Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

PROPERTY AND INCOME TAX.

PROPERTY AND INCOME TAX.

[Acts 5 & 6 Vict. c. 35 ; 14 and 15 Vict. c. 12 ; 16 & 17 Vict. c. 34 ; 17 and 18 Vict. c. 10 and c. 24 ;

18 and 19 Vict. c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c. 14 ; 24

Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict. c. 33 ; 27 Vict. c. 18 ; 28 Vict. c. 30 ; 29

Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict. c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14; 33 and 34 Vict.

c. 32; 34 and 35 Vict. c. 21; 35 and 36 Vict. c. 20; 36 Vict. c. 18; 37 Vict. c. 16; 38 Vict. c. 23;

39 Vict. c. 16; 40 Vict. c. 13; 41 Vict. c. 15; 42 and 43 Vict. c. 21 ; 43 Vict. c. 14; 43 and 44 Vict,

c. 20 ; 44 Vict. c. 12 ; 45 and 46 Vict. c. 41 ; 46 Vict. c. 10 ; 47 and 48 Vict. c. 25 ; 48 and 49 Vict.

c. 51; 49 Vict. c. 18; 50 and 51 Vict. c. 15'; 51 Vict. c. 8 ; 52 Vict. c. 7 ; 53 Vict. c. 8; and 54 and 55

Vict. c. 25.]

Schedule A— (Real Property.") On each 20s. of

annual value of lands, tenements, and heri-

tages, in respect of the property, 6d.

Schedule B. — (Occupancy of Real Property.") On

each 20s. of annual value of lands, tenements,

and heritages (other than a dwelling-house

separate from a farm), in Scotland, in respect

of the occupancy, 2^d.

Schedule C. — (Public Funds.) On each 20s. of

annual amount of profits from interest, an-

nuities, dividends, and shares of annuities,

payable out of the public revenue, 6d. .

Schedule D. — (Trades and Professions.) On each

20s. of annual amount of gains, profits, or re-

turns, from trades, professions, employments,

or vocations, or from personal or other property

not included in schedules A, B, 0, or E, 6d.

Schedule E. — (Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or an-

nuities paid out of the public revenue, or for

public offices or employments, 6d.

Exemption and Abatement. — Under the Act 39

Vict. c. 16. § 8, persons whose whole incomes

from every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duty

upon £120 of their income.

Deductions. — Deduction is allowed, when

claimed, of any annual premium (not exceeding

one-sixth part of the claimant's income from

every source) paid for insurance, or deferred

annuity, on the claimant's own or his wife's

life, to any insurance company in existence on

1st November 1844, or registered pursuant to

Act 7 and 8 Vict. c. 110 ; or of any annual pay-

ment made under Act of Parliament to a

widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and

tear of machinery or plant used in any trade,

manufacture, adventure, etc., the profits or

gains of which are chargeable under the rules

of schedule D.

By the Act 19 and 20 Vict. c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repayment) from any amount of

income tax which may be assessed upon them

in respect of the annual value of such rates,

taxes, assessments, and public burdens, as may

be charged upon them and not charged upon

landlords in England.

Occupiers of lands for the purposes of husbandry

only are entitled, on proof to the satisfaction

of the commissioners, to an abatement of duty

proportionate to the deficiency of their profits

or gains. (13 and 14 Vict. c. 12; 16 and

17 Vict. c. 34, § 46 ; 43 and 44 Vict. c. 20,

§52.)

Person sustaining loss in any trade or pro-

fession carried on by him, either solely or in

partnership, or in farming of lands, may, on '

application to the commissioners through the

district surveyor of taxes within six months

after the year of assessment, obtain repayment

of so much of the Income Tax on his aggregate

income as represents the tax on income equal

to his loss. (53 Vict. c. 8, § 23.)

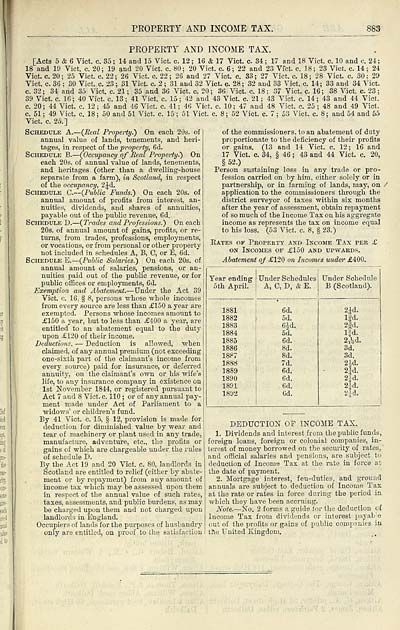

Bates of Property and Income Tax per £

on Incomes of £150 and upwards.

Abatement of £120 on Incomes under £400.

Year ending

Under Schedules

Under Schedule

5th April.

A, C, D, & E.

B (Scotland).

1881

6d.

2£d.

1882

5d.

lfd.

1883

6,Jd;

2|d.

1884

5d.

lfd.

1885

6d.

2 T Vd.

1886

8d.

3d.

1887

8d.

3d.

1888

7d.

2id.

1889

6d.

24d.

1890

6d.

2Jd.

1891

6d.

2Jd.

1892

Gd.

2Jd.

DEDUCTION OF INCOME TAX.

1. Dividends and interest from the public funds,

foreign loans, foreign or colonial companies, in-

terest of money borrowed ou the security of rates,

and official salaries and pensions, are subject to

deduction of Income Tax at the rate in force at

the date of payment.

2. Mortgage interest, feu-duties, and ground

annuals are subject to deduction of Income Tax

at the rate or rates in force during the period in

which they have been accruing.

Note. — No. 2 forms a guide for the deduction of

Income Tax from dividends or interest payable

out of the profits or gains of public companies in

the United Kingdom.

PROPERTY AND INCOME TAX.

[Acts 5 & 6 Vict. c. 35 ; 14 and 15 Vict. c. 12 ; 16 & 17 Vict. c. 34 ; 17 and 18 Vict. c. 10 and c. 24 ;

18 and 19 Vict. c. 20 ; 19 and 20 Vict. c. 80 ; 20 Vict. c. 6 ; 22 and 23 Vict. c. 18 ; 23 Vict. c. 14 ; 24

Vict. c. 20 ; 25 Vict. c. 22 ; 26 Vict. c. 22 ; 26 and 27 Vict. c. 33 ; 27 Vict. c. 18 ; 28 Vict. c. 30 ; 29

Vict. c. 36 ; 30 Vict. c. 23 ; 31 Vict. c. 2 ; 31 and 32 Vict. c. 28 ; 32 and 33 Vict. c. 14; 33 and 34 Vict.

c. 32; 34 and 35 Vict. c. 21; 35 and 36 Vict. c. 20; 36 Vict. c. 18; 37 Vict. c. 16; 38 Vict. c. 23;

39 Vict. c. 16; 40 Vict. c. 13; 41 Vict. c. 15; 42 and 43 Vict. c. 21 ; 43 Vict. c. 14; 43 and 44 Vict,

c. 20 ; 44 Vict. c. 12 ; 45 and 46 Vict. c. 41 ; 46 Vict. c. 10 ; 47 and 48 Vict. c. 25 ; 48 and 49 Vict.

c. 51; 49 Vict. c. 18; 50 and 51 Vict. c. 15'; 51 Vict. c. 8 ; 52 Vict. c. 7 ; 53 Vict. c. 8; and 54 and 55

Vict. c. 25.]

Schedule A— (Real Property.") On each 20s. of

annual value of lands, tenements, and heri-

tages, in respect of the property, 6d.

Schedule B. — (Occupancy of Real Property.") On

each 20s. of annual value of lands, tenements,

and heritages (other than a dwelling-house

separate from a farm), in Scotland, in respect

of the occupancy, 2^d.

Schedule C. — (Public Funds.) On each 20s. of

annual amount of profits from interest, an-

nuities, dividends, and shares of annuities,

payable out of the public revenue, 6d. .

Schedule D. — (Trades and Professions.) On each

20s. of annual amount of gains, profits, or re-

turns, from trades, professions, employments,

or vocations, or from personal or other property

not included in schedules A, B, 0, or E, 6d.

Schedule E. — (Public Salaries.) On each 20s. of

annual amount of salaries, pensions, or an-

nuities paid out of the public revenue, or for

public offices or employments, 6d.

Exemption and Abatement. — Under the Act 39

Vict. c. 16. § 8, persons whose whole incomes

from every source are less than £150 a year are

exempted. Persons whose incomes amount to

£150 a year, but to less than £400 a year, are

entitled to an abatement equal to the duty

upon £120 of their income.

Deductions. — Deduction is allowed, when

claimed, of any annual premium (not exceeding

one-sixth part of the claimant's income from

every source) paid for insurance, or deferred

annuity, on the claimant's own or his wife's

life, to any insurance company in existence on

1st November 1844, or registered pursuant to

Act 7 and 8 Vict. c. 110 ; or of any annual pay-

ment made under Act of Parliament to a

widows' or children's fund.

By 41 Vict. c. 15, § 12, provision is made for

deduction for diminished value by wear and

tear of machinery or plant used in any trade,

manufacture, adventure, etc., the profits or

gains of which are chargeable under the rules

of schedule D.

By the Act 19 and 20 Vict. c. 80, landlords in

Scotland are entitled to relief (either by abate-

ment or by repayment) from any amount of

income tax which may be assessed upon them

in respect of the annual value of such rates,

taxes, assessments, and public burdens, as may

be charged upon them and not charged upon

landlords in England.

Occupiers of lands for the purposes of husbandry

only are entitled, on proof to the satisfaction

of the commissioners, to an abatement of duty

proportionate to the deficiency of their profits

or gains. (13 and 14 Vict. c. 12; 16 and

17 Vict. c. 34, § 46 ; 43 and 44 Vict. c. 20,

§52.)

Person sustaining loss in any trade or pro-

fession carried on by him, either solely or in

partnership, or in farming of lands, may, on '

application to the commissioners through the

district surveyor of taxes within six months

after the year of assessment, obtain repayment

of so much of the Income Tax on his aggregate

income as represents the tax on income equal

to his loss. (53 Vict. c. 8, § 23.)

Bates of Property and Income Tax per £

on Incomes of £150 and upwards.

Abatement of £120 on Incomes under £400.

Year ending

Under Schedules

Under Schedule

5th April.

A, C, D, & E.

B (Scotland).

1881

6d.

2£d.

1882

5d.

lfd.

1883

6,Jd;

2|d.

1884

5d.

lfd.

1885

6d.

2 T Vd.

1886

8d.

3d.

1887

8d.

3d.

1888

7d.

2id.

1889

6d.

24d.

1890

6d.

2Jd.

1891

6d.

2Jd.

1892

Gd.

2Jd.

DEDUCTION OF INCOME TAX.

1. Dividends and interest from the public funds,

foreign loans, foreign or colonial companies, in-

terest of money borrowed ou the security of rates,

and official salaries and pensions, are subject to

deduction of Income Tax at the rate in force at

the date of payment.

2. Mortgage interest, feu-duties, and ground

annuals are subject to deduction of Income Tax

at the rate or rates in force during the period in

which they have been accruing.

Note. — No. 2 forms a guide for the deduction of

Income Tax from dividends or interest payable

out of the profits or gains of public companies in

the United Kingdom.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (941) |

|---|

| Permanent URL | https://digital.nls.uk/83665866 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|