Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

Xlll

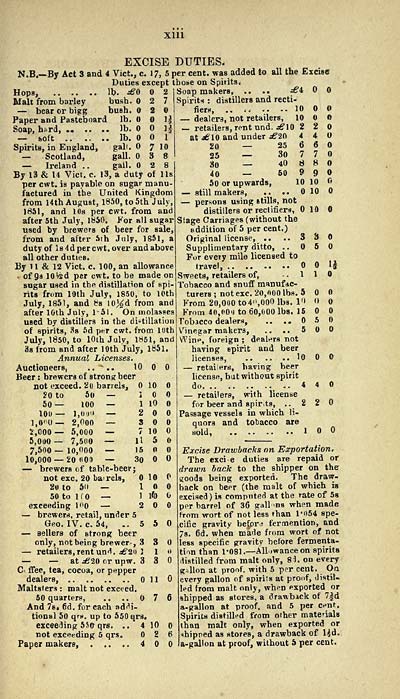

EXCISE DUTIES.

N.B.— By Act 3 and 4 Vict., c. 17, 5 per cent, was added to all the Excisef

Duties except those on Spirits*

Hops, It). ^6 2

Malt from barley bush. 2 7

— bear or bigg bush. 2

Paper and Pasteboard lb, I|

Soap, hard, lb. ]|

— soft lb. 1

Spirits, in England, gali. 7 10

— Scotland, gall, 3 8

— Ireland .. gall. 2 8

By 13 & 14 Vict. c. 13, a duty of lis

per cwt. is payable on sugar manu-

factured in the United Kingdom

from 14th August, 1850, to 5th July,

1851, and lOs per cwt. from and

after 5th July, 1850. For all sugar

used by brewers of beer for sale,

from and after 5th July, 1851, a

duty of Is 4 d per cwt. over and above

all other duties.

By 1 1 & 12 Vict. c. 100, an allowance

. of 93 lOted per cwt. to be made on

sugar used in the distillation of spi-

rits from 10th July, 1850, to 10th

July, 1851, and 8s lOj^d from and

after lOth July, 1-51, On molasses

used by distillers in the distillation

of spirits, Xs 6d per cwt. from 10th

July, 1850, to 10th Julv, 1851, and

3s from and after 10th July, I861.

Annual Licenses,

Auctioneers, .."-.. 10

Beer : brewers of strong beer

not exceed, 2o barrels, 10

?0 to 60 — ;

50 — 100 — 1

100 — l,oi)i» — 2

2,000 — s

5,000 — 7

7,500

l.O'^O —

2,000 —

5,000 —

7,500 — 10,000

10,000 — 20 (iOO

brewers of table-beer j

not exc. 20 bairels, 10

2o to 50 — 10

50to IfO — 1 ifo

exceeding l^O — 2

— brewerrt, retail, under 5

Geo. IV. c. 54, ..550

— sellers of strong beer

only, not being brewer, 3 3

— retailers, rent un'1. ^211 ] 1 «•

— — at ^20 or upw. 330

C' flfee, tea, cocoa, or pepper

dealers, Oil

Maltsters : malt not exceed.

50 quarters, . . . . 7 6

And 7s, fid. for each adHi-

tional 50 qrs), up to 550 qrs.

exceeding 550 qrs. .. 4 10

not exceeding 5 qrs. 2 6

Paper makers, 4

3

5

H

1

n

i)

5

Soap makers, .. .. •s6'4

Spirits : distillers and recti-

fiers, .. -. .. .. 10

— dealers, not retailers, 10 «>

— retailers, rent nnd. ^10 2 2

at J^IO and under sSiO 4 4 U

20 — 25 6 6

25 — 30 7 7

.So — 40 8 8

40 — 50 9 9

5o or upwards, 10 10

— still makers, .. .. 10

— persons using stills, not

distillers or rectifiers, 10

Stage Carriages (without the

addition of 5 per cent.)

Original license, .. ,. 3

Supplimentary ditto, . .

For every mile licensed to

travel,

Sweets, retailers of, . . 1

Tobacco and snuff manufac-

turers ; not exc. 20,000 lbs. 5

From 20,000 to4i',000 lbs. 1<>

From 40,000 to 60,000 lbs. 15

Tobacco dealers, .. ..

Vinegar makers, .. .. 5

Winp, foreign ; dealers not

having spirit and beer

licenses, lO

— retailers, having beer

license, bat without spirit

do ..440

— retailers, with license

for beer and spir.ts, .-2 2

Passage vessels in which li-

quors and tobacco are

sold, 10

Excise Drawbacks on Exportation,

The exci e duties are repaid or

drawn back to the shipper on the

«oods being exported. The draw-

back on beer (the malt of whicb is

excised) is computed at the rate of 58

per barrel of 36 gallms when made

from wort of not less than 1'054 spe-

cific gravity be^pri fermention, and

7s. 6d. when made from wort of not

less specific gravity before fermenta-

tion than I'OSl .— Alliwanceon spirits

distilled from malt only, 81. on every

gsUon at proof, with 5 per cent. On

every gallon of spirits at proof, distil-

led from malt only, when exported^ or

shipped as stores, a drawback of 7|d

a.gallon at proof, and 5 per Ct^nt.

Spirits distilled from other materials

than malt only, when exported or

"^hipped as stores, a drawback of l^d,

a-galion at proof, without 5 per cent.

EXCISE DUTIES.

N.B.— By Act 3 and 4 Vict., c. 17, 5 per cent, was added to all the Excisef

Duties except those on Spirits*

Hops, It). ^6 2

Malt from barley bush. 2 7

— bear or bigg bush. 2

Paper and Pasteboard lb, I|

Soap, hard, lb. ]|

— soft lb. 1

Spirits, in England, gali. 7 10

— Scotland, gall, 3 8

— Ireland .. gall. 2 8

By 13 & 14 Vict. c. 13, a duty of lis

per cwt. is payable on sugar manu-

factured in the United Kingdom

from 14th August, 1850, to 5th July,

1851, and lOs per cwt. from and

after 5th July, 1850. For all sugar

used by brewers of beer for sale,

from and after 5th July, 1851, a

duty of Is 4 d per cwt. over and above

all other duties.

By 1 1 & 12 Vict. c. 100, an allowance

. of 93 lOted per cwt. to be made on

sugar used in the distillation of spi-

rits from 10th July, 1850, to 10th

July, 1851, and 8s lOj^d from and

after lOth July, 1-51, On molasses

used by distillers in the distillation

of spirits, Xs 6d per cwt. from 10th

July, 1850, to 10th Julv, 1851, and

3s from and after 10th July, I861.

Annual Licenses,

Auctioneers, .."-.. 10

Beer : brewers of strong beer

not exceed, 2o barrels, 10

?0 to 60 — ;

50 — 100 — 1

100 — l,oi)i» — 2

2,000 — s

5,000 — 7

7,500

l.O'^O —

2,000 —

5,000 —

7,500 — 10,000

10,000 — 20 (iOO

brewers of table-beer j

not exc. 20 bairels, 10

2o to 50 — 10

50to IfO — 1 ifo

exceeding l^O — 2

— brewerrt, retail, under 5

Geo. IV. c. 54, ..550

— sellers of strong beer

only, not being brewer, 3 3

— retailers, rent un'1. ^211 ] 1 «•

— — at ^20 or upw. 330

C' flfee, tea, cocoa, or pepper

dealers, Oil

Maltsters : malt not exceed.

50 quarters, . . . . 7 6

And 7s, fid. for each adHi-

tional 50 qrs), up to 550 qrs.

exceeding 550 qrs. .. 4 10

not exceeding 5 qrs. 2 6

Paper makers, 4

3

5

H

1

n

i)

5

Soap makers, .. .. •s6'4

Spirits : distillers and recti-

fiers, .. -. .. .. 10

— dealers, not retailers, 10 «>

— retailers, rent nnd. ^10 2 2

at J^IO and under sSiO 4 4 U

20 — 25 6 6

25 — 30 7 7

.So — 40 8 8

40 — 50 9 9

5o or upwards, 10 10

— still makers, .. .. 10

— persons using stills, not

distillers or rectifiers, 10

Stage Carriages (without the

addition of 5 per cent.)

Original license, .. ,. 3

Supplimentary ditto, . .

For every mile licensed to

travel,

Sweets, retailers of, . . 1

Tobacco and snuff manufac-

turers ; not exc. 20,000 lbs. 5

From 20,000 to4i',000 lbs. 1<>

From 40,000 to 60,000 lbs. 15

Tobacco dealers, .. ..

Vinegar makers, .. .. 5

Winp, foreign ; dealers not

having spirit and beer

licenses, lO

— retailers, having beer

license, bat without spirit

do ..440

— retailers, with license

for beer and spir.ts, .-2 2

Passage vessels in which li-

quors and tobacco are

sold, 10

Excise Drawbacks on Exportation,

The exci e duties are repaid or

drawn back to the shipper on the

«oods being exported. The draw-

back on beer (the malt of whicb is

excised) is computed at the rate of 58

per barrel of 36 gallms when made

from wort of not less than 1'054 spe-

cific gravity be^pri fermention, and

7s. 6d. when made from wort of not

less specific gravity before fermenta-

tion than I'OSl .— Alliwanceon spirits

distilled from malt only, 81. on every

gsUon at proof, with 5 per cent. On

every gallon of spirits at proof, distil-

led from malt only, when exported^ or

shipped as stores, a drawback of 7|d

a.gallon at proof, and 5 per Ct^nt.

Spirits distilled from other materials

than malt only, when exported or

"^hipped as stores, a drawback of l^d,

a-galion at proof, without 5 per cent.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Counties > Ayrshire > Ayrshire Directory > (21) |

|---|

| Permanent URL | https://digital.nls.uk/86562959 |

|---|

| Description | Directories of individual Scottish counties or parts of counties. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|