Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

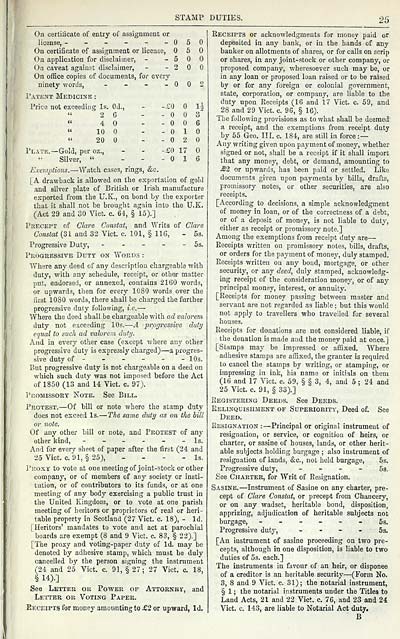

STAMP DUTIES.

25

On certificate of entry of assignment or

license, - - - - - -050

On certificate of assignment or license, 5

On application for disclaimer, - -500

On caveat against disclaimer, - - 2

On office copies of documents, for every

ninety words, - - - - 2

Patent Medicine :

Price not exceeding Is. 0d., - -£0 1^

" 2 6 - - 3~

" 40 - -006

" 10 - - 1

" 20 - - 2

PLATE.-Gold, per oz., - - -£0 17

Silver, " - - - 1 6

Exemptions. — Watch cases, rings, &c.

[A drawback is allowed on the exportation of gold

and silver plate of British or Irish manufacture

exported from the U.K., on bond by the exporter

that it shall not be brought again into the U.K.

(Act 29 and 30 Vict. c. 64, § 15).]

Precept of Clare Constat, and Writs of Clare

Constat (31 and 32 Vict. c. 101, § 116, - 5s.

Progressive Duty, - - - - 5s.

Progressive Duty on Words :

Where any deed of any description chargeable with

duty, with any schedule, receipt, or other matter

put, endorsed, or annexed, contains 2160 words,

or upwards, then for every 1080 words over the

first 1080 words, there shall be charged the further

progressive duty following, i.e. —

Where the deed shall be chargeable with ad valorem

duty not exceeding 10s. — A progressive duty

equal to such ad valorem duty.

And in every other case (except where any other

progressive duty is expressly charged) — a progres-

sive duty of ----- - 10s.

But progressive duty is not chargeable on a deed on

which such duty was not imposed before the Act

of 1850 (13 and 14 Vict. c. 97).

Promissory Note. See Bill.

Protest. — Of bill or note where the stamp duty

does not exceed Is. — The same duty as on the bill

or note.

Of any other bill or note, and Protest of any

other kind, - - - - - - Is.

And for every sheet of paper after the first (24 and

25 Vict. c. 91, § 25), - - - - Is.

Proxy to vote at one meeting of joint-stock or other

company, or of members of any society or insti-

tution, or of contributors to its funds, or at one

meeting of any body exercising a public trust in

the United Kingdom, or to vote at one parish

meeting of heritors or proprietors of real or heri-

table property in Scotland (27 Vict. c. 18), - Id.

[Heritors' mandates to vote and act at parochial

boards are exempt (8 and 9 Vict. c. 83, § 22).]

[The prosy and voting-paper duty of Id. may be

denoted by adhesive stamp, which must be duly

cancelled by the person signing the instrument

(2.4 and 25 Vict. c. 91, § 27; 27 Vict. c. 18,

§ 14).]

See Letter or Power of Attorney, and

Letter or Voting Paper.

Receipts for money amounting to £2 or upward, Id.

Receipts or acknowledgments for money paid or

deposited in any bank, or in the hands of any

banker on allotments of shares, or for calls on serip

or shares, in any joint-stock or other company, or

proposed company, wheresoever such may be, or

in any loan or proposed loan raised or to be raised

by or for any foreign or colonial government,

state, corporation, or company, are liable to the

duty upon Receipts (16 and 17 Vict. c. 59, and

28 and 29 Vict. c. 96, § 16).

The following provisions as to what shall be deemed'

a receipt, and the exemptions from receipt duty

by 55 Geo. III. c. 184, are still in force : —

Any writing given upon payment of money, whether

signed or not, shall be a receipt if it shall import

that any money, debt, or demand, amounting to

£2 or upwards, has been paid or settled. Like

documents given upon payments by bills, drafts,

promissory notes, or other securities, are also

receipts.

[According to decisions, a simple acknowledgment

of money in loan, or of the correctness of a debt,

or of a deposit of money, is not liable to duty,

either as receipt or promissory note.]

Among the exemptions from receipt duty are —

Receipts written on promissory notes, bills, drafts,

or orders for the payment of money, duly stamped.

Receipts written on any bond, mortgage, or other

security, or any deed, duly stamped, acknowledg-

ing receipt of the consideration money, or of any

principal money, interest, or annuity.

[Receipts for money passing between master and

servant are not regarded as liable; but this would

not apply to travellers who travelled for several

houses.

Receipts for donations are not considered liable, if

the donation is made and the money paid at once.]

[Stamps may be impressed or affixed. Where

adhesive stamps are affixed, the granter is required

to cancel the stamps by writing, or stamping, or

impressing in ink, his name or initials on them

(16 and 17 Vict. c. 59, § § 3, 4, and 5 ; 24 and

25 Vict, c 91, § 33).]

Registering Deeds. See Deeds.

Relinquishment of Superiority, Deed of. See

Deed.

Resignation : — Principal or original instrument of

resignation, or service, or cognition of heirs, or

charter, or sasine of houses, lands, or other herit-

able subjects holding burgage ; also instrument of

resignation of lands, &c, not held burgage, 5s.

Progressive duty, - - - - 5s.

See Charter, for Writ of Resignation.

Sasine. — Instrument of Sasine on any charter, pre-

cept of Clare Constat, or precept from Chancery,

or on any wadset, heritable bond, disposition,

apprizing, adjudication of heritable subjects not

burgage, ------ 5s.

Progressive duty, 5s.

[An instrument of sasine proceeding on two pre-

cepts, although in one disposition, is liable to two

duties of 5s. each.]

The instruments in favour of an heir, or disponee

of a creditor is an heritable security — (Form No.

3, 8 and 9 Vict. c. 31); the notarial instrument,

§ 1 ; the notarial instruments under the Titles to

Land Acts, 21 and 22 Vict. c. 76, and 23 and 24

Vict. c. 143, are liable to Notarial Act duty.

B

25

On certificate of entry of assignment or

license, - - - - - -050

On certificate of assignment or license, 5

On application for disclaimer, - -500

On caveat against disclaimer, - - 2

On office copies of documents, for every

ninety words, - - - - 2

Patent Medicine :

Price not exceeding Is. 0d., - -£0 1^

" 2 6 - - 3~

" 40 - -006

" 10 - - 1

" 20 - - 2

PLATE.-Gold, per oz., - - -£0 17

Silver, " - - - 1 6

Exemptions. — Watch cases, rings, &c.

[A drawback is allowed on the exportation of gold

and silver plate of British or Irish manufacture

exported from the U.K., on bond by the exporter

that it shall not be brought again into the U.K.

(Act 29 and 30 Vict. c. 64, § 15).]

Precept of Clare Constat, and Writs of Clare

Constat (31 and 32 Vict. c. 101, § 116, - 5s.

Progressive Duty, - - - - 5s.

Progressive Duty on Words :

Where any deed of any description chargeable with

duty, with any schedule, receipt, or other matter

put, endorsed, or annexed, contains 2160 words,

or upwards, then for every 1080 words over the

first 1080 words, there shall be charged the further

progressive duty following, i.e. —

Where the deed shall be chargeable with ad valorem

duty not exceeding 10s. — A progressive duty

equal to such ad valorem duty.

And in every other case (except where any other

progressive duty is expressly charged) — a progres-

sive duty of ----- - 10s.

But progressive duty is not chargeable on a deed on

which such duty was not imposed before the Act

of 1850 (13 and 14 Vict. c. 97).

Promissory Note. See Bill.

Protest. — Of bill or note where the stamp duty

does not exceed Is. — The same duty as on the bill

or note.

Of any other bill or note, and Protest of any

other kind, - - - - - - Is.

And for every sheet of paper after the first (24 and

25 Vict. c. 91, § 25), - - - - Is.

Proxy to vote at one meeting of joint-stock or other

company, or of members of any society or insti-

tution, or of contributors to its funds, or at one

meeting of any body exercising a public trust in

the United Kingdom, or to vote at one parish

meeting of heritors or proprietors of real or heri-

table property in Scotland (27 Vict. c. 18), - Id.

[Heritors' mandates to vote and act at parochial

boards are exempt (8 and 9 Vict. c. 83, § 22).]

[The prosy and voting-paper duty of Id. may be

denoted by adhesive stamp, which must be duly

cancelled by the person signing the instrument

(2.4 and 25 Vict. c. 91, § 27; 27 Vict. c. 18,

§ 14).]

See Letter or Power of Attorney, and

Letter or Voting Paper.

Receipts for money amounting to £2 or upward, Id.

Receipts or acknowledgments for money paid or

deposited in any bank, or in the hands of any

banker on allotments of shares, or for calls on serip

or shares, in any joint-stock or other company, or

proposed company, wheresoever such may be, or

in any loan or proposed loan raised or to be raised

by or for any foreign or colonial government,

state, corporation, or company, are liable to the

duty upon Receipts (16 and 17 Vict. c. 59, and

28 and 29 Vict. c. 96, § 16).

The following provisions as to what shall be deemed'

a receipt, and the exemptions from receipt duty

by 55 Geo. III. c. 184, are still in force : —

Any writing given upon payment of money, whether

signed or not, shall be a receipt if it shall import

that any money, debt, or demand, amounting to

£2 or upwards, has been paid or settled. Like

documents given upon payments by bills, drafts,

promissory notes, or other securities, are also

receipts.

[According to decisions, a simple acknowledgment

of money in loan, or of the correctness of a debt,

or of a deposit of money, is not liable to duty,

either as receipt or promissory note.]

Among the exemptions from receipt duty are —

Receipts written on promissory notes, bills, drafts,

or orders for the payment of money, duly stamped.

Receipts written on any bond, mortgage, or other

security, or any deed, duly stamped, acknowledg-

ing receipt of the consideration money, or of any

principal money, interest, or annuity.

[Receipts for money passing between master and

servant are not regarded as liable; but this would

not apply to travellers who travelled for several

houses.

Receipts for donations are not considered liable, if

the donation is made and the money paid at once.]

[Stamps may be impressed or affixed. Where

adhesive stamps are affixed, the granter is required

to cancel the stamps by writing, or stamping, or

impressing in ink, his name or initials on them

(16 and 17 Vict. c. 59, § § 3, 4, and 5 ; 24 and

25 Vict, c 91, § 33).]

Registering Deeds. See Deeds.

Relinquishment of Superiority, Deed of. See

Deed.

Resignation : — Principal or original instrument of

resignation, or service, or cognition of heirs, or

charter, or sasine of houses, lands, or other herit-

able subjects holding burgage ; also instrument of

resignation of lands, &c, not held burgage, 5s.

Progressive duty, - - - - 5s.

See Charter, for Writ of Resignation.

Sasine. — Instrument of Sasine on any charter, pre-

cept of Clare Constat, or precept from Chancery,

or on any wadset, heritable bond, disposition,

apprizing, adjudication of heritable subjects not

burgage, ------ 5s.

Progressive duty, 5s.

[An instrument of sasine proceeding on two pre-

cepts, although in one disposition, is liable to two

duties of 5s. each.]

The instruments in favour of an heir, or disponee

of a creditor is an heritable security — (Form No.

3, 8 and 9 Vict. c. 31); the notarial instrument,

§ 1 ; the notarial instruments under the Titles to

Land Acts, 21 and 22 Vict. c. 76, and 23 and 24

Vict. c. 143, are liable to Notarial Act duty.

B

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1870-1871 > (53) |

|---|

| Permanent URL | https://digital.nls.uk/84393462 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|