Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

The future sources of prolit, therefore, will always remain the same, viz.: —

1. Any difference betwixt the assumed and thereat rate of Interest, which at present

is from a Half to One per Cent. ;

2. The difference betwixt the actual and the anticipated Mortality ;

3. The profit upon lapsed and surrendered Policies ; and

4. The difference betwixt the per Centages added for Management and the Expenses

which may be incurred.

The Directors having had before them the different methods in use for apportioning

the free profit among the Policy holders, have resolved to adopt that plan which consti-

tutes the sum insured and the duration of the policy the elements on which the division

is made.

All the Assurances current upon the 30th of April last will have assigned to them a

bonus proportioned to the sum insured, and to the number of years which have elapsed

since the opening of the Policy. At next investigation, in 1851, the additions will be

made for the five years preceding, upon the sum contained in the policy, increased by the

bonus now declared. Each investigation, therefore, constitutes a distinct resting place

from which a new departure is taken, the bonus being regulated at each succeeding

period, not by the original sum insured, but upon that sum increased by the former

accumulations of profit.

It is almost unnecessary to state that this system is pursued by the Scottish Widows'

Fund, and recommended by the example of the Scottish Equitable, North British, and a

variety of other Offices. The Directors may be permitted to say, that although, in their

opinion, the plan is not altogether free from inequalities, yet, as a whole, it adjusts the

interests of the different classes of policy holders, with very considerable precision, and

they trust that it will be satisfactory to all concerned.

After allowing an ample Fund for contingencies, the Directors are enabled to propose

additions to all Policies opened on or before the 30th day of April, 1846, at the rate of

one and a fourth per Cent, per Annum upon the sums insured, for each Annual Payment

made ; and in relation to Policies where the payments are made by Single Premiums,

or by any mode of contribution other than Annual Payments, the same rate of additions

as if the Assurance had been granted upon Annual Premiums.

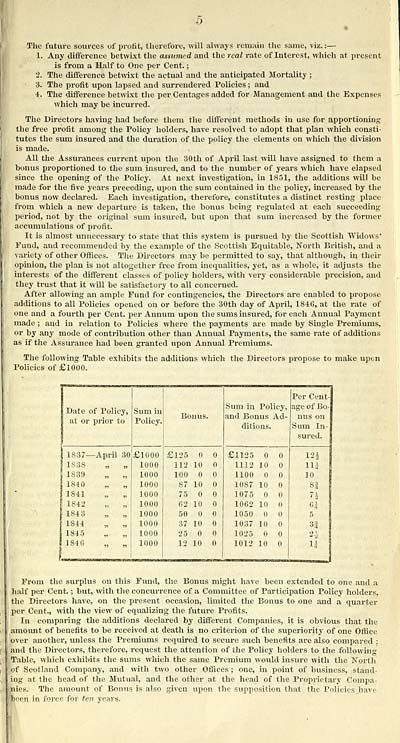

The following Table exhibits the additions which the Directors propose to make upon

Policies of £1000.

j

Per Cent-I

j Date of Policy,

| at or prior to

Sum in

Policy.

Bonus

Sum in Policy,

and Bonus Ad-

ditions.

age of Bo-I

nus on I

Sum In- 1

sured. j

1837— April 30

£1000

£125

£1125

12J

' 1S38 „ „

1000

112

10

1112 10

Hi

1S39 „ „

1000

100

1100

10

1 1840 „ „

1000

87

10

10S7 10

Si

! 1841 „ „

1000

75

1075

7J

! 1842 „ „

1000

62

10

1062 10

hi

184 3

1000

50

1050

5

1844 „ „

1000

37

10

1037 10

3J

1845 „ „

1000

25

1025

184G „ „

1000

12

10

1012 10

H 1

From the surplus on this Fund, the Bonus might have been extended to one and a

half per Cent. ; but, with the concurrence of a Committee of Participation Policy holders,

the Directors have, on the present occasion, limited the Bonus to one and a quarter

per Cent., with the view of equalizing the future Profits.

In comparing the additions declared by different Companies, it is obvious that the

amount of benefits to be received at death is no criterion of the superiority of one Office

over another, unless the Premiums required to secure such benefits are also compared ;

and the Directors, therefore, request the attention of the Policy holders to the following

Table, which exhibits the sums which the same Premium would insure with the North

of Scotland Company, and with two other Offices ; one, in point of business, stand-

ing at the head of the Mutual, and the other at the head of the Proprietary Compa-

nies. The amount of Bonus is also given upon the supposition that the Policies hare

'been in force for ten years.

1. Any difference betwixt the assumed and thereat rate of Interest, which at present

is from a Half to One per Cent. ;

2. The difference betwixt the actual and the anticipated Mortality ;

3. The profit upon lapsed and surrendered Policies ; and

4. The difference betwixt the per Centages added for Management and the Expenses

which may be incurred.

The Directors having had before them the different methods in use for apportioning

the free profit among the Policy holders, have resolved to adopt that plan which consti-

tutes the sum insured and the duration of the policy the elements on which the division

is made.

All the Assurances current upon the 30th of April last will have assigned to them a

bonus proportioned to the sum insured, and to the number of years which have elapsed

since the opening of the Policy. At next investigation, in 1851, the additions will be

made for the five years preceding, upon the sum contained in the policy, increased by the

bonus now declared. Each investigation, therefore, constitutes a distinct resting place

from which a new departure is taken, the bonus being regulated at each succeeding

period, not by the original sum insured, but upon that sum increased by the former

accumulations of profit.

It is almost unnecessary to state that this system is pursued by the Scottish Widows'

Fund, and recommended by the example of the Scottish Equitable, North British, and a

variety of other Offices. The Directors may be permitted to say, that although, in their

opinion, the plan is not altogether free from inequalities, yet, as a whole, it adjusts the

interests of the different classes of policy holders, with very considerable precision, and

they trust that it will be satisfactory to all concerned.

After allowing an ample Fund for contingencies, the Directors are enabled to propose

additions to all Policies opened on or before the 30th day of April, 1846, at the rate of

one and a fourth per Cent, per Annum upon the sums insured, for each Annual Payment

made ; and in relation to Policies where the payments are made by Single Premiums,

or by any mode of contribution other than Annual Payments, the same rate of additions

as if the Assurance had been granted upon Annual Premiums.

The following Table exhibits the additions which the Directors propose to make upon

Policies of £1000.

j

Per Cent-I

j Date of Policy,

| at or prior to

Sum in

Policy.

Bonus

Sum in Policy,

and Bonus Ad-

ditions.

age of Bo-I

nus on I

Sum In- 1

sured. j

1837— April 30

£1000

£125

£1125

12J

' 1S38 „ „

1000

112

10

1112 10

Hi

1S39 „ „

1000

100

1100

10

1 1840 „ „

1000

87

10

10S7 10

Si

! 1841 „ „

1000

75

1075

7J

! 1842 „ „

1000

62

10

1062 10

hi

184 3

1000

50

1050

5

1844 „ „

1000

37

10

1037 10

3J

1845 „ „

1000

25

1025

184G „ „

1000

12

10

1012 10

H 1

From the surplus on this Fund, the Bonus might have been extended to one and a

half per Cent. ; but, with the concurrence of a Committee of Participation Policy holders,

the Directors have, on the present occasion, limited the Bonus to one and a quarter

per Cent., with the view of equalizing the future Profits.

In comparing the additions declared by different Companies, it is obvious that the

amount of benefits to be received at death is no criterion of the superiority of one Office

over another, unless the Premiums required to secure such benefits are also compared ;

and the Directors, therefore, request the attention of the Policy holders to the following

Table, which exhibits the sums which the same Premium would insure with the North

of Scotland Company, and with two other Offices ; one, in point of business, stand-

ing at the head of the Mutual, and the other at the head of the Proprietary Compa-

nies. The amount of Bonus is also given upon the supposition that the Policies hare

'been in force for ten years.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Aberdeen > Post-office and Bon-accord directory > 1846-1847 > (299) |

|---|

| Permanent URL | https://digital.nls.uk/86825344 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|