Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

Economic affairs

29 Finance and other service industries

operation in December 2001, replacing eight

previous compensation schemes. It provides

compensation for:

■ deposits - when an authorised deposit-taking

firm (such as a bank, building society or

credit union) goes out of business or the FSA

considers that it is unable to repay depositors

or likely to be unable to do so. The maximum

level of compensation for a customer,

covering all of his or her deposits, is £31,700

(100 per cent of the first £2,000 and

90 per cent of the next £33,000);

■ investments - two kinds of loss are covered:

when an authorised investment firm goes out

of business and cannot return investments or

money, and a loss arising from bad

investment advice or poor investment

management. The maximum compensation

is £48,000 (all of the first £30,000 and

90 per cent of the next £20,000); and

■ insurance - 100 per cent cover for

compulsory insurance (such as third-party

motor insurance) and for other insurance

(including long-term insurance, such as

pensions and life assurance) 100 per cent

cover for the first £2,000, with 90 per cent

protection for amounts above this threshold.

Financial Ombudsman Service

The Financial Ombudsman Service is a one-stop

service for dealing with complaints about financial

services firms. The budget for 2002/03 is around

£28 million. All firms authorised by the FSA are

subject to the Ombudsman’s procedures, but

consumers have to seek a resolution to a

complaint from the firm in the first instance. If

the matter is not resolved satisfactorily, they can

ask the Ombudsman to intervene.

Introduction to other service

industries

The distribution of goods, including food and

drink, to their point of sale is a major economic

activity. The large wholesalers and retailers of food

and drink operate extensive distribution networks,

either directly or through contractors.

With rising real incomes, consumer spending on

personal and leisure services has increased

considerably. Travel, hotel and restaurant services

in the UK are among those to have benefited from

long-term growth in tourism. The UK is one of

the world’s leading tourist destinations, even

though the foot-and-mouth outbreak in 2001 and

the aftermath of 11 September caused a

temporary decline in visitor numbers.

Computer activities and research and

development are among the non-financial sectors

which experienced strong growth in turnover in

2001 (see Table 29.7).

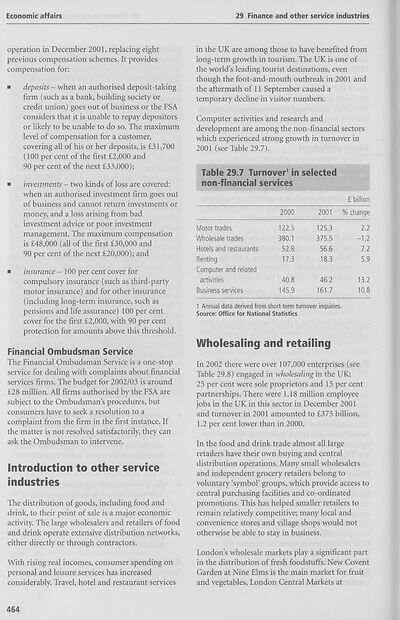

Table 29.7 Turnover1 in selected

non-financial services

£ billion

2000 2001 % change

Motor trades

Wholesale trades

Hotels and restaurants

Renting

Computer and related

activities

Business services

122.5 125.3 2.2

380.1 375.5 -1.2

52.8 56.6 7.2

17.3 18.3 5.9

40.8 46.2 13.2

145.9 161.7 10.8

1 Annual data derived from short-term turnover inquiries.

Source: Office for National Statistics

Wholesaling and retailing

In 2002 there were over 107,000 enterprises (see

Table 29.8) engaged in wholesaling in the UK;

25 per cent were sole proprietors and 15 per cent

partnerships. There were 1.18 million employee

jobs in the UK in this sector in December 2001

and turnover in 2001 amounted to £375 billion,

1.2 per cent lower than in 2000.

In the food and drink trade almost all large

retailers have their own buying and central

distribution operations. Many small wholesalers

and independent grocery retailers belong to

voluntary ‘symbol’ groups, which provide access to

central purchasing facilities and co-ordinated

promotions. This has helped smaller retailers to

remain relatively competitive; many local and

convenience stores and village shops would not

otherwise be able to stay in business.

London’s wholesale markets play a significant part

in the distribution of fresh foodstuffs. New Covent

Garden at Nine Elms is the main market for fruit

and vegetables, London Central Markets at

464

29 Finance and other service industries

operation in December 2001, replacing eight

previous compensation schemes. It provides

compensation for:

■ deposits - when an authorised deposit-taking

firm (such as a bank, building society or

credit union) goes out of business or the FSA

considers that it is unable to repay depositors

or likely to be unable to do so. The maximum

level of compensation for a customer,

covering all of his or her deposits, is £31,700

(100 per cent of the first £2,000 and

90 per cent of the next £33,000);

■ investments - two kinds of loss are covered:

when an authorised investment firm goes out

of business and cannot return investments or

money, and a loss arising from bad

investment advice or poor investment

management. The maximum compensation

is £48,000 (all of the first £30,000 and

90 per cent of the next £20,000); and

■ insurance - 100 per cent cover for

compulsory insurance (such as third-party

motor insurance) and for other insurance

(including long-term insurance, such as

pensions and life assurance) 100 per cent

cover for the first £2,000, with 90 per cent

protection for amounts above this threshold.

Financial Ombudsman Service

The Financial Ombudsman Service is a one-stop

service for dealing with complaints about financial

services firms. The budget for 2002/03 is around

£28 million. All firms authorised by the FSA are

subject to the Ombudsman’s procedures, but

consumers have to seek a resolution to a

complaint from the firm in the first instance. If

the matter is not resolved satisfactorily, they can

ask the Ombudsman to intervene.

Introduction to other service

industries

The distribution of goods, including food and

drink, to their point of sale is a major economic

activity. The large wholesalers and retailers of food

and drink operate extensive distribution networks,

either directly or through contractors.

With rising real incomes, consumer spending on

personal and leisure services has increased

considerably. Travel, hotel and restaurant services

in the UK are among those to have benefited from

long-term growth in tourism. The UK is one of

the world’s leading tourist destinations, even

though the foot-and-mouth outbreak in 2001 and

the aftermath of 11 September caused a

temporary decline in visitor numbers.

Computer activities and research and

development are among the non-financial sectors

which experienced strong growth in turnover in

2001 (see Table 29.7).

Table 29.7 Turnover1 in selected

non-financial services

£ billion

2000 2001 % change

Motor trades

Wholesale trades

Hotels and restaurants

Renting

Computer and related

activities

Business services

122.5 125.3 2.2

380.1 375.5 -1.2

52.8 56.6 7.2

17.3 18.3 5.9

40.8 46.2 13.2

145.9 161.7 10.8

1 Annual data derived from short-term turnover inquiries.

Source: Office for National Statistics

Wholesaling and retailing

In 2002 there were over 107,000 enterprises (see

Table 29.8) engaged in wholesaling in the UK;

25 per cent were sole proprietors and 15 per cent

partnerships. There were 1.18 million employee

jobs in the UK in this sector in December 2001

and turnover in 2001 amounted to £375 billion,

1.2 per cent lower than in 2000.

In the food and drink trade almost all large

retailers have their own buying and central

distribution operations. Many small wholesalers

and independent grocery retailers belong to

voluntary ‘symbol’ groups, which provide access to

central purchasing facilities and co-ordinated

promotions. This has helped smaller retailers to

remain relatively competitive; many local and

convenience stores and village shops would not

otherwise be able to stay in business.

London’s wholesale markets play a significant part

in the distribution of fresh foodstuffs. New Covent

Garden at Nine Elms is the main market for fruit

and vegetables, London Central Markets at

464

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

The item on this page appears courtesy of Office for National Statistics and may be re-used under the Open Government Licence for Public Sector Information.

| Britain and UK handbooks > UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland > 2003 > (514) |

|---|

| Permanent URL | https://digital.nls.uk/204929795 |

|---|

| Attribution and copyright: |

|

|---|---|

| Description | Three volumes of 'UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland', published annually by the Office of National Statistics from 2002-2005. |

|---|---|

| Shelfmark | GII.11 SER |

| Description | Three titles produced by the British Government from 1954-2005 describing 'how Britain worked'. They are: 'Britain: An official handbook' (1954-1998), 'Britain: The official yearbook of the United Kingdom' (1999-2001), and 'UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland' (2002-2005). These 50 reports provide an overview of Britain's economic, social and cultural affairs, its environment, international relations, and the systems of government. They give an impartial summary of government policies and initiatives, and explain how public services are organised. |

|---|---|

| Additional NLS resources: |

|