Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

882

INHABITED HOUSE DUTIES.

the same shall not be liable to legacy duty or

succession duty.

The term 'accountable officer' means any

chamberlain, treasure^, bursar, receiver,

secretary, or other officer, trustee, or member

of a body corporate or unincorporate by whom

the annual income or profits of property in

respect whereof duty is chargeable under this

Act shall be received, or in whose possession

or under whose control the same shall be.

(76. § 12.)

The duty to be under the care of the Commis-

sioners of Inland Kevenue. (76. § 13.)

The duty to be a first charge on property, and

the parties accountable for the duty are the

body corporate or unincorporate and every

accountable officer. (lb. § 12.)

(1.) Every body corporate or unincorporate

chargeable with the duty hereby imposed

shall, on or before the 1st day of December

18S5, and on or before the 1st day of October

in every subsequent year, deliver or cause to

be delivered to the commissioners or their

officers a full and true account of all property

in respect whereof any such duty shall be

payable, and of the gross annual value,

income, or profits thereof accrued to the same

body in the year ended on the preceding 5th

day of April, and of all deductions claimed in

respect thereof, whether by relation to any

of the beforementioned exemptions from such

duty or as necessary outgoings.

(2.) The account shall be made in such form,

and shall contain all such particulars as the

commissioners shall, by any general or

special notice, require, or as shall be necessary

or proper, for enabling them fully and cor-

rectly to ascertain the duty due ; and every

accountable officer hereinbefore made answer-

able for payment of duty in respect of any

property chargeable under this Act shall be

answerable also for the delivery to the com-

missioners of such full and true account as

aforesaid of and relating to such property.

(lb. § 15.)

Persons answerable may retain moneys for pay-

ment of duty. (76. § 16.)

The commissioners may assess duty according

to accounts rendered, or may obtain other

accounts. (76. § 17.)

In the case of any proceeding in any Court for

the administration of any property chargeable

with duty under this Act, such Court shall

provide out of any such property in its pos-

session or control for the payment of the duty

to the commissioners. (lb. § 20.)

INHABITED HOUSE DUTIES.

[Acts 14 and 15 Vict. c. 36 ; 53 Vict

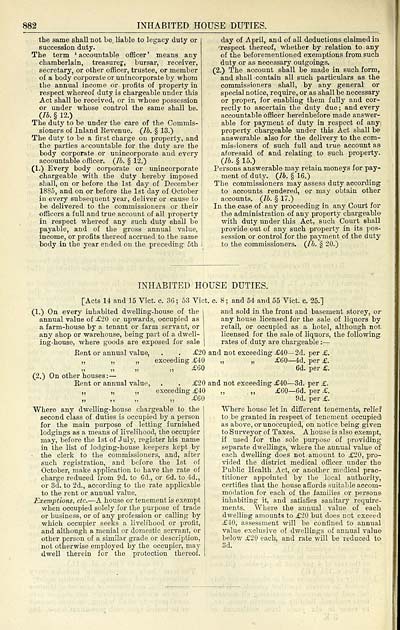

(1.) On every inhabited dwelling-house of the

annual value of £20 or upwards, occupied as

a farm-house by a tenant or farm servant, or

any shop or warehouse, being part of a dwell-

ing-house, where goods are exposed for sale

Bent or annual value,

exceedim

£20

£40

£60

(2.) On other houses: —

Kent or annual value,

. £20

exceeding £40

;; „ £60

Where any dwelling-house chargeable to the

second class of duties is occupied by a person

for the main purpose of letting furnished

lodgings as a means of livelihood, the occupier

may, before the 1st of July, register his name

in the list of lodging-house keepers kept by

■ the clerk to the commissioners, and, after

such registration, and before the 1st of

October, make application to have the rate of

charge reduced from 9d. to 6d., or 6d. to 4d.,

or 3d. to 2d., according to the rate applicable

to the rent or annual value.

Exemptions, etc. — A house or tenement is exempt

when occupied solely for the purpose of trade

or business, or of any profession or calling by

which occupier seeks a livelihood or profit,

and although a menial or domestic servant, or

other person of a similar grade or description,

not otherwise employed by the occupier, may

dwell therein for the protection thereof.

. c. 8 ; and 54 and 55 Vict. c. 25.]

and sold in the front and basement storey, or

any house licensed for the sale of liquors by

retail, or occupied as a hotel, although not

licensed for the sale of liquors, the following

rates of duty are chargeable : —

and not exceeding £40 — 2d. per £.

„ „ £60— 4d. per £.

6d. per £.

and not exceeding £40 — 3d. per £.

„ ,, £60 — 6d. per £.

9d. per £.

"Where house let in different tenements, relief

to be granted in respect of tenement occupied!

as above, or unoccupied, on notice being given

to Surveyor of Taxes. A house is also exempt,

if used for the sole purpose of providing

separate dwellings, where the annual value of

each dwelling does not amount to £20, pro-

vided the district medical officer under the

Public Health Act, or another medical prac-

titioner appointed by the local authority,

certifies that the house affords suitable accom-

modation for each of the families or persons

inhabiting it, and satisfies sanitary require-

ments. Where the annual value of each

dwelling amounts to £20 but does not exceed

£40, assessment will be confined to annual

value exclusive of dwellings of annual value

below £20 each, and rate will be reduced to

3d.

INHABITED HOUSE DUTIES.

the same shall not be liable to legacy duty or

succession duty.

The term 'accountable officer' means any

chamberlain, treasure^, bursar, receiver,

secretary, or other officer, trustee, or member

of a body corporate or unincorporate by whom

the annual income or profits of property in

respect whereof duty is chargeable under this

Act shall be received, or in whose possession

or under whose control the same shall be.

(76. § 12.)

The duty to be under the care of the Commis-

sioners of Inland Kevenue. (76. § 13.)

The duty to be a first charge on property, and

the parties accountable for the duty are the

body corporate or unincorporate and every

accountable officer. (lb. § 12.)

(1.) Every body corporate or unincorporate

chargeable with the duty hereby imposed

shall, on or before the 1st day of December

18S5, and on or before the 1st day of October

in every subsequent year, deliver or cause to

be delivered to the commissioners or their

officers a full and true account of all property

in respect whereof any such duty shall be

payable, and of the gross annual value,

income, or profits thereof accrued to the same

body in the year ended on the preceding 5th

day of April, and of all deductions claimed in

respect thereof, whether by relation to any

of the beforementioned exemptions from such

duty or as necessary outgoings.

(2.) The account shall be made in such form,

and shall contain all such particulars as the

commissioners shall, by any general or

special notice, require, or as shall be necessary

or proper, for enabling them fully and cor-

rectly to ascertain the duty due ; and every

accountable officer hereinbefore made answer-

able for payment of duty in respect of any

property chargeable under this Act shall be

answerable also for the delivery to the com-

missioners of such full and true account as

aforesaid of and relating to such property.

(lb. § 15.)

Persons answerable may retain moneys for pay-

ment of duty. (76. § 16.)

The commissioners may assess duty according

to accounts rendered, or may obtain other

accounts. (76. § 17.)

In the case of any proceeding in any Court for

the administration of any property chargeable

with duty under this Act, such Court shall

provide out of any such property in its pos-

session or control for the payment of the duty

to the commissioners. (lb. § 20.)

INHABITED HOUSE DUTIES.

[Acts 14 and 15 Vict. c. 36 ; 53 Vict

(1.) On every inhabited dwelling-house of the

annual value of £20 or upwards, occupied as

a farm-house by a tenant or farm servant, or

any shop or warehouse, being part of a dwell-

ing-house, where goods are exposed for sale

Bent or annual value,

exceedim

£20

£40

£60

(2.) On other houses: —

Kent or annual value,

. £20

exceeding £40

;; „ £60

Where any dwelling-house chargeable to the

second class of duties is occupied by a person

for the main purpose of letting furnished

lodgings as a means of livelihood, the occupier

may, before the 1st of July, register his name

in the list of lodging-house keepers kept by

■ the clerk to the commissioners, and, after

such registration, and before the 1st of

October, make application to have the rate of

charge reduced from 9d. to 6d., or 6d. to 4d.,

or 3d. to 2d., according to the rate applicable

to the rent or annual value.

Exemptions, etc. — A house or tenement is exempt

when occupied solely for the purpose of trade

or business, or of any profession or calling by

which occupier seeks a livelihood or profit,

and although a menial or domestic servant, or

other person of a similar grade or description,

not otherwise employed by the occupier, may

dwell therein for the protection thereof.

. c. 8 ; and 54 and 55 Vict. c. 25.]

and sold in the front and basement storey, or

any house licensed for the sale of liquors by

retail, or occupied as a hotel, although not

licensed for the sale of liquors, the following

rates of duty are chargeable : —

and not exceeding £40 — 2d. per £.

„ „ £60— 4d. per £.

6d. per £.

and not exceeding £40 — 3d. per £.

„ ,, £60 — 6d. per £.

9d. per £.

"Where house let in different tenements, relief

to be granted in respect of tenement occupied!

as above, or unoccupied, on notice being given

to Surveyor of Taxes. A house is also exempt,

if used for the sole purpose of providing

separate dwellings, where the annual value of

each dwelling does not amount to £20, pro-

vided the district medical officer under the

Public Health Act, or another medical prac-

titioner appointed by the local authority,

certifies that the house affords suitable accom-

modation for each of the families or persons

inhabiting it, and satisfies sanitary require-

ments. Where the annual value of each

dwelling amounts to £20 but does not exceed

£40, assessment will be confined to annual

value exclusive of dwellings of annual value

below £20 each, and rate will be reduced to

3d.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (940) |

|---|

| Permanent URL | https://digital.nls.uk/83665854 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|