Download files

Complete book:

Individual page:

Thumbnail gallery: Grid view | List view

632

STAMP DUTIES, ETC.

coupons attached, in the same circumstances

as to registration, and certificates issued, or

stock created in lieu thereof, shall be per-

sonal estate and bona notabilia in England

of the deceased person (23 Vict. c. 5, § 1) :

Also any ship, or any share of a ship, be-

longing to a deceased person, registered in

any port in the United Kingdom, notwith-

standing such ship at the time of the death

may have been at sea, or elsewhere out of the

United Kingdom, shall be deemed to be at

the port at which she may be registered (27 &

28 Vict. c. 56), and liable to inventory, probate,

or administration duty.

Specialty Debts. — For probate and administra-

tion duty, debts and sums of money due from

persons in the United Kingdom to a deceased

on obligation or other specialty, shall be estate

and effects of the deceased within the jurisdic-

tion of Her Majesty's Court of Probate in Eng-

land or Ireland in which the same would be if

they were debts upon simple contract, without

regard to the place where the obligation or

specialty shall be at the time of the death.

(25 Vict. c. 22, § 39.)

Foreign Bonds and Stocks. — Documents of the

debts of foreign governments and foreign

companies which pass from hand to hand are

property where the documents may be. De-

bentures orj bonds by foreign companies and

governments, and the title to stocks of foreign

companies and governments, are property in

this country if in the possession of any person

in this country, and can be sold in the market,

and the title of the purchasers "completed to

them in this country. See Attorney-General

v. Bouwens, 4 Meeson and Welsby 171.

Rents of Heritage. — If the deceased survive Whit-

sunday, one moiety of the rents of the crop

of that year is personal estate. If he survive

Martinmas, the whole rents of that crop fall

into the executry. In addition, from and after

1st August 1870, the Act 33 & 34 Vict. 1870,

c. 35, would seem to give the executor a pro-

portion of the rents from the term precedin

the date of death to the date of death. That

Act would also seem to give a proportion of the

term's rents of quarries, minerals, and houses,

and also feu-duties current at the death. The

executor's right to house rents would not there-

fore be to the half-year's rents current at death

but to a proportion only to the date of death.

Modes in which Duty may be paid.

When deceased domiciled in Scotland. — In the case

of a person dying domiciled in Scotland having

personal property in Scotland, England, and

Ireland, and also heritable securities excluding

executors, and personal bonds excluding exe

cutors, duty in respect of the whole may be

paid on the inventory required to be recorded

in the Commissary Court; or inventory duty

may be paid on the personal property situated

in Scotland, including heritable securities made

moveable by the Act 31 & 32 Vict. c. 101,

§ 117, and duty may be paid on a 'special

inventory' of the heritable securities excluding

executors, and personal bonds excluding exe

cutors, and probate or administration may be

obtained in England and Ireland in respect

of the personal estate in these countries, and

duty paid in respect of such on these instru-

ments.

When deceased domiciled furth of the U. K. — In

case of a person dying domiciled furth of the

United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each country.

In the case of Intestate Estates not exceeding

£150, the widow, or any one or more of the

children, or in the case of a widow dying

intestate, any one or more of her children may

apply to the Commissary Clerk, and he shall

prepare an inventory and oath and record the

inventor}" and expede confirmation according

to statutory forms, 38 and 39 Vict. c. 41.

Exemptions. — Inventory of the estate of any

common seaman or soldier dying in service.

Additional inventory when the duty on the

whole estate does not exceed that already paid

on the former inventory.

RETURN OF INVENTORY DUTY.

The inventory duty and probate and admini-

stration duty are paid on the whole personal

property, without deduction of debts ; but the

Act 5 & 6 Vict. c. 79, § 23, provides for a re-

turn being given on proof of the constitution

and payment of the debts. This return must

be claimed within three years ; but the time

will be prolonged on application to the Board

of Inland Revenue. No return to be granted

in respect of a voluntary debt due from a

person dying after 28th June 1861, expressed

to be payable on the death of such person, or

payable under an instrument which shall not

have been bona fide delivered to the donee

three months before the death of such person.

(24 & 25 Vict. c. 92, § 3.)

Note. — Forms of inventory and additional inven-

tory will be found in the Juridical Styles, vol.

in. App. pp. 8-11. Forms of inventories, and

also regulations for return of inventory duty,

may be obtained at the office of the Solicitor,

Inland Revenue, Edinburgh.

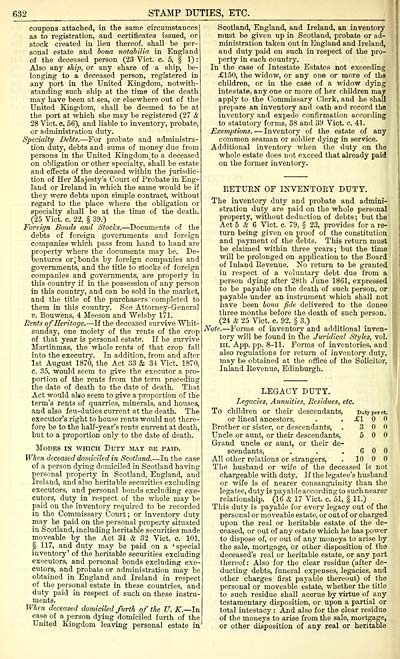

LEGACY DUTY.

Legacies, Annuities, Residues, etc.

To children or their descendants, Dutyperct.

or lineal ancestors, . .£100

Brother or sister, or descendants, . 3

Uncle or aunt, or their descendants, 5

Grand uncle or aunt, or their de-

scendants, . . .600

All other relations or strangers, . 10

The husband or wife of the deceased is not

chargeable with duty. If the legatee's husband

or wife is of nearer consanguinity than the

legatee, duty is payable according to such nearer

relationship. (16 & 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

personal or moveable estate, or out of or charged

upon the real or heritable estate of the de-

ceased, or out of any estate which he has power

to dispose of, or out of any moneys to arise by

the sale, mortgage, or other disposition of the

deceased's real or heritable estate, or any part

thereof: Also for the clear residue (after de-

ducting debts, funeral expenses, legacies, and

other charges first payable thereout) of the

personal or moveable estate, whether the title

to such residue shall accrue by virtue of any

testamentary disposition, or upon a partial or

total intestacy : And also for the clear residue

of the moneys to arise from the sale, mortgage,

or other disposition of any real or heritable

STAMP DUTIES, ETC.

coupons attached, in the same circumstances

as to registration, and certificates issued, or

stock created in lieu thereof, shall be per-

sonal estate and bona notabilia in England

of the deceased person (23 Vict. c. 5, § 1) :

Also any ship, or any share of a ship, be-

longing to a deceased person, registered in

any port in the United Kingdom, notwith-

standing such ship at the time of the death

may have been at sea, or elsewhere out of the

United Kingdom, shall be deemed to be at

the port at which she may be registered (27 &

28 Vict. c. 56), and liable to inventory, probate,

or administration duty.

Specialty Debts. — For probate and administra-

tion duty, debts and sums of money due from

persons in the United Kingdom to a deceased

on obligation or other specialty, shall be estate

and effects of the deceased within the jurisdic-

tion of Her Majesty's Court of Probate in Eng-

land or Ireland in which the same would be if

they were debts upon simple contract, without

regard to the place where the obligation or

specialty shall be at the time of the death.

(25 Vict. c. 22, § 39.)

Foreign Bonds and Stocks. — Documents of the

debts of foreign governments and foreign

companies which pass from hand to hand are

property where the documents may be. De-

bentures orj bonds by foreign companies and

governments, and the title to stocks of foreign

companies and governments, are property in

this country if in the possession of any person

in this country, and can be sold in the market,

and the title of the purchasers "completed to

them in this country. See Attorney-General

v. Bouwens, 4 Meeson and Welsby 171.

Rents of Heritage. — If the deceased survive Whit-

sunday, one moiety of the rents of the crop

of that year is personal estate. If he survive

Martinmas, the whole rents of that crop fall

into the executry. In addition, from and after

1st August 1870, the Act 33 & 34 Vict. 1870,

c. 35, would seem to give the executor a pro-

portion of the rents from the term precedin

the date of death to the date of death. That

Act would also seem to give a proportion of the

term's rents of quarries, minerals, and houses,

and also feu-duties current at the death. The

executor's right to house rents would not there-

fore be to the half-year's rents current at death

but to a proportion only to the date of death.

Modes in which Duty may be paid.

When deceased domiciled in Scotland. — In the case

of a person dying domiciled in Scotland having

personal property in Scotland, England, and

Ireland, and also heritable securities excluding

executors, and personal bonds excluding exe

cutors, duty in respect of the whole may be

paid on the inventory required to be recorded

in the Commissary Court; or inventory duty

may be paid on the personal property situated

in Scotland, including heritable securities made

moveable by the Act 31 & 32 Vict. c. 101,

§ 117, and duty may be paid on a 'special

inventory' of the heritable securities excluding

executors, and personal bonds excluding exe

cutors, and probate or administration may be

obtained in England and Ireland in respect

of the personal estate in these countries, and

duty paid in respect of such on these instru-

ments.

When deceased domiciled furth of the U. K. — In

case of a person dying domiciled furth of the

United Kingdom leaving personal estate in

Scotland, England, and Ireland, an inventory

must be given up in Scotland, probate or ad-

ministration taken out in England and Ireland,

and duty paid on such in respect of the pro-

perty in each country.

In the case of Intestate Estates not exceeding

£150, the widow, or any one or more of the

children, or in the case of a widow dying

intestate, any one or more of her children may

apply to the Commissary Clerk, and he shall

prepare an inventory and oath and record the

inventor}" and expede confirmation according

to statutory forms, 38 and 39 Vict. c. 41.

Exemptions. — Inventory of the estate of any

common seaman or soldier dying in service.

Additional inventory when the duty on the

whole estate does not exceed that already paid

on the former inventory.

RETURN OF INVENTORY DUTY.

The inventory duty and probate and admini-

stration duty are paid on the whole personal

property, without deduction of debts ; but the

Act 5 & 6 Vict. c. 79, § 23, provides for a re-

turn being given on proof of the constitution

and payment of the debts. This return must

be claimed within three years ; but the time

will be prolonged on application to the Board

of Inland Revenue. No return to be granted

in respect of a voluntary debt due from a

person dying after 28th June 1861, expressed

to be payable on the death of such person, or

payable under an instrument which shall not

have been bona fide delivered to the donee

three months before the death of such person.

(24 & 25 Vict. c. 92, § 3.)

Note. — Forms of inventory and additional inven-

tory will be found in the Juridical Styles, vol.

in. App. pp. 8-11. Forms of inventories, and

also regulations for return of inventory duty,

may be obtained at the office of the Solicitor,

Inland Revenue, Edinburgh.

LEGACY DUTY.

Legacies, Annuities, Residues, etc.

To children or their descendants, Dutyperct.

or lineal ancestors, . .£100

Brother or sister, or descendants, . 3

Uncle or aunt, or their descendants, 5

Grand uncle or aunt, or their de-

scendants, . . .600

All other relations or strangers, . 10

The husband or wife of the deceased is not

chargeable with duty. If the legatee's husband

or wife is of nearer consanguinity than the

legatee, duty is payable according to such nearer

relationship. (16 & 17 Vict. c. 51, § 11.)

This duty is payable for every legacy out of the

personal or moveable estate, or out of or charged

upon the real or heritable estate of the de-

ceased, or out of any estate which he has power

to dispose of, or out of any moneys to arise by

the sale, mortgage, or other disposition of the

deceased's real or heritable estate, or any part

thereof: Also for the clear residue (after de-

ducting debts, funeral expenses, legacies, and

other charges first payable thereout) of the

personal or moveable estate, whether the title

to such residue shall accrue by virtue of any

testamentary disposition, or upon a partial or

total intestacy : And also for the clear residue

of the moneys to arise from the sale, mortgage,

or other disposition of any real or heritable

Set display mode to: Large image | Transcription

Images and transcriptions on this page, including medium image downloads, may be used under the Creative Commons Attribution 4.0 International Licence unless otherwise stated. ![]()

| Scottish Post Office Directories > Towns > Edinburgh > Post Office Edinburgh and Leith directory > 1876-1877 > (668) |

|---|

| Permanent URL | https://digital.nls.uk/84001608 |

|---|

| Description | Directories of individual Scottish towns and their suburbs. |

|---|

| Description | Around 700 Scottish directories published annually by the Post Office or private publishers between 1773 and 1911. Most of Scotland covered, with a focus on Edinburgh, Glasgow, Dundee and Aberdeen. Most volumes include a general directory (A-Z by surname), street directory (A-Z by street) and trade directory (A-Z by trade). |

|---|