Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

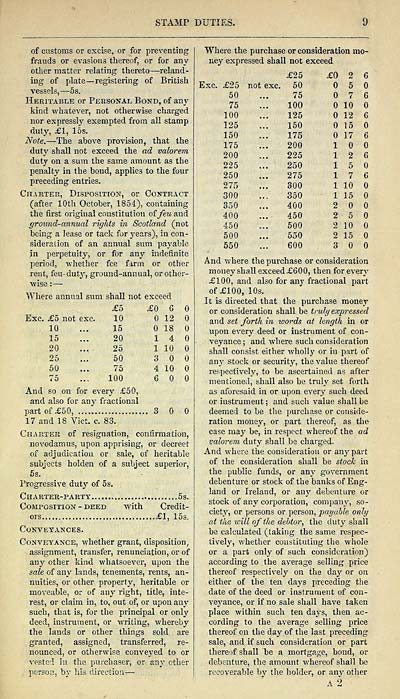

STAMP DUTIES.

of customs or excise, or for preventing

frauds or evasions thereof, or for any

other matter relating thereto — reland-

ing of plate — registering of British

vessels, — 5s.

Heritable or Personal Bond, of any

kind whatever, not otherwise charged

nor expressly exempted from all stamp

duty, £1, 15s.

Note. — The above provision, that the

duty shall not exceed the ad valorem

duty on a sum the same amount as the

penalty in the botid, applies to the four

preceding entries.

Charter, Disposition, or Contract

(after 10th October, 1851), containing

the first original constitution of feu and

ground-annual rights in Scotland (not

being a lease or tack for years), in con-

sideration of an annual sum payable

in perpetuity, or for any indefinite

period, whether fee farm or other

rent, feu- duty, ground-annual, or other-

wise :—

"Where annual sum shall not exceed

£5

10

15

20

25

50

75

100

£0 6

12

18

14

1 10

3

4 10

6

Exc. £5 not exc.

10

15

20

25

50

75

And so on for every £50,

and also for any fractional

part of £50, 3

17 and 18 Vict. c. 83.

Charter of resignation, confirmation,

novodamus, upon apprising, or decreet

of adjudication or sale, of heritable

subjects holden of a subject superior,

5s.

Progressive duty of 5s.

Charter-party 5s.

Composition - deed with Credit-

ors £1, 15s.

Conveyances.

Conveyance, whether grant, disposition,

assignment, transfer, renunciation, or of

any other kind whatsoever, upon the

sale of any lands, tenements, rents, an-

nuities, or other property, heritable or

moveable, or of any right, title, inte-

rest, or claim in, to, out of, or upon any

such, that is, for the principal or only

deed, instrument, or writing, whereby

the lands or other things sold are

granted, assigned, transferred, re-

nounced, or otherwise conveyed to or

vested in the purchaser, or any ether

person, by his direction —

Where the purchase or consideration mo-

ney expressed shall not exceed

£25

£0

2

6

Exc. £25 not

exc. 50

5

50

75

7

6

75

100

10

100

125

12

6

125

150

15

150

175

17

6

175

200

1

200

225

1

2

6

225

250

1

.5

250

275

1

7

6

275

300

1

10

300

350

1

15

350

400

2

400

450

2

- 5

450

500

2

10

500

550

2

15

550

600

3

And where the purchase or consideration

money shall exceed £600, then for every

£100, and also for any fractional part

of £100, 10s.

It is directed that the purchase money

or consideration shall be truly expressed

and set forth in words at length in or

upon every deed or instrument of con-

veyance ; and where such consideration

shall consist either wholly or in part of

any stock or security, the value thereof

respectively, to be ascertained as after-

mentioned, shall also be truly set forth

as aforesaid in or upon every such deed

or instrument ; and such value shall be

deemed to be the purchase or conside-

ration money, or part thereof, as the

case may be, in respect whereof the ad

valorem duty shall be charged.

And where the consideration or any part

of the consideration shall be stock in

the public funds, or any government

debenture or stock of the banks of Eng-

land or Ireland, or any debenture or

stock of any corporation, company, so-

ciety, or persons or person, payable, only

at the will of the debtor, the duty shall

be calculated (taking the same respec-

tively, whether constituting the whole

or a part only of such consideration)

according to the average selling price

thereof respectively on the day or on

either of the ten days preceding the

date of the deed or instrument of con-

veyance, or if no sale shall have taken

place within such ten days, then ac-

cording to the average selling price

thereof on the day of the last preceding

sale, and if such consideration or part

thereof shall he a mortgage, bond, or

debenture, the amount whereof shall be

recoverable bv the holder, or any other

A 2

of customs or excise, or for preventing

frauds or evasions thereof, or for any

other matter relating thereto — reland-

ing of plate — registering of British

vessels, — 5s.

Heritable or Personal Bond, of any

kind whatever, not otherwise charged

nor expressly exempted from all stamp

duty, £1, 15s.

Note. — The above provision, that the

duty shall not exceed the ad valorem

duty on a sum the same amount as the

penalty in the botid, applies to the four

preceding entries.

Charter, Disposition, or Contract

(after 10th October, 1851), containing

the first original constitution of feu and

ground-annual rights in Scotland (not

being a lease or tack for years), in con-

sideration of an annual sum payable

in perpetuity, or for any indefinite

period, whether fee farm or other

rent, feu- duty, ground-annual, or other-

wise :—

"Where annual sum shall not exceed

£5

10

15

20

25

50

75

100

£0 6

12

18

14

1 10

3

4 10

6

Exc. £5 not exc.

10

15

20

25

50

75

And so on for every £50,

and also for any fractional

part of £50, 3

17 and 18 Vict. c. 83.

Charter of resignation, confirmation,

novodamus, upon apprising, or decreet

of adjudication or sale, of heritable

subjects holden of a subject superior,

5s.

Progressive duty of 5s.

Charter-party 5s.

Composition - deed with Credit-

ors £1, 15s.

Conveyances.

Conveyance, whether grant, disposition,

assignment, transfer, renunciation, or of

any other kind whatsoever, upon the

sale of any lands, tenements, rents, an-

nuities, or other property, heritable or

moveable, or of any right, title, inte-

rest, or claim in, to, out of, or upon any

such, that is, for the principal or only

deed, instrument, or writing, whereby

the lands or other things sold are

granted, assigned, transferred, re-

nounced, or otherwise conveyed to or

vested in the purchaser, or any ether

person, by his direction —

Where the purchase or consideration mo-

ney expressed shall not exceed

£25

£0

2

6

Exc. £25 not

exc. 50

5

50

75

7

6

75

100

10

100

125

12

6

125

150

15

150

175

17

6

175

200

1

200

225

1

2

6

225

250

1

.5

250

275

1

7

6

275

300

1

10

300

350

1

15

350

400

2

400

450

2

- 5

450

500

2

10

500

550

2

15

550

600

3

And where the purchase or consideration

money shall exceed £600, then for every

£100, and also for any fractional part

of £100, 10s.

It is directed that the purchase money

or consideration shall be truly expressed

and set forth in words at length in or

upon every deed or instrument of con-

veyance ; and where such consideration

shall consist either wholly or in part of

any stock or security, the value thereof

respectively, to be ascertained as after-

mentioned, shall also be truly set forth

as aforesaid in or upon every such deed

or instrument ; and such value shall be

deemed to be the purchase or conside-

ration money, or part thereof, as the

case may be, in respect whereof the ad

valorem duty shall be charged.

And where the consideration or any part

of the consideration shall be stock in

the public funds, or any government

debenture or stock of the banks of Eng-

land or Ireland, or any debenture or

stock of any corporation, company, so-

ciety, or persons or person, payable, only

at the will of the debtor, the duty shall

be calculated (taking the same respec-

tively, whether constituting the whole

or a part only of such consideration)

according to the average selling price

thereof respectively on the day or on

either of the ten days preceding the

date of the deed or instrument of con-

veyance, or if no sale shall have taken

place within such ten days, then ac-

cording to the average selling price

thereof on the day of the last preceding

sale, and if such consideration or part

thereof shall he a mortgage, bond, or

debenture, the amount whereof shall be

recoverable bv the holder, or any other

A 2

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1855-1856 > (25) |

|---|

| Permanent URL | https://digital.nls.uk/84130759 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|