Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

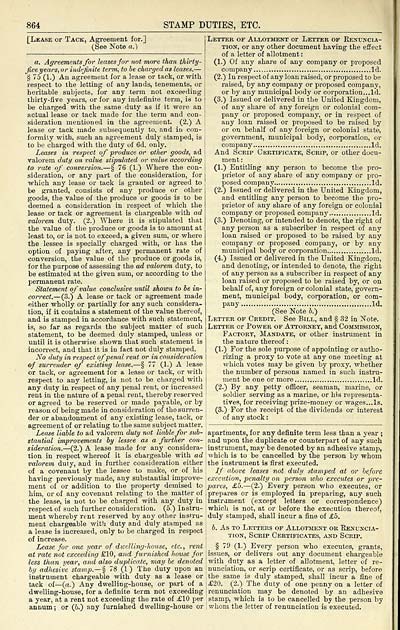

864

STAMP DUTIES, ETC.

[Lea.se or Tack, Agreement for.]

(See Note a.)

a. Agreements for leases for not more than thirty-

fioe years, or indefinite term, to be charged as leases. —

§ 75 (1.) An agreement for a lease or tack, or with

respect to the letting of any lands, tenements, or

heritable subjects, for any term not exceeding

thirty-five years, or for any indefinite term, is to

be charged with the same duty as if it were an

actual lease or tack made for the term and con-

sideration mentioned in the agreement. (2.) A

lease or tack made subsequently to, and in con-

formity with, such an agreement duly stamped, is

to be charged with the duty of 6d. only.

Leases in respect of produce or other goods, ad

valorem duty on value stipulated or value according

to rate of conversion. — § 76 (1.) Where the con-

sideration, or any part of the consideration, for

which any lease or tack is granted or agreed to

be granted, consists of any produce or other

goods, the value of the produce or goods is to be

deemed a consideration in respect of which the

lease or tack or agreement is chargeable with ad

valorem duty. (2.) Where it is stipulated that

the value of the produce or goods is to amount at

least to, or is not to exceed, a given sum, or where

the lessee is specially charged with, or has the

option of paying after, any permanent rate of

conversion, the value of the produce or goods is,

for the purpose of assessing the ad valorem duty, to

be estimated at the given sum, or according to the

permanent rate.

Statement of value conclusive until shown to be in-

correct. — (3.) A lease or tack or agreement made

either wholly or partially for any such considera-

tion, if it contains a statement of the value thereof,

and is stamped in accordance with such statement,

is, so far as regards the subject matter of such

statement, to be deemed duly stamped, unless or

until it is otherwise shown that such statement is

incorrect, and that it is in fact not duly stamped.

No duty in respect of penal rent or in consideration

of surrender of existing lease. — § 77 (1.) A lease

or tack, or agreement for a lease or tack, or with

respect to any letting, is not to be charged with

any duty in respect of any penal rent, or increased

rent in the nature of a penal rent, thereby reserved

or agreed to be reserved or made payable, or by

reason of being made in consideration of tho surren-

der or abandonment of any existing lease, tack, or

agreement of or relating to the same subject matter.

Lease liable to ad valorem duty not liable for sub-

stantial improvements by lessee as a further con-

sideration. — (2.) A lease made for any considera-

tion in respect whereof it is chargeable with ad

valorem duty, and in further consideration either

of a covenant by the lessee to make, or of his

having previously made, any substantial improve-

ment of or addition to the property demised to

him, or of any covenant relating to the matter of

the lease, is not to be charged with any duty in

respect of such further consideration. (5.) Instru-

ment whereby rent reserved by any other instru-

ment chargeable with duty and duly stamped as

a lease is increased, only to be charged in respect

of increase.

Lease for one year of dwelling-house, etc., rent

at rate not exceeding £10, and furnished house for

less than year, and also duplicate, may be denoted

by adhesive stamp.— § 78 (1) The duty upon an

instrument chargeable with duty as a lease or

tack of— (a.) Any dwelling-house, or part of a

dwelling-house, for a definite term not exceeding

a year, at a rent not exceeding the rate of £10 per

annum; or (6.) any furnished dwelling-house or

Letter of Allotment or Lefter op Renuncia-

tion, or any other document having the effect

of a letter of allotment :

(1.) Of any share of any company or proposed

company Id.

(2.) In respect of any loan raised, or proposed to be

raised, by any company or proposed company,

or by any municipal body or corporation. ..Id.

(3.) Issued or delivered in the United Kingdom,

of any share of any foreign or colonial com-

pany or proposed company, or in respect of

any loan raised or proposed to be raised by

or on behalf of any foreign or colonial state,

government, municipal bodj T , corporation, or

company Id.

And Scrip Certificate, Scrip, or other docu-

ment :

(1.) Entitling any person to become the pro-

prietor of any share of any company or pro-

posed company Id.

(2.) Issued or delivered in the United Kingdom,

and entitling any person to become the pro-

prietor of any share of any foreign or colonial

company or proposed company .Id.

(3.) Denoting, or intended to denote, the right of

any person as a subscriber in respect of any

loan raised or proposed to be raised by any

company or proposed company, or by any

municipal body or corporation Id.

(4.) Issued or delivered in the United Kingdom,

and denoting, or intended to denote, the right

of any person as a subscriber in respect of any

loan raised or proposed to be raised by, or on

behalf of, any foreign or colonial state, govern-

ment, municipal body, corporation, or com-

pany Id.

(See Note b.)

Letter of Credit. See Bill, and § 32 in Note.

Letter or Power of Attorney, and Commission,

Factory, Mandate, or other instrument in

the nature thereof :

(1.) For the sole purpose of appointing or autho-

rizing a proxy to vote at any one meeting at

which votes may be given by proxy, whether

the number of persons named in such instru-

ment be one or more Id.

(2.) By any petty officer, seaman, marine, or

soldier serving as a marine, or his representa-

tives, for receiving prize-money or wages. ..Is.

(3.) For the receipt of the dividends or interest

of any stock :

apartments, for any definite term less than a year ;

and upon the duplicate or counterpart of any such

instrument, may be denoted by an adhesive stamp,

which is to be cancelled by the person by whom

the instrument is first executed.

Lf above leases not duly stamped at or before

execution, penalty on person who executes or pre-

pares, £5. — (2.) Every person who executes, or

prepares or is employed in preparing, any such

instrument (except letters or correspondence)

which is not, at or before the execution thereof,

duly stamped, shall incur a fine of £5.

b. As to Letters of Allotment or Renuncia-

tion, Scrip Certificates, and Scrip.

§ 79 (1.) Every person who executes, grants,

issues, or delivers out any document chargeable

with duty as a letter of allotment, letter of re-

nunciation, or scrip certificate, or as scrip, before

the same is duly stamped, shall incur a fine of

£20. (2.) The duty of one penny on a letter of

renunciation may be denoted by an adhesive

stamp, which is to be cancelled by the person by

whom the letter of renunciation is executed.

STAMP DUTIES, ETC.

[Lea.se or Tack, Agreement for.]

(See Note a.)

a. Agreements for leases for not more than thirty-

fioe years, or indefinite term, to be charged as leases. —

§ 75 (1.) An agreement for a lease or tack, or with

respect to the letting of any lands, tenements, or

heritable subjects, for any term not exceeding

thirty-five years, or for any indefinite term, is to

be charged with the same duty as if it were an

actual lease or tack made for the term and con-

sideration mentioned in the agreement. (2.) A

lease or tack made subsequently to, and in con-

formity with, such an agreement duly stamped, is

to be charged with the duty of 6d. only.

Leases in respect of produce or other goods, ad

valorem duty on value stipulated or value according

to rate of conversion. — § 76 (1.) Where the con-

sideration, or any part of the consideration, for

which any lease or tack is granted or agreed to

be granted, consists of any produce or other

goods, the value of the produce or goods is to be

deemed a consideration in respect of which the

lease or tack or agreement is chargeable with ad

valorem duty. (2.) Where it is stipulated that

the value of the produce or goods is to amount at

least to, or is not to exceed, a given sum, or where

the lessee is specially charged with, or has the

option of paying after, any permanent rate of

conversion, the value of the produce or goods is,

for the purpose of assessing the ad valorem duty, to

be estimated at the given sum, or according to the

permanent rate.

Statement of value conclusive until shown to be in-

correct. — (3.) A lease or tack or agreement made

either wholly or partially for any such considera-

tion, if it contains a statement of the value thereof,

and is stamped in accordance with such statement,

is, so far as regards the subject matter of such

statement, to be deemed duly stamped, unless or

until it is otherwise shown that such statement is

incorrect, and that it is in fact not duly stamped.

No duty in respect of penal rent or in consideration

of surrender of existing lease. — § 77 (1.) A lease

or tack, or agreement for a lease or tack, or with

respect to any letting, is not to be charged with

any duty in respect of any penal rent, or increased

rent in the nature of a penal rent, thereby reserved

or agreed to be reserved or made payable, or by

reason of being made in consideration of tho surren-

der or abandonment of any existing lease, tack, or

agreement of or relating to the same subject matter.

Lease liable to ad valorem duty not liable for sub-

stantial improvements by lessee as a further con-

sideration. — (2.) A lease made for any considera-

tion in respect whereof it is chargeable with ad

valorem duty, and in further consideration either

of a covenant by the lessee to make, or of his

having previously made, any substantial improve-

ment of or addition to the property demised to

him, or of any covenant relating to the matter of

the lease, is not to be charged with any duty in

respect of such further consideration. (5.) Instru-

ment whereby rent reserved by any other instru-

ment chargeable with duty and duly stamped as

a lease is increased, only to be charged in respect

of increase.

Lease for one year of dwelling-house, etc., rent

at rate not exceeding £10, and furnished house for

less than year, and also duplicate, may be denoted

by adhesive stamp.— § 78 (1) The duty upon an

instrument chargeable with duty as a lease or

tack of— (a.) Any dwelling-house, or part of a

dwelling-house, for a definite term not exceeding

a year, at a rent not exceeding the rate of £10 per

annum; or (6.) any furnished dwelling-house or

Letter of Allotment or Lefter op Renuncia-

tion, or any other document having the effect

of a letter of allotment :

(1.) Of any share of any company or proposed

company Id.

(2.) In respect of any loan raised, or proposed to be

raised, by any company or proposed company,

or by any municipal body or corporation. ..Id.

(3.) Issued or delivered in the United Kingdom,

of any share of any foreign or colonial com-

pany or proposed company, or in respect of

any loan raised or proposed to be raised by

or on behalf of any foreign or colonial state,

government, municipal bodj T , corporation, or

company Id.

And Scrip Certificate, Scrip, or other docu-

ment :

(1.) Entitling any person to become the pro-

prietor of any share of any company or pro-

posed company Id.

(2.) Issued or delivered in the United Kingdom,

and entitling any person to become the pro-

prietor of any share of any foreign or colonial

company or proposed company .Id.

(3.) Denoting, or intended to denote, the right of

any person as a subscriber in respect of any

loan raised or proposed to be raised by any

company or proposed company, or by any

municipal body or corporation Id.

(4.) Issued or delivered in the United Kingdom,

and denoting, or intended to denote, the right

of any person as a subscriber in respect of any

loan raised or proposed to be raised by, or on

behalf of, any foreign or colonial state, govern-

ment, municipal body, corporation, or com-

pany Id.

(See Note b.)

Letter of Credit. See Bill, and § 32 in Note.

Letter or Power of Attorney, and Commission,

Factory, Mandate, or other instrument in

the nature thereof :

(1.) For the sole purpose of appointing or autho-

rizing a proxy to vote at any one meeting at

which votes may be given by proxy, whether

the number of persons named in such instru-

ment be one or more Id.

(2.) By any petty officer, seaman, marine, or

soldier serving as a marine, or his representa-

tives, for receiving prize-money or wages. ..Is.

(3.) For the receipt of the dividends or interest

of any stock :

apartments, for any definite term less than a year ;

and upon the duplicate or counterpart of any such

instrument, may be denoted by an adhesive stamp,

which is to be cancelled by the person by whom

the instrument is first executed.

Lf above leases not duly stamped at or before

execution, penalty on person who executes or pre-

pares, £5. — (2.) Every person who executes, or

prepares or is employed in preparing, any such

instrument (except letters or correspondence)

which is not, at or before the execution thereof,

duly stamped, shall incur a fine of £5.

b. As to Letters of Allotment or Renuncia-

tion, Scrip Certificates, and Scrip.

§ 79 (1.) Every person who executes, grants,

issues, or delivers out any document chargeable

with duty as a letter of allotment, letter of re-

nunciation, or scrip certificate, or as scrip, before

the same is duly stamped, shall incur a fine of

£20. (2.) The duty of one penny on a letter of

renunciation may be denoted by an adhesive

stamp, which is to be cancelled by the person by

whom the letter of renunciation is executed.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1892-1893 > (922) |

|---|

| Permanent URL | https://digital.nls.uk/83665638 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|