Britain: An official handbook > 1966

(467)

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

TRADE AND PAYMENTS

TABLE 30

United Kingdom

General Bal/

of Payments

435

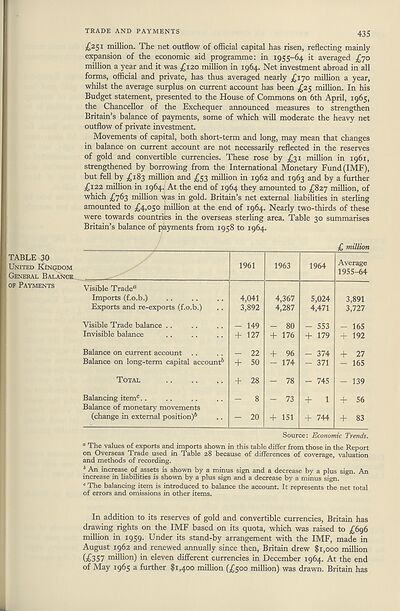

£251 million. The net outflow of official capital has risen, reflecting mainly

expansion of the economic aid programme: in 1955-64 it averaged £70

million a year and it was £120 million in 1964. Net investment abroad in all

forms, official and private, has thus averaged nearly ^170 million a year,

whilst the average surplus on current account has been £25 million. In his

Budget statement, presented to the House of Commons on 6th April, 1965,

the Chancellor of the Exchequer announced measures to strengthen

Britain’s balance of payments, some of which will moderate the heavy net

outflow of private investment.

Movements of capital, both short-term and long, may mean that changes

in balance on current account are not necessarily reflected in the reserves

of gold and convertible currencies. These rose by £31 million in 1961,

strengthened by borrowing from the International Monetary Fund (IMF),

but fell by ^183 million and £53 million in 1962 and 1963 and by a further

£122 million in 1964. At the end of 1964 they amounted to £827 million, of

which £763 million was in gold. Britain’s net external liabilities in sterling

amounted to £4,050 million at the end of 1964. Nearly two-thirds of these

were towards countries in the overseas sterling area. Table 30 summarises

Britain’s balance of payments from 1958 to 1964.

£ million

Visible Tradea

Imports (f.o.b.)

Exports and re-exports (f.o.b.)

Visible Trade balance . .

Invisible balance

Balance on current account

Balance on long-term capital account6

Total

Balancing item0. .

Balance of monetary movements

(change in external position)6

1961

4,041

3,892

- 149

+ 127

- 22

+ 50

+ 28

- 8

- 20

1963

4,367

4,287

- 80

+ 176

+ 96

- 174

- 78

- 73

+ 151

1964

5,024

4,471

- 553

+ 179

- 374

- 371

- 745

+ 1

+ 744

Average

1955-64

3,891

3,727

- 165

+ 192

+ 27

- 165

- 139

+ 56

+ 83

Source: Economic Trends.

a The values of exports and imports shown in this table differ from those in the Report

on Overseas Trade used in Table 28 because of differences of coverage, valuation

and methods of recording.

1 An increase of assets is shown by a minus sign and a decrease by a plus sign. An

increase in liabilities is shown by a plus sign and a decrease by a minus sign.

c The balancing item is introduced to balance the account. It represents the net total

of errors and omissions in other items.

In addition to its reserves of gold and convertible currencies, Britain has

drawing rights on the IMF based on its quota, which was raised to £696

million in 1959. Under its stand-by arrangement with the IMF, made in

August 1962 and renewed annually since then, Britain drew $1,000 million

(£357 million) in eleven different currencies in December 1964. At the end

of May 1965 a further $1,400 million (£500 million) was drawn. Britain has

TABLE 30

United Kingdom

General Bal/

of Payments

435

£251 million. The net outflow of official capital has risen, reflecting mainly

expansion of the economic aid programme: in 1955-64 it averaged £70

million a year and it was £120 million in 1964. Net investment abroad in all

forms, official and private, has thus averaged nearly ^170 million a year,

whilst the average surplus on current account has been £25 million. In his

Budget statement, presented to the House of Commons on 6th April, 1965,

the Chancellor of the Exchequer announced measures to strengthen

Britain’s balance of payments, some of which will moderate the heavy net

outflow of private investment.

Movements of capital, both short-term and long, may mean that changes

in balance on current account are not necessarily reflected in the reserves

of gold and convertible currencies. These rose by £31 million in 1961,

strengthened by borrowing from the International Monetary Fund (IMF),

but fell by ^183 million and £53 million in 1962 and 1963 and by a further

£122 million in 1964. At the end of 1964 they amounted to £827 million, of

which £763 million was in gold. Britain’s net external liabilities in sterling

amounted to £4,050 million at the end of 1964. Nearly two-thirds of these

were towards countries in the overseas sterling area. Table 30 summarises

Britain’s balance of payments from 1958 to 1964.

£ million

Visible Tradea

Imports (f.o.b.)

Exports and re-exports (f.o.b.)

Visible Trade balance . .

Invisible balance

Balance on current account

Balance on long-term capital account6

Total

Balancing item0. .

Balance of monetary movements

(change in external position)6

1961

4,041

3,892

- 149

+ 127

- 22

+ 50

+ 28

- 8

- 20

1963

4,367

4,287

- 80

+ 176

+ 96

- 174

- 78

- 73

+ 151

1964

5,024

4,471

- 553

+ 179

- 374

- 371

- 745

+ 1

+ 744

Average

1955-64

3,891

3,727

- 165

+ 192

+ 27

- 165

- 139

+ 56

+ 83

Source: Economic Trends.

a The values of exports and imports shown in this table differ from those in the Report

on Overseas Trade used in Table 28 because of differences of coverage, valuation

and methods of recording.

1 An increase of assets is shown by a minus sign and a decrease by a plus sign. An

increase in liabilities is shown by a plus sign and a decrease by a minus sign.

c The balancing item is introduced to balance the account. It represents the net total

of errors and omissions in other items.

In addition to its reserves of gold and convertible currencies, Britain has

drawing rights on the IMF based on its quota, which was raised to £696

million in 1959. Under its stand-by arrangement with the IMF, made in

August 1962 and renewed annually since then, Britain drew $1,000 million

(£357 million) in eleven different currencies in December 1964. At the end

of May 1965 a further $1,400 million (£500 million) was drawn. Britain has

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

The item on this page appears courtesy of Office for National Statistics and may be re-used under the Open Government Licence for Public Sector Information.

| Britain and UK handbooks > Britain: An official handbook > 1966 > (467) |

|---|

| Permanent URL | https://digital.nls.uk/204633470 |

|---|

| Attribution and copyright: |

|

|---|---|

| Description | 'Britain: An official handbook' was produced annually by the Central Office of Information from 1954-1998. There are 44 volumes available here to view. |

|---|---|

| Shelfmark | GII.11 |

| Description | Three titles produced by the British Government from 1954-2005 describing 'how Britain worked'. They are: 'Britain: An official handbook' (1954-1998), 'Britain: The official yearbook of the United Kingdom' (1999-2001), and 'UK: The official yearbook of the United Kingdom of Great Britain and Northern Ireland' (2002-2005). These 50 reports provide an overview of Britain's economic, social and cultural affairs, its environment, international relations, and the systems of government. They give an impartial summary of government policies and initiatives, and explain how public services are organised. |

|---|---|

| Additional NLS resources: |

|