Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

22

STAMP DUTIES.

Policy of Insurance, whereby any sum of money

shall be assured to be paid as and for loss or dam-

age or compensation for or indemnity against loss

or damage arising from or consequent upon the

happening of any accident (23 and 24 Vict.

c. Ill): —

If the premium or consideration of such assurance

shall not exceed 2s. 6d., - - - Id.

Exceeding 2s. 6d. and not exceeding 5s., 3d.

Exceeding 5s., then for every 5s. and every

fractional part of 5s., - 3d.

If the insurance shall be made on such terms that

these rates cannot be applied, then there shall be

charged upon the policy, in respect of the amount

of the sum insured, the same rate of stamp duty

as on a policy of life insurance (28 and 29 Vict,

c. 96, § 10).

[Accidental Death policy not to be chargeable

as a life policy. The above not to repeal or

alter the duties payable under 12 and 13 Vict,

by the Railway Passengers Assurance Company

(28 and 29 Vict. c. 96, § 11). For preventing

frauds, 16 and 17 Vict. c. 59, § 6, to apply to

these duties, and also to all other duties on policies

of insurance, excepting Sea Insurance, imposed by

28 and 29 Vict. c. 96. And further, if any person

shall make, sign, or deliver out a policy not duly

stamped, he shall forfeit £20. The managing

directors, secretary, or other principal officer of an

insurance company, as well as the company, shall

be liable to the penalty. — lb. 13.]

[" Policy " shall mean and include any agreement

or other instrument, by whatever name the same

shall be called, whereby any insurance shall be

made or agreed to be made. — lb. § 14.]

5. FOREIGN INSURANCES.

Foreign Policiks for a person carrying on the

business of insurance within the United Kingdom,

or by which any loss or damage or sum of money

shall be payable or recoverable in the United

Kingdom upon the happening of any contingency,

are liable to the same stamp duties as policies

made in the United Kingdom. May be stamped

within two months after being received in the

United Kingdom, but cannot be stamped after-

wards (28 and 29 Vict. c. 96, § 15).

Joint-Stock Companies. See Deed.

Leases. See Agreement.

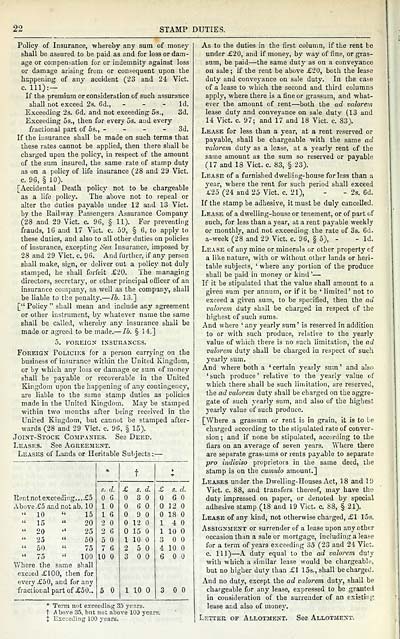

Leases of Lands or Heritable Subjects :—

*

f

i

s.

d.

£

s.

d.

£

s. d.

Pent not exceeding. . .£5

6

3

6

A bove £5 and not ab. 10

1

6

12

" 10 " 15

1

6

9

18

" 15 " 20

2

12

1

4

" 20 " 25

2

6

15

1

10

" 25 " 50

5

1

10

3

" 50 " 75

7

6

2

5

4

10

" 75 " 100

10

3

6

Where the same shall

escsed £100, then for

every £50, and for any

fractional part of £50..

5

1

10

3

* Term not exceeding 35 years.

■J Above 35, but not above 100 years

% Exceeding 100 years.

As to the duties in the first column, if the rent be

under £20, and if money, by way of fine, or gras-

sum, be paid — the same duty as on a conveyance

on sale; if the rent be above £20, both the lease

duty and conveyance on sale duty. In the case

of a lease to which the second and third columns

apply, where there is a fine or grassum, and what-

ever the amount of rent — both the ad valorem

lease duty and conveyance on sale dutv (13 and

14 Vict. c. 97; and 17 and 18 Vict. c. 83).

Lease for less than a year, at a rent reserved or

payable, shall be chargeable with the same ad

valorem duty as a lease, at a yearly rent of the

same amount as the sum so reserved or payable

(17 and 18 Vict. c. 83, § 23).

Lease of a furnished dwelling-house for less than a

year, where the rent for such period shall exceed

£25 (24 and 25 Vict. c. 21), - - 2s. 6d.

If the stamp be adhesive, it must be duly cancelled.

Lease of a dwelling-house or tenement, or of part of

such, for less than a year, at a rent payable weekly

or monthly, and not exceeding the rate of 3s. 6d.

a- week (28 and 29 Vict. c. 96, § 5), - - Id.

Lease of any mine or minerals or other property of

a like nature, with or without other lands or heri-

table subjects, ' where any portion of the produce

shall be paid in money or kind ' —

If it be stipulated that the value shall amount to a

given sum per annum, or if it be ' limited' not to

exceed a given sum, to be specified, then the ad

valorem duty shall be charged in respect of the

highest of such sums.

And where ' any yearly sum' is reserved in addition

to or with such produce, relative to the yearly

value of which there is no such limitation, the ad

valorem duty shall be charged in respect of such

yearly sum.

And where both a ' certain yearly sum ' and also

' such produce ' relative to the yearly value of

which there shall be such limitation, are reserved,

the ad valorem duty shall be charged on the aggre-

gate of such yearly sum, and also of the highest

yearly value of such produce.

[Where a grassum or rent is in grain, it is to be

charged according to the stipulated rate of conver-

sion ; and if none be stipulated, according to the

fiars on an average of seven years. Where there

are separate grassums or rents payable to separate

pro indiviso proprietors in the same deed, the

stamp is on the cumulo amount.]

Leases under the Dwelling- Houses Act, 18 and 19

Vict. c. 88, and transfers thereof, may have the

duty impressed on paper, or denoted by special

adhesive stamp (18 and 19 Vict. c. 88, § 21).

Lease of any kind, not otherwise charged, £1 15a,

Assignment or surrender of a lease upon any other

occasion than a sale or mortgage, including a lease

for a term of years exceeding 35 (23 and 24 Vict,

c. Ill) — A duty equal to the ad valorem duty

with which a similar lease would be chargeable,

but no higher duty than £1 15s., shall be charged.

And no duty, except the ad valorem duty, shall be

chargeable for any lease, expressed to be granted

in consideration of the surrender of an existing

lease and also of money.

Letter of Allotment. See Allotment.

STAMP DUTIES.

Policy of Insurance, whereby any sum of money

shall be assured to be paid as and for loss or dam-

age or compensation for or indemnity against loss

or damage arising from or consequent upon the

happening of any accident (23 and 24 Vict.

c. Ill): —

If the premium or consideration of such assurance

shall not exceed 2s. 6d., - - - Id.

Exceeding 2s. 6d. and not exceeding 5s., 3d.

Exceeding 5s., then for every 5s. and every

fractional part of 5s., - 3d.

If the insurance shall be made on such terms that

these rates cannot be applied, then there shall be

charged upon the policy, in respect of the amount

of the sum insured, the same rate of stamp duty

as on a policy of life insurance (28 and 29 Vict,

c. 96, § 10).

[Accidental Death policy not to be chargeable

as a life policy. The above not to repeal or

alter the duties payable under 12 and 13 Vict,

by the Railway Passengers Assurance Company

(28 and 29 Vict. c. 96, § 11). For preventing

frauds, 16 and 17 Vict. c. 59, § 6, to apply to

these duties, and also to all other duties on policies

of insurance, excepting Sea Insurance, imposed by

28 and 29 Vict. c. 96. And further, if any person

shall make, sign, or deliver out a policy not duly

stamped, he shall forfeit £20. The managing

directors, secretary, or other principal officer of an

insurance company, as well as the company, shall

be liable to the penalty. — lb. 13.]

[" Policy " shall mean and include any agreement

or other instrument, by whatever name the same

shall be called, whereby any insurance shall be

made or agreed to be made. — lb. § 14.]

5. FOREIGN INSURANCES.

Foreign Policiks for a person carrying on the

business of insurance within the United Kingdom,

or by which any loss or damage or sum of money

shall be payable or recoverable in the United

Kingdom upon the happening of any contingency,

are liable to the same stamp duties as policies

made in the United Kingdom. May be stamped

within two months after being received in the

United Kingdom, but cannot be stamped after-

wards (28 and 29 Vict. c. 96, § 15).

Joint-Stock Companies. See Deed.

Leases. See Agreement.

Leases of Lands or Heritable Subjects :—

*

f

i

s.

d.

£

s.

d.

£

s. d.

Pent not exceeding. . .£5

6

3

6

A bove £5 and not ab. 10

1

6

12

" 10 " 15

1

6

9

18

" 15 " 20

2

12

1

4

" 20 " 25

2

6

15

1

10

" 25 " 50

5

1

10

3

" 50 " 75

7

6

2

5

4

10

" 75 " 100

10

3

6

Where the same shall

escsed £100, then for

every £50, and for any

fractional part of £50..

5

1

10

3

* Term not exceeding 35 years.

■J Above 35, but not above 100 years

% Exceeding 100 years.

As to the duties in the first column, if the rent be

under £20, and if money, by way of fine, or gras-

sum, be paid — the same duty as on a conveyance

on sale; if the rent be above £20, both the lease

duty and conveyance on sale duty. In the case

of a lease to which the second and third columns

apply, where there is a fine or grassum, and what-

ever the amount of rent — both the ad valorem

lease duty and conveyance on sale dutv (13 and

14 Vict. c. 97; and 17 and 18 Vict. c. 83).

Lease for less than a year, at a rent reserved or

payable, shall be chargeable with the same ad

valorem duty as a lease, at a yearly rent of the

same amount as the sum so reserved or payable

(17 and 18 Vict. c. 83, § 23).

Lease of a furnished dwelling-house for less than a

year, where the rent for such period shall exceed

£25 (24 and 25 Vict. c. 21), - - 2s. 6d.

If the stamp be adhesive, it must be duly cancelled.

Lease of a dwelling-house or tenement, or of part of

such, for less than a year, at a rent payable weekly

or monthly, and not exceeding the rate of 3s. 6d.

a- week (28 and 29 Vict. c. 96, § 5), - - Id.

Lease of any mine or minerals or other property of

a like nature, with or without other lands or heri-

table subjects, ' where any portion of the produce

shall be paid in money or kind ' —

If it be stipulated that the value shall amount to a

given sum per annum, or if it be ' limited' not to

exceed a given sum, to be specified, then the ad

valorem duty shall be charged in respect of the

highest of such sums.

And where ' any yearly sum' is reserved in addition

to or with such produce, relative to the yearly

value of which there is no such limitation, the ad

valorem duty shall be charged in respect of such

yearly sum.

And where both a ' certain yearly sum ' and also

' such produce ' relative to the yearly value of

which there shall be such limitation, are reserved,

the ad valorem duty shall be charged on the aggre-

gate of such yearly sum, and also of the highest

yearly value of such produce.

[Where a grassum or rent is in grain, it is to be

charged according to the stipulated rate of conver-

sion ; and if none be stipulated, according to the

fiars on an average of seven years. Where there

are separate grassums or rents payable to separate

pro indiviso proprietors in the same deed, the

stamp is on the cumulo amount.]

Leases under the Dwelling- Houses Act, 18 and 19

Vict. c. 88, and transfers thereof, may have the

duty impressed on paper, or denoted by special

adhesive stamp (18 and 19 Vict. c. 88, § 21).

Lease of any kind, not otherwise charged, £1 15a,

Assignment or surrender of a lease upon any other

occasion than a sale or mortgage, including a lease

for a term of years exceeding 35 (23 and 24 Vict,

c. Ill) — A duty equal to the ad valorem duty

with which a similar lease would be chargeable,

but no higher duty than £1 15s., shall be charged.

And no duty, except the ad valorem duty, shall be

chargeable for any lease, expressed to be granted

in consideration of the surrender of an existing

lease and also of money.

Letter of Allotment. See Allotment.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1870-1871 > (50) |

|---|

| Permanent URL | https://digital.nls.uk/84393426 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|