Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

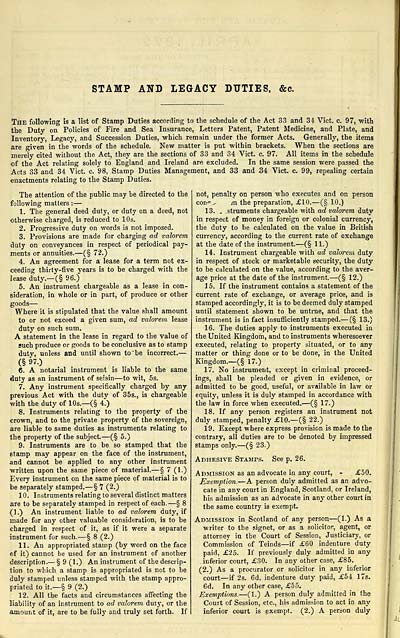

STAMP AND LEGACY DUTIES, &c.

The following is a list of Stamp Duties according to the schedule of the Act 83 and 34 Vict. c. 97, with

the Duty on Policies of Fire and Sea Insurance, Letters Patent, Patent Medicine, and Plate, and

Inventory, Legacy, and Succession Duties, -which remain under the former Acts. Generally, the items

are given in the "words of the schedule. New matter is put within brackets. When the sections are

merely cited without the Act, they are the sections of 33 and 34 Vict. c. 97. All items in the schedule

of the Act relating solely to England and Ireland are excluded. In the same session were passed the

Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and 34 Vict. c. 99, repealing certain

enactments relating to the Stamp Duties.

The attention of the public may he directed to the

following matters : —

1. The general deed duty, or duty on a deed, not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of periodical pay-

ments or annuities. — (§ 72.)

4. An agreement for a lease for a term not ex-

ceeding thirty-five years is to be charged with the

lease duty.— (§ 96.)

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

Where it is stipulated that the value shall amount

to or not exceed a given sum, ad valorem lease

duty on such sum.

A statement in the lease in regard to the value of

such produce or goods to be conclusive as to stamp

duty, unless and until shown to be incorrect. —

(§ 97.)

6. A notarial instrument is liable to the same

«luty as an instrument of seisin — to wit, 5s.

7. Any instrument specifically charged by any

previous Act with the duty of 35s., is chargeable

with the duty of 10s.— (§ 4.)

8. Instruments relating to the property of the

crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject — (§ 5.)

9. Instruments are to be so stamped that the

stamp may appear on the face of the instrument,

and cannot be applied to any other instrument

written upon the same piece of material. — § 7 (1.)

Every instrument on the same piece of material is to

be separately stamped. — § 7 (2.)

10. Instruments relating to several distinct matters

are to be separately stamped in respect of each. — § 8

(1.) An instrument liable to ad valorem duty, if

made for any other valuable consideration, is to be

charged in respect of it, as if it were a separate

instrument for such. — § 8 (2.)

11. An appropriated stamp (by word on the face

of it) cannot be used for an instrument of another

description. — § 9 (1.) An instrument of the descrip-

tion to which a stamp is appropriated is not to be

duly stamped unless stamped with the stamp appro-

priated to it.— § 9 (2.)

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth. If

not, penalty on person who executes and on person

con"^ m the preparation, £10. — (§ 10.)

13. . .struments chargeable with ad valorem duty

in respect of money in foreign or colonial currency,

the duty to be calculated on the value in British

currency, according to the current rate of exchange

at the date of the instrument. — (§ 11.)

14. Instrument chargeable with ad valorem duty

in respect of stock or marketable security, the duty

to be calculated on the value, according to the aver-

age price at the date of the instrument. — (§ 12.)

1 5. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly stamped

until statement shown to be untrue, and that the

instrument is in fact insufficiently stamped. — (§ 13.)

16. The duties apply to instruments executed in

the United Kingdom, and to instruments wheresoever

executed, relating to property situated, or to any

matter or thing done or to be done, in the United

Kingdom.— (§ 17.)

17. No instrument, except in criminal proceed-

ings, shall be pleaded or given in evidence, or

admitted to be good, useful, or available in law or

equity, unless it is duly stamped in accordance with

the law in force when executed. — (§ 17.)

18. If any person registers an instrument not

duly stamped, penalty £10.— (§ 22.)

19. Except where express provision is made to the

contrary, all duties are to be denoted by impressed

stamps only. — (§ 23.)

Adhesive Stamps. See p. 26.

Admission as an advocate in any court, - £50.

Exemption. — A person duly admitted as an advo-

cate in any court in England, Scotland, or Ireland,

his admission as an advocate in any other court in

the same country is exempt.

Admission in Scotland of any person — (1.) As a

writer to the signet, or as a solicitor, agent, or

attorney in the Court of Session, Justiciary, or

Commission of Teinds — if £60 indenture duty

paid, £25. If previously duly admitted in any

inferior court, £30. In any other case, £85.

(2.) As a procurator or solicitor in any inferior

court — if 2s. 6d. indenture duty paid, £54 17s.

6d. In any other case, £55.

Exemptions. — (1.) A person duly admitted in the

Court of Session, etc., his admission to act in any

inferior court is exempt. (2.) A person duly

The following is a list of Stamp Duties according to the schedule of the Act 83 and 34 Vict. c. 97, with

the Duty on Policies of Fire and Sea Insurance, Letters Patent, Patent Medicine, and Plate, and

Inventory, Legacy, and Succession Duties, -which remain under the former Acts. Generally, the items

are given in the "words of the schedule. New matter is put within brackets. When the sections are

merely cited without the Act, they are the sections of 33 and 34 Vict. c. 97. All items in the schedule

of the Act relating solely to England and Ireland are excluded. In the same session were passed the

Acts 33 and 34 Vict. c. 98, Stamp Duties Management, and 33 and 34 Vict. c. 99, repealing certain

enactments relating to the Stamp Duties.

The attention of the public may he directed to the

following matters : —

1. The general deed duty, or duty on a deed, not

otherwise charged, is reduced to 10s.

2. Progressive duty on words is not imposed.

3. Provisions are made for charging ad valorem

duty on conveyances in respect of periodical pay-

ments or annuities. — (§ 72.)

4. An agreement for a lease for a term not ex-

ceeding thirty-five years is to be charged with the

lease duty.— (§ 96.)

5. An instrument chargeable as a lease in con-

sideration, in whole or in part, of produce or other

Where it is stipulated that the value shall amount

to or not exceed a given sum, ad valorem lease

duty on such sum.

A statement in the lease in regard to the value of

such produce or goods to be conclusive as to stamp

duty, unless and until shown to be incorrect. —

(§ 97.)

6. A notarial instrument is liable to the same

«luty as an instrument of seisin — to wit, 5s.

7. Any instrument specifically charged by any

previous Act with the duty of 35s., is chargeable

with the duty of 10s.— (§ 4.)

8. Instruments relating to the property of the

crown, and to the private property of the sovereign,

are liable to same duties as instruments relating to

the property of the subject — (§ 5.)

9. Instruments are to be so stamped that the

stamp may appear on the face of the instrument,

and cannot be applied to any other instrument

written upon the same piece of material. — § 7 (1.)

Every instrument on the same piece of material is to

be separately stamped. — § 7 (2.)

10. Instruments relating to several distinct matters

are to be separately stamped in respect of each. — § 8

(1.) An instrument liable to ad valorem duty, if

made for any other valuable consideration, is to be

charged in respect of it, as if it were a separate

instrument for such. — § 8 (2.)

11. An appropriated stamp (by word on the face

of it) cannot be used for an instrument of another

description. — § 9 (1.) An instrument of the descrip-

tion to which a stamp is appropriated is not to be

duly stamped unless stamped with the stamp appro-

priated to it.— § 9 (2.)

12. All the facts and circumstances affecting the

liability of an instrument to ad valorem duty, or the

amount of it, are to be fully and truly set forth. If

not, penalty on person who executes and on person

con"^ m the preparation, £10. — (§ 10.)

13. . .struments chargeable with ad valorem duty

in respect of money in foreign or colonial currency,

the duty to be calculated on the value in British

currency, according to the current rate of exchange

at the date of the instrument. — (§ 11.)

14. Instrument chargeable with ad valorem duty

in respect of stock or marketable security, the duty

to be calculated on the value, according to the aver-

age price at the date of the instrument. — (§ 12.)

1 5. If the instrument contains a statement of the

current rate of exchange, or average price, and is

stamped accordingly, it is to be deemed duly stamped

until statement shown to be untrue, and that the

instrument is in fact insufficiently stamped. — (§ 13.)

16. The duties apply to instruments executed in

the United Kingdom, and to instruments wheresoever

executed, relating to property situated, or to any

matter or thing done or to be done, in the United

Kingdom.— (§ 17.)

17. No instrument, except in criminal proceed-

ings, shall be pleaded or given in evidence, or

admitted to be good, useful, or available in law or

equity, unless it is duly stamped in accordance with

the law in force when executed. — (§ 17.)

18. If any person registers an instrument not

duly stamped, penalty £10.— (§ 22.)

19. Except where express provision is made to the

contrary, all duties are to be denoted by impressed

stamps only. — (§ 23.)

Adhesive Stamps. See p. 26.

Admission as an advocate in any court, - £50.

Exemption. — A person duly admitted as an advo-

cate in any court in England, Scotland, or Ireland,

his admission as an advocate in any other court in

the same country is exempt.

Admission in Scotland of any person — (1.) As a

writer to the signet, or as a solicitor, agent, or

attorney in the Court of Session, Justiciary, or

Commission of Teinds — if £60 indenture duty

paid, £25. If previously duly admitted in any

inferior court, £30. In any other case, £85.

(2.) As a procurator or solicitor in any inferior

court — if 2s. 6d. indenture duty paid, £54 17s.

6d. In any other case, £55.

Exemptions. — (1.) A person duly admitted in the

Court of Session, etc., his admission to act in any

inferior court is exempt. (2.) A person duly

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Glasgow > Post-Office annual Glasgow directory > 1871-1872 > (34) |

|---|

| Permanent URL | https://digital.nls.uk/84405120 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|