1917

(107) Page 27

Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

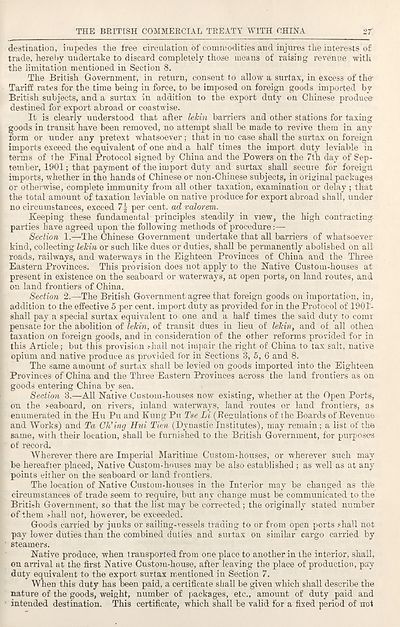

THE BRITISH COMMERCIAL TREATY WITH CHINA

2T

destination, impedes the free circulation of commodities and injures the interests of

trade, hereby undertake to discard completely those means of raising revenue with

the limitation mentioned in Section 8.

The British Government, in return, consent to allow a surtax, in excess of the1

Tariff rates for the time being in force, to he imposed on foreign goods imported by

British subjects, and a surtax in addition to the export duty on Chinese produce

destined for export abroad or coastwise.

It is clearly understood that after lehin barriers and other stations for taxing

goods in transit have been removed, no attempt shall be made to revive them in any

form or under any pretext whatsoever; that in no case shall the surtax on foreign

imports exceed the equivalent of one and a half times the import duty leviable in

terms of the Final Protocol signed by China and the Powers on the 7th day of Sep¬

tember, 1901; that payment of the import duty and surtax shall secure for foreign

imports, whether in the hands of Chinese or non-Chinese subjects, in original packages

or otherwise, complete immunity from all other taxation, examination or delay ; that

the total amount of taxation leviable on native produce for export abroad shall, under

no circumstances, exceed 7| per cent, ad valorem.

Keeping these fundamental principles steadily in view, the high contracting

parties have agreed upon the following methods of procedure:—

Section 1.—The Chinese Government undertake that all barriers of whatsoever

kind, collecting lehin or such like dues or duties, shall be permanently abolished on all

roads, railways, and waterways in the Eighteen Provinces of China and the Three

Eastern Provinces. This provision does not apply to the Native Custom-houses at

present in existence on the seaboard or waterways, at open ports, on land routes, and

on land frontiers of China.

Section 2.—The British Government agree that foreign goods on importation, in,

addition to the effective 5 per cent, import duty as provided for in the Protocol of 1901-

shall pay a special surtax equivalent to one and a half times the said duty to comr

pensate for the abolition of lekin, of transit dues in lieu of lehin, and of all otheA

taxation on foreign goods, and in consideration of the other reforms provided for in

this Article; but this provision shall not impair the right of China to tax salt, native

opium and native produce as provided for in Sections 8, 5, 6 and 8.

The same amount of surtax shall be levied on goods imported into the Eighteen

Provinces of China and the Three Eastern Provinces across the land frontiers as on

goods entering China by sea.

Section 3.—All Native Custom-houses now existing, whether at the Open Ports,

on the seaboard, on rivers, inland waterways, land routes or land frontiers, as

enumerated in the Hu Pu and Kung Pu Tse Li (Regulations of the Boards of Bevenue

and Works) and Ta Ch’ing Hui Tien (Dynastic Institutes), may remain; a list of the

same, with their location, shall be furnished to the British Government, for purposes

of record.

Wherever there are Imperial Maritime Custom-houses, or wherever such may

be hereafter placed, Native Custom-houses may be also established ; as well as at any

points either on the seaboard or land frontiers.

The location of Native Custom-houses in the Interior may be changed as the

circumstances of trade seem to require, but any change must be communicated to the

British Government, so that the list may be corrected; the originally stated number

of them shall not, however, be exceeded.

Goods carried by junks or sailing-vessels trading to or from open ports shall not

pay lower duties than the combined duties and surtax on similar cargo carried by

steamers.

Native produce, when transported from one place to another in the interior, shall,

on arrival at the first Native Custom-house, after leaving the place of production, pay

duty equivalent to the export surtax mentioned in Section 7.

When this duty has been paid, a certificate shall be given which shall describe the

nature of the goods, weight, number of packages, etc., amount of duty paid and

intended destination. This certificate, which shall be valid for a fixed period of not

2T

destination, impedes the free circulation of commodities and injures the interests of

trade, hereby undertake to discard completely those means of raising revenue with

the limitation mentioned in Section 8.

The British Government, in return, consent to allow a surtax, in excess of the1

Tariff rates for the time being in force, to he imposed on foreign goods imported by

British subjects, and a surtax in addition to the export duty on Chinese produce

destined for export abroad or coastwise.

It is clearly understood that after lehin barriers and other stations for taxing

goods in transit have been removed, no attempt shall be made to revive them in any

form or under any pretext whatsoever; that in no case shall the surtax on foreign

imports exceed the equivalent of one and a half times the import duty leviable in

terms of the Final Protocol signed by China and the Powers on the 7th day of Sep¬

tember, 1901; that payment of the import duty and surtax shall secure for foreign

imports, whether in the hands of Chinese or non-Chinese subjects, in original packages

or otherwise, complete immunity from all other taxation, examination or delay ; that

the total amount of taxation leviable on native produce for export abroad shall, under

no circumstances, exceed 7| per cent, ad valorem.

Keeping these fundamental principles steadily in view, the high contracting

parties have agreed upon the following methods of procedure:—

Section 1.—The Chinese Government undertake that all barriers of whatsoever

kind, collecting lehin or such like dues or duties, shall be permanently abolished on all

roads, railways, and waterways in the Eighteen Provinces of China and the Three

Eastern Provinces. This provision does not apply to the Native Custom-houses at

present in existence on the seaboard or waterways, at open ports, on land routes, and

on land frontiers of China.

Section 2.—The British Government agree that foreign goods on importation, in,

addition to the effective 5 per cent, import duty as provided for in the Protocol of 1901-

shall pay a special surtax equivalent to one and a half times the said duty to comr

pensate for the abolition of lekin, of transit dues in lieu of lehin, and of all otheA

taxation on foreign goods, and in consideration of the other reforms provided for in

this Article; but this provision shall not impair the right of China to tax salt, native

opium and native produce as provided for in Sections 8, 5, 6 and 8.

The same amount of surtax shall be levied on goods imported into the Eighteen

Provinces of China and the Three Eastern Provinces across the land frontiers as on

goods entering China by sea.

Section 3.—All Native Custom-houses now existing, whether at the Open Ports,

on the seaboard, on rivers, inland waterways, land routes or land frontiers, as

enumerated in the Hu Pu and Kung Pu Tse Li (Regulations of the Boards of Bevenue

and Works) and Ta Ch’ing Hui Tien (Dynastic Institutes), may remain; a list of the

same, with their location, shall be furnished to the British Government, for purposes

of record.

Wherever there are Imperial Maritime Custom-houses, or wherever such may

be hereafter placed, Native Custom-houses may be also established ; as well as at any

points either on the seaboard or land frontiers.

The location of Native Custom-houses in the Interior may be changed as the

circumstances of trade seem to require, but any change must be communicated to the

British Government, so that the list may be corrected; the originally stated number

of them shall not, however, be exceeded.

Goods carried by junks or sailing-vessels trading to or from open ports shall not

pay lower duties than the combined duties and surtax on similar cargo carried by

steamers.

Native produce, when transported from one place to another in the interior, shall,

on arrival at the first Native Custom-house, after leaving the place of production, pay

duty equivalent to the export surtax mentioned in Section 7.

When this duty has been paid, a certificate shall be given which shall describe the

nature of the goods, weight, number of packages, etc., amount of duty paid and

intended destination. This certificate, which shall be valid for a fixed period of not

Set display mode to:

![]() Universal Viewer |

Universal Viewer | ![]() Mirador |

Large image | Transcription

Mirador |

Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Asian directories and chronicles > 1917 > (107) Page 27 |

|---|

| Permanent URL | https://digital.nls.uk/194533699 |

|---|

| Attribution and copyright: |

|

|---|---|

| Description | Volumes from the Asian 'Directory and Chronicle' series covering 1917-1941, but missing 1919 and 1923. Compiled annually from a multiplicity of local sources and research. They provide listings of each country's active corporations, foreign residents and government agencies of all nationalities for that year, together with their addresses. Content includes: various treaties; coverage of conflicts; currencies and taxes; consular fees; weights and measures; public holidays; festivals and traditions. A source of information for both Western states and communities of foreigners living in Asia. Published by Hongkong Daily Press. |

|---|---|

| Shelfmark | H3.86.1303 |

| Additional NLS resources: |