Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

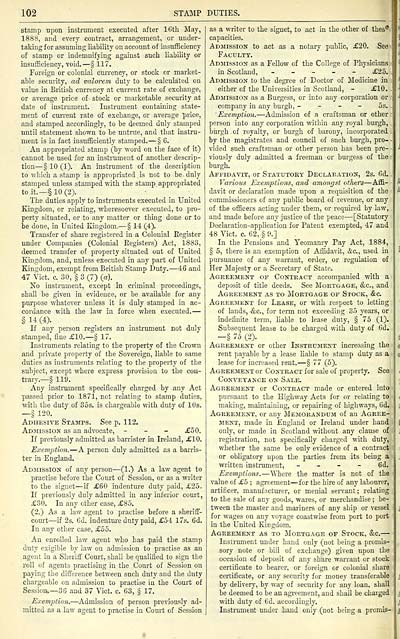

102

STAMP DUTIES.

stamp upon instrument executed after 16th ]May,

1888, and every contract, arrangement, or under-

taking for assuming liability on account of insufficiency

of stamp or indemnifying against such liability or

insuificiency, void. — § 117.

Foreign or colonial currency, or stock or market-

able security, ad valorem duty to be calculated on

value in British currency at current rate of exchange,

or average price of stock or marketable security at

date of instrument. Instrument containing state-

ment of current rate of exchange, or average price,

and stamped accordingly, to be deemed duly stamped

until statement shown to be untrue, and that instru-

ment is in fact insufficiently stamped. — § 6.

An appropriated stamp (by word on the face of it)

cannot be used for an instrument of another descrip-

tion — § 10 (1). An instrument of the description

to which a stamp is appropriated . is not to be duly

stamped unless stamped with the stamp appropriated

to it.— § 10 (2).

The duties apply to instruments executed in United

Kingdom, or relating, wheresoever executed, to pro-

perty situated, or to any matter or thing done or to

te done, in United Kingdom. — § 14 (4).

Transfer of share registered in a Colonial Register

under Companies (Colonial Eegisters) Act, 1883,

deemed transfer of property situated out of United

Kingdom, and, unless executed in any part of United

Kingdom, exempt from British Stamp Duty. — 46 and

47 Vict. c. 30, § 3 (7) (a).

No instrument, except in criminal proceedings,

shall be given in evidence, or be available for any

purpose whatever unless it is duly stamped in ac-

cordance with the law in force when executed. —

§ 14 (4).

If any person registers an instrument not duly

stamped, fine £10. — § 17.

Instruments relating to the property of the Crown

and private property of the Sovereign, liable to same

duties as instruments relating to the property of the

subject, except where express provision to the cou-

ti-ary.— § 119.

Any instrument specifically charged by any Act

passed prior to 1871, not relating to stamp duties,

with the duty of 35s. is chargeable with duty of 10s.

— § 120.

Adhesive Stamps. See p. 112.

Admission as an advocate, - - - £50.

If previously admitted as barrister in Ireland, £10.

Exemption. — A person duly admitted as a barris-

ter in England.

Admission of any person — (1.) As a law agent to

practise before the Court of Session, or as a writer

to the signet — if £60 indenture duty paid, £25.

If previously duly admitted in any inferior court,

£30. In any other case, £85.

(2.) As a law agent to practise before a sheriff-

court— if 2s. 6d. iudentm-e duty paid, £54 17s. 6d.

In any other case, £55.

An enrolled law agent who has paid the stamp

duty exigible by law on admission to practise as an

agent in a Sheriff Court, shall be qualified to sign the

roll of agents practising in the Court of Session on

paying the difference between such duty and the duty

chargeable on admission to practise in the Court of

Session.— 36 and 37 Vict. c. 63, § 17.

Exemption. — Admission of person previously ad-

mitted as a law agent to practise in Court of Session

as a writer to the signet, to act in the other of thes®

capacities.

Admission to act as a notary public, £20. See

Faculty.

Admission as a Fellow of the College of Physicians

in Scotland, _ _ - _ - £25.

Admission to the degree of Doctor of Medicine in

either of the Universities in Scotland, - £10,

Adjiission as a Burgess, or into any corporation or

company in any burgh, - - - - 5s.

'Exemption. — Admission of a craftsman or other

person into any corporation within any royal burgh,

burgh of royalty, or burgh of barony, incorporated .

by the magistrates and council of such burgh, pro- ■

vided such craftsman or other person has been pre-

viously duly admitted a freeman or burgess of the -

burgh.

Affidavit, or Statutory Declaeation, 2s. 6d.

Various Exemptions, and amongst others — Affi-

davit or declaration made upon a requisition of the

commissioners of any public board of revenue, or any

of the officers acting under them, or required by law,

and made before any justice of the peace — [Statutory

Declaration-application for Patent exempted, 47 and

48 Vict. c. 62, § 9.]

In the Pensions and Yeomanry Pay Act, 1884,

§ 5, there is an exemption of Aflidavit, &c., used in

pursuance of any warrant, order, or regulation of

Her Majesty or a Secretary of State.

Agreement of Contract accompanied with a

deposit of title deeds. See Mortgage, &c., and

Agreement as to Mortgage of Stock, &c.

Agreement for Lease, or with respect to letting

of lands, &c., for term not exceeding 35 years, or

indefinite term, liable to lease duty, § 75 (1).

Subsequent lease to be charged with duty of 6d.

-§ 75 (2).

Agreement or other Instrument increasing the

rent payable by a lease Hable to stamp duty as a

lease for increased rent. — § 77 (5).

Agreement or Contract for sale of property. See

Conveyance on Sale.

Agreement or Contract made or entered into

pursuant to the Highway Acts for or relating to

making, maintaining, or repairing of highways, 6d.

Agreement, or any Memorandum of an Agree-

ment, made in England or Ireland under hand

only, or made in Scotland without any clause of

registration, not specifically charged with duty,

whether the same be only evidence of a contract

or obligatory upon the parties from its being a

written instrument, - _ - - 6d.

ExemjHions. — Where the matter is not of the

%'alue of £5 ; agreement — for the hire of any labourer,

artificer, manufactm-er, or menial servant ; relating

to the sale of any goods, wares, or merchandise ; be-

tween the master and mariners of any ship or vessel

for wages on any voyage coastwise from port to port

in the United Kingdom.

Agreement as to Mortgage of Stock, &c. —

Instrmnent under hand only (not being a promis-

sory note or bill of exchange) given upon the

occasion of deposit of any share wan-ant or stock

certificate to bearer, or foreign or colonial share

certificate, or any security for money transferable

by delivery, by way of security for any loan, shall

be deemed to be an agreement, and shall be charged

with duty of 6d. accordingly.

Instrument under hand only (not being a promis-

STAMP DUTIES.

stamp upon instrument executed after 16th ]May,

1888, and every contract, arrangement, or under-

taking for assuming liability on account of insufficiency

of stamp or indemnifying against such liability or

insuificiency, void. — § 117.

Foreign or colonial currency, or stock or market-

able security, ad valorem duty to be calculated on

value in British currency at current rate of exchange,

or average price of stock or marketable security at

date of instrument. Instrument containing state-

ment of current rate of exchange, or average price,

and stamped accordingly, to be deemed duly stamped

until statement shown to be untrue, and that instru-

ment is in fact insufficiently stamped. — § 6.

An appropriated stamp (by word on the face of it)

cannot be used for an instrument of another descrip-

tion — § 10 (1). An instrument of the description

to which a stamp is appropriated . is not to be duly

stamped unless stamped with the stamp appropriated

to it.— § 10 (2).

The duties apply to instruments executed in United

Kingdom, or relating, wheresoever executed, to pro-

perty situated, or to any matter or thing done or to

te done, in United Kingdom. — § 14 (4).

Transfer of share registered in a Colonial Register

under Companies (Colonial Eegisters) Act, 1883,

deemed transfer of property situated out of United

Kingdom, and, unless executed in any part of United

Kingdom, exempt from British Stamp Duty. — 46 and

47 Vict. c. 30, § 3 (7) (a).

No instrument, except in criminal proceedings,

shall be given in evidence, or be available for any

purpose whatever unless it is duly stamped in ac-

cordance with the law in force when executed. —

§ 14 (4).

If any person registers an instrument not duly

stamped, fine £10. — § 17.

Instruments relating to the property of the Crown

and private property of the Sovereign, liable to same

duties as instruments relating to the property of the

subject, except where express provision to the cou-

ti-ary.— § 119.

Any instrument specifically charged by any Act

passed prior to 1871, not relating to stamp duties,

with the duty of 35s. is chargeable with duty of 10s.

— § 120.

Adhesive Stamps. See p. 112.

Admission as an advocate, - - - £50.

If previously admitted as barrister in Ireland, £10.

Exemption. — A person duly admitted as a barris-

ter in England.

Admission of any person — (1.) As a law agent to

practise before the Court of Session, or as a writer

to the signet — if £60 indenture duty paid, £25.

If previously duly admitted in any inferior court,

£30. In any other case, £85.

(2.) As a law agent to practise before a sheriff-

court— if 2s. 6d. iudentm-e duty paid, £54 17s. 6d.

In any other case, £55.

An enrolled law agent who has paid the stamp

duty exigible by law on admission to practise as an

agent in a Sheriff Court, shall be qualified to sign the

roll of agents practising in the Court of Session on

paying the difference between such duty and the duty

chargeable on admission to practise in the Court of

Session.— 36 and 37 Vict. c. 63, § 17.

Exemption. — Admission of person previously ad-

mitted as a law agent to practise in Court of Session

as a writer to the signet, to act in the other of thes®

capacities.

Admission to act as a notary public, £20. See

Faculty.

Admission as a Fellow of the College of Physicians

in Scotland, _ _ - _ - £25.

Admission to the degree of Doctor of Medicine in

either of the Universities in Scotland, - £10,

Adjiission as a Burgess, or into any corporation or

company in any burgh, - - - - 5s.

'Exemption. — Admission of a craftsman or other

person into any corporation within any royal burgh,

burgh of royalty, or burgh of barony, incorporated .

by the magistrates and council of such burgh, pro- ■

vided such craftsman or other person has been pre-

viously duly admitted a freeman or burgess of the -

burgh.

Affidavit, or Statutory Declaeation, 2s. 6d.

Various Exemptions, and amongst others — Affi-

davit or declaration made upon a requisition of the

commissioners of any public board of revenue, or any

of the officers acting under them, or required by law,

and made before any justice of the peace — [Statutory

Declaration-application for Patent exempted, 47 and

48 Vict. c. 62, § 9.]

In the Pensions and Yeomanry Pay Act, 1884,

§ 5, there is an exemption of Aflidavit, &c., used in

pursuance of any warrant, order, or regulation of

Her Majesty or a Secretary of State.

Agreement of Contract accompanied with a

deposit of title deeds. See Mortgage, &c., and

Agreement as to Mortgage of Stock, &c.

Agreement for Lease, or with respect to letting

of lands, &c., for term not exceeding 35 years, or

indefinite term, liable to lease duty, § 75 (1).

Subsequent lease to be charged with duty of 6d.

-§ 75 (2).

Agreement or other Instrument increasing the

rent payable by a lease Hable to stamp duty as a

lease for increased rent. — § 77 (5).

Agreement or Contract for sale of property. See

Conveyance on Sale.

Agreement or Contract made or entered into

pursuant to the Highway Acts for or relating to

making, maintaining, or repairing of highways, 6d.

Agreement, or any Memorandum of an Agree-

ment, made in England or Ireland under hand

only, or made in Scotland without any clause of

registration, not specifically charged with duty,

whether the same be only evidence of a contract

or obligatory upon the parties from its being a

written instrument, - _ - - 6d.

ExemjHions. — Where the matter is not of the

%'alue of £5 ; agreement — for the hire of any labourer,

artificer, manufactm-er, or menial servant ; relating

to the sale of any goods, wares, or merchandise ; be-

tween the master and mariners of any ship or vessel

for wages on any voyage coastwise from port to port

in the United Kingdom.

Agreement as to Mortgage of Stock, &c. —

Instrmnent under hand only (not being a promis-

sory note or bill of exchange) given upon the

occasion of deposit of any share wan-ant or stock

certificate to bearer, or foreign or colonial share

certificate, or any security for money transferable

by delivery, by way of security for any loan, shall

be deemed to be an agreement, and shall be charged

with duty of 6d. accordingly.

Instrument under hand only (not being a promis-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1897-1898 > (1506) |

|---|

| Permanent URL | https://digital.nls.uk/85341429 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|