1926

(475) Page 423

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

CHINA’S PERMANENT CONSTITUTION

423

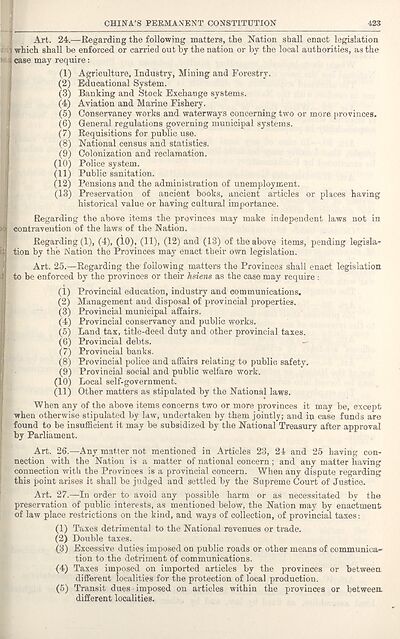

Art. 24.—Regarding the following matters, the Nation shall enact legislation

which shall be enforced or carried out bj the nation or by the local authorities, as the

case may require:

(1) Agriculture, Industry, Mining and Forestry.

(2) Educational System.

(3) Banking and Stock Exchange systems.

(4) Aviation and Marine Fishery.

(5) Conservancy works and waterways concerning two or more provinces.

(6) General regulations governing municipal systems.

(7) Requisitions for public use.

(8) National census and statistics.

(9) Colonization and reclamation.

(10) Police system.

(11) Public sanitation.

(12) Pensions and the administration of unemployment.

(13) Preservation of ancient books, ancient articles or places having

historical value or having cultural importance.

Regarding the above items the provinces may make independent laws not in

contravention of the laws of the Nation.

Regarding (1), (4), (10), (11), (12) and (13) of the above items, pending legisla¬

tion by the Nation the Provinces may enact their own legislation.

Art. 25.—Regarding the following matters the Provinces shall enact legislation

to be enforced by the provinces or their hsiens as the case may require :

(1) Provincial education, industry and communications.

(2) Management and disposal of provincial properties,

(3) Provincial municipal affairs.

(4) Provincial conservancy and public works.

(5) Land tax, title-deed duty and other provincial taxes.

(6) Provincial debts.

(7) Provincial banks.

(8) Provincial police and affairs relating to public safety.

(9) Provincial social and public welfare work.

(10) Local self-government.

(11) Other matters as stipulated by the National laws.

When any of the above items concerns two or more provinces it may be, except

when otherwise stipulated by law, undertaken by them jointly; and in case funds are

found to be insufficient it may be subsidized by the National Treasury after approval

by Parliament.

Art. 26.—Any matter not mentioned in Articles 23, 24 and 25 having con¬

nection with the Nation is a matter of national concern; and any matter having

connection with the Provinces is a provincial concern. When any dispute regarding

this point arises it shall be judged and settled by the Supreme Court of Justice.

Art. 27.—In order to avoid any possible harm or as necessitated by the

preservation of public interests, as mentioned below, the Nation may by enactment

of law place restrictions on the kind, and ways of collection, of provincial taxes :

(1) Taxes detrimental to the National revenues or trade.

(2) Double taxes.

(3) Excessive duties imposed on public roads or other means of communica¬

tion to the detriment of communications.

(4) Taxes imposed on imported articles by the provinces or between

different localities for the protection of local production.

(5) Transit dues imposed on articles within the provinces or between,

different localities.

423

Art. 24.—Regarding the following matters, the Nation shall enact legislation

which shall be enforced or carried out bj the nation or by the local authorities, as the

case may require:

(1) Agriculture, Industry, Mining and Forestry.

(2) Educational System.

(3) Banking and Stock Exchange systems.

(4) Aviation and Marine Fishery.

(5) Conservancy works and waterways concerning two or more provinces.

(6) General regulations governing municipal systems.

(7) Requisitions for public use.

(8) National census and statistics.

(9) Colonization and reclamation.

(10) Police system.

(11) Public sanitation.

(12) Pensions and the administration of unemployment.

(13) Preservation of ancient books, ancient articles or places having

historical value or having cultural importance.

Regarding the above items the provinces may make independent laws not in

contravention of the laws of the Nation.

Regarding (1), (4), (10), (11), (12) and (13) of the above items, pending legisla¬

tion by the Nation the Provinces may enact their own legislation.

Art. 25.—Regarding the following matters the Provinces shall enact legislation

to be enforced by the provinces or their hsiens as the case may require :

(1) Provincial education, industry and communications.

(2) Management and disposal of provincial properties,

(3) Provincial municipal affairs.

(4) Provincial conservancy and public works.

(5) Land tax, title-deed duty and other provincial taxes.

(6) Provincial debts.

(7) Provincial banks.

(8) Provincial police and affairs relating to public safety.

(9) Provincial social and public welfare work.

(10) Local self-government.

(11) Other matters as stipulated by the National laws.

When any of the above items concerns two or more provinces it may be, except

when otherwise stipulated by law, undertaken by them jointly; and in case funds are

found to be insufficient it may be subsidized by the National Treasury after approval

by Parliament.

Art. 26.—Any matter not mentioned in Articles 23, 24 and 25 having con¬

nection with the Nation is a matter of national concern; and any matter having

connection with the Provinces is a provincial concern. When any dispute regarding

this point arises it shall be judged and settled by the Supreme Court of Justice.

Art. 27.—In order to avoid any possible harm or as necessitated by the

preservation of public interests, as mentioned below, the Nation may by enactment

of law place restrictions on the kind, and ways of collection, of provincial taxes :

(1) Taxes detrimental to the National revenues or trade.

(2) Double taxes.

(3) Excessive duties imposed on public roads or other means of communica¬

tion to the detriment of communications.

(4) Taxes imposed on imported articles by the provinces or between

different localities for the protection of local production.

(5) Transit dues imposed on articles within the provinces or between,

different localities.

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Asian directories and chronicles > 1926 > (475) Page 423 |

|---|

| Permanent URL | https://digital.nls.uk/196494348 |

|---|

| Attribution and copyright: |

|

|---|---|

| Description | Volumes from the Asian 'Directory and Chronicle' series covering 1917-1941, but missing 1919 and 1923. Compiled annually from a multiplicity of local sources and research. They provide listings of each country's active corporations, foreign residents and government agencies of all nationalities for that year, together with their addresses. Content includes: various treaties; coverage of conflicts; currencies and taxes; consular fees; weights and measures; public holidays; festivals and traditions. A source of information for both Western states and communities of foreigners living in Asia. Published by Hongkong Daily Press. |

|---|---|

| Shelfmark | H3.86.1303 |

| Additional NLS resources: |