Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

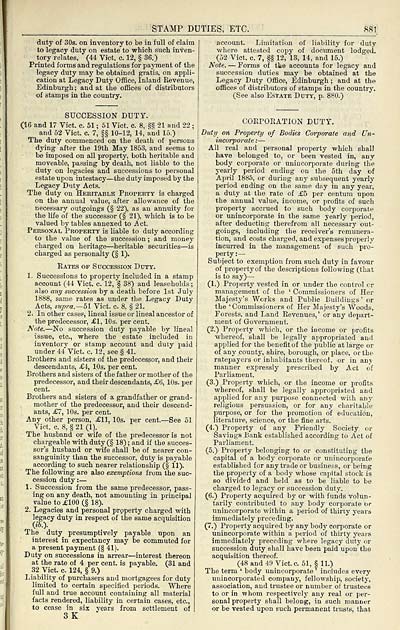

STAMP DUTIES, ETC.

881

duty of 30s. on inventory to be in full of claim

to legacy duty on estate to which such inven-

tory relates. (44 Vict. c. 12, § 36.)

Printed forms and regulations for payment of the

legacy duty may be obtained gratis, on appli-

cation at Legacy Duty Office, Inland Revenue,

Edinburgh ; and at the offices of distributors

of stamps in the country.

SUCCESSION DUTY.

(16 and 17 Vict. c. 51 ; 51 Vict. c. 8, §§ 21 and 22 ;

and 52 Vict. c. 7, §§ 10-12, 14, and 15.)

The duty commenced on the death of persons

dying after the 19th May 1853, and seems to

be imposed on all property, both heritable and

moveable, passing by death, not liable to the

duty on legacies and successions to personal

estate upon intestacy — the duty imposed by the

Legacy Duty Acts.

The duty on Heritable Property is charged

on the annual value, after allowance of the

necessary outgoings (§ 22), as an annuity for

the life of the successor (§ 21), which is to be

valued by tables annexed to Act.

Personal Property is liable to duty according

to the value of the succession ; and money

charged on heritage — heritable securities — is

charged as personalty (§ 1).

Eates of Succession Duty.

1. Successions to property included in a stamp

account (44 Vict. c. 12, § 38) and leaseholds ;

also any succession by a death before 1st July

1888, same rates as under the Legacy Duty

Acts, supra. — 51 Vict. c. 8, § 21.

2. In other cases, lineal issue or lineal ancestor of

the predecessor, £1, 10s. per cent.

Note. — No succession duty payable by lineal

issue, etc., where the estate included in

inventory or stamp account and duty paid

under 44 Vict. c. 12, see § 41.

Brothers and sisters of the predecessor, and their

descendants, £4, 10s. per cent.

Brothers and sisters of the father or mother of the

predecessor, and their descendants, £6, 10s. per

cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor, and their descend-

ants, £7, 10s. per cent.

Any other person, £11, 10s. per cent. — See 51

Vict. c. 8, § 21 (1).

The husband or wife of the predecessor is not

chargeable with duty (§ 18) ; and if the succes-

sor's husband or wife shall be of nearer con-

sanguinity than the successor, duty is payable

according to such nearer relationship (§ 11).

The following are also exemptions from the suc-

cession duty : —

1. Succession from the same predecessor, pass-

ing on any death, not amounting in principal

value to £100 (§ 18).

2. Legacies and personal property charged with

legacy duty in respect of the same acquisition

(ib.).

The duty presumptively payable upon an

interest in expectancy may be commuted for

a present payment (§ 41).

Duty on successions in arrear — interest thereon

at the rate of 4 per cent, is payable. (31 and

32 Vict. c. 124, § 9.)

Liability of purchasers and mortgagees for duty

limited to certain specified periods. Where

full and true account containing all material

facts rendered, liability in certain cases, etc.,

to cease in six years from settlement of

3K

account. Limitation of liability for duty

where attested copy of document lodged.

(52 Vict. c. 7, §§ 12, 13, 14, and 15.)

Note. — Forms of the accounts for legacy and

succession duties may be obtained at the

Legacy Duty Office, Edinburgh ; and at the

offices of distributors of stamps in the country.

(See also Estate Duty, p. 880.)

CORPORATION DUTY.

Duty on Property of Bodies Corporate and Un-

incorporate : —

All real and personal property which shall

have belonged to, or been vested in, any

body corporate or unincorporate during the

yearly period ending on the 5th day of

April 1885, or during any subsequent yearly

period ending on the same day in any year,

a duty at the rate of £5 per centum upon

the annual value, income, or profits of such

property accrued to such body corporate

or unincorporate in the same yearly period,

after deducting therefrom all necessary out-

goings, including the receiver's remunera-

tion, and costs charged, and expenses properly

incurred in the management of such pro-

perty :—

Subject to exemption from such duty in favour

of property of the descriptions following (that

is to say) —

(1.) Property vested in or under the control cr

management of the ' Commissioners of Her

Majesty's Works and Public Buildings ' or

the ' Commissioners of Her Majesty's Woods,

Forests, and Land Revenues,' or any depart-

ment of Government.

(2.) Property which, or the income or profits

whereof, shall be legally appropriated and

applied for the benefit of the public at large or

of any county, shire, borough, or place, or the

ratepayers or inhabitants thereof, or in any

manner expressly prescribed by Act of

Parliament.

(3.) Property which, or the income or profits

whereof, shall be legally appropriated and

applied for any purpose connected with any

religious persuasion, or for any charitable

purpose, or for the promotion of education,

literature, science, or the fine arts.

(4.) Property of any Friendly Society or

Savings Bank established according to Act of

Parliament.

(5.) Property belonging to or constituting the

capital of a body corporate or unincorporate

established for any trade or business, or being

the property of a body whose capital stock is

so divided and held as to be liable to be

charged to legacy or succession duty.

(6.) Property acquired by or with funds volun-

tarily contributed to any body corporate or

unincorporate within a period of thirty years

immediately preceding.

(7.) Property acquired by any bodj r corporate or

unincorporate within a period of thirty years

immediately preceding where legacy duty or

succession duty shall have been paid upon the

acquisition thereof.

(48 and 49 Vict. c. 51, 8 11.)

The term ' body unincorporate includes every

unincorporated company, fellowship, society,

association, and trustee or number of trustees

to or in whom respectively any real or per-

sonal property shall belong, in such manner

or be vested upon such permanent trusts, that

881

duty of 30s. on inventory to be in full of claim

to legacy duty on estate to which such inven-

tory relates. (44 Vict. c. 12, § 36.)

Printed forms and regulations for payment of the

legacy duty may be obtained gratis, on appli-

cation at Legacy Duty Office, Inland Revenue,

Edinburgh ; and at the offices of distributors

of stamps in the country.

SUCCESSION DUTY.

(16 and 17 Vict. c. 51 ; 51 Vict. c. 8, §§ 21 and 22 ;

and 52 Vict. c. 7, §§ 10-12, 14, and 15.)

The duty commenced on the death of persons

dying after the 19th May 1853, and seems to

be imposed on all property, both heritable and

moveable, passing by death, not liable to the

duty on legacies and successions to personal

estate upon intestacy — the duty imposed by the

Legacy Duty Acts.

The duty on Heritable Property is charged

on the annual value, after allowance of the

necessary outgoings (§ 22), as an annuity for

the life of the successor (§ 21), which is to be

valued by tables annexed to Act.

Personal Property is liable to duty according

to the value of the succession ; and money

charged on heritage — heritable securities — is

charged as personalty (§ 1).

Eates of Succession Duty.

1. Successions to property included in a stamp

account (44 Vict. c. 12, § 38) and leaseholds ;

also any succession by a death before 1st July

1888, same rates as under the Legacy Duty

Acts, supra. — 51 Vict. c. 8, § 21.

2. In other cases, lineal issue or lineal ancestor of

the predecessor, £1, 10s. per cent.

Note. — No succession duty payable by lineal

issue, etc., where the estate included in

inventory or stamp account and duty paid

under 44 Vict. c. 12, see § 41.

Brothers and sisters of the predecessor, and their

descendants, £4, 10s. per cent.

Brothers and sisters of the father or mother of the

predecessor, and their descendants, £6, 10s. per

cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor, and their descend-

ants, £7, 10s. per cent.

Any other person, £11, 10s. per cent. — See 51

Vict. c. 8, § 21 (1).

The husband or wife of the predecessor is not

chargeable with duty (§ 18) ; and if the succes-

sor's husband or wife shall be of nearer con-

sanguinity than the successor, duty is payable

according to such nearer relationship (§ 11).

The following are also exemptions from the suc-

cession duty : —

1. Succession from the same predecessor, pass-

ing on any death, not amounting in principal

value to £100 (§ 18).

2. Legacies and personal property charged with

legacy duty in respect of the same acquisition

(ib.).

The duty presumptively payable upon an

interest in expectancy may be commuted for

a present payment (§ 41).

Duty on successions in arrear — interest thereon

at the rate of 4 per cent, is payable. (31 and

32 Vict. c. 124, § 9.)

Liability of purchasers and mortgagees for duty

limited to certain specified periods. Where

full and true account containing all material

facts rendered, liability in certain cases, etc.,

to cease in six years from settlement of

3K

account. Limitation of liability for duty

where attested copy of document lodged.

(52 Vict. c. 7, §§ 12, 13, 14, and 15.)

Note. — Forms of the accounts for legacy and

succession duties may be obtained at the

Legacy Duty Office, Edinburgh ; and at the

offices of distributors of stamps in the country.

(See also Estate Duty, p. 880.)

CORPORATION DUTY.

Duty on Property of Bodies Corporate and Un-

incorporate : —

All real and personal property which shall

have belonged to, or been vested in, any

body corporate or unincorporate during the

yearly period ending on the 5th day of

April 1885, or during any subsequent yearly

period ending on the same day in any year,

a duty at the rate of £5 per centum upon

the annual value, income, or profits of such

property accrued to such body corporate

or unincorporate in the same yearly period,

after deducting therefrom all necessary out-

goings, including the receiver's remunera-

tion, and costs charged, and expenses properly

incurred in the management of such pro-

perty :—

Subject to exemption from such duty in favour

of property of the descriptions following (that

is to say) —

(1.) Property vested in or under the control cr

management of the ' Commissioners of Her

Majesty's Works and Public Buildings ' or

the ' Commissioners of Her Majesty's Woods,

Forests, and Land Revenues,' or any depart-

ment of Government.

(2.) Property which, or the income or profits

whereof, shall be legally appropriated and

applied for the benefit of the public at large or

of any county, shire, borough, or place, or the

ratepayers or inhabitants thereof, or in any

manner expressly prescribed by Act of

Parliament.

(3.) Property which, or the income or profits

whereof, shall be legally appropriated and

applied for any purpose connected with any

religious persuasion, or for any charitable

purpose, or for the promotion of education,

literature, science, or the fine arts.

(4.) Property of any Friendly Society or

Savings Bank established according to Act of

Parliament.

(5.) Property belonging to or constituting the

capital of a body corporate or unincorporate

established for any trade or business, or being

the property of a body whose capital stock is

so divided and held as to be liable to be

charged to legacy or succession duty.

(6.) Property acquired by or with funds volun-

tarily contributed to any body corporate or

unincorporate within a period of thirty years

immediately preceding.

(7.) Property acquired by any bodj r corporate or

unincorporate within a period of thirty years

immediately preceding where legacy duty or

succession duty shall have been paid upon the

acquisition thereof.

(48 and 49 Vict. c. 51, 8 11.)

The term ' body unincorporate includes every

unincorporated company, fellowship, society,

association, and trustee or number of trustees

to or in whom respectively any real or per-

sonal property shall belong, in such manner

or be vested upon such permanent trusts, that

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (939) |

|---|

| Permanent URL | https://digital.nls.uk/83665842 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|