Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

Economic affairs

23 Public finance

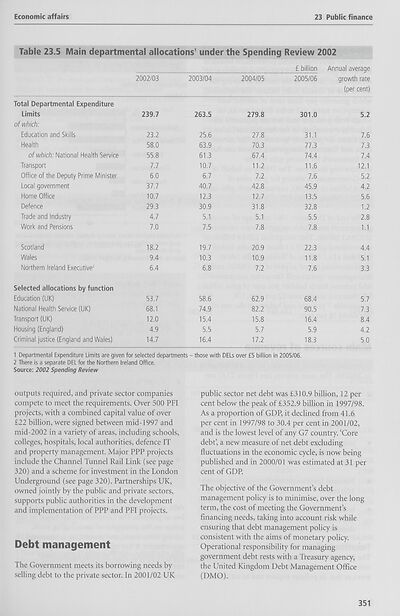

Table 23.5 Main departmental allocations1 under the Spending Review 2002

Total Departmental Expenditure

Limits

of which:

Education and Skills

Health

of which: National Health Service

Transport

Office of the Deputy Prime Minister

Local government

Home Office

Defence

Trade and Industry

Work and Pensions

2002/03

239.7

23.2

58.0

55.8

7.7

6.0

37.7

10.7

29.3

4.7

7.0

2003/04

263.5

25.6

63.9

61.3

10.7

6.7

40.7

12.3

30.9

5.1

7.5

2004/05

279.8

27.8

70.3

67.4

11.2

7.2

42.8

12.7

31.8

5.1

7.8

£ billion Annual average

growth rate

(per cent)

2005/06

301.0

31.1

77.3

74.4

11.6

7.6

45.9

13.5

32.8

5.5

7.8

5.2

7.6

7.3

7.4

12.1

5.2

4.2

5.6

1.2

2.8

1.1

Scotland

Wales

Northern Ireland Executive2

18.2

9.4

6.4

19.7

10.3

6.8

20.9

10.9

7.2

22.3

11.8

7.6

4.4

5.1

3.3

Selected allocations by function

Education (UK) 53.7

National Health Service (UK) 68.1

Transport (UK) 12.0

Housing (England) 4.9

Criminal justice (England and Wales) 14.7

58.6

74.9

15.4

5.5

16.4

62.9

82.2

15.8

5.7

17.2

68.4

90.5

16.4

5.9

18.3

1 Departmental Expenditure Limits are given for selected departments - those with DELs over £5 billion in 2005/06.

2 There is a separate DEL for the Northern Ireland Office.

Source: 2002 Spending Review

5.7

7.3

8.4

4.2

5.0

outputs required, and private sector companies

compete to meet the requirements. Over 500 PFI

projects, with a combined capital value of over

£22 billion, were signed between mid-1997 and

mid-2002 in a variety of areas, including schools,

colleges, hospitals, local authorities, defence IT

and property management. Major PPP projects

include the Channel Tunnel Rail Link (see page

320) and a scheme for investment in the London

Underground (see page 320). Partnerships UK,

owned jointly by the public and private sectors,

supports public authorities in the development

and implementation of PPP and PFI projects.

Debt management

The Government meets its borrowing needs by

selling debt to the private sector. In 2001/02 UK

public sector net debt was £310.9 billion, 12 per

cent below the peak of £352.9 billion in 1997/98.

As a proportion of GDP, it declined from 41.6

per cent in 1997/98 to 30.4 per cent in 2001/02,

and is the lowest level of any G7 country. ‘Core

debt’, a new measure of net debt excluding

fluctuations in the economic cycle, is now being

published and in 2000/01 was estimated at 31 per

cent of GDP.

The objective of the Government’s debt

management policy is to minimise, over the long

term, the cost of meeting the Government’s

financing needs, taking into account risk while

ensuring that debt management policy is

consistent with the aims of monetary policy.

Operational responsibility for managing

government debt rests with a Treasury agency,

the United Kingdom Debt Management Office

(DMO).

351

23 Public finance

Table 23.5 Main departmental allocations1 under the Spending Review 2002

Total Departmental Expenditure

Limits

of which:

Education and Skills

Health

of which: National Health Service

Transport

Office of the Deputy Prime Minister

Local government

Home Office

Defence

Trade and Industry

Work and Pensions

2002/03

239.7

23.2

58.0

55.8

7.7

6.0

37.7

10.7

29.3

4.7

7.0

2003/04

263.5

25.6

63.9

61.3

10.7

6.7

40.7

12.3

30.9

5.1

7.5

2004/05

279.8

27.8

70.3

67.4

11.2

7.2

42.8

12.7

31.8

5.1

7.8

£ billion Annual average

growth rate

(per cent)

2005/06

301.0

31.1

77.3

74.4

11.6

7.6

45.9

13.5

32.8

5.5

7.8

5.2

7.6

7.3

7.4

12.1

5.2

4.2

5.6

1.2

2.8

1.1

Scotland

Wales

Northern Ireland Executive2

18.2

9.4

6.4

19.7

10.3

6.8

20.9

10.9

7.2

22.3

11.8

7.6

4.4

5.1

3.3

Selected allocations by function

Education (UK) 53.7

National Health Service (UK) 68.1

Transport (UK) 12.0

Housing (England) 4.9

Criminal justice (England and Wales) 14.7

58.6

74.9

15.4

5.5

16.4

62.9

82.2

15.8

5.7

17.2

68.4

90.5

16.4

5.9

18.3

1 Departmental Expenditure Limits are given for selected departments - those with DELs over £5 billion in 2005/06.

2 There is a separate DEL for the Northern Ireland Office.

Source: 2002 Spending Review

5.7

7.3

8.4

4.2

5.0

outputs required, and private sector companies

compete to meet the requirements. Over 500 PFI

projects, with a combined capital value of over

£22 billion, were signed between mid-1997 and

mid-2002 in a variety of areas, including schools,

colleges, hospitals, local authorities, defence IT

and property management. Major PPP projects

include the Channel Tunnel Rail Link (see page

320) and a scheme for investment in the London

Underground (see page 320). Partnerships UK,

owned jointly by the public and private sectors,

supports public authorities in the development

and implementation of PPP and PFI projects.

Debt management

The Government meets its borrowing needs by

selling debt to the private sector. In 2001/02 UK

public sector net debt was £310.9 billion, 12 per

cent below the peak of £352.9 billion in 1997/98.

As a proportion of GDP, it declined from 41.6

per cent in 1997/98 to 30.4 per cent in 2001/02,

and is the lowest level of any G7 country. ‘Core

debt’, a new measure of net debt excluding

fluctuations in the economic cycle, is now being

published and in 2000/01 was estimated at 31 per

cent of GDP.

The objective of the Government’s debt

management policy is to minimise, over the long

term, the cost of meeting the Government’s

financing needs, taking into account risk while

ensuring that debt management policy is

consistent with the aims of monetary policy.

Operational responsibility for managing

government debt rests with a Treasury agency,

the United Kingdom Debt Management Office

(DMO).

351

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

The item on this page appears courtesy of Office for National Statistics and may be re-used under the Open Government Licence for Public Sector Information.

| Britain and UK handbooks > UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland > 2003 > (389) |

|---|

| Permanent URL | https://digital.nls.uk/204928167 |

|---|

| Attribution and copyright: |

|

|---|---|

| Description | Three volumes of 'UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland', published annually by the Office of National Statistics from 2002-2005. |

|---|---|

| Shelfmark | GII.11 SER |

| Description | Three titles produced by the British Government from 1954-2005 describing 'how Britain worked'. They are: 'Britain: An official handbook' (1954-1998), 'Britain: The official yearbook of the United Kingdom' (1999-2001), and 'UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland' (2002-2005). These 50 reports provide an overview of Britain's economic, social and cultural affairs, its environment, international relations, and the systems of government. They give an impartial summary of government policies and initiatives, and explain how public services are organised. |

|---|---|

| Additional NLS resources: |

|