporation, shall be applied to the

uses of all the members of the said association of the

governor and company of the Bank of England, rateably

and in proportion to each member’s part, share, and interest

in the common capital and principal stock of the said

governor and company hereby established.”

In 1696, during the great recoinage, the bank was

involved in great difficulties, and was even compelled to

suspend payment of its notes, which were at a heavy

discount. Owing, however, to the judicious conduct of the

directors, and the assistance of the Government, the bank

got over the crisis. But it was at the same time judged

expedient, in order to place it in a situation the better to

withstand any adverse circumstances that might afterwards

occur, to increase the capitalfrom£l,200,OOOto £2,201,171.

In 1708 the directors undertook to pay off and cancel one

mdlion and a half of exchequer bills they had circulating

two years befoi'e, at 4J per cent., with the interest upon

them, amounting in all to £1,775,028, which increased the

permanent debt due by the public to the bank, including

£400,000 then advanced in consideration of the renewal

of the charter, to £3,375,028, for which they were allowed

6 per cent. The bank capital was then also doubled, or

increased to £4,402,342. But the year 1708 is chiefly

memorable in the history of the bank, for the Act pre¬

viously alluded to, which declared, that during the con¬

tinuance of the corporation of the Bank of England, “ it

should not be lawful for any body politic, erected or to be

erected, other than the said governor and company of the

Bank of England, or of any other persons whatsoever,

united or to be united in covenants or partnership, exceed¬

ing the number of six persons, in that part of Great Britain

called England, to borrow, owe, or take up any sum or

sums of money on their bills or notes payable on demand,

or in any less time than six months from the borrowing

thereof.” This proviso is said to have been elicited by the

Mine Adventurers Company having commenced banking

business and begun to issue notes. It will be seen on

examination that the proviso did not prohibit the forma¬

tion of associations for general banking business; it simply

forbade the issue of notes by associations of more than six

partners; but the issue of notes was regarded as so essen¬

tial to the business of banking, that it came to be believed

that joint-stock banking associations were absolutely pro¬

hibited in England, and no such association was founded

until after the legislation of 1826 (see p. 322) expressly

permitting them to be established. The charter of the

Bank of England, when first granted, was to continue for

eleven years certain, or till a year’s notice after the 1st of

August 1705. The charter was further prolonged in 1697.

In 1708, the bank, having advanced £400,000 for the

public service, without interest, the exclusive privileges of

the corporation were prolonged till 1733. And in con¬

sequence of various advances made at different times, the

exclusive privileges of the bank were continued by suc¬

cessive renewals till the 1st of August 1855, with the

proviso that they might be cancelled on a year’s notice

to that effect being given after the said 1st of August

1855.

We subjoin an account of the successive renewals of the

charter, of the conditions under which these renewals were

made, and of the variations in the amount and interest

of the permanent debt due by Government to the bank,

exclusive of the dead weight.

Date of

Renewal,

1694

Conditions under which Renewals were

made and Permanent Debt contracted.

Charter granted under the Act 5 and

6 Will. III. c. 20, redeemable

upon the expiration of twelve

months’ notice after the 1st

August 1705, upon payment by

the public to the hank of the de¬

mand therein specified.

Under this Act the hank ad¬

vanced to the public £1,200,000

in consideration of their receiving

an annuity of £100,000 a year,

viz., 8 per cent. interest and £4000

for management

Permanent Debt.

S. d.

1,200,000 0 0

Carry forward | 1.200,000 0 0

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Encyclopaedia Britannica > Encyclopaedia Britannica > Volume 3, Athens-BOI > (329) Page 317 |

|---|

| Permanent URL | https://digital.nls.uk/193654578 |

|---|

| Attribution and copyright: |

|

|---|---|

| Shelfmark | EB.17 |

|---|---|

| Description | Ten editions of 'Encyclopaedia Britannica', issued from 1768-1903, in 231 volumes. Originally issued in 100 weekly parts (3 volumes) between 1768 and 1771 by publishers: Colin Macfarquhar and Andrew Bell (Edinburgh); editor: William Smellie: engraver: Andrew Bell. Expanded editions in the 19th century featured more volumes and contributions from leading experts in their fields. Managed and published in Edinburgh up to the 9th edition (25 volumes, from 1875-1889); the 10th edition (1902-1903) re-issued the 9th edition, with 11 supplementary volumes. |

|---|---|

| Additional NLS resources: |

|