Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

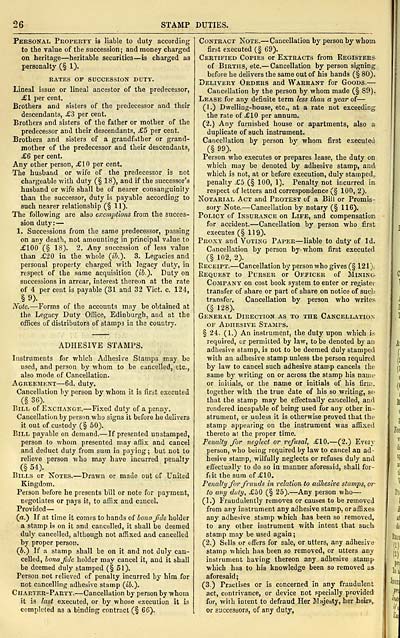

26

STAMP DUTIES.

Personal Property is liable to duty according

to the value of the succession; and money charged

on heritage — heritable securities — is charged as

personalty (§ 1).

RATES OF SUCCESSION DUTY".

Lineal issue or lineal ancestor of the predecessor,

£1 per cent.

Brothers and sisters of the predecessor and their

descendants, £3 per cent.

Brothers and sisters of the father or mother of the

predecessor and their descendants, £5 per cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor and their descendants,

£6 per cent.

Any other person, £10 per cent.

The husband or wife of the predecessor is not

chargeable with duty (§ 18), and if the successor's

husband or wife shall be of nearer consanguinity

than the successor, duty is payable according to

such nearer relationship (§ 11).

The following are also exemptions from the succes-

sion duty: —

1. Successions from the same predecessor, passing

on any death, not amountiog in principal value to

£100 (§ 18). 2. Any succession of less value

than £20 in the whole (ib.~). 3. Legacies and

personal property charged with legacy duty, in

respect of the same acquisition (ib.). Duty on

successions in arrear, interest thereon at the rate

of 4 per cent is payable (31 and 32 Vict. c. 124,

§9).

Note. — Forms of the accounts may be obtained at

the Legacy Duty Office, Edinburgh, and at the

offices of distributors of stamp3 in the country.

ADHESIVE STAMPS.

Instruments for which Adhesive Stamps may bo

used, and person by whom to be cancelled, etc.,

also mode of Cancellation.

Agreement — 6d. duty.

Cancellation by person by whom it is first executed

(§ 36).

Bill of Exchange. — Fixed duty of a penny.

Cancellation by person who signs it before he delivers

it out of custody (§ 50).

Bill payable on demand. — If presented unstamped,

person to whom presented may affix and cancel

and deduct duty from sum in paying; but not to

relieve person who may have incurred penalty

(§ 54).

Bills or Notes. — Drawn or made out of United

Kingdom.

Person before he presents bill or note for payment,

negotiates or pays it, to affix and cancel.

Provided —

(a.) If at time it comes to hands of lonaji.de holder

a stamp is on it and cancelled, it shall be deemed

duly cancelled, although not affixed and cancelled

by proper person.

(6.) If a stamp shall be on it and not duly can-

celled, bona fide holder may cancel it, and it shall

be deemed duly stamped (§ 51).

Person not relieved of penalty incurred by him for

not cancelling adhesive stamp (£&.).

Charter-Party/. — Cancellation by person by whom

it is last executed, or by whose execution it is

completed as a binding contract (§ 66).

Contract Note. — Cancellation by person by whom

first executed (§ 69).

Certified Copies or Extracts from Registers

of Births, etc. — Cancellation by person signing

before he delivers the same out of his hands (§ 80).

Delivery Orders and Warrant for Goods. —

Cancellation by the person by whom made (§ 89).

Lease for any definite term less than a year of —

(1.) Dwelling-house, etc., at a rate not exceeding

the rate of £10 per annum.

(2.) Any furnished house or apartments, also a

duplicate of such instrument.

Cancellation by person by whom first executed

(§ M)-

Person who executes or prepares lease, the duty on

which may be denoted by adhesive stamp, and

which is not, at or before execution, duly stamped,

penalty £5 (§ 100, 1). Penalty not incurred in

respect of letters and correspondence (§ 100, 2).

Notarial Act and Protest of a Bill or Promis-

sory Note. — Cancellation by notary (§ 116).

Policy of Insurance on Life, and compensation

for accident. — Cancellation by person who first

executes (§ 119).

Proxy and Voting Paper — liable to duty of Id.

Cancellation by person by whom first executed

(§ 102, 2).

Receipt. — Cancellation by person who gives (§121).

Request to Purser or Officer of Mining

Company on cost book system to enter or register

transfer of share or part of share on notice of such

transfer. Cancellation by person who writer

(§ 128).

General Direction as to the Cancellation

of Adhesive Stamps.

§ 24. (1.) An instrument, the duty upon which is

required, or permitted by law, to be denoted by an

adhesive stamp, is not to be deemed duly stamped

with an adhesive stamp unless the person required

by law to cancel such adhesive stamp cancels the

same by writing on or across the stamp his uainr

or initials, or the name or initials of his firm.

together with the true date of his so writing, so

that the stamp may be effectually cancelled, and

rendered incapable of being used for any other in-

strument, or unless it is otherwise proved that the

stamp appearing on the instrument was affixed

thereto at the proper time.

Penalty for neglect or refusal, £10. — (2.) Even-

person, who being required by law to cancel an ad-

hesive stamp, wilfully neglects or refuses duly and

effectually to do so in manner aforesaid, shall for-

feit the sum of £10.

Penalty for frauds in relation to adhesive stamps, or

to any duty, £50 (§ 25). — Any person who —

(1.) Fraudulently removes or causes to be removed

from any instrument any adhesive stamp, or affixes

any adhesive stamp which has been so removed,

to any other instrument with intent that such

stamp may be used again;

(2.) Sells or offers for sale, or utters, any adhesive

stamp which has been so removed, or utters any

instrument having thereon any adhesive stamp

which has to his knowledge been so removed as

aforesaid;

(3.) Practises or is concerned in any fraudulent

act, contrivance, or device not specially provided

for, with intent to defraud Her Majesty, her heirs,

or successors, of any duty,

STAMP DUTIES.

Personal Property is liable to duty according

to the value of the succession; and money charged

on heritage — heritable securities — is charged as

personalty (§ 1).

RATES OF SUCCESSION DUTY".

Lineal issue or lineal ancestor of the predecessor,

£1 per cent.

Brothers and sisters of the predecessor and their

descendants, £3 per cent.

Brothers and sisters of the father or mother of the

predecessor and their descendants, £5 per cent.

Brothers and sisters of a grandfather or grand-

mother of the predecessor and their descendants,

£6 per cent.

Any other person, £10 per cent.

The husband or wife of the predecessor is not

chargeable with duty (§ 18), and if the successor's

husband or wife shall be of nearer consanguinity

than the successor, duty is payable according to

such nearer relationship (§ 11).

The following are also exemptions from the succes-

sion duty: —

1. Successions from the same predecessor, passing

on any death, not amountiog in principal value to

£100 (§ 18). 2. Any succession of less value

than £20 in the whole (ib.~). 3. Legacies and

personal property charged with legacy duty, in

respect of the same acquisition (ib.). Duty on

successions in arrear, interest thereon at the rate

of 4 per cent is payable (31 and 32 Vict. c. 124,

§9).

Note. — Forms of the accounts may be obtained at

the Legacy Duty Office, Edinburgh, and at the

offices of distributors of stamp3 in the country.

ADHESIVE STAMPS.

Instruments for which Adhesive Stamps may bo

used, and person by whom to be cancelled, etc.,

also mode of Cancellation.

Agreement — 6d. duty.

Cancellation by person by whom it is first executed

(§ 36).

Bill of Exchange. — Fixed duty of a penny.

Cancellation by person who signs it before he delivers

it out of custody (§ 50).

Bill payable on demand. — If presented unstamped,

person to whom presented may affix and cancel

and deduct duty from sum in paying; but not to

relieve person who may have incurred penalty

(§ 54).

Bills or Notes. — Drawn or made out of United

Kingdom.

Person before he presents bill or note for payment,

negotiates or pays it, to affix and cancel.

Provided —

(a.) If at time it comes to hands of lonaji.de holder

a stamp is on it and cancelled, it shall be deemed

duly cancelled, although not affixed and cancelled

by proper person.

(6.) If a stamp shall be on it and not duly can-

celled, bona fide holder may cancel it, and it shall

be deemed duly stamped (§ 51).

Person not relieved of penalty incurred by him for

not cancelling adhesive stamp (£&.).

Charter-Party/. — Cancellation by person by whom

it is last executed, or by whose execution it is

completed as a binding contract (§ 66).

Contract Note. — Cancellation by person by whom

first executed (§ 69).

Certified Copies or Extracts from Registers

of Births, etc. — Cancellation by person signing

before he delivers the same out of his hands (§ 80).

Delivery Orders and Warrant for Goods. —

Cancellation by the person by whom made (§ 89).

Lease for any definite term less than a year of —

(1.) Dwelling-house, etc., at a rate not exceeding

the rate of £10 per annum.

(2.) Any furnished house or apartments, also a

duplicate of such instrument.

Cancellation by person by whom first executed

(§ M)-

Person who executes or prepares lease, the duty on

which may be denoted by adhesive stamp, and

which is not, at or before execution, duly stamped,

penalty £5 (§ 100, 1). Penalty not incurred in

respect of letters and correspondence (§ 100, 2).

Notarial Act and Protest of a Bill or Promis-

sory Note. — Cancellation by notary (§ 116).

Policy of Insurance on Life, and compensation

for accident. — Cancellation by person who first

executes (§ 119).

Proxy and Voting Paper — liable to duty of Id.

Cancellation by person by whom first executed

(§ 102, 2).

Receipt. — Cancellation by person who gives (§121).

Request to Purser or Officer of Mining

Company on cost book system to enter or register

transfer of share or part of share on notice of such

transfer. Cancellation by person who writer

(§ 128).

General Direction as to the Cancellation

of Adhesive Stamps.

§ 24. (1.) An instrument, the duty upon which is

required, or permitted by law, to be denoted by an

adhesive stamp, is not to be deemed duly stamped

with an adhesive stamp unless the person required

by law to cancel such adhesive stamp cancels the

same by writing on or across the stamp his uainr

or initials, or the name or initials of his firm.

together with the true date of his so writing, so

that the stamp may be effectually cancelled, and

rendered incapable of being used for any other in-

strument, or unless it is otherwise proved that the

stamp appearing on the instrument was affixed

thereto at the proper time.

Penalty for neglect or refusal, £10. — (2.) Even-

person, who being required by law to cancel an ad-

hesive stamp, wilfully neglects or refuses duly and

effectually to do so in manner aforesaid, shall for-

feit the sum of £10.

Penalty for frauds in relation to adhesive stamps, or

to any duty, £50 (§ 25). — Any person who —

(1.) Fraudulently removes or causes to be removed

from any instrument any adhesive stamp, or affixes

any adhesive stamp which has been so removed,

to any other instrument with intent that such

stamp may be used again;

(2.) Sells or offers for sale, or utters, any adhesive

stamp which has been so removed, or utters any

instrument having thereon any adhesive stamp

which has to his knowledge been so removed as

aforesaid;

(3.) Practises or is concerned in any fraudulent

act, contrivance, or device not specially provided

for, with intent to defraud Her Majesty, her heirs,

or successors, of any duty,

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1871-1872 > (46) |

|---|

| Permanent URL | https://digital.nls.uk/84405264 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|