Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

130

ADVERTISEMENTS.

MUTUAL ASSURANCE BY MODERATE PREMIUMS.

SCOTTISH PROVIDENT INSTITUTION,

FOR LIFE ASSURANCE AND ANNUITIES.

Incorporated by Act of Parliament.

TRUSTEES.

The Right Hon. William Johnston, of Kirkhill.

Charles Cowan, Esq., M.P.

John Masterjian, Junior, Esq.,

Banker, London.

William Campbell, Esq. of Tilli-

chewan.

James Peddie, Esq., W.S.

GLASGOW BOARD OF DIRECTORS.

Wm. Jas. Davidson, Esq., Merchant.

John Innes Wright, Esq., Merchant.

Anderson Kirkwood, Esq., Writer.

William West Watson, Esq., Merchant.

Jas. A. Campbell, Esq., yr. of Stracathro.

George Readman, Esq., Banker.

Medical Officer — Dr. John J. Fleming, 12 Abercromby Place.

npHE SCOTTISH PKOVIDENT INSTITUTION is the only Office which com-

.1. bines the advantage of participation in the Whole Profits, with moderate Pre-

miums. It is a Mutual Assurance Society, in which the Whole Profits belong to the

Policy-holders ; and it is free from the objection of excessive premiums, which is

urged by the Proprietary Companies against other Mutual Societies.

The Premiums are as low as those of the non-participating scale of the Proprietary

Companies. The} - admit of being so not only with safety, but with ample reversion

of Profits to the Policy-holders — being free from the burden of payment of dividends

to Shareholders.

The principle on which the profits are divided is at once safe, equitable, and favour-

able to good lives — the Surplus being reserved for those members who alone can have

made surplus payments ; in other words, for those whose Premiums, with Accumu-

lated Interest, amount to the sums in their Policies.

This principle, while it on the one hand avoids the anomaly of giving additions to

those Policies which become claims in their earlier years, secures on the other hand

that there is no Member who has not been, in a pecuniary sense, a gainer by the

transaction, who does not receive a share of the Profits.

On this principle bonuses as high as 54 per cent, were added to some of the older

policies on the first division of profits declared at last annual meeting, detailed re-

ports of which may be had on application.

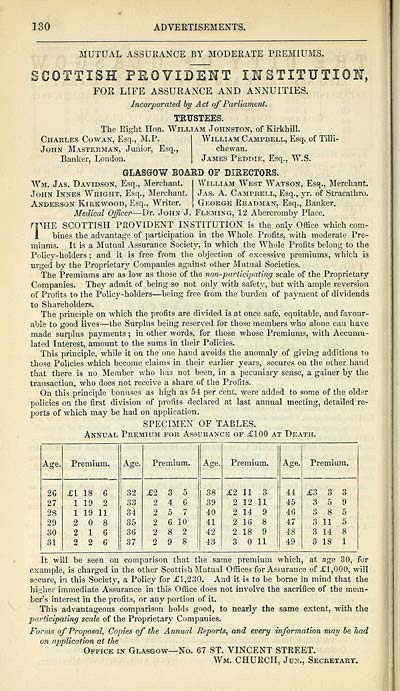

SPECIMEN OF TABLES.

Annual Premium for Assurance of £100 at Death.

Age.

Premium.

Age.

Premium.

Age.

Premium.

Age.

Premium.

20

£1 18 6

32

£2 3 5

38

£2 11 3

44

£3 3 3

27

1 19 2

33

2 4 6

39

2 12 11

45

3 5 9

2S

1 19 11

34

2 5 7

40

2 14 9

46

3 8 5

29

2 8

35

2 6 10

41

2 16 8

47

3 11 5

30

2 16

36

2 8 2

42

2 18 9

48

3 14 8

31

2 2 6

37

2 9 8

43

3 11

49

3 18 1

It -will be seen on comparison that the same premium which, at age 30, for

example, is charged in the other Scottish Mutual Offices for Assurance of £1,000, will

secure, in this Society, a Policy for £1,230. And it is to be borne in mind that the

higher immediate Assurance in this Office does not involve the sacrifice of the mem-

ber's interest in the profits, or any portion of it.

This advantageous comparison holds good, to nearly the same extent, with the

participating scale of the Proprietary Companies.

Forms of Proposal, Copies of the Annual Reports, and every information may be had

on application at the

Office in Glasgow— No. 67 ST. VINCENT STREET.

Wm. CHURCH, Jun., Secretary.

ADVERTISEMENTS.

MUTUAL ASSURANCE BY MODERATE PREMIUMS.

SCOTTISH PROVIDENT INSTITUTION,

FOR LIFE ASSURANCE AND ANNUITIES.

Incorporated by Act of Parliament.

TRUSTEES.

The Right Hon. William Johnston, of Kirkhill.

Charles Cowan, Esq., M.P.

John Masterjian, Junior, Esq.,

Banker, London.

William Campbell, Esq. of Tilli-

chewan.

James Peddie, Esq., W.S.

GLASGOW BOARD OF DIRECTORS.

Wm. Jas. Davidson, Esq., Merchant.

John Innes Wright, Esq., Merchant.

Anderson Kirkwood, Esq., Writer.

William West Watson, Esq., Merchant.

Jas. A. Campbell, Esq., yr. of Stracathro.

George Readman, Esq., Banker.

Medical Officer — Dr. John J. Fleming, 12 Abercromby Place.

npHE SCOTTISH PKOVIDENT INSTITUTION is the only Office which com-

.1. bines the advantage of participation in the Whole Profits, with moderate Pre-

miums. It is a Mutual Assurance Society, in which the Whole Profits belong to the

Policy-holders ; and it is free from the objection of excessive premiums, which is

urged by the Proprietary Companies against other Mutual Societies.

The Premiums are as low as those of the non-participating scale of the Proprietary

Companies. The} - admit of being so not only with safety, but with ample reversion

of Profits to the Policy-holders — being free from the burden of payment of dividends

to Shareholders.

The principle on which the profits are divided is at once safe, equitable, and favour-

able to good lives — the Surplus being reserved for those members who alone can have

made surplus payments ; in other words, for those whose Premiums, with Accumu-

lated Interest, amount to the sums in their Policies.

This principle, while it on the one hand avoids the anomaly of giving additions to

those Policies which become claims in their earlier years, secures on the other hand

that there is no Member who has not been, in a pecuniary sense, a gainer by the

transaction, who does not receive a share of the Profits.

On this principle bonuses as high as 54 per cent, were added to some of the older

policies on the first division of profits declared at last annual meeting, detailed re-

ports of which may be had on application.

SPECIMEN OF TABLES.

Annual Premium for Assurance of £100 at Death.

Age.

Premium.

Age.

Premium.

Age.

Premium.

Age.

Premium.

20

£1 18 6

32

£2 3 5

38

£2 11 3

44

£3 3 3

27

1 19 2

33

2 4 6

39

2 12 11

45

3 5 9

2S

1 19 11

34

2 5 7

40

2 14 9

46

3 8 5

29

2 8

35

2 6 10

41

2 16 8

47

3 11 5

30

2 16

36

2 8 2

42

2 18 9

48

3 14 8

31

2 2 6

37

2 9 8

43

3 11

49

3 18 1

It -will be seen on comparison that the same premium which, at age 30, for

example, is charged in the other Scottish Mutual Offices for Assurance of £1,000, will

secure, in this Society, a Policy for £1,230. And it is to be borne in mind that the

higher immediate Assurance in this Office does not involve the sacrifice of the mem-

ber's interest in the profits, or any portion of it.

This advantageous comparison holds good, to nearly the same extent, with the

participating scale of the Proprietary Companies.

Forms of Proposal, Copies of the Annual Reports, and every information may be had

on application at the

Office in Glasgow— No. 67 ST. VINCENT STREET.

Wm. CHURCH, Jun., Secretary.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1853-1854 > (802) |

|---|

| Permanent URL | https://digital.nls.uk/84118011 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|