Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

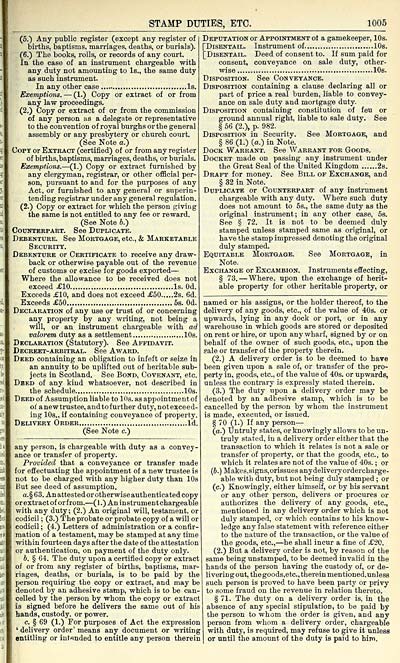

STAMP DUTIES, ETC.

1005

(5.) Any public register (except any register of

births, baptisms, marriages, deaths, or burials).

(6.) The books, rolls, or records of any court.

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract of or from the commission

of any person as a delegate or representative

to the convention of royal burghs or the general

assembly or any presbytery or church court.

(See Note a.)

Copy or Extract (certified) of or from any register

of births, baptisms, marriages, deaths, or burials.

Exemptions. — (1.) Copy or extract furnished by

any clergyman, registrar, or other official per-

son, pursuant to and for the purposes of any

Act, or furnished to any general or superin-

tending registrar under any general regulation.

(2.) Copy or extract for which the person giving

the same is not entitled to any fee or reward.

(See Note 6.)

Counterpart. See Duplicate.

Debenture. See Mortgage, etc., & Marketable

Security.

Debenture or Certificate to receive any draw-

back or otherwise payable out of the revenue

of customs or excise for goods exported —

Where the allowance to be received does not

exceed £10 Is. Od.

Exceeds £10, and does not exceed £50 2s. 6d.

Exceeds £50 5s. Od.

Declaration of any use or trust of or concerning

any property by any writing, not being a

will, or an instrument chargeable with ad

valorem duty as a settlement 10s.

Declaration (Statutory). See Affidavit.

Decreet-arbitral. See Award.

Deed containing an obligation to infeft or seize in

an annuity to be uplifted out of heritable sub-

jects in Scotland. See Bond, Covenant, etc.

Deed of any kind whatsoever, not described in

the schedule 10s.

Deed of Assumption liable to 10s. as appointment of

01 anewtrustee, audtofurther duty,notexceed-

ing 10s., if containing conveyance of property.

Delivery Order Id.

(See Note c.)

any person, is chargeable with duty as a convey-

ance or transfer of property.

Provided that a conveyance or transfer made

for effectuating the appointment of a new trustee is

not to be charged with any higher duty than lOs

But see deed of assumption.

a.§ 63. An attested or otherwise authenticated copy

or extract of or from. — ( 1 .) An instrument chargeable

with any duty ; (2.) An original will, testament, or

codicil ; (3.) The probate or probate copy of a will or

codicil ; (4.) Letters of administration or a confir-

mation of a testament, may be stamped at any time

within fourteen days after the date of the attestation

or authentication, on payment of the duty only.

b. § 64. The duty upon a certified copy or extract

of or from any register of births, baptisms, mar-

riages, deaths, or burials, is to be paid by the

person requiring the copy or extract, and may "

denoted by an adhesive stamp, which is to be can-

celled by the person by whom the copy or extract

is signed before he delivers the same out of his

hands, custody, or power.

c. § 69 (1.) For purposes of Act the expression

' delivery order' means any document or writing

entitling or intended to entitle any person therein

Deputation or Appointment ot a gamekeeper, 10s.

[Disentail. Instrument of 10s.

[Disentail. Deed of consent to. If sum paid for

consent, conveyance on sale duty, other-

wise 10s.

Disposition. See Conveyance.

Disposition containing a clause declaring all or

part of price a real burden, liable to convey-

ance on sale duty and mortgage duty.

Disposition containing constitution of feu or

ground annual right, liable to sale duty. See

§56(2.), p. 982.

Disposition in Security. See Mortgage, and

§ 86 (1.) (a.) in Note.

Dock Warrant. See Warrant for Goods.

Docket made on passing any instrument under

the Great Seal of the United Kingdom 28.

Draft for money. See Bill of Exchange, and

§ 32 in Note.

Duplicate or Counterpart of any instrument

chargeable with any duty. Where such duty

does not amount to 5s., the same duty as the

original instioiment; in any other case, 5s.

See § 72. It is not to be deemed duly

stamped unless stamped same as original, or

have the stamp impressed denoting the original

duly stamped.

Equitable Mortgage. See Mortgage, in

Note.

Exchange or Excambion. Instruments effecting,

§ 73. — Where, upon the exchange of herit-

able property for other heritable property, or

named or his assigns, or the holder thereof, to the

delivery of any goods, etc., of the value of 40s. or

upwards, lying in any dock or port, or in any

warehouse in which goods are stored or deposited

on rent or hire, or upon any wharf, signed by or on

behalf of the owner of such goods, etc., upon the

sale or transfer of the property therein.

(2.) A delivery order is to be deemed to have

been given upon a sale of, or transfer of the pro-

perty in, goods, etc., of the value of 40s. or upwards,

unless the contrary is expressly stated therein.

(3.) The duty upon a delivery order may be

denoted by an adhesive stamp, which is to be

cancelled by the person by whom the instrument

is made, executed, or issued.

§ 70 (1.) If any person —

(a.) Untruly states, or knowingly allows to be un-

truly stated, in a delivery order either that the

transaction to which it relates is not a sale or

transfer of property, or that the goods, etc., to

which it relates are not of the value of 40s. ; or

(b.) Makes,signs,orissues anydeliveryordercharge-

able with duty, but not being duly stamped ; or

(c.) Knowingly, either himself, or by his servant

or any other person, delivers or procures or

authorizes the delivery of any goods, etc.,

mentioned in any delivery order which is not

duly stamped, or which contains to his know-

ledge any false statement with reference either

to the nature of the transaction, or the value of

the goods, etc., — he shall incur a fine of £20.

(2.) But a delivery order is not, by reason of the

same being unstamped, to be deemed invalid in the

hands of the person having the custody of, or de-

livering out, the goods,etc., therein mentioned,unless

such person is proved to have been party or privy

to some fraud on the revenue in relation thereto.

§ 71. The duty on a delivery order is, in the

absence of any special stipulation, to be paid by

the person to whom the order is given, and any

person from whom a delivery order, chargeable

with duty, is required, may refuse to give it unless

or until the amount of the duty is paid to him.

1005

(5.) Any public register (except any register of

births, baptisms, marriages, deaths, or burials).

(6.) The books, rolls, or records of any court.

In the case of an instrument chargeable with

any duty not amounting to Is., the same duty

as such instrument.

In any other case Is.

Exemptions. — (1.) Copy or extract of or from

any law proceedings.

(2.) Copy or extract of or from the commission

of any person as a delegate or representative

to the convention of royal burghs or the general

assembly or any presbytery or church court.

(See Note a.)

Copy or Extract (certified) of or from any register

of births, baptisms, marriages, deaths, or burials.

Exemptions. — (1.) Copy or extract furnished by

any clergyman, registrar, or other official per-

son, pursuant to and for the purposes of any

Act, or furnished to any general or superin-

tending registrar under any general regulation.

(2.) Copy or extract for which the person giving

the same is not entitled to any fee or reward.

(See Note 6.)

Counterpart. See Duplicate.

Debenture. See Mortgage, etc., & Marketable

Security.

Debenture or Certificate to receive any draw-

back or otherwise payable out of the revenue

of customs or excise for goods exported —

Where the allowance to be received does not

exceed £10 Is. Od.

Exceeds £10, and does not exceed £50 2s. 6d.

Exceeds £50 5s. Od.

Declaration of any use or trust of or concerning

any property by any writing, not being a

will, or an instrument chargeable with ad

valorem duty as a settlement 10s.

Declaration (Statutory). See Affidavit.

Decreet-arbitral. See Award.

Deed containing an obligation to infeft or seize in

an annuity to be uplifted out of heritable sub-

jects in Scotland. See Bond, Covenant, etc.

Deed of any kind whatsoever, not described in

the schedule 10s.

Deed of Assumption liable to 10s. as appointment of

01 anewtrustee, audtofurther duty,notexceed-

ing 10s., if containing conveyance of property.

Delivery Order Id.

(See Note c.)

any person, is chargeable with duty as a convey-

ance or transfer of property.

Provided that a conveyance or transfer made

for effectuating the appointment of a new trustee is

not to be charged with any higher duty than lOs

But see deed of assumption.

a.§ 63. An attested or otherwise authenticated copy

or extract of or from. — ( 1 .) An instrument chargeable

with any duty ; (2.) An original will, testament, or

codicil ; (3.) The probate or probate copy of a will or

codicil ; (4.) Letters of administration or a confir-

mation of a testament, may be stamped at any time

within fourteen days after the date of the attestation

or authentication, on payment of the duty only.

b. § 64. The duty upon a certified copy or extract

of or from any register of births, baptisms, mar-

riages, deaths, or burials, is to be paid by the

person requiring the copy or extract, and may "

denoted by an adhesive stamp, which is to be can-

celled by the person by whom the copy or extract

is signed before he delivers the same out of his

hands, custody, or power.

c. § 69 (1.) For purposes of Act the expression

' delivery order' means any document or writing

entitling or intended to entitle any person therein

Deputation or Appointment ot a gamekeeper, 10s.

[Disentail. Instrument of 10s.

[Disentail. Deed of consent to. If sum paid for

consent, conveyance on sale duty, other-

wise 10s.

Disposition. See Conveyance.

Disposition containing a clause declaring all or

part of price a real burden, liable to convey-

ance on sale duty and mortgage duty.

Disposition containing constitution of feu or

ground annual right, liable to sale duty. See

§56(2.), p. 982.

Disposition in Security. See Mortgage, and

§ 86 (1.) (a.) in Note.

Dock Warrant. See Warrant for Goods.

Docket made on passing any instrument under

the Great Seal of the United Kingdom 28.

Draft for money. See Bill of Exchange, and

§ 32 in Note.

Duplicate or Counterpart of any instrument

chargeable with any duty. Where such duty

does not amount to 5s., the same duty as the

original instioiment; in any other case, 5s.

See § 72. It is not to be deemed duly

stamped unless stamped same as original, or

have the stamp impressed denoting the original

duly stamped.

Equitable Mortgage. See Mortgage, in

Note.

Exchange or Excambion. Instruments effecting,

§ 73. — Where, upon the exchange of herit-

able property for other heritable property, or

named or his assigns, or the holder thereof, to the

delivery of any goods, etc., of the value of 40s. or

upwards, lying in any dock or port, or in any

warehouse in which goods are stored or deposited

on rent or hire, or upon any wharf, signed by or on

behalf of the owner of such goods, etc., upon the

sale or transfer of the property therein.

(2.) A delivery order is to be deemed to have

been given upon a sale of, or transfer of the pro-

perty in, goods, etc., of the value of 40s. or upwards,

unless the contrary is expressly stated therein.

(3.) The duty upon a delivery order may be

denoted by an adhesive stamp, which is to be

cancelled by the person by whom the instrument

is made, executed, or issued.

§ 70 (1.) If any person —

(a.) Untruly states, or knowingly allows to be un-

truly stated, in a delivery order either that the

transaction to which it relates is not a sale or

transfer of property, or that the goods, etc., to

which it relates are not of the value of 40s. ; or

(b.) Makes,signs,orissues anydeliveryordercharge-

able with duty, but not being duly stamped ; or

(c.) Knowingly, either himself, or by his servant

or any other person, delivers or procures or

authorizes the delivery of any goods, etc.,

mentioned in any delivery order which is not

duly stamped, or which contains to his know-

ledge any false statement with reference either

to the nature of the transaction, or the value of

the goods, etc., — he shall incur a fine of £20.

(2.) But a delivery order is not, by reason of the

same being unstamped, to be deemed invalid in the

hands of the person having the custody of, or de-

livering out, the goods,etc., therein mentioned,unless

such person is proved to have been party or privy

to some fraud on the revenue in relation thereto.

§ 71. The duty on a delivery order is, in the

absence of any special stipulation, to be paid by

the person to whom the order is given, and any

person from whom a delivery order, chargeable

with duty, is required, may refuse to give it unless

or until the amount of the duty is paid to him.

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1899-1900 > (1071) |

|---|

| Permanent URL | https://digital.nls.uk/84073153 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|