Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES, ETC.

tion of receipt for legacy or succession duty,

or certificate by Commissioners of Inland

Eevenue, none payable.

§ 10 (2.) Nomination or payment under Act not to

affect inventory duty.-

(These provisions do not apply to Building

Societies. 76 L. T. 183, 12th January 1884.)

Pensions and Yeomanry Pay Act. — Personal estate,

whether arising from pay, pension, allowances,

surplus property, prize money, or otherwise !

however, held under control of Secretary of j

State, may be distributed without requiring j

probate if not exceeding £100. (47 and 48

Vict. c. 55, § 4.)

(See also Estate D uty infra.)

ACCOUNT STAMP DUTY.

Personal property taken as a donation mortis

causa, or by inter vivos gift within tioelve

months of death, or gift ivhenever made of which

bona fide possession not immediately assumed

to exclusion of donor or benefit to him : Pro-

perty, the beneficial interest in which accrues

by survivorship : Property passing under volun-

tary settlement by loriting or otherwise, an

interest for life or an absolute power of revo-

cation being reserved to the settler where deceased

died on or after 1st June 1881 : Proceeds of a

policy on deceased's life to extent to which kept

up by him for donee where deceased died after

1st June 1889 — Such property is liable to

stamp duties at the like rates as charged on

inventories. (44 Vict. c. 12, § 38, and 52 Vict.

c 7, § 11.)

The duties are payable on an account, forms of

which and relative affidavit may be obtained

at the Inland Revenue Office (Legacy and

Succession Duty Department).

(See also Estate Duty, infra.')

ESTATE DUTY.

(52 Vict. c. 7, §§ 5, 6, 7, 8, and 9.)

(1.) Where an inventory of personal estate exhi-

bited after 1st June 1889, and value chargeable

with duty exceeds £10,000. (2.) Where value

in an account under 44 Vict. c. 12, § 38, deli-

vered after 1st June 1889, exceeds £10,000.

(3.) Where an additional inventory exhibited

— (a.) if value in former inventory under 44

Vict. c. 12, § 27, exhibited after 1st June 1889,

exceeded £10,000; (5.) if value in former in-

ventory exhibited after 1st June 1889 do not

exceed £10,000, but with value in additional

inventory exceeds that sum. (4.) Where value

of any succession under Succession Duty Acts

on a death on or after 1st June 1889 exceeds

£10,000, and where value of any succession to

heritable property under will or intestacy,

together with the value of any other benefit

taken by the successor under such will or in-

testacy, exceeds £10,000. In each case duly

stamped statement of value or further value to

be delivered. Duty, £1 on each £100 or frac-

tion thereof.

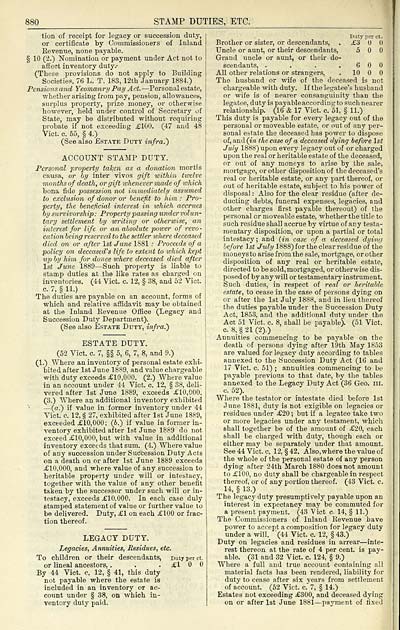

LEGACY DUTY.

Legacies, Annuities, Residues, etc.

To children or their descendants, Duty per ct.

or lineal ancestors, . . .£100

By 44 Vict. c. 12, § 41, this duty

not payable where the estate is

included in an inventory or ac-

count under § 38, on which in-

ventory duty paid.

Duty per ct.

Brother or sister, or descendants, . £3 U

Uncle or aunt, or their descendants, 5

Grand uncle or aunt, or their de-

scendants, . . . .600

All other relations or strangers, . 10

The husband or wife of the deceased is not

chargeable with duty. If the legatee's husband

or wife is of nearer consanguinity than the

legatee, duty is payable according to such nearer

relationship. (16 & 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

personal or moveable estate, or out of any per-

sonal estate the deceased has power to dispose

of, and(i« the case of a deceased dying before 1st

July 1888) upon every legacy out of or charged

upon the real or heritable estate of the deceased,

or out of any moneys to arise by the sale,

mortgage, or other disposition of the deceased's

real or heritable estate, or any part thereof, or

out of heritable estate, subject to his power of

disposal : Also for the clear residue (after de-

ducting debts, funeral expenses, legacies, and

other charges first payable thereout) of the

personal or moveable estate, whether the title to

such residue shall accrue by virtue of any testa-

mentary disposition, or upon a partial or total

intestacy; and (in case of a deceased dying

before 1st July 1888) for the clear residue of the

moneys to arise from the sale, mortgage, or other

disposition of any real or heritable estate,

directed to be sold, mortgaged, or otherwise dis-

posed of by any will or testamentary instrument.

Such duties, in respect of real or heritable

estate, to cease in the case of persons dying on

or after the 1st July 1888, and in lieu thereof

the duties payable under the Succession Duty

Act, 1853, and the additional duty under the

Act 51 Vict. c. 8, shall be payable). (51 Vict.

c.8,§21(2).)

Annuities commencing to be payable on the

death of persons dying after 19th May 1853

are valued for legacy duty according to tables

annexed to the Succession Duty Act (16 and

17 Vict. c. 51) ; annuities commencing to be

payable previous to that date, by the tables

annexed to the Legacy Duty Act (36 Geo. in.

c. 52).

Where the testator or intestate died before 1st

June 1881, duty is not exigible on legacies or

residues under £20; but if a legatee take two

or more legacies under any testament, which

shall together be of the amount of £20, each

shall be charged with duty, though each or

either may be separately under that amount.

See 44 Vict. c. 12, § 42. Also, where the value of

the whole of the personal estate of any person

dying after 24th March 1880 does not amount

to £100, no duty shall be chargeable in respect

thereof, or of any portion thereof. (43 Vict, c.

14, §13.)

The legacy duty presumptively payable upon an

interest in expectancy may be commuted for

a present payment. (43 Vict c. 14, § 11.)

The Commissioners of Inland Revenue have

power to accept a composition for legacy duty

under a will. (44 Vict. c. 12, § 43.)

Duty on legacies and residues in arrear — inte-

rest thereon at the rate of 4 per cent, is pay-

able. (31 and 32 Vict. c. 124, § 9.)

Where a full and true account containing all

material facts has been rendered, liability for

duty to cease after six years from settlement

of account. (52 Vict. c. 7, § 14.)

Estates not exceeding £300, and deceased dying

on or after 1st June 1881 — payment of fixed

tion of receipt for legacy or succession duty,

or certificate by Commissioners of Inland

Eevenue, none payable.

§ 10 (2.) Nomination or payment under Act not to

affect inventory duty.-

(These provisions do not apply to Building

Societies. 76 L. T. 183, 12th January 1884.)

Pensions and Yeomanry Pay Act. — Personal estate,

whether arising from pay, pension, allowances,

surplus property, prize money, or otherwise !

however, held under control of Secretary of j

State, may be distributed without requiring j

probate if not exceeding £100. (47 and 48

Vict. c. 55, § 4.)

(See also Estate D uty infra.)

ACCOUNT STAMP DUTY.

Personal property taken as a donation mortis

causa, or by inter vivos gift within tioelve

months of death, or gift ivhenever made of which

bona fide possession not immediately assumed

to exclusion of donor or benefit to him : Pro-

perty, the beneficial interest in which accrues

by survivorship : Property passing under volun-

tary settlement by loriting or otherwise, an

interest for life or an absolute power of revo-

cation being reserved to the settler where deceased

died on or after 1st June 1881 : Proceeds of a

policy on deceased's life to extent to which kept

up by him for donee where deceased died after

1st June 1889 — Such property is liable to

stamp duties at the like rates as charged on

inventories. (44 Vict. c. 12, § 38, and 52 Vict.

c 7, § 11.)

The duties are payable on an account, forms of

which and relative affidavit may be obtained

at the Inland Revenue Office (Legacy and

Succession Duty Department).

(See also Estate Duty, infra.')

ESTATE DUTY.

(52 Vict. c. 7, §§ 5, 6, 7, 8, and 9.)

(1.) Where an inventory of personal estate exhi-

bited after 1st June 1889, and value chargeable

with duty exceeds £10,000. (2.) Where value

in an account under 44 Vict. c. 12, § 38, deli-

vered after 1st June 1889, exceeds £10,000.

(3.) Where an additional inventory exhibited

— (a.) if value in former inventory under 44

Vict. c. 12, § 27, exhibited after 1st June 1889,

exceeded £10,000; (5.) if value in former in-

ventory exhibited after 1st June 1889 do not

exceed £10,000, but with value in additional

inventory exceeds that sum. (4.) Where value

of any succession under Succession Duty Acts

on a death on or after 1st June 1889 exceeds

£10,000, and where value of any succession to

heritable property under will or intestacy,

together with the value of any other benefit

taken by the successor under such will or in-

testacy, exceeds £10,000. In each case duly

stamped statement of value or further value to

be delivered. Duty, £1 on each £100 or frac-

tion thereof.

LEGACY DUTY.

Legacies, Annuities, Residues, etc.

To children or their descendants, Duty per ct.

or lineal ancestors, . . .£100

By 44 Vict. c. 12, § 41, this duty

not payable where the estate is

included in an inventory or ac-

count under § 38, on which in-

ventory duty paid.

Duty per ct.

Brother or sister, or descendants, . £3 U

Uncle or aunt, or their descendants, 5

Grand uncle or aunt, or their de-

scendants, . . . .600

All other relations or strangers, . 10

The husband or wife of the deceased is not

chargeable with duty. If the legatee's husband

or wife is of nearer consanguinity than the

legatee, duty is payable according to such nearer

relationship. (16 & 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

personal or moveable estate, or out of any per-

sonal estate the deceased has power to dispose

of, and(i« the case of a deceased dying before 1st

July 1888) upon every legacy out of or charged

upon the real or heritable estate of the deceased,

or out of any moneys to arise by the sale,

mortgage, or other disposition of the deceased's

real or heritable estate, or any part thereof, or

out of heritable estate, subject to his power of

disposal : Also for the clear residue (after de-

ducting debts, funeral expenses, legacies, and

other charges first payable thereout) of the

personal or moveable estate, whether the title to

such residue shall accrue by virtue of any testa-

mentary disposition, or upon a partial or total

intestacy; and (in case of a deceased dying

before 1st July 1888) for the clear residue of the

moneys to arise from the sale, mortgage, or other

disposition of any real or heritable estate,

directed to be sold, mortgaged, or otherwise dis-

posed of by any will or testamentary instrument.

Such duties, in respect of real or heritable

estate, to cease in the case of persons dying on

or after the 1st July 1888, and in lieu thereof

the duties payable under the Succession Duty

Act, 1853, and the additional duty under the

Act 51 Vict. c. 8, shall be payable). (51 Vict.

c.8,§21(2).)

Annuities commencing to be payable on the

death of persons dying after 19th May 1853

are valued for legacy duty according to tables

annexed to the Succession Duty Act (16 and

17 Vict. c. 51) ; annuities commencing to be

payable previous to that date, by the tables

annexed to the Legacy Duty Act (36 Geo. in.

c. 52).

Where the testator or intestate died before 1st

June 1881, duty is not exigible on legacies or

residues under £20; but if a legatee take two

or more legacies under any testament, which

shall together be of the amount of £20, each

shall be charged with duty, though each or

either may be separately under that amount.

See 44 Vict. c. 12, § 42. Also, where the value of

the whole of the personal estate of any person

dying after 24th March 1880 does not amount

to £100, no duty shall be chargeable in respect

thereof, or of any portion thereof. (43 Vict, c.

14, §13.)

The legacy duty presumptively payable upon an

interest in expectancy may be commuted for

a present payment. (43 Vict c. 14, § 11.)

The Commissioners of Inland Revenue have

power to accept a composition for legacy duty

under a will. (44 Vict. c. 12, § 43.)

Duty on legacies and residues in arrear — inte-

rest thereon at the rate of 4 per cent, is pay-

able. (31 and 32 Vict. c. 124, § 9.)

Where a full and true account containing all

material facts has been rendered, liability for

duty to cease after six years from settlement

of account. (52 Vict. c. 7, § 14.)

Estates not exceeding £300, and deceased dying

on or after 1st June 1881 — payment of fixed

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (938) |

|---|

| Permanent URL | https://digital.nls.uk/83665830 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|