Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

STAMP DUTIES, ETC.

879

Rents of Heritage. — If the deceased survive Whit-

sunday, one moiety of the rents of the crop

of that year is personal estate. If he survive

Martinmas, the -whole rents of that crop fall

into the executry. In addition, from and after

1st August 1870, the Act 33 & 34 Vict. 1870,

c. 35, would seem to give the executor a pro-

portion of the rents from the term preceding

the date of death to the date of death. That

Act would also seem to give a proportion of

the term's rents of quarries, minerals, and

houses, and also feu-duties current at the

death. The executor's right to house rents

would not therefore be to the ^half - year's

rents current at death, but to a proportion

only to the date of death.

Modes in which Duty may be paid.

When deceased domiciled in Scotland. — In the case

of a person dying domiciled in Scotland having

personal property in Scotland, England, and

Ireland, and also heritable securities excluding

executors, and personal bonds excluding exe-

cutors, duty in respect of the whole may be

paid on the inventory required to be recorded

in the Sheriff Court; or inventory duty may

be paid on the personal property situated in

Scotland, including heritable securities made

moveable by the Act 31 & 32 Vict. c. 101,

§ 117, and duty may be paid on a ' special

inventory' of the heritable securities excluding

executors, and personal bonds excluding exe-

cutors, and probate or administration may be

obtained in England and Ireland in respect of

the personal estate in these countries, and duty

paid in respect of such on these instruments.

When deceased domiciled furth of the U. K. — In

case of a person dying domiciled furth of the

United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each country.

In exhibiting inventories after 1st June 1881,

the amount of debts due and owing by the

deceased to persons in the United Kingdom,

and funeral expenses, may be deducted from

the value of the estate, for the purpose of pay-

ing the inventory duty. The account of such to

be delivered with or annexed to the affidavit to

the inventory.

The debts not to include voluntary debts payable

on death, or payable under instruments not

bona fide delivered three months before death.

The Commissioners of Inland Eevenue,

within three years, may call for evidence of

the contents of, or particulars verified by, the

affidavit or inventory.

Where the gross estate of a deceased person

dying after 1st June 1881 does not exceed

£300, and the estate exceeds £100, if an in-

ventory shall be given up in accordance with

the special provisions of the Act, the duty to

which the inventory is liable is 30s. (44 Vict.

c. 12, § 34.)

Forms of the inventory and relative affidavit

may be obtained at the Inland Eevenue Office

(Legacy and Succession Duty Department).

Additional and Corrective Inventories. — If there

shall be any omission in the inventory infer-

ring the payment of further duty, an additional

inventory is required to be exhibited (48 Geo.

in. c. 149, § 38 ; 16 and 17 Vict. c. 59, § 8).

The stamp on the additional inventory is re-

quired to be of an amount sufficient to make

up the stamp duty in respect of the total

amount of all the estate. If the estate shall

be over-estimated, or if something shall be im-

properly included in the inventory, a correc-

tive inventory, duly stamped, requires to be

exhibited. Allowance of the original inven-

tory as a spoiled stamp will be obtained within

six months after the recording of the second

inventory.

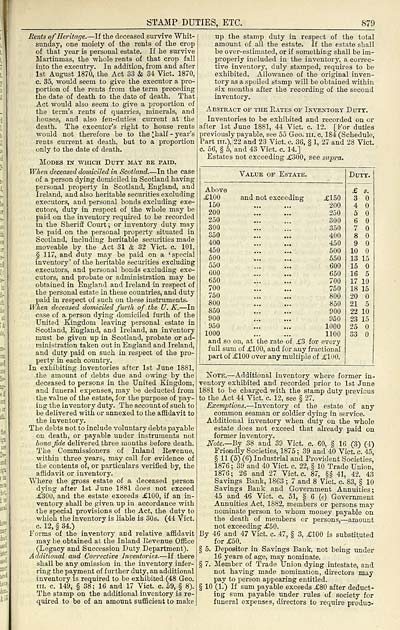

Abstract of the Bates of Inventory Duty.

Inventories to be exhibited and recorded on or

after 1st June 1881, 44 Vict. c. 12. [For duties

previously payable, see 55 Geo. in. c. 184 (Schedule,

Part in.), 22 and 23 Vict. c. 36, § 1, 27 and 28 Vict,

c. 56, § 5, and 43 Vict. c. 14.]

Estates not exceeding £300, see supra.

Value of Estate.

Above

£100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

' 950

1000

and not exceeding

£150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

950

1000

1100

and so on, at the rate of £3 for every

full sum of £100, and for any fractional

part of £100 over any multiple of £100.

Duty.

£ s.

3

4

5

6

7

8

9

10

13 15

15

16 5

17 10

18 15

20

21 5

22 10

23 15

25

33

Note. — Additional inventory where former in-

ventory exhibited and recorded prior to 1st June

1881 to be charged with the stamp duty previous

to the Act 44 Vict. c. 12, see § 27.

Exemptions. — Inventory of the estate of any

common seaman or soldier dying in service.

Additional inventory when duty on the whole

estate does not exceed that already paid on

former inventory.

Note.— By 38 and 39 Vict. c. 60, § 16 (3) (4)

Friendly Societies, 1875 ; 39 and 40 Vict. c. 45,

§ 11 (5) (6) Industrial and Provident Societies,

1876 ; 39 and 40 Vict. c. 22, § 10 Trade Union,

1876 ; 26 and 27 Vict. c. 87, §§ 41, 42, 43

Savings Bank, 1863 ; 7 and 8 Vict. c. 83, § 10

Savings Bank and Government Annuities;

45 and 46 Vict. c. 51, § 6 (e) Government

Annuities Act, 1882, members or persons may-

nominate person to whom money payable on

the death of members or persons, — amount

not exceeding £50.

By 46 and 47 Vict. c. 47, § 3, £100 is substituted

for £50.

§ 5. Depositor in Savings Bank, not being under

16 years of age, may nominate.

§ 7. Member of Trade Union dying intestate, and

not having made nomination, directors may

pay to person appearing entitled.

§ 10 (1.) If sum payable exceeds £80 after deduct-

ing sum payable under rules of society for

funeral expenses, directors to require produc-

879

Rents of Heritage. — If the deceased survive Whit-

sunday, one moiety of the rents of the crop

of that year is personal estate. If he survive

Martinmas, the -whole rents of that crop fall

into the executry. In addition, from and after

1st August 1870, the Act 33 & 34 Vict. 1870,

c. 35, would seem to give the executor a pro-

portion of the rents from the term preceding

the date of death to the date of death. That

Act would also seem to give a proportion of

the term's rents of quarries, minerals, and

houses, and also feu-duties current at the

death. The executor's right to house rents

would not therefore be to the ^half - year's

rents current at death, but to a proportion

only to the date of death.

Modes in which Duty may be paid.

When deceased domiciled in Scotland. — In the case

of a person dying domiciled in Scotland having

personal property in Scotland, England, and

Ireland, and also heritable securities excluding

executors, and personal bonds excluding exe-

cutors, duty in respect of the whole may be

paid on the inventory required to be recorded

in the Sheriff Court; or inventory duty may

be paid on the personal property situated in

Scotland, including heritable securities made

moveable by the Act 31 & 32 Vict. c. 101,

§ 117, and duty may be paid on a ' special

inventory' of the heritable securities excluding

executors, and personal bonds excluding exe-

cutors, and probate or administration may be

obtained in England and Ireland in respect of

the personal estate in these countries, and duty

paid in respect of such on these instruments.

When deceased domiciled furth of the U. K. — In

case of a person dying domiciled furth of the

United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each country.

In exhibiting inventories after 1st June 1881,

the amount of debts due and owing by the

deceased to persons in the United Kingdom,

and funeral expenses, may be deducted from

the value of the estate, for the purpose of pay-

ing the inventory duty. The account of such to

be delivered with or annexed to the affidavit to

the inventory.

The debts not to include voluntary debts payable

on death, or payable under instruments not

bona fide delivered three months before death.

The Commissioners of Inland Eevenue,

within three years, may call for evidence of

the contents of, or particulars verified by, the

affidavit or inventory.

Where the gross estate of a deceased person

dying after 1st June 1881 does not exceed

£300, and the estate exceeds £100, if an in-

ventory shall be given up in accordance with

the special provisions of the Act, the duty to

which the inventory is liable is 30s. (44 Vict.

c. 12, § 34.)

Forms of the inventory and relative affidavit

may be obtained at the Inland Eevenue Office

(Legacy and Succession Duty Department).

Additional and Corrective Inventories. — If there

shall be any omission in the inventory infer-

ring the payment of further duty, an additional

inventory is required to be exhibited (48 Geo.

in. c. 149, § 38 ; 16 and 17 Vict. c. 59, § 8).

The stamp on the additional inventory is re-

quired to be of an amount sufficient to make

up the stamp duty in respect of the total

amount of all the estate. If the estate shall

be over-estimated, or if something shall be im-

properly included in the inventory, a correc-

tive inventory, duly stamped, requires to be

exhibited. Allowance of the original inven-

tory as a spoiled stamp will be obtained within

six months after the recording of the second

inventory.

Abstract of the Bates of Inventory Duty.

Inventories to be exhibited and recorded on or

after 1st June 1881, 44 Vict. c. 12. [For duties

previously payable, see 55 Geo. in. c. 184 (Schedule,

Part in.), 22 and 23 Vict. c. 36, § 1, 27 and 28 Vict,

c. 56, § 5, and 43 Vict. c. 14.]

Estates not exceeding £300, see supra.

Value of Estate.

Above

£100

150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

' 950

1000

and not exceeding

£150

200

250

300

350

400

450

500

550

600

650

700

750

800

850

900

950

1000

1100

and so on, at the rate of £3 for every

full sum of £100, and for any fractional

part of £100 over any multiple of £100.

Duty.

£ s.

3

4

5

6

7

8

9

10

13 15

15

16 5

17 10

18 15

20

21 5

22 10

23 15

25

33

Note. — Additional inventory where former in-

ventory exhibited and recorded prior to 1st June

1881 to be charged with the stamp duty previous

to the Act 44 Vict. c. 12, see § 27.

Exemptions. — Inventory of the estate of any

common seaman or soldier dying in service.

Additional inventory when duty on the whole

estate does not exceed that already paid on

former inventory.

Note.— By 38 and 39 Vict. c. 60, § 16 (3) (4)

Friendly Societies, 1875 ; 39 and 40 Vict. c. 45,

§ 11 (5) (6) Industrial and Provident Societies,

1876 ; 39 and 40 Vict. c. 22, § 10 Trade Union,

1876 ; 26 and 27 Vict. c. 87, §§ 41, 42, 43

Savings Bank, 1863 ; 7 and 8 Vict. c. 83, § 10

Savings Bank and Government Annuities;

45 and 46 Vict. c. 51, § 6 (e) Government

Annuities Act, 1882, members or persons may-

nominate person to whom money payable on

the death of members or persons, — amount

not exceeding £50.

By 46 and 47 Vict. c. 47, § 3, £100 is substituted

for £50.

§ 5. Depositor in Savings Bank, not being under

16 years of age, may nominate.

§ 7. Member of Trade Union dying intestate, and

not having made nomination, directors may

pay to person appearing entitled.

§ 10 (1.) If sum payable exceeds £80 after deduct-

ing sum payable under rules of society for

funeral expenses, directors to require produc-

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (937) |

|---|

| Permanent URL | https://digital.nls.uk/83665818 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|